Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.A Violent Dr. Pangloss

TGIF! Friday’s sometimes leave us feeling so good! All markets were up on Friday. US stocks had their best week of the year with a 4.4% up week in both Dow & the S&P. Even Transports rallied over 4%. And interest rates fell hard in the belly of the curve & at the very short end. And even the 30-year yield closed flat. Gold rallied to touch $1350 intra-day Friday. And the best signal to a scared world – the inverse of the U.S. Dollar rose 1% on the week.

Did Dr. Powell turn into Dr. Pangloss this week? And not merely a sedate one, but a violent one as Market Ear pointed out:

- “The NASDAQ bounce is actually more violent than the sell off. NASDAQ +5.75% since recent low…”

The S&P was not that slovenly either:

The S&P was not that slovenly either:

- It took SPX 9 days to fall from 2870 to 2730. It took SPX 5 days to go from 2730 to 2870. Gamma works both ways….

It was like January all over again:

- Jim Bianco @biancoresearch – The DJIA is now up over 1,000 points since Chairman Powell said “act as appropriate” Tuesday morning. Do not underestimate the power of monetary stimulus on financial markets.

Actually, the Dow was up 1169 points this week & the S&P was up 121 handles. The purists might grumble but reality struck again:

- Jim Bianco @biancoresearch – This old saying appears more true than ever … “The Fed decides when to hike and the market decides when to cut.”

How powerful is Powell when he gets in sync with the market?

- Market Ear – Powell Power – the S&P is up 320 points this year. 184 of those points came on three days when Powell spoke: January 4, January 30, and June 4

The Powell Fed has NOT yet decided to cut but the market is absolutely convinced:

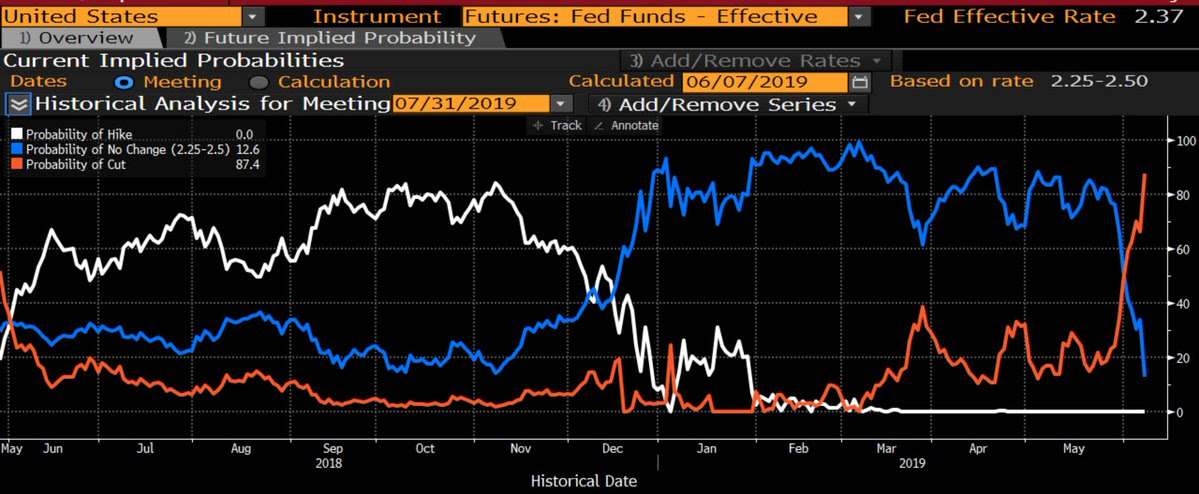

- jeroen bloklandVerified account @jsblokland – Wow! The market implied probability of a July #FederalReserve rate cut is now a massive 87%! Imagine what would happen if that somehow doesn’t come…

Forgive us but we don’t get this “July” stuff. What’s wrong with the first cut on June 20? It would be a shame to waste a perfectly bad NFP number. When did you last see a perfectly ZERO net jobs added on NFP day?

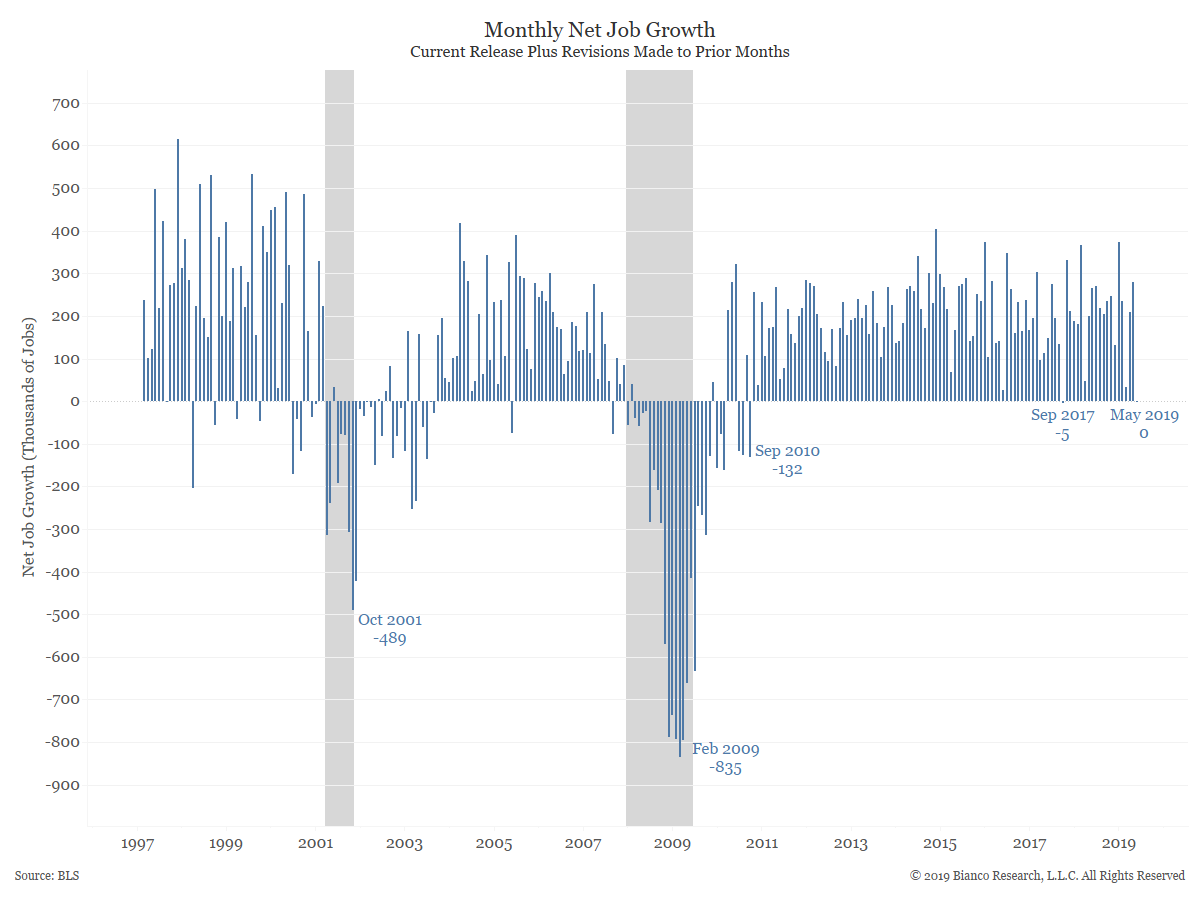

- Jim Bianco @biancoresearch – Payrolls rose 75k jobs in May, but an equal number of jobs were revised away from previous months. On this “net” basis, no jobs were added with this month’s release. With the exception of Hurricane Harvey (Sept 17), this is the worst net payroll report in almost 9 years.

Remember how the Powell Fed surprised the markets in the January FOMC? They should do that again on June 20. They just don’t need to wait for another bad round of data & then be forced to ease by 50 bps in July. If they cut in June & then we get a good NFP number in July, then they can justify the cut as a prudent move to forestall the slowdown. By easing in June, the Fed can buy some time for future action. Hope they remember the old good proverb – strike when the iron is hot.

And how hot is the iron now? Bianco called the NFP a net zero. That was so wimpy, right?

- David Rosenberg @EconguyRosie – Adjusted for the revisions and the Birth-Death model, payrolls shrank 65k in May. Aggregate hours worked peaked in March. Worst first 5 months for HH jobs since 2009. Still don’t see the recession?

- David Rosenberg @EconguyRosie – Need evidence that the global economy is heading for recession? How about the price of copper on track for its 8th straight weekly decline, the longest losing streak since…2001!

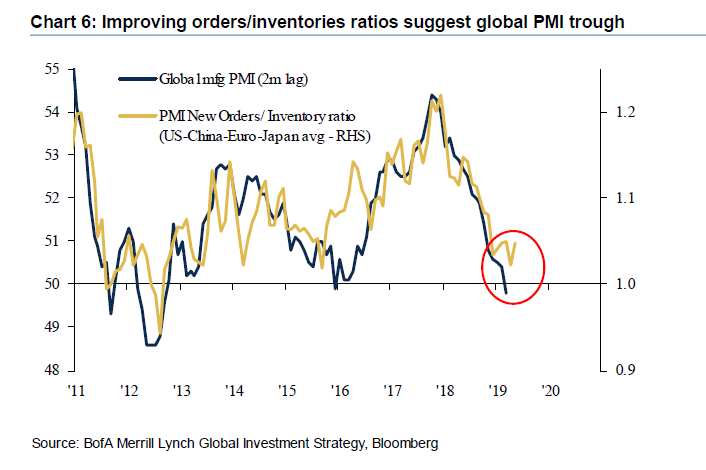

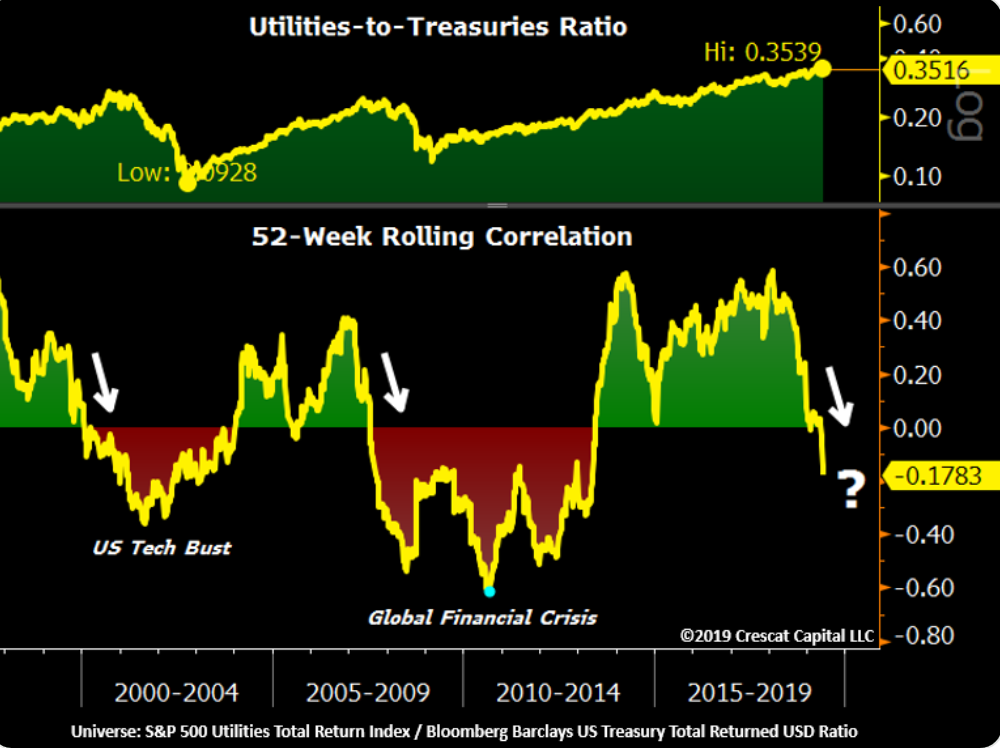

If Thursday’s global PMI data doesn’t bother you, perhaps the break in the old correlation from Market Ear might:

- Utilities / Treasuries correlation broken – The correlation between utilities & Treasuries has decisively turned negative – Such shifts tend to precede bear markets and recessionary periods.

Finally a warning from one who used to be their own:

Finally a warning from one who used to be their own:

- Danielle DiMartino @DiMartinoBooth – “We go into Fed blackout on Monday. What if we get up to 50% while they are in blackout by June 19? Do they defy markets? They defied markets in December. How did that work out? Not so well.” @DiMartinoBooth @QuillIntel @CNBC —

Given the remembrance of Normandy and that historic day, shouldn’t Powell also look to Germany?

- Jenna & John @StrategicBond – Never seen a bond future trade > €200! 30-year German bund future now got a 2 handle! #Disinflation #Japanification

Looking at Germany got very scary on Friday. We saw something we never thought we would see. The German 30-year Bund yield closed at 33 bps, a full 5 bps BELOW the Japanese 30-year JGB yield of 38 bps and the Germ1n 10-year yield closed at minus 26 bps a full dozen bps below the minus 13 bps JGB 10-year.

What is going on in Germany and in Europe? Hopefully, only a tsunami of money flowing into German Bunds from the rest of Europe. Think how awful it is when that can be viewed as the only ray of hope.

2. Dawn of Hope?

Last week we wrote in our US-Mexico article:

- “The question is how much pain will Mexico endure before AMLO seals Mexico’s southern border, perhaps with help of U.S. Military. If AMLO does that, we could see a US-Mexico summit that could also become a trigger for Congressional ratification of USMCA. And wouldn’t that create an awesome rally in both US & Mexican stock Markets?”

Look what happened on Friday evening?

- Donald J. TrumpVerified account @realDonaldTrump– I am pleased to inform you that The United States of America has reached a signed agreement with Mexico. The Tariffs scheduled to be implemented by the U.S. on Monday, against Mexico, are hereby indefinitely suspended. Mexico, in turn, has agreed to take strong measures to….

- Donald J. TrumpVerified account @realDonaldTrump– ….stem the tide of Migration through Mexico, and to our Southern Border. This is being done to greatly reduce, or eliminate, Illegal Immigration coming from Mexico and into the United States. Details of the agreement will be released shortly by the State Department. Thank you!

Some 6,000 Mexican troops will be sent to Mexico’s southern border. And more importantly, the Asylum applicants will be held in Mexico and not on the U.S. border. The key paragraphs are below:

Mexican Enforcement Surge

Mexico will take unprecedented steps to increase enforcement to curb irregular migration, to include the deployment of its National Guard throughout Mexico, giving priority to its southern border. Mexico is also taking decisive action to dismantle human smuggling and trafficking organizations as well as their illicit financial and transportation networks. Additionally, the United States and Mexico commit to strengthen bilateral cooperation, including information sharing and coordinated actions to better protect and secure our common border.

Migrant Protection Protocols

The United States will immediately expand the implementation of the existing Migrant Protection Protocols across its entire Southern Border. This means that those crossing the U.S. Southern Border to seek asylum will be rapidly returned to Mexico where they may await the adjudication of their asylum claims.

This is a very positive signal for ratification of the USMCA. Or would the suicidally stupid Democrat Party damage its standing with the Hispanic community by opposing the USMCA?

3. Sweet Timing

We entered this week down 4 weeks in a row and with “AAII bulls lowest level this year. NAAIM exposure lowest level this year” according to a @RyanDetrick tweet. The Powell signal came in at the perfect time for the best week of 2019 in stocks. Now at the end of the week and before next week begins, the first positive news on the tariff front is announced. A real win for President’s tariff strategy.

And, perhaps, with the global PMI possibly at a trough! If so, what? Market Ear was clear:

- PMI trough? if so, see you at new significant All Time Highs

- Tony Dwyer @dwyerstrategy- The entire bull story going forward remains data that is weak enough to cause the Fed to fix the policy mistake last year…just like the July 1995 rate cut. Prior to that cut there was a bull steepener to the 2-10yr UST Yield curve as well

Just as in November 2016, we need a resurgence of animal spirits to set aside the ills that are now being noticed. If the Fed gets off their high horse and investors respond to falling inflation & a sense of confidence about tariffs not getting worse, then we could see a breakout in animal spirits that could actually spur corporate confidence & capex.

A number of “ifs” in that but without those ifs the road seems downward both in spirit & in data and coincidentally in markets. Look one guru is saying Debbie Downer is fading away.

- Ralph Acampora CMT @Ralph_Acampora – My Presentation, Part VI: Granted the current rally will encounter considerable resistance but I left this wonderful audience with my new, updated conclusion: We have seen the market’s lows for this cycle. I now expect a new trading range…..

Since a picture is worth lots & lots of words,

- Steve Deppe, CMT @SJD10304 – That’s without question one of the biggest bullish outside reversal bars i’ve ever seen on $SPX.

Remember what Stan Druckenmiller said to CNBC’s Becky Quick at the end of his appearance on Friday (before the NFP number & Friday’s rally)?

First that he had already increased his allocation from flat to 15% with this week’s rally. Secondly he warned that CNBC viewers should understand that his allocation could be very different even as early as Monday or Tuesday. Thirdly he said he uses the NFP number to decide entry & exit points. He also said the 2-year Treasury is now a two-way bet meaning it may not be ideal for safe haven from stocks.

Finally, why had Druckenmiller reduced his allocation to flat? Because of fear of random application of tariffs. Does that fear go down after President Trump’s success in getting Mexico to come to an agreement & the resultant cancellation of tariffs on Mexico?

Will CNBC Squawk Box follow up with Mr. Druckenmiller on Monday or Tuesday and let us ordinary folks know if & how Friday’s two big events, NFP & Mexico-deal, changed his mind?

Finally, remember the tweet we featured two weeks ago:

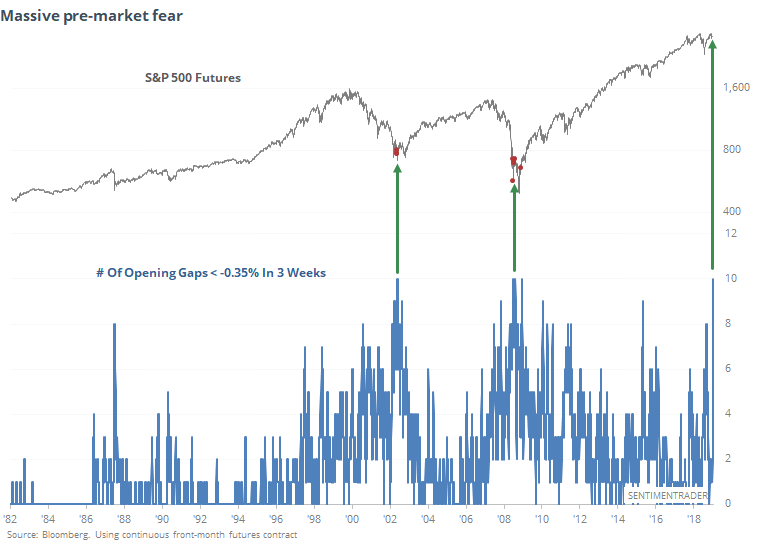

- SentimenTraderVerified account @sentimentrader – Since the inception of the S&P 500 futures market, there have been two time periods with this much pre-market anxiety. * The bottom of the 2002 bear market * The bottom of the 2008 bear market

Perhaps this message was ignored during the vehemence of the May correction. But what if the chart does signal a bottom in this year’s correction similar to the two bottoms in 2002 & 2008?

What if Dr. Powell does turn out to be Dr. Pangloss of 2019 with a rate cut, lower Dollar, higher Treasury prices & a beautiful stock rally? And we may not even have to worry about becoming pigs ready for slaughter. Hasn’t China already slaughtered all the pigs they can find?

Of course, with all this positive talk, the market Gods could ridicule us with a nasty sell off next week. We will see.

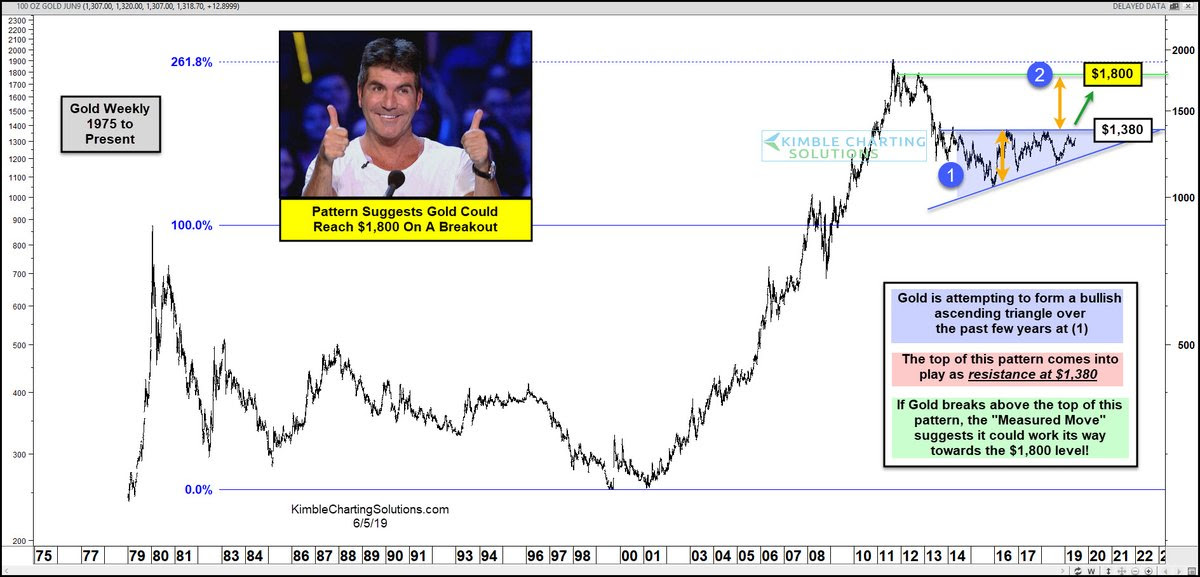

4. Gold

A lower Dollar with a rate cut is the perfect medicine to end Gold’s doldrums. But after a two week rally that touched the previous obstacle of $1,350, is there a sell off coming?

- Jeff York, PPT @Pivotal_Pivots – #Gold $GC_F $GLD hitting it’s head again on the Fibonacci Yr1 Pivot Point. Pivot points, shows traders in advance where to add & reduce risk. The Biggest reversals happen at the Yearly Pivots!

- Chris Kimble @KimbleCharting – Gold target is $1,800 following a breakout of this bullish ascending triangle. $1,380 is the HUGE breakout test! $GLD $SLV $GDX $DXY $EURUSD https://kimblechartingsolution

s.com/2019/06/gold-target- 1800-following-upside- breakout/ …

If you hate such “ifs”, then just listen to a straight call for a breakout in gold by Carter Worth of CNBC Options Action:

If you hate such “ifs”, then just listen to a straight call for a breakout in gold by Carter Worth of CNBC Options Action:

Perhaps the most interesting comment in this clip is the expression Carter uses about the $1,350 level that has been an obstacle for 5 years:

- “the more authority a level has, the more authoritative the resolution”

Remember the old Sanskrut proverb we used a few weeks ago about the optimal path being the one used by the Mahaa-Jan (big shots). Guess the Najarian Brothers use that regularly following activity of the big option players. Jon Najarian had highlighted a big bet on GLD August 27 call some 2-4 weeks ago. The call was trading at about 50 cents. It closed on Friday at $2.35. And that is before above breakout call in Gold.

And no “Jan” or person is more Mahaa than Mr. Druckenmiller. That is why CNBC Squawk Box & Joe Kernen in particular should check with Mr. Drukenmiller early next week.

5. Health Benefits of Bollywood Dancing

Folks, we love Bollywood songs but even we were surprised to see this news from BBC, London:

- “Harefield hospital in London is giving some of its patients a taste of Bollywood and classical Indian dance – and the results are apparently proving helpful to health.”

With that, we just have to include one of our old favorites, a classic fun party song & dance. How old you ask? From 1967, yes 1967 when the Hippie movement was active. We heard this song years later & it stuck with us. Nothing but pure light fun. Try to dance to it. It will put you in good spirits. This is why analysts have described Bollywood as a therapist for & of simple folks. The title line simply means a chance encounter led to love.

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter