What a week this was! The most important trading commodity in the world crashed and so did the currency & financial markets of the second most powerful nuclear military power in the world. Capital rushed out of Russia as if it was chased by a mad bear and its sisterly capital ran out of all emerging markets. It didn’t stop there. The contagion spread fast & furious to corporate credit & stocks of US energy companies and created a sharp sell-off in the US stock market. Then came soothing words from a wonderfully dignified silver-haired lady on Wednesday afternoon and calm was restored to Russia & Oil. Stock markets shot up as if they had struck a new gusher of money. We pity the poor souls who get their entertainment from movies and books. Is there a better game in the world to play or watch?

1. Never ask why – Ask how

The most expensive question in the world is why? It is expensive because it is utterly useless and because of the old wisdom that when you think you have it figured out you get a bullet in the head. The real question is how this happened. How did a country that can destroy the entire world with its strategic nuclear missiles, a country with a strong determined leader, get so utterly humiliated & totter on the verge of financial ruin?

This week in the Ruble, the Russian currency, was captured in the tweet below:

- Kirit Radia @KiritRadia – Here’s how the ruble fared for the entire week. It largely recovered from the crash, but tough times expected ahead .

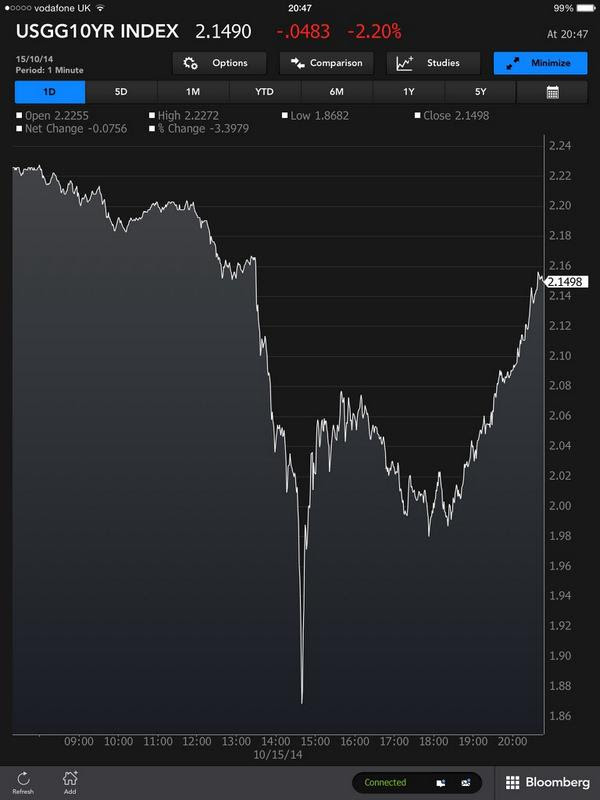

Now compare the graph above to the unbelievable action seen in US Treasury market on Wednesday, October 15:

- Toby Nangle @toby_n – 10yr UST intraday yield is one for the photo collection. As whacky as those JGB yield shifts in April 2013 (?)

The photos look similar as they should. If we had a graph of the crash of the Indian Rupee in August 2013, it would look similar. The question isn’t why the Ruble collapsed this week, why the Rupee collapsed in August 2013 or why interest rates collapsed on October 15, 2014. The question is how these very different entities collapse with similar speeds in a similar fashion.

The answer is simple. It is just like how the largest army in the world collapsed in a week at the start of World War II. The collapse and the surrender of France in just one week tells the story of how that large, powerful army was caught in a horribly wrong position, massed at its maginot line while the Germans blitzkrieged from the Ardennes and caught the French army facing the wrong way.

In each of the three financial cases above, huge forces were positioned the wrong way and they were blitzkreiged from behind. They collapsed and ran as a poorly positioned army does. In the financial markets, there is only one way to run – find a buyer/seller at any price for what you must sell/buy. We bet that is what happened on October 15, 2014 when machines ran amuck in search of treasuries they needed to buy to cover their shorts. Traders with decades of experience said that they had never ever seen anything like that. Somebody big got wiped out that Wednesday morning.

So what happened this month to Oil? Smug self-glorifying publications like Economist wrote “the trigger for this acceleration of the crisis is mysterious“. That’s because people at the Economist are talkers not doers. The answer is obvious as David Rosenberg of Gluskin Sheff said to CNBC’s Kelly Evans this week:

- “nobody talks about the financial demand for oil;we had the first 25% decline & before the OPEC mtg oil was sitting at $75; a lot of speculators were expecting the Saudis to do something; they didn’t; those net specs long on the NYMEX who were at 500,000 are down at 280K; there has been a large demand destruction happening on the financial side; that is the principal cause for this latest swoon in the price of oil”

Translation – Large Speculators were caught massively long in Oil; as others began selling after the OPEC meeting on November 30, losses began building for those who had not sold. So, finally, some big guys decided to cut their losses & run. When the big guys run, you get a price collapse. And a collapse looks the same whether the battleground is US Treasuries, the Indian Rupee, Oil, the Russian Ruble, or the French army on the maginot line.

Frankly, the sell-off was worse because of the impending year-end. People get paid based on their investing performance or profit-loss. No one can afford to lose their realized gains by sticking to losing positions. So the natural propensity to sell in fear got amplified this month because of fear of losing their year-end bonus. Ergo meltdown!

2. Fall in Emerging Markets

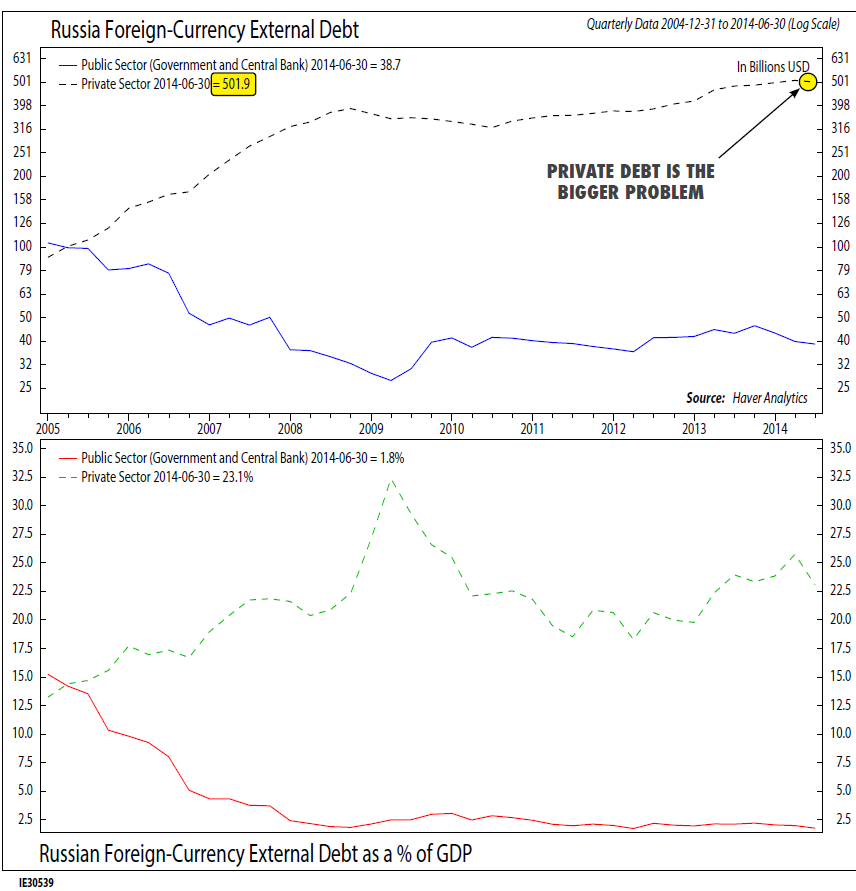

In every collapse, the worst hit is the entity that is the most exposed. This week it was Russia. Yes, the middle eastern markets like Dubai, Abu Dhabi also collapsed. But they are not systemic and frankly few care about how hard they fall. Russia is different. It is a developed European country and global investors are large players in Russian markets. The Russian economy is essentially a one-factor model – Oil. But unlike Saudi Arabia or UAE, Russia has been a large borrower of credit from global investors in foreign currency:

- Alejandra Grindal @AleGrindal Dec – #Russia’s problem… foreign currency external debt @NDR_Research NDREurope

The epi-center of this crisis is not Russia’s government debt but debt of huge Russian energy companies like Rosneft. And a crisis in the private debt market of a country always becomes a crisis of that country’s banks. And when the health of the banking sector comes in doubt, the currency craters. This is manageable as long as domestic savings are perceived to be large enough to support the debt markets – read Japan, UAE, Saudi Arabia. But when the financial markets of a country are largely supported by global investors, you get a currency crisis – read Russia, India, Brazil, EM in general.

3. EM-Fed – the more they change, the more they stay the same

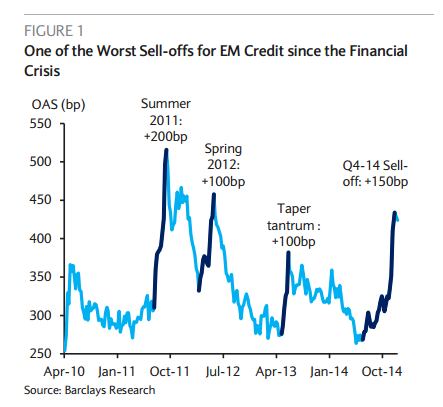

Russia has drawn all the attention but this crisis is much broader and much more global.

- Tracy Alloway @tracyalloway – The emerging markets sell-off, in context. From Barclays:

- When did the second QE end? June 2011. What happened during the Summer of 2011 – the largest EM debt crisis as the above chart shows.

- The Fed then launched its Operation Twist program with $400 billion in September 2011. They extended it in June 2012 by a smaller amount after the Spring 2012 crisis.

- Then came September 2012 and the launch of QE3 or QEternity with $85 billion of injections every month for ever.

- In May 2013, Bernanke’s announced his intention to “taper” their monthly stimulus. The chart shows you the next EM debt crisis in July-August 2013.

- Come October 2014 – the taper is complete. The markets now have been weaned of monthly stimulus of $85 billion and have to look forward to the Fed raising interest rates in 2015. Presto – another big EM Debt crisis.

- Lawrence Altman @traderxaspen Aspen, CO – I have been trading for 30 years this is the first crash up I have ever seen amazing!!