Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.A Bullish Turn in Risk?

The first three days of this past week were clearly bullish. It was almost as if a turn had taken place over the G20 weekend. Jim Cramer wondered whether US & China had come to an agreement and Paul Richards of Medley Global converted that belief into a call on Wednesday morning on BTV.

- “Very interesting listening to Navarro; his language has changed; A lot more was achieved in Osaka than perhaps the markets think; see a big turn coming into risk again..”

He then alluded to the big announcement of Tuesday – the nomination of Christine Lagarde as ECB Chair, a far more impactful position than the IMF Director position she has now. Everyone knows that the real problem at the ECB has been political, a problem of persuading the leaders to loosen the fiscal strings to complement the monetary easing of Draghi. And Christine Lagarde is first & foremost an astute politician.

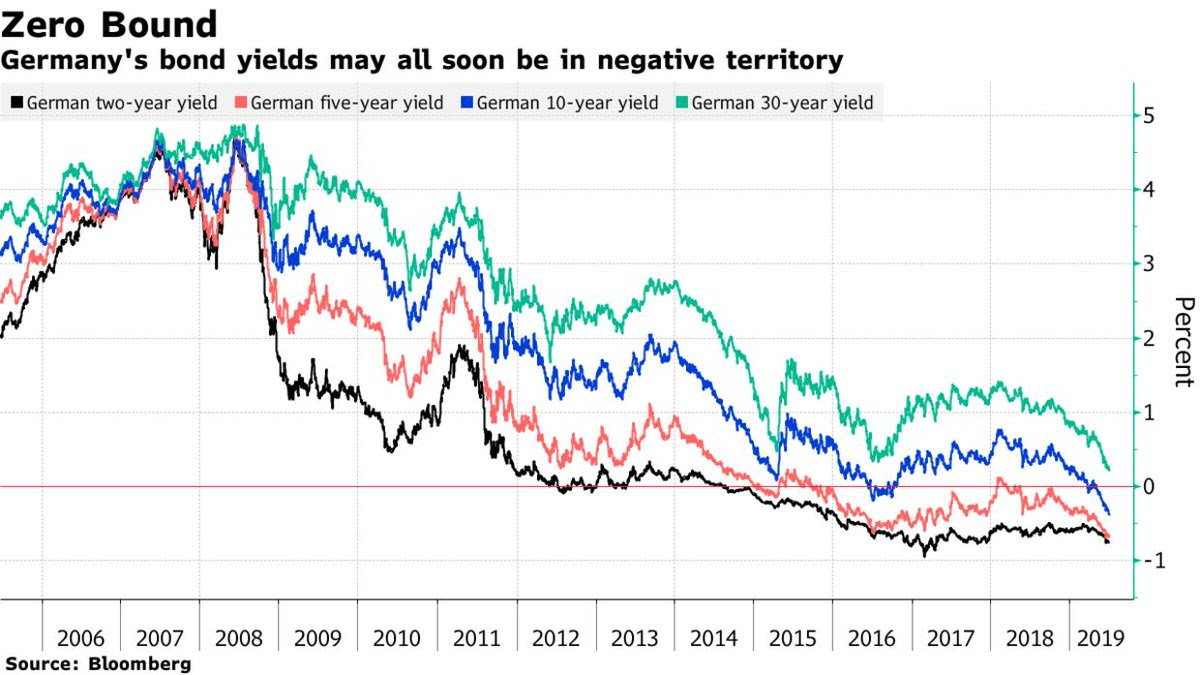

- Jesse Felder @jessefelder – Germany, despite a slowing economy that could arguably benefit from a fiscal boost, continues to run a large budget surplus and reduce its already relatively low debt burden.’ https://www.bloomberg.com/

news/articles/2019-07-05/ germany-s-tight-purse-strings- are-a-worry-when-borrowing-is- free …

Coincidentally or otherwise, a DeMarkian asked whether the German 10-yr bund yield is actually about to go up.

Coincidentally or otherwise, a DeMarkian asked whether the German 10-yr bund yield is actually about to go up.

- Thomas Thornton @TommyThornton – German 10 year yields. When we see short term DeMark Countdown 13’s fail we know the trend is exceptionally strong and then we focus on weekly and monthly time periods. We could see yields go up soon on Bunds with weekly and monthly signals. Watch trend line on daily too

That could well be the markets reacting to Ms. Lagarde’s appointment with hope for a fiscal stimulus from Germany. Nothing would move US Treasury yields higher & faster than a rise in German Bund rates.

The S&P actually closed on Wednesday within a hair breadth of the 3,000 mark. And rates kept falling until Friday morning. Into these overbought markets came the 224,000 jobs added NFP report on Friday morning, much stronger than feared.

The Dow dropped 230 points in the morning but then began a steady recovery. The big indices only closed down about 20 bps or less, something that the bulls can regard as a victory. And this recovery came with a steady but smaller recovery in Treasury prices. The 10-year yield that had fallen almost 11 bps closed down 8 bps. But the short end rose higher in yield & the July rate cuts priced by the bond market lost much of their conviction. That stocks recovered as rate cut probability got reduced has to be taken as a positive.

Lawrence McMillan of Option Strategist wrote in his Friday’s summary:

- “There is support on the $SPX chart at the old highs (2940- 2950) and below that, where there was more work done, at 2890- 2910. The equity-only put-call ratios remain strong and on buy signals, as those ratios continue to drop rapidly. Both breadth oscillators are on buy signals and both are in overbought territory. That’s a good thing when $SPX is making new all-time highs. $VIX has dropped quite a bit in the last week and is now approaching 12. In any case, $VIX is in a bullish spot, and would only turn negative for stocks if it were to climb above 17. In summary, we remain bullish along with our indicators.“

So where could the S&P go? To 3015 & eventually into 3300s or so according to Carolyn Boroden, a colleague of Jim Cramer. Watch Cramer explain her methodology in the clip below.

With all the above, someone has to see the other side, right?

- Lawrence McDonaldVerified account @Convertbond – Trannies Don’t Lie… Fail at the Two Hundred Day… (the 200-day moving average itself is sloping downwards, so a couple of days of yet again closing below it would be a bad sign for sure, not there yet)

And,

- Thomas Thornton @TommyThornton – Bloomberg Total Exchange Market Capitalization Index with upside DeMark Aggressive Sequential and Sequential Countdown 13’s in 5th wave. Decent record ahead of reversals. Some small some large.

2. “fake” NFP?

Was the explosion in interest rates as much a factor of positioning as anything else?

- jeroen bloklandVerified account @jsblokland – Just when everyone capitulated and went long #duration… US 10-year Treasury #yield up almost 12 bps after strong #payrolls.

Then why did the 10-year yield closer lower by 4 bps than this morning’s level, especially when stocks were steadily rallying? Was there a “fake” involved?

- David Rosenberg @EconguyRosie – Just to reiterate. The term ‘head fake’ was coined precisely for the sort of employment report we received today. You’ll soon be scurrying to buy those bonds you sold today.

OK, but why?

- David Rosenberg@EconguyRosie – Half the payroll gain came from the ‘Birth-Death’ BLS guesstimate; and prime-adult male employment actually sagged 97k in June, collapsing 338k over the past three months, which hasn’t happened since September 2009. Lift open the shiny hood and check out the sputtering engine.

There are many who think the recent collapse in bond yields will reverse hard just as in 2016. Rosenberg dismissed that two days before the NFP:

- David Rosenberg@EconguyRosie – The small business sector leads the cycle and employment here has plunged 61k in the past two months. Haven’t seen this in over 9 years; same decline we saw in Feb-March of 2008 when the consensus was busy calling for a soft landing. This isn’t a repeat of 2016 by any stretch.

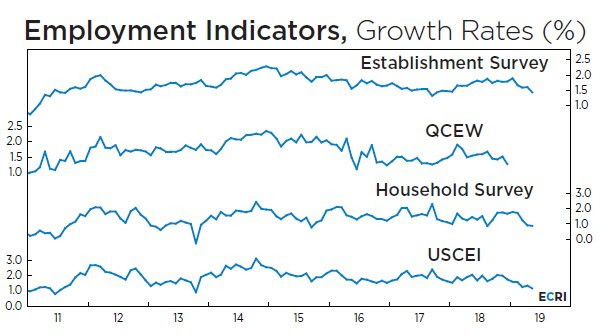

ECRI didn’t use the “fake” adjective. Instead they were content to say “mislead”.

- Lakshman AchuthanVerified account@businesscycle – Great headlines mislead on jobs. Read more here: http://bit.ly/2Jgg3aX

We urge all to read the article linked in the above tweet. Below we include just a few excerpts:

We urge all to read the article linked in the above tweet. Below we include just a few excerpts:

- “A key part of the answer lies with jobs “growth,” which has been slowing much more than most probably realize. … Growth in ECRI’s more comprehensive U.S. Coincident Employment Index (USCEI), which includes both those figures and more – is near its worst reading since late 2013 (bottom line). Because it subsumes data from both surveys, its verdict about overall job growth is more reliable than the others’. … The Establishment Survey’s nonfarm jobs figures will clearly be revised down as the QCEW data show job growth averaging only 177,000 a month in 2018. That means the Establishment Survey may be overstating the real numbers by more than 25%.”

After all the above, is there a simple fact that simple minds can grasp?

- GreekFire23@GreekFire23 – We’ve added almost 400,000 fewer jobs this year than we did in the first 6 months last year. That’s called “job growth slowing” which is why Fed funds market rate cut odds are still 100%

The message from the recent ISMs was not positive.

- Raoul PalVerified account @RaoulGMI – The joy of irritating half of FinTwit – Here is ISM New Orders. Yes, this is technical analysis on ISM. Yes, it has worked for me for the two previous cycles. Yes, it is suggesting a high odds of a sharp move lower. Yes, many of you will shake your heads & call me a charlatan

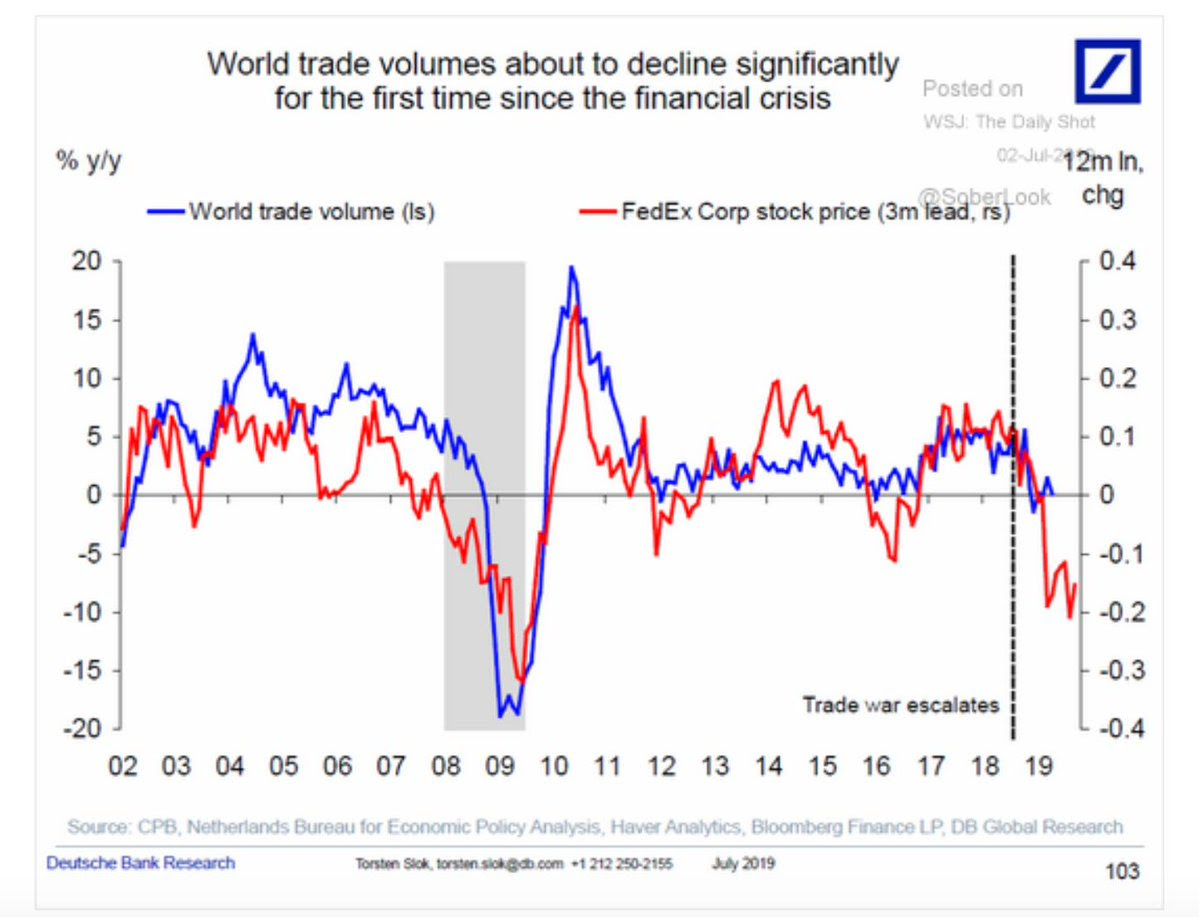

USA is an island, of course. But just for the heck of it, how is world trade looking?

- Adam Tooze @adam_tooze – World trade may be about to decline significantly for the first time since the great recession. @DeutscheBank via @SoberLook

Is there a way of summarizing much of the above?

Is there a way of summarizing much of the above?

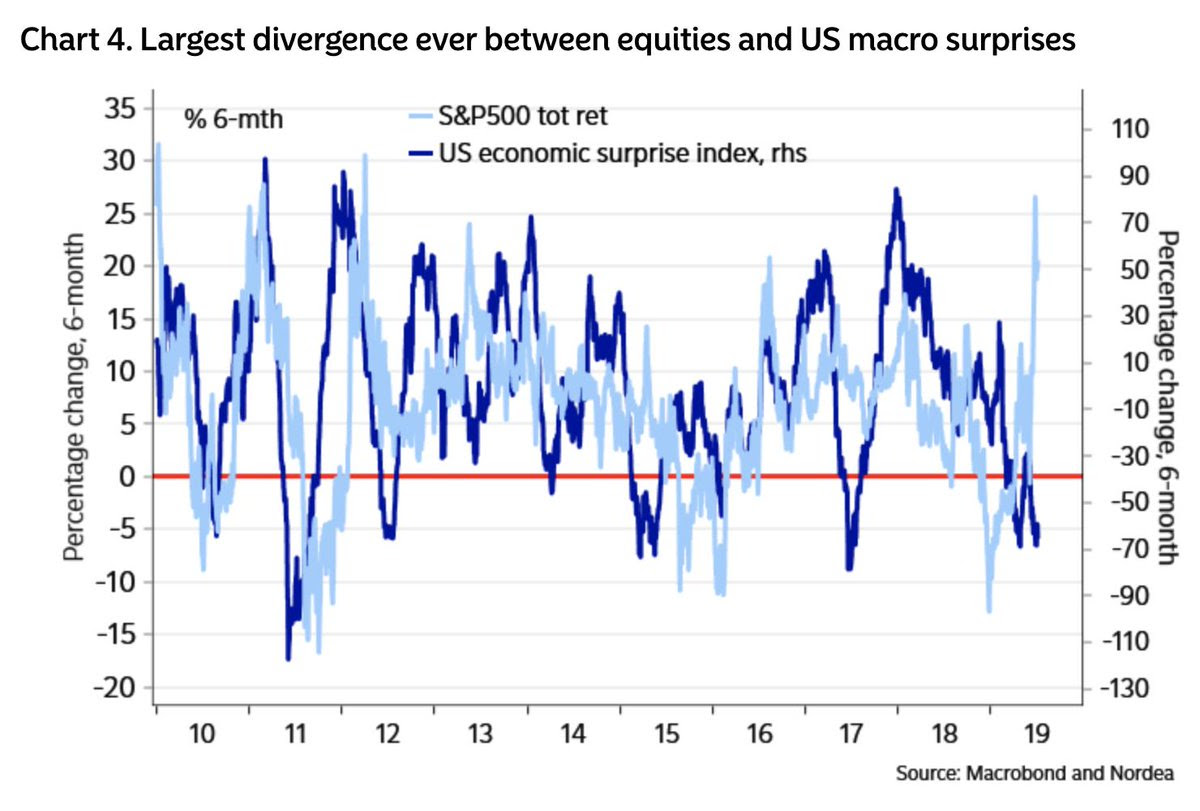

- Jesse Felder @jessefelder – Comparing US equity market performance over the past six months with US macro surprises reveals the largest divergence ever.’ https://e-markets.nordea.com/#

!/article/49828/week-ahead- all-about-that-fed …

This is why we have been arguing that a back up in Treasury rates to 2.25% – 2.5% could prove to be a terrific opportunity to buy Treasury bonds.

Our worst fear for 2019 is getting closer to being realized, fear that the Fed will be too late to the easing the US economy needs to stem the deflationary slowdown spreading through its body. The Bernanke Fed was too late to recognize it and by the time he saw it, it was too late. We think the Powell Fed is following that path.

By the way, the Treasury curve flattened again this week. The 30-yr rate closed the week up 0.6 bps while the 2-year rate closed the week up 11.4 bps – a flattening of 11 bps in one week. The 10-year rate only closed up 3 bps while the 3-year rate closed up 10.6 bps.

Good luck to us all. We may need it big time by the fall.

3. Gold

Gold may have been the one asset that was even more overbought then Treasury bonds. No wonder, Gold got shot after the NFP number on Friday morning. This was the second whacking of Gold this past week.

But Carter Worth of CNBC Options Action said “keep buying Gold” on Friday evening. He said “all the elements of a major rounding bottom” are in place. And amazingly, CNBC.com doesn’t list this video. It has been relegated to msn.com. Watch it here .

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter