Editor’s Note: In this series of articles, we include important or interesting videoclips with our comments. This is an article that expresses our personal opinions about comments made on Television and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. Green Light to Taper in December

That was the assessment of the Fed Whisperer-in-chief on Friday afternoon on CNBC Fast Money. Jon Hilsenrath said flatly that the Fed will debate taper at the December 17-18 FOMC meeting. How could they not? The data has once again delivered a perfect tapering opportunity to the FOMC.

This week’s data must have been sweet music to their ears. Almost every single component showed that the economy is getting stronger. The old Economy vs Economy debate between ISMs & Employment has been decidedly resolved with both components rising in tandem.

So will they? So many gurus, including Bill Gross, keep telling us that the Fed is fed up with QE and they are sort of desperate to end it. Jim Bianco has been saying this for months. Then why don’t they? Is it because of the reality portrayed in the following tweet on Friday?

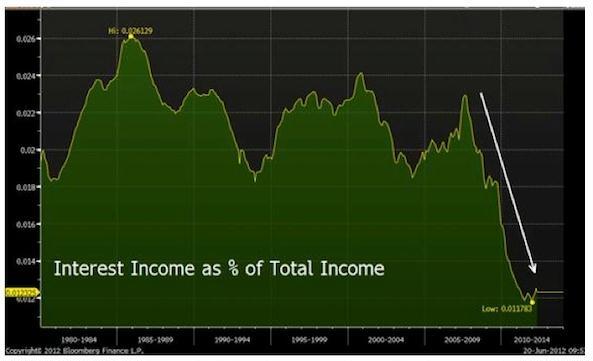

- Eric Pomboy @epomboy – so many charts when considering the “we’re out of the woods or taper scenario. This one worth a double-take … pic.twitter.com/hJIWXoMjS6

Remember Bernanke’s nightmare is deflation and his first priority is to raise inflation expectations. And the chart above is screaming “disinflation”. We are simple folk and we think inflation requires spending which in turn requires income. And what is the story of income in America? The tweet & its chart below tells the story better than we could:

- Rudolf E. Havenstein @RudyHavenstein – Here’s the ZIRP pic.twitter.com/cRQ4RVFc4h

So is Bernanke’s QE4ever contributing to persistently low inflation? The chart says yes and so do the inventory builds at retailers. The reality is that Fed’s QE4ever is actually creating a negative income effect in its desperate quest to create a wealth effect. This could get worse when the Fed actually tapers. Because a taper will be tantamount to decreasing the so-called wealth effect while forward guidance of low rates forever will maintain today’s negative income effect.

This leads us to come in from the left field and ask whether the Fed should actually do the opposite – Raise interest rates while keeping QE4ever at current levels. This would create a higher interest income effect while maintaining the wealth effect of QE. We think the yield curve would flatten some under this scenario and longer duration yields could come down a bit giving a boost to the interest sensitive sectors of the economy.

Coming back to today’s center field, will the Fed taper on December 18? We sincerely hope they do but we bet they won’t. That’s the history of the post-1994 Fed. They are so loath to tighten* when they should that they end up waiting until the economy is ready to slow down on its own and then their tightening adds to the downward slope of the economy.

* yes, tapering is tightening despite the attempts on CNBC shows to say otherwise. Those who disagree should listen to the disdain in Santelli’s voice as he demolished this nonsense on Thursday.

2. Did Markets say ‘No Taper in December’?

What would have happened had the Fed publicly said ‘No December Taper”? The stock market would have rallied hard, Emerging markets would have rallied even harder, Treasury yields would have fallen and Gold-Silver would have rallied.

Isn’t that exactly what happened on Friday despite a great & clean jobs number? Rates jumped, TLT fell by a point when the numbers were came out at 8:30am. But then, TLT began ralling and Gold began rallying with stocks. This action continued despite a higher than expected sentiment numbers at 9:55 am. The stock market closed up by 198 Dow points and 20 S&P handles. TLT was up by almost half-point, Gold-Silver closed up and EM markets outperformed S&P by over 1%.

This is on a day when you would have expected the 10-year yield to approach 3% and the S&P to be down hard. Was it just an oversold bounce after 5 down days in S&P and a sharp drop in Treasuries & Gold earlier in the week? Or was it the markets deciding “no taper” in December? We vote for the latter.

3. U. S. Equities.

The most bullish comment came from Richard Bernstein and it is his No. 1 theme for 2014:

- “The US stock market continues its bull run – We continue to believe that the US stock market may be in the midst of one of the biggest bull markets of our careers. The yield curve remains positively sloped, valuation appears normal for this point in the cycle, and sentiment remains very attractive according to our models. Although stocks in 2014 might not provide returns as high as those during 2013, the US stock market’s return might be above average in 2014“

Scott Minerd of Guggenheim Partners gave an opposite, bleak forecast for the next 10 years on CNBC Squawk Box:

- “When you look at valuations today for the market, we are sitting at total market cap to GDP of about 120%; on a forward basis when we have gotten to these valuations for the next decade, generally gives us sort of 1-3% return on equities“

What about 2014? Suni Harper of Citibank was bullish on stocks for next year on CNBC Fast Money on Thursday:

- we’re not in a bubble. in fact, the rally is sustainable … the equity market has priced in the taper …. and I think we have a way to run. … We’re looking at a 7%, 8%. we’re consistent with eps growth in the equity market. we had been in the 12%, 15% camp, but a lot of that’s played out in the fourth quarter…. we’ve pulled forward some growth… so the multiple probably doesn’t have much room to expand,

- I probably like European equities better than U.S. equities, but that’s a close race. … shy in emerging markets. it will take a while for the markets to recover, I say 2015 for that one.

Lawrence McMillan of Option Strategist is more cautious:

- “From a broad viewpoint, using our indicators, the picture is actually fairly bearish except for one major thing: the price chart of the Standard & Poors 500 Index ($SPX) has not broken down. A decline below 1780 would also interrupt the bullish pattern that currently exists of higher highs and higher lows on the $SPX chart.”

- In summary, despite a mounting array of sell signals, we would not sell this market unless $SPX can close below 1780

4. U.S. Treasuries & Municipals

Hardly any one is bullish on long duration Treasuries. That is what makes Friday’s call by Carter Worth on CNBC Options Action interesting:

- Options Action @CNBCOptions – Carter Worth: The ten-year note futures chart has all the hallmarks of a head-and-shoulders bottom. The presumption is that the $TLT bounces.

His colleague Dan Nathan was bearish and recommded buying March puts on TLT when TLT rallies to $105 on Carter’s call.

Bill Gross remains bullish on short-duration Treasuries because of low rates policy of the Yellen Fed:

- @PIMCO Gross: GDP today & a good Jobs tomorrow provide incentive for transition from QE to forward guidance. Stay on frontend.

Municipal Bonds have taken a beating this year. That has drawn some smart investors to recommend municipals. In fact, that is Rich Bernstein’s 4th theme for 2014:

- High yield municipals lead the bond market – municipal finances are generally getting stronger. Investors also seem very concerned that interest rates will rise, but an increase in interest rates can actually improve pension funding status (the present value of future liabilities shrinks as interest rates rise). Because of such factors, high yield municipal bonds might lead bond market performance during2014.

Suni Harper of Citi also recommended Municipals on CNBC Fast Money on Thursday:

- “Municipal bonds, a controversial call, I’m sure. It’s had a difficult year in Munis, three years in 20, negative returns in the municipal market. I think a lot of is overblown because of the headline risk. I think Detroit, Puerto Rico, Jefferson County, get a lot of play, but historically we’ve seen a big bounce-back after a market like that in municipals.”

Scott Minerd of Guggenheim Partners was succinct in his tweet on Friday afternoon:

- Scott Minerd ?@ScottMinerd – Best buying opportunity for #munis since 2010

5. Gold

At least Treasuries provide carry. Gold does not. And the action in Gold is uglier. But that suggests an opportunity to Larry McDonald of NewEdge:

- “I think overall tremendous tax law selling, tremendous capitulation. We saw this at the end of the second quarter with gold. just an absolute rush to the exits, quarter end rebalancing is a phenomenal time for investors to take advantage of capitulation. and that’s what we’re seeing with gold. I think after January 1st, there’s going to be nobody left to sell gold and, say, coal names and gold names. both of those sectors are completely decimated. “

Tom McClellan makes a similar analogy to the June 2013 action in Gold in his Friday’s article:

- “When the commercial traders were at this same sort of low net short position back in June 2013, that marked a nice price bottom for gold prices. Now we are seeing the same sort of sentiment condition, and with gold prices retesting that June low. Gold stock prices (XAU and GDM) have already broken below their June 2013 lows, as stock traders seem to be uniformly pessimistic about the future for gold“

- “The recent drop in gold prices has had the commercial gold traders paring their collective net short position, perhaps due to hedging less of their future production, or perhaps out of outright smart-money speculation on a bullish outcome. We cannot know which motivation is the operative one, but we are able to say that the last time the commercials were at a similar level, it marked a pretty decent bottom for gold prices”

Richard Bernstein is very negative on Gold for 2014. In fact his 5th theme for 2014 calls for Gold to fall below $1,000:

- “the global credit

bubble is deflating, and developed economies’ inflation rates continue

to fall without credit’s fuel. we think US-dollar based investors should

emphasizefinancial assets rather than real assets like gold. In USD terms, we think gold will continue its bear market, and could fall below $1,000/oz“

6. Bernstein’s 10 themes for 2014

We have followed Richard Bernstein’s work for years and developed a healthy respect for his recommendations. This week, he published his 10 themes for 2014 on his website. A quick summary is below:

- The US stock market continues its bull run

- Japan outperforms emerging markets – The Currency Wars Begin – We think Japan is likely to outperform emerging markets again during 2014. The aftershocks of the global credit bubble (i.e., massive global overcapacity and falling productivity in the emerging markets) could result in currency wars… we still believe that investors have yet to fully recognize the significant structural headwinds facing the emerging markets

- European small cap stocks lead global equity performance

- High yield municipals lead the bond market.

- Gold falls below $1,000

- The American Industrial Renaissance continues – Smaller, domestically-focused US industrial and manufacturing companies have been gaining market share, and we think that trend is likely to continue. Energy costs, productivity, transportation costs, quality control, political stability, and labor costs are some of the contributing factors

- The Fed stays on hold much longer than investors expect – … stock market valuations could be higher and volatility could be lower than investors currently expect

- Investors realize that the term “Liquid Alts” may be an oxymoron

- The king has no clothes: high quality stocks underperform – 2008’s lingering fears have led investors toward more conservative, higher quality stocks. We think that trend might reverse during 2014

- Small banks – Larger banks’ balance sheets ballooned during the credit bubble, but their balance sheets have yet to fully contract. Smaller bank balance sheets seem much better aligned to the post-bubble credit world

7. Boom, Bust & Bore Scenarios

Michael Hartnett of BAC-Merrill Lynch begins his report with:

- The Global Economy “Cried Wolf” in 2013 – so gold collapsed, stocks rocked and the great bull market in bonds ended with a thud. We say equities and credit outperform again in 2014. But few are positioned for the major risk scenarios: a “boom” that causes >4% yields; or a “bust” that causes <2% yields.

Then he describes his 3 scenarios:

- The Boom – If it “booms” raise cash and buy volatility. Should growth surge, inflation expectations rise and central banks fall behind-the-curve, then cash will be king (a la 1994), volatility will return, Wall St assets underperform and a GEM FX crisis becomes feasible.

- The Bust – If it “busts” buy Growth, Gold, GEMs & Government bonds. Should growth disappoint, boosting central bank liquidity and hurting the US dollar, then a barbell of the “loved” (assets with bubble risks such as London/HK/Singapore/Dubai real estate, Macau gaming stocks, US tech “dislocators”…) and “unloved” (Gold, GEMs, and Government bonds) outperforms.

- The Bore – Of course the other risk is that the macro of 2014 has already been discounted by the markets of 2013. A long US dollar trade would still work but investors schooled in “relative value” would be most likely to outperform boring, low, single-digit risk asset returns.

In his companion report, Hartnett provides a simple graphical representation of 2013 winners & losers of fund flows:

Source: Hartnett’s report, BofAML Global Research, EPFR Global .

Featured Videoclips:

- Alan Greenspan on BTV Street Smart on Wednesday, December 4

1. Alan Greenspan with BTV’s Adam Johnson & Trish Regan – Wednesday, December 4

When the maestro speaks, we do listen. And this is a thoughtful interview about Fed policy. The excellent summary below is courtesy of Bloomberg Television PR.

Greenspan on whether Bitcoin is a bubble:

- “I guess so. Let me say that currencies to be exchangeable have to be backed by something. When we had – when we were on the gold standard, gold and silver had intrinsic value and people would be willing to exchange their goods and services for gold or silver and wouldn’t ask any questions of where the monies came from. Alternatively, when we went into currencies, it was the backing off the issuer of the currency. In other words, if some individual had great credit standing, his checks could circulate as money. But the question is I do not understand where the backing of bitcoin is coming from. There is no fundamental issue of capabilities of repaying it in anything which is universally acceptable which is either intrinsic value of the currency or the credit or trust of the individual who is issuing the money, whether it’s a government or an individual. Individuals with very high net worth and who have great reputations could create their own currency because people would be willing to exchange their checks with others probably at par. That is not the case with bitcoin.”

On whether Bitcoin could be the new gold:

- “No. Well, see that – it has to – it has to have intrinsic value. You have to really stretch your imagination to infer what the intrinsic value of bitcoin is. I haven’t been able to do it. Maybe somebody else can. But if – you asked me is this a bubble in bitcoin. Yeah, it’s a bubble.” Bitcoin has been a very profitable virtual commodity for millions of people that have decided to trade with it and this is expected to continue. If you would like to make some of this money yourself, it may be a good idea to check out a website such as https://bitcoinrevolution.cloud/. Online platforms for trading these cryptocurrencies are becoming quite popular as of late. It is also worth the investment with things like Bitcoin Superstar Bild, where it is important to gather all the information about Bitcoin investment before you go ahead and do it!

14px;” face=”Times New Roman”>On what has changed with investors’ perception about gold this year:

- “Well first of all, remember we used to be at $35 an ounce. And then even several years ago we were well under $1,000 an ounce now we’re $1,2000 or thereabouts. And to be sure, we’ve come down a bit but it’s after a very significant rise. So the issue here is that the reasons for buying gold were, one, fears of significant inflation first of all which didn’t materialize, and just generally the notion that inflation looks to be relatively stable for the indefinite future and that therefore the hedging aspects of gold are really not that all necessary at the moment. And so what you’re getting is clearly this type of problem which one would ordinarily expect when the – the basic reasons for holding gold are not – not that strong. My – I think that we’re probably at a gold price now which is not all that different from where it probably would be considering that it’s, on the one hand a commodity, copper, on the other hand a monetary asset like the Swiss franc used to be before they fixed it against the euro.”

On new market highs and whether we’ve entered a new age of irrational exuberance:

- “No, I don’t think that’s the best way to describe what we’re looking at. I tend to look at the market as being made up of two major components.

- One is the fundamentals of earnings obviously and long-term interest rates and the various risk premiums associated with them.

- On top of that, we have the valuation process run largely by the extent of animal spirits, to the extent that they’re operating. And that basically includes euphoria, fear and herding. The concept of bubbles has to apply solely to the latter or has no meaning. And in that context, you have to measure what we are looking at with respect to these valuations. And there’s no bubble there in the sense that…”

On whether people should look at the median price to sales ratio:

- “I look at it, but I find that the most useful thing to capture the extent to which we’re pricing products above what the fundamentals is essentially what we call the equity premium. That is, the price that individuals are willing to hold stocks at. And JPMorgan, which has got the best equity premium measure that I know of, up until a couple of years ago had the highest ratio, meaning the lowest value – the lowest markups – I’m sorry, the lowest valuations for stocks in 50 years. Now of course it’s come down a significant amount with the big bulge that’s occurred in the market, and obviously you can’t continue doing what we’re doing. I’m more concerned about the fundamentals at this stage…the market than I am – yeah, exactly. Than I am about the state of euphoria, fear and herding.”

On what he’s most concerned about right now:

- “Well first of all, profits have been rising extraordinarily, as you know. And the result is that the share of national income has been rising to levels which cannot persist in the sense that if you get even a slowdown in the rate of increase in the share of profits to national income, that in and of itself slows the growth in earnings and eventually slows the expectations of future earnings. So that’s one of them. But the main issue is interest rates. As I’ve written in the book that I published a few weeks ago, it’s very difficult for me to see that we’re not on the edge of a significant rise in long-term rates. I don’t know when that is. I do know that we are very significantly undervalued. The rates are significantly lower than they would ordinarily be and that obviously is the result of various QE1, QE2 and QE3, which essentially have focused on not monetary policy but buying long-term assets. That’s not something the Fed has done in the past and it’s going to be very interesting to see in retrospect how successful this whole process has been. But it clearly is driving the markets.”

On the Fed’s quantitative easing:

- “Well I’ve stayed away from commenting on current policy. But let me just say that what is actual causing this is not related to the Fed. It’s essentially the fact that if you look at the data on the economy and look at the GDP for example, you find out that all of the shortfall from where we would expect the GDP to be occurs in assets with very long life expectations. Homes, new structures in the industrial sector, all sorts of assets whose average earnings are coming over a very long period of time. Those parts of the economy have never really never fully recovered.”

- “Housing clearly has come back. But remember, housing starts with single-family dwellings. At the moment it’s still only a third of where it was in 2006 and ‘07. So we have a – we’ve come back but very little. And the extent of that failure to come back accounts for the rise in the unemployment rate and – and the abnormally low sag in – in growth in the GDP far different from any recovery we’ve seen since the end of World War II.”

On whether he believes there’s a problem between what is a bubble in the amount of credit brought by the current Fed and the fact that asset prices haven’t followed suit:

- “No, asset prices have followed suit. That is the issue. The Fed has succeed in raising asset prices by lowering long-term interest rates. And long-term interest rates are the fundamental financial factor that drives the stock market.”

- ‘Well, the issue basically is that it is certainly the case that there’s been a dramatic increase in the size of the balance sheet in the United States, and indeed the ECB, Bank of Japan and Bank of England. But the problem basically is that those monies have not fundamentally filtered into the economies and galvanized economic activity. JPMorgan, for example, holders a large balance at the Federal Reserve Bank of New York as an excess reserve. It clearly has not been relending it out because the total amount of loans and debt increases over the last several years have been very modest. And this tells me that there’s – that money is not actually working yet.”

On how Yellen might differ from Bernanke as Federal Reserve chair:

- “Well the markets that they’re dealing with are going to be very significantly different. Ben was involved when the Fed saw the necessity of significant balance sheet expansion. We’re coming to a point now where we’re about to not only end the taper, but eventually of course pull a good deal of those assets in because they have not yet really moved into the outer markets where they can affect incomes and inflation. They affect interest rates. They affect stock prices, but until those monies are actually lent out by the commercial banks w

ho hold those deposits of the 12 Federal Reserves, it’s just a – it’s just a bookkeeping activity. Nothing has happened. And you could reverse that. If it weren’t for the psychology of the Fed reserving itself by swapping out of treasury bills, they would – not treasury bills. They don’t hold any treasury bills. Swapping out of treasury notes or even any other type of asset. When you – you can do that now.” - “A deal could be made between the US treasury and the Federal Reserve to offset the holdings of US treasury instruments, and probably even asset – rather mortgage-backeds against their deposits at the 12 reserve banks with just a simple bookkeeping error – entry rather. The issue there is do people – if people did not expect that that was a prelude to tightening, it would literally have no effect. But there is going to be a psychological effect when they move, and that’s going to put the monetary policy actions of the Fed in a quite different mode in the years immediately ahead than in the years that have just preceded us.”

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter