Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Chuck Daly Dictum

Chuck Daly, the championship coach of the Detroit Pistons, had a dictum about his successful plays – “keep running it until they figure out how to stop it”. Those who followed this sagaciously simple dictum are feeling happy now.

What play are we talking out? As we wrote two weeks ago, the Fed, at least the power duo of Powell & Brainard, are now committed to stomping on the stock rally. Powell did it first on Monday March 21, 3 days after his dovishly bullish presser at the March FOMC. He couldn’t deliver the results. So on Tuesday March 5, Brainard threatened Rapid QT and that did the trick as you can see below:

So we wrote last week about the new Numero Uno factor in the markets – Fed posturing. That naturally leads to a play – Buy S&P puts before Fedspeak, especially speak of Powell/Brainard. Any one who did so this Thursday & Friday was happy about Thursday’s massive reversal and even happier after Friday’s carnage.

The carnage was bad because Powell spoke twice, first on Thursday with IMF & then on Friday with Yellen. Why would Powell do this just 8 days before his FOMC presser on May 4? David Rosenberg said it succinctly & precisely on Friday April 23:

- “.. this to the Fed is all about a credibility game”

The “pure lunacy” of this was pointed out by Larry McDonald on Monday, April 18:

- Lawrence McDonald@Convertbond – – Fed Governors – who have NEVER held a job outside the Fed and Academia Williams* Bullard* George* Daly* Evans* Bostic* Brainard* Harken* Black* Montgomery* *Never have actually sat in a risk-taking seat, but now are overseeing $9T of risk assets. Pure lunacy.

It was David Rosenberg who voiced the fear we felt on Friday into the close:

- David Rosenberg@EconguyRosie – – Just remember — before Black Monday on October 19th, 1987, they were calling the 5% plunge the prior session Black Friday and the promoters were calling the low! #RosenbergResearch

What play would Chuck Daly have called into Friday’s close? Buy S&P puts expiring Monday 4/25 evening. If you lose, you lose small. If you win, you might hit a mini version of Dark Monday October 19, 87.

2. Stocks – Winners discarded as trash!

Let us look at the week:

- Dow down 1.9%; SPX down 2.8%; NDX down 3.9%; RUT down 3.2%; IWC (micro caps) down 4.5%; EWZ (Brazil) down 7.7%; Chinese ETFs down 6% ish with KWEB down 10%;

Treasury yields were up and furiously so at the short end:

- 1-year yield up 29 bps; 2-yr yield up 22 bps; 3-yr up 18 bps; 5-yr up 15 bps; 7-yr up 11 bps; 10-yr up 8 bps; 20-yr up 5 bps & 30-yr up 3 bps.

Given the disclosed intensity of Fed’s rage against inflation, it was strange to see that basic materials & commodities were trashed late this past week:

- Copper down 2.8%; CLF down 6%, FCX down 14.9%, MOS down 13%; Oil down 4.3%; Brent down 5%; Nat Gas down 11.7%; OIH down 5%; Gold miners down 9.7% & 10.6%.

David Rosenberg pointed out on Friday that “basic materials have not made a new cycle high since December 31“.

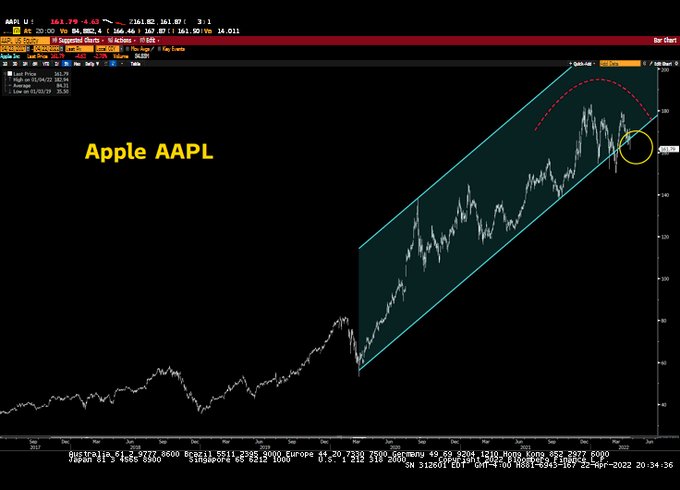

Also hurt badly were what we will call MAFAA with Microsoft down 2.4%, Apple down 2.4%, FB down 12.5%, Alphabet down 5.6% & Amazon down 5.1%. This suggests a serious down leg to one smart guru:

- Lawrence McDonald@Convertbond – – They are coming after the Crown Jewels – The largest down volume day for Google GOOGL since the March 2020 Covid panic. BEFORE lower prices bring out sellers – there are classic hide-outs. Now – all the hide-outs, XLU, MegaCaps, etc – are giving way. Up volume vs. Down – is key.

and,

Then Carter Worth of CNBC Options Action said “its a very bad set up” and suggested another potentially 10% downside in QQQ.

Big Tech earnings on deck!@CarterBWorth charts the $QQQ for where we may be headed. @Michael_Khouw lays out a trade. @OptionsPlay's Tony Zhang gives his thoughts. pic.twitter.com/KQBO9R7PfM

— Options Action (@OptionsAction) April 22, 2022

Then a tweet that might be the most bearish of them all highlighting a condition that normally would be bullish but is bearish right now.

3. Is it finally his time?

We have followed David Rosenberg for a long time. In that experience, we have learned that he is early, often way early. Sometime so much so early that following his advice early might lead to loss of quite a bit of capital. So we patiently read & listen. For example, he suggested buying 30-year Treasuries at the start of 2022 for reasons that seemed valid. Unfortunately, long duration Treasuries have suffered one of their worst starts of any year we recall, including 1994.

But there comes a time in each cycle when he begins proving correct and the economy, the Fed & the markets jointly act to make his ideas seem profitably actionable. We wonder whether Friday, April 22 would turn out to be the propitious time to listen to him and begin acting. Listen to him for 6 minutes & decide for yourselves. Some excerpts are below:

- Treasury Bonds – the technical picture shows one of the most oversold conditions in modern times; … the spot yield on the 10-year Treasury note at 2.93% is a whopping 122 bps above the 200-day moving average; it is a 2-standard deviation event; yield spasms like we witnessed in the past few weeks, past few months – which typically occur in Fed tightening cycles – have foreshadowed a recession in the past more than 70% of the time and when they don’t, they have occurred in some very tough periods for the equity market, e.g., fall of 1987, summer of 1994 – both episodes that were followed by the way by mammoth Treasury market rallies ..

- signs of stock market telling us about consumer demand destruction but the bond market hasn’t repriced for this yet; it has inflation on the brain; … on the precipice of seeing a softer underbelly take hold in the labor market – the Fed committed to 250 bps hikes in May & June and sounding so tough right now; we are peaking out on this score of Fed hawkishness – this to the Fed is all about a credibility game …

Watch this clip.

Finally as Dennis Gartman used to highlight the timeless caution from Hill Street Blues -“Let’s Be Careful Out There“.

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on Twitter