Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Velocity to Growth; 5% growth

We are fans of the simple and bigger fans of simple articulation of the simple. That is unfortunately rare, mainly because the self-proclaimed cognoscenti look down on both the simple & the simple articulation. Unless you are one of those, you should watch the 5- minute clip below of BlackRock’s Rick Rieder on Friday’s CNBC 1/2 Time.

It begins with CNBC’s Scott Wapner asking about Rieder’s call that “the market is going significantly higher – perhaps even before the election“. Below is the thinking of Rick Rieder, at least the key points of it:

- “… the free cash flow yield of the equity market is well into 4% off of next year’s earnings; … I think it will propel the market higher ..

- “… you are going to get more stimulus into the system; … you put $2 trillion like we already have, you are talking about 10% of GDP; … then you grow the monetary base, you create a velocity to growth & you are growing the monetary base… its pretty hard for you not to get nominal GDP that starts significantly higher into next year … we think we are going to get 5% nominal growth next year ..”

Then Wapner asked incredulously about Rieder’s statement that “… equities are as cheap as they have ever been … ” Rieder responded with the simplest of simple basics:

- “.. people focus on PE ratios & PE ratios are a useful metric; but when we finance real-estate or you finance a receivables pool or talk about any other form of sophisticated financing, what you think about is your cash flow that comes in & your cash flow relative to your cost of financing … when companies today have the ability to finance themselves at extraordinarily cheap levels, it allows them to do M&A, it allows them to do Cap-Ex, it allows them to do R&D and you create a really different dynamic; people under-estimate the discount rate … in the equity market they do; the equity market on the true metrics you look at & all the right metrics you look at … I don’t think the equity market is high at all”

You knew what was coming after that, right? After all Wapner is a CNBC anchor & probably mind-washed from listening to renowned gurus asking over the past few years why would anybody “lend money to US Government at 4%/3%/2% etc.”? Yes, that is the nonsense that CNBC anchors have been listening to since the 10-year yield was 4%. Naturally, Wapner asked what happens to Rieder’s bullish thesis if the 10-year rate goes to 1%?

Rieder patiently replied:

- “first of all, companies don’t borrow at all off of Treasuries; companies don’t borrow off of 10-year notes; they borrow off where the high-yield market is, where the investment grade market is, loan market … and as long they are able to finance at these levels, it is incredible; some companies, the big companies, 5 years & in, are able to borrow at 50 bps; that’s incredible; …. when you can finance like that, you move up 15-20-40 bps in rates…”

He didn’t say it but Rieder clearly meant “who cares?”. Then he added,

- “I think the back-end of the yield curve will probably elevate over the next few months … partly because the economy’s growth is good & Treasury has to issue a tremendous amount of debt … [but] I think they are not going to move up that dramatically to affect the equity market … “

That brings us to:

2. Rates

We don’t mean to pick on Scott Wapner because his CNBC colleagues also jumped on the rates rising bandwagon. But the bandwagon did accelerate this week with the 30-10 year yield curve up 11-10 bps & the 5-year up 5 bps on the week. It was not just the size of the move but the pace of the move.

No wonder the Fed woke from its self-mandated slumber:

- Holger Zschaepitz@Schuldensuehner – #Fed balance sheet hit fresh All-Time High. Total assets rose by $26bn from prior week, to $7.177tn on QE. Treasury securities rose by $25bn to $4.50tn. Now balance sheet equal to 37% of US’s GDP vs #ECB‘s 66% and BoJ’s 137%.

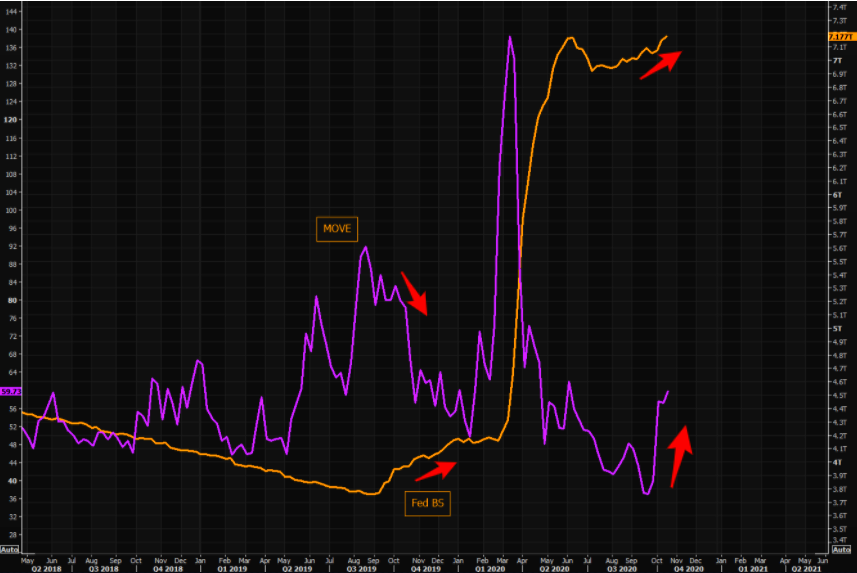

Is the MOVE impressed with the BS? Not yet:

- Market Ear – The chart bothering Powell the most… Fed does not like spiking bond volatility, MOVE index. Recall the “problematic” MOVE index development a year ago? That was “fixed” with the BS expanding “normally”. We all know what happened later… Note that despite the Fed BS actually expanding, less extreme than during the crisis, MOVE index has spiked higher and refuses coming down… Watch this closely…

What do you see if you look outside the US?

- Lisa Abramowicz@lisaabramowicz1 – U.S. 10-year yields are about the highest vs similarly-dated German bunds since March.

Does that mean US Treasuries are now even more attractive to European investors as Bob Michele of JP Morgan had predicted weeks ago? Yes, said a Bloomberg.com article this week with the following chart:

The article stated:

- “Any increase in yields should also draw foreign investors, with over $16 trillion of global investment-grade debt yielding less than zero. With hedging costs having cheapened and the U.S. yield curve steepening, the pick-up on 30-year Treasuries for euro-hedged investors is roughly 80 basis points above German bunds.”

And that is also due to the cop on duty:

- “The Fed’s move this year to bolster currency swap lines has helped make the pricing more attractive for currency hedgers, says Zoltan Pozsar at Credit Suisse Group AG. And while central banks have stepped back from the swaps, the lines still create a backstop to keep hedging costs down.”

And,

- “Yields are almost behaving as if we have yield-curve control already,” said Esty Dwek, head of global market strategy for Natixis Investment Managers, which oversees about $1 billion. “The yield rise will probably remain contained because the Fed is more important than anything else and they will limit it.”

So what are the smart guys doing according to the Bloomberg article?

- “Jim Caron at Morgan Stanley Investment Management says he’s “slowly taking advantage” of buying opportunities when 10- or 30-year Treasury yields rise. He predicts the 10-year rate will get no higher than 1.25% and expects the Fed won’t lift rates until at least 2024 or possibly 2025.”

What about now? Look what the guy who said “Buy Bonds, Wear Diamonds” in 2019 is saying now:

- Raoul Pal@RaoulGMI – – Feels like the next leg lower in rates could be coming, regardless of the current narrative. This is just a small part of my work on this idea. I wrote it up in Macro Insiders /Real Vision Pro yesterday with some trade ideas around it. Let’s see…

In our experience, rates usually head lower when CNBC Anchors get talkative about rates going higher & higher. Is there any metric that is suggesting that their rhetoric is getting priced in?

- Macro Charts@MacroCharts – Added to the growing list of imbalances: “Panic at the Bond disco” Bond Puts the most expensive in years. Near important lows. Traders perhaps too aggressive on easy stimulus/election? Watch closely.

But is there someone who is actually suggesting trading for a bounce in Treasuries? Yes that with a chart from @sentimenttrader

- Jay Kaeppel@jaykaeppel – JayOnTheMarkets.com: If Bonds Bounce… tinyurl.com/yxkmknd6

3. Election, VIX, Stocks

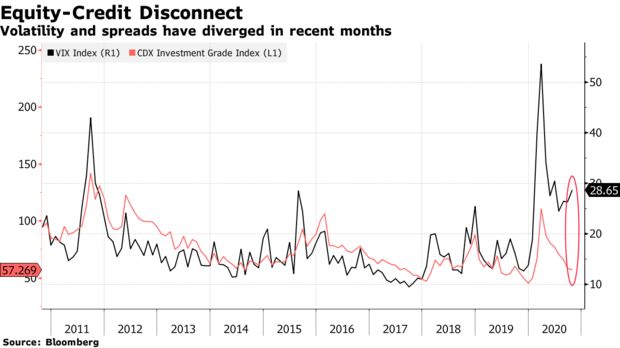

The ball was opened by Boaz Weinstein of Saba Capital, the brilliant & sometimes brash relative-value savant. His view is simply encapsulated by the chart below with the catalyst being the chaos from the election:

As Bloomberg’s Erik Schatzker reports:

- “It’s like a calm before the storm,” he said in a Bloomberg Front Row interview. “Equity volatility is almost inescapably high. Is that a good form of insurance? The payoff profiles are nothing like they were back in January. Whereas in credit, we’re almost back to where we were in January.”

Schatzker adds,

- “Weinstein has multiple trades on. He’s underwriting the risk of swings in certain stock prices by selling out-of-the-money put options, for example, while taking out protection against debt defaults by the same companies — a bit like selling flood insurance in one market and buying it in another at the same time.”

But what if equity volatility is actually “low” and explodes up during a chaotic aftermath of the election? His short puts would create a loss & his credit protection will have to pay off bigger. It depends on what companies he is putting his positions. His seems to be a set of specific company trades & not index-based trades.

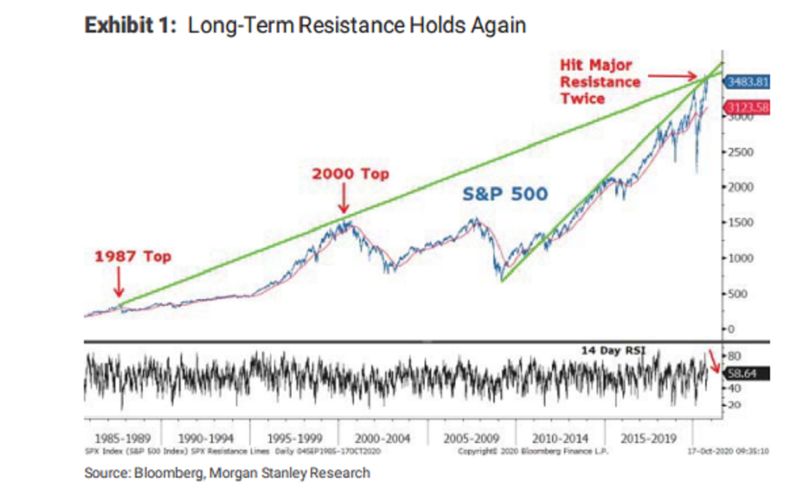

Morgan Stanley’s Mike Wilson, on the other hand, expects the S&P to go down by 10% to about 3,100 both on election chaos & long-term resistance on the S&P:

But he suggests buying the decline at 3,100 or so. In contrast to Wilson, the positioning is all on the other side, the Weinstein selling puts side :

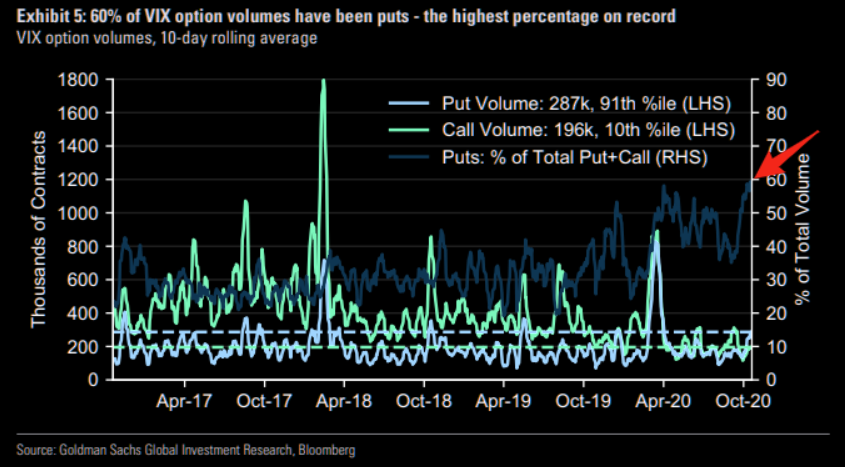

- Market Ear – Everybody expects the melt-up (7) ; Heavy VIX put volumes…nobody hedging VIX explosion scenario?

What about Hedge-Fund positioning?

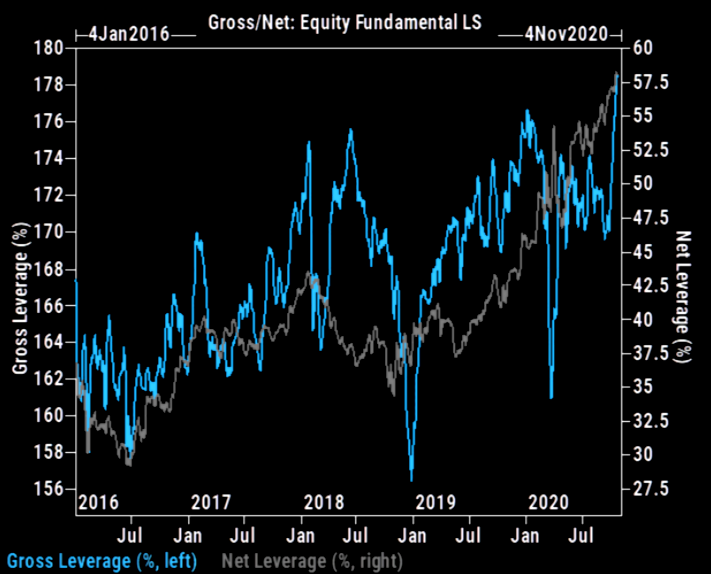

- Market Ear – Everybody expects the melt-up (4); Hedge funds are already positioned for the melt-up. Nets at multi-year highs. Gross Exposure: Level at 100%-tile since Jan-2018. Net Exposure: Level at 100%-tile since Jan-2018.

What about mutual funds?

- Market Ear – The current equity mutual fund liquidity ratio is at the lowest level in decades; With funds all having peak long positioning–a lot of which is piled in the same, very crowded names, volatility tails become fatter.; Lets have at least a small “redemption run” (they actually do happen every now and then even without external catalysts) and see how much of a selling tsunami it can create…

And all this need not happen the morning after the election. The Jim Bianco scenario suggests that the we get a clear winner on election night and three days later we get a different winner based on mail-in ballots. When would such a mess get resolved? November 26, according to Morgan Stanley’s Wilson, per a Bloomberg article.

On the other hand,

- Market Ear – The right tail-risk: JPM sees an ‘orderly’ Trump victory leading to a rally to 3900 for S&P500 until year-end

Here is where the old “career risk” may come in. No professional investor, hedged or unhedged, can afford to miss such an explosive year-end rally. That is why they may be positioned all-in. What if the stock market falls apart after the election? Professional managers have not, at least historically speaking, suffered career risk when everybody’s returns collapse due to a major event.

And then, you have the “In Fed We Trust” mantra.

Finally what two smart & veteran observers are saying about VIX:

- Lawrence McMillan – This brings us to volatility, which is preoccupied with post- election option pricing and as a result is not acting as its usual barometer for the broad stock market. $VIX continues to remain high — just below 30. It would certainly not be this elevated without the Election pricing. Is the election going to be a big deal or not? In some ways, this whole anticipation reminds me of Y2K — a lot of hype, but not much substance once the event actually arrived. It could play out that way. There are some who are predicting a volatility implosion after the election that will spur a large stock market rally as hedges are unwound. We shall see.

- Tom McClellan – The weird behavior now is that prices are close to a new all-time high, but the VIX futures open interest remains below the 200MA. The implication is that we are not seeing the normal sort of topping condition of the past few years. …. The interpretation which makes the most sense is that the lack of a big rise in VIX futures open interest in 2020 says that we are not encountering a major price top. If we see VIX futures open interest start to rise in the months ahead, we could get to a condition meriting a major price top, but at the moment this is not that condition.

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter