Editor’s Note: In this series of articles, we include important or interesting tweets, articles, videoclips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. Ennui or Boredom

This difference may be the biggest discussion of this sleepy week. Even a negative 2.9% print in Q1 GDP could not shake anyone. Perhaps because,

- Wednesday morning – Gluskin Sheff @GluskinSheffInc – David Rosenberg: As bad as it was, the Q1 GDP contraction was temporary

- Friday afternoon – Gluskin Sheff @GluskinSheffInc – Rosie: Consumer spending on cyclical goods & services +1% in May & +15% SAAR since Jan… there’s NO divergence with 6-year high confidence.

But by Friday, a number of economists had reduced their Q2 GDP projections.

2. Second Half of 2014

The environment is simple – ample liquidity, low rates for awhile, inflation fears alleviated by the mild PCE deflator. So what’s not to like? Wharton Professor Jeremy Siegel answered on Monday via his call for Dow 18,000 because of “green light” from the Fed.

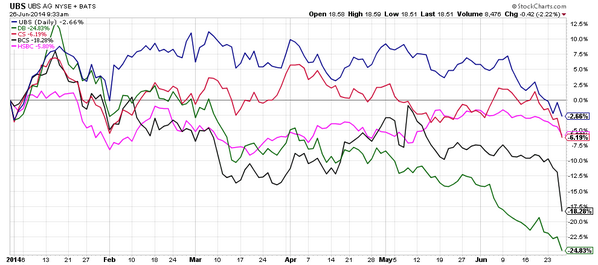

But one old factor worried a few this week – the action in European Financial stocks. As Matt Maley, equity strategist at Miller Tabak told CNBC Street Signs on Friday:

- ” … we’ve had a bit of a sell on the news thing after the ECB’s announcement earlier this month. the financial stocks are down about 7% over there. that’s very similar to what we saw in 2011. the Financials had been lagging all year and they had been lagging back in 2011. however, once they started to roll over instead of just rising more slowly, the rest of the European market rolled over with it. we’re seeing the same thing now. European financial stocks are starting to roll over a bit. It’s not broken a key support level yet, but if it does, you may see the correlation regain itself and see the European stocks roll over; that could be a problem for us, because if you look at the correlation between Germany’s DAX and US S&P, it’s been incredibly strong in the last five years, so Europe is something that people aren’t focusing on, especially the financials. if that continues, it could cause a problem”

The same point was made on Thursday by,

- Charlie Bilello, CMT @MktOutperform – These European banks continue to weaken. Nobody talking about it yet but suspect it will become an issue soon. pic.twitter.com/X1L8r3Qqpx.

.

.

and on Friday by,

- Mark Newton @MarkNewtonCMT – European Financials have moved to new 4-wk lows, closing in on 200d, but June’s reversal problematic http://stks.co/s0TUK

3. Treasuries

Despite Professor Siegel’s claim of a “green light” from the Fed for Dow 18,000, the asset class that did well this week were Treasuries. TLT rallied by 1.3% and yields fell across the Treasury curve – 30 yrs by 7 bps, 10-yrs by 8 bps and 5-yrs by 5 bps. But the 10-year yield did not break through 2.5% and in fact rose 3 bps after touching 2.% in the morning.

The long end has enjoyed a terrific rally in the first half of 2014 with TLT Up 12% ytd. What about 2nd half of the year? Rick Santelli gave his view on Friday:

- “keep an eye on two extremes in terms of interest rates. 2.66% May 12th, 2.44% May 28th. look for a breakthrough in either direction if we get a yield close above or below the two extremes“

But what about next week & next month? The Nonfarm Payroll number on Thursday, July 3 will answer that.

Santelli also spoke about the 10-yr Treasury-Bund spread reaching 135 bps, a 15-year wide spread. This will keep a lid on interest rates in the US, he argued. Since a picture is worth many words,

- Wednesday – Bespoke @bespokeinvest – Nominal German bund yields trading at their most negative spread to Treasuries since June 1999. pic.twitter.com/pQhQfAECxO

.

.

Words like “chasing yield” don’t mean much until you read

- Friday – Lawrence McDonald @Convertbond – How do you Spell Credit Froth? Downgraded: 1 notch above junk this month; Bulgaria, EU’s poorest member state just sold $2B bonds at 3.05%

and more generally,

- Friday – Lawrence McDonald @Convertbond – One of the Fed’s Colossal Side Effects – Total Emerging Market Debt Securities 2014: $6.9T 2010: $5.2T 2005: $2.1T 2000: $500b BIS Data

4. U.S. Equities

The Dow 18,000 target of Jeremy Siegel is due to what he sees as the “green light” by the Fed. The “most bullish” strategist on the street is Tony Dwyer of Cannacord Genuity who has his year-end S&P target as 2,185, about 11% from here. But he does not see getting there in a straight line. As he said on CNBC Futures Now on Tuesday:

- In real bull markets, it’s the unknown unknowns that come in and cause a 5 to 10 percent correction,” he said. “It’s just that when the market gets very tired and it gets extended, you don’t know what’s going to cause it, but it comes in, and I think that’s what we’re set up for.”

- In the first six months of a new Fed chair, the market pulls back a median 9 percent. When the market’s up this long over the 200-day moving average, before you get another 5 percent, you typically get a 7 percent correction, so there’s a lot of different quantitative historical nuances that command staying with a correction call, even if it’s against you right now

But what about the Only Chart that Matters per Tom McClellan?

The article states:

- “it is sufficient to note that the Fed’s balance sheet is still getting larger, and that is still bullish for the stock market. It may not be as bullish as when it was $85 billion a month, but it is still an upward slope. When the Fed gets down to zero again later this year, we can start to worry.” .

Lawrence McMillan was straightforward in his Friday’s summary:

- There is support for $SPX at or just below 1950. In addition, there is support at 1925 (the lows from a couple of weeks ago), and then there is major support at 1900…. In summary, nearly all of the intermediate-term indicators are bullish (save the weighted put-call ratio), so the longer-term outlook is bullish. It remains to be seen whether the overbought conditions will generate any meaningful short-term correction

Most people have given up on talking negatively about the U.S. stock market. In fact, the most cautionary comment came from Robert Shiller of Yale in his Yahoo Finance interview. He spoke about his CAPE (cyclically adjusted price-earnings ratio) that goes back to 1881. He pointed out that the ratio has been higher than current levels only 3 times in history – 1929, 2000 & 2007. But Shiller added that his CAPE is not a market-timing tool and he would not be short the market, only lighten up.

5. Gold & Silver

Gold & Silver closed basically flat this week. Dennis Gartman said on CNBC Futures Now that “there is somebody selling Gold who is fairly large whoever that somebody is”. He is bullish of Gold in Euro terms but not yet in Dollar terms. Based on what he said, getting Gold over $1,350 is necessary. On the other hand, Neil Azous of Rareview Macro is bullish in the short term but says “stay away” from Gold for the medium term. He gave the following arguments in support of a short-term trade in Gold:

- Oil-to-Gold correlation has swung to positive from negative

- Market narrative has swung harshly to inflation away from growth

- Positioning is well below 5-year average so that argues in favor of it

- Technically there is an argument as we have crossed above the 50 & 200-day moving averages

Jeff Kilburg of CNBC Futures Now added that:

- “If we get Gold above that 1330 level , shorts will be on the run because there is back & fill all the way to 1390“

Send your feedback to [email protected] OR @Macro Viewpoints on Twitter.