Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TACs is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. Crash-up!

The word melt-up seems so mellow & slow, doesn’t it. That may be why the renowned day-trader tweeted:

- Lawrence Altman @traderxaspen Aspen, CO – I have been trading for 30 years this is the first crash up I have ever seen amazing!!

And some called it for us just before the market crashed up:

- Charles Biderman with Rick Santelli on Tuesday, December 16 – there is a huge amount of cash available to buy stocks; assuming there is no major bankruptcy, financial dislocation uncovered in the next day or two, … we could have a major meltup in prices between now & end of January just based on supply & demand of stock & money.

Then the tweet on Tuesday afternoon that drew attention to an earlier article from QuantifiableEdges titled A Fed Day Setup That Has Seen SPX Higher 3 Days Later Every Time Since 1982:

- “Tuesday’s decline was the 3rd down day in a row. Many people are now aware that Fed Days have historically had a bullish tilt. So 3-day selloffs leading up to Fed Days have been quite rare. But they have also been a very bullish setup. The table below shows the hypothetical results of buying at the close on the day before a Fed Day if it was at least the 3rd consecutive lower close. The exit is 3 days later.”

But what about on Wednesday afternoon as the Dow was in a 300+ point rally?

- Urban Carmel @ukarlewitz – Major accumulation days are more rare than a Wall St strategist recommending bonds over equities

- Urban Carmel @ukarlewitz – Last two major accumulation days: Jan 2 2013 and Oct 10 2013

- Urban Carmel @ukarlewitz – The big ticks, engulfing candles and lopsided volume are sending a message. Listen to it

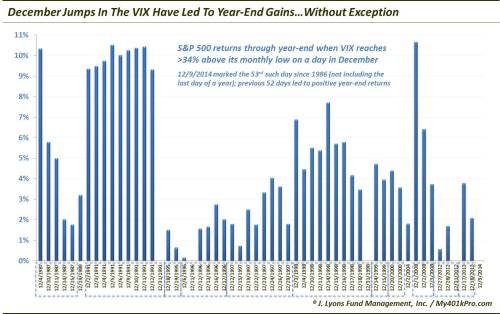

Remember the perfect signal from Dana Lyons we featured last week?

That signal & this week’s spike in VIX told you that the year-end rally was coming. The sell-off on Tuesday afternoon was a perfect set up to buy if you followed the smart folks above. Kudos & thanks to these traders.

Kudos also to Larry McDonald who, in his proprietary Bear Traps newsletter, recommended buying XLE on Monday and selling it on Friday. His thesis as he explained on CNBC Closing Bell on Friday is that these are bear market rallies in Oil.

We have to give a shout out to Jack Bouroudjian who has been right, passionate, and simple for the benefit of simple minds like ours. He summarized it simply on CNBC Closing Bell on Friday:

- “you can call it a low inflation rally, a strong dollar rally; a Republican victory in November rally; but the bottom line is equities are good; they are not overvalued; the multiple is digestible & corporate America has a strong balance sheet; you combine all that with a very low interest rate environment & that is a bullish scenario”

2. Where does this rally go?

- Friday afternoon – Chad Gassaway, CMT @WildcatTrader – Past 10 years the SPX has been strong the 3 days before Christmas. Two sessions after has fallen last 6 out of 7

Tim Seymour of CNBC FM seems to concur because he said on Friday afternoon “I would be selling this market from Monday“. Lest people accuse him of being a Grinch, he hastily added that he was really bullish, more bullish than his colleagues. Paul Richards of UBS was not so two-handed and said succinctly on CNBC FM 1/2 on Friday:

- “I think you have to be really careful from here … everything needs to be good now … I would say it is all in the price right now; I would say on a short term basis, there is risk to the downside in this market particularly over year-end when China PMI data comes out, I would be very careful of that; I am pretty cautious here & I would take my chips off the table“

What about the intermediate term?

- Bespoke @bespokeinvest – Last two times S&P was up 175 bps or more for two straight days were March 2009 and October 2011

Bespoke used the following chart in their article A Typical December:

Chad Gassaway made a similar case in his article Monster Gains Lead To Further Increases In Price:

- This has only taken place when closing above the 50 day SMA eight times excluding yesterday’s close. When above the 50 day SMA, results have been far more bullish …. Four sessions later the market tacked on additional gains of 2.19% with an 87.50% win rate. Additionally, five sessions later the market was higher all eight times with average gains of 2.56%. At worst, the smallest gain a week later was 0.59%. Win rates decreased when looking out a month and while returns remained positive, they did not continue to add to gains on average after the first week. However, two months later the market rose 6.13% on average with a 87.50% win rate. Since 1975, the market was higher on all seven occasions with average returns of 8.11%. Finally, three months later the S&P 500 was higher 100% of the time with a healthy gain of 7.74% on average.

- In conclusion, after such a rapid rise it would not come as a surprise to see some consolidation in the market. However, a number of data points show that gains could very well continue over the short and intermediate term.

How about a level?

- Joe Kunkle @OptionsHawk – $SPX – Busting out the yearly chart again, year 2 of what should be 15 years up :), 2155 big Fib extension

Josh Brown of CNBC FM 1/2 referred to the talk on Friday about a breakout in the Russell 2000:

- “4th attempt to get above 1200; if it does it is a whole new component to the rally; if we get above 1200, it could be bullish for 2015”

Getting back to a two-handed analyst, read An Unprecedented Rally Part 2 by Dana Lyons:

He gives us three points to ponder:

- Of the 29 consecutive +2% days in the S&P 500 since 1950 this was just the 2nd that began within 10% of its 2-year high. The other was on 3/16/2000, right near the cyclical top.

- Of the 29 consecutive +2% days in the S&P 500 since 1950 this was just the 2nd that began above the 200-Day moving average. The other was on 10/7/1982, just after the secular bull market was launched.

- Another indication that the current streak may be nearer to a top than some of the others (though, it does not preclude a shorter-term rally) is this:

- Of the 14 consecutive +2% days in the S&P 500 since the VIX began trading in 1986, this was the only one that began with the $VIX below 26, at 23.57. In fact, the median level of the VIX at the previous 13 occurrences was nearly 50. The lowest other figure was 26.43 on 3/16/2000.

The Dow rallied by over 700 points on Wednesday-Thursday. When were other rallies of this magnitude?

- Jamie McGeever @ReutersJamie – Dow’s biggest 2-day rallies:

- 891 pts 23-24 Nov ’08

859 pts 13-14 Oct ’08

819 pts 15-16 Mar ’00

815 pts 28-29 Oct ’08

778 pts 18-19 Sep ’08

- 891 pts 23-24 Nov ’08

3. Fed up!

Last week, David Rosenberg said on CNBC Closing Bell that he doesn’t expect the Fed to raise interest rates next year. On Tuesday, Jim Rickards voiced the same opinion and actually went farther:

- “I don’t see the Fed raising interest rates next year; that would be a shock to the markets; you may have a shock in US dollar-euro cross rates; because people expect Draghi to ease & the Fed to tighten; I don’t expect fed to tighten in 2015; Draghi will ease less and Fed wont tighten; that will turn the Dollar and we will have QE4 in 2016 in US.”

It seems Chair Yellen was fed up with this talk. That is why she seemed edgy in her presser. At one point she became almost nasty when she said according to the dictionary a couple means two. She was more hawkish in her comments than what was reflected in the Fed statement:

- @JustinWolfers: Fed talk matters. And why you should listen

- “I think this Fed has decided they don’t want to be at zero; They have been at zero interest rate now for 6 years; they are tired of it; … I don’t think they know where they are going to end up or how fast they are going to get there; there is almost a unanimous view they want to get off zero next year; they have to do something; they have to show they can hike”

- “my personal view is that the base line still remains June is the most likely event; could be September; it wont be March; April is a little bit early if for no other reason that, because of oil prices, headline inflation could be negative in March & April; I dont think you want to have your first hike with negative inflation”

- “It is not at all out of the question by June of next year, the headline CPI inflation rate is sitting near 0% and the core would be south of 1%“.

- “so the Fed should not be raising interest rates & yet they don’t want to be at zero; they are in a conundrum; they might raise rates just to see what happens“

Because Gundlach thinks that Fed will raise rates when they should not, his biggest surprise for 2015 was:

- “Yield curve will flatten at a level previously thought unthinkable“

But is Chair Yellen that irresponsible? We doubt it and so we fall in with Rosenberg & Rickards. The bond market is also with us because both the 30-5 yield spread & 30-10 year spread flattened hard this week by 11 bps & 7 bps resp.

If you think Jim Rickards was nuts to call for QE4 in 2016, read what Larry McDonald tweeted on Friday:

- Lawrence McDonald @Convertbond Manhattan, NY – With the new #Fed There’s a greater chance of more QE in 2015 than a rate hike

Why?

- Lawrence McDonald @Convertbond Manhattan, NY – Fed’s inflation outlook reached an all time low yesterday, it’s been revised 7 times, LOWER

As he tweeted pre-Fed on Wednesday:

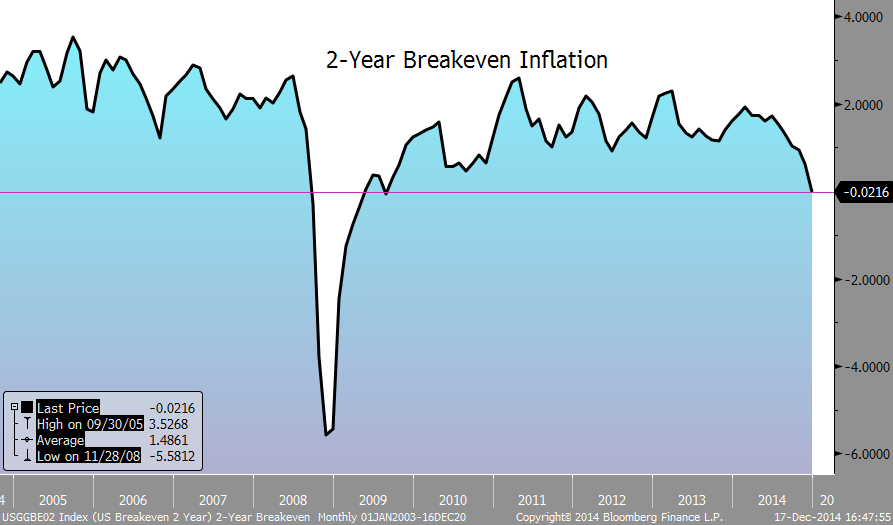

- Lawrence McDonald @Convertbond Manhattan, NY – A Picture Says a Billion Words #Fed #DisInflation

- Thursday – Charlie Bilello, CMT ?@MktOutperform – US 2-year breakeven inflation rate went negative today for first time since August 2009.

And this is before headline inflation comes in negative in March-April as Richard Clarida expects.

4. Bonds!

Treasuries certainly followed Chair Yellen’s lead on Wednesday & Thursday:

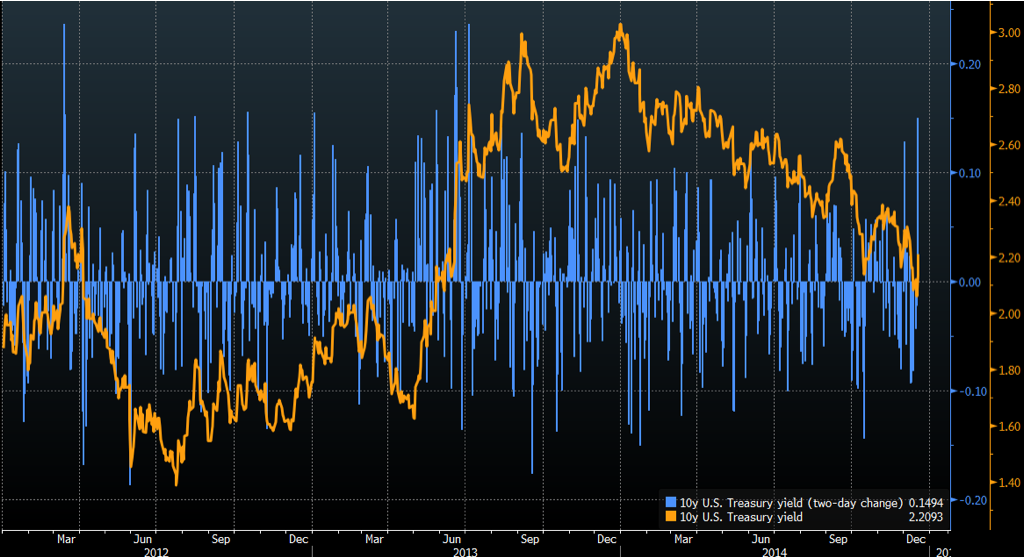

- Thursday – Matthew B @boes_ Biggest two-day jump in 10y Treasury yields in 17 months (that jobs report on July 5, 2013)

Then came Friday and with it the usual Friday rally in Treasuries. Naturally the best performing duration of 2014 was also the best performer of this week with a mere 2 bps rise in the 30-year yield. The 5-yr & 3-yr jumped up by 14 & 12 bps resp. Thus the 30-5 curve flattened from 122 bps to 111 bps and the 30-10 yr curve flattened by 7 bps from 66 to 59. In other words, the more things change in 2014, the more they stay the same. That includes short positions in Treasuries per Deutsche Bank:

- “In rates, aggregate bond futures positioning has turned very short, particularly in the 10y but also across the curve. Bond funds continue to be underweight duration, overweight HY and MBS“

Since a picture is worth many words,

- Jesse Felder @jessefelder – Bonds: Amazingly STILL the most hated asset class $TLT $TBT http://stks.co/a1OSo via @ukarlewitz http://stks.co/s1Amk

Is this why Charles Biderman made the following prediction to Rick Santelli on Tuesday?

- “next year we are going to see 1% on the 10-yr and 2% on the 30-yr absent some major shift that I can’t see happening”

Treasuries are fine but what about High Yield, the sector that drove much of the decline in risk assets last week? Dr. Yellen waved her magic wand and all became ok in the high yield world. In the words of Bespoke, junk bonds had their best day since August 2011 on Fed-Wednesday:

- “The high-yield (junk) bond ETF — HYG — has been tumbling lately due to oil’s big price drop. As oil has fallen into the $50s, worries that companies in the US Energy industry won’t be able to meet their debt obligations have weighed on the junk bond market as a whole. Below is a six-month chart of the HYG ETF. After a big decline over the past month or so, HYG is finally seeing a bounce today. In fact, its one-day gain of 2% is its biggest one-day move since August 2011.”

The High yield ETFs, HYG & JNK, rallied by 3.6% & 3.1% resp. If high yield rallies, can oil be far behind?

5. Oil

Oil did rally somewhat but oil stocks had a great week. USO & BNO were up by 37 bps & 45 bps while OIH & XLE rallied by 11% & 8% resp. on the week. When conditions change, smart investors change their minds as Dennis Gartman said on Friday on CNBC Closing Bell:

- “I think Oil probably does stay down here; it might even go just a tad lower; I have been very bearish for a long period of time; but all of a sudden in the past couple of days, the term structure is beginning to move in the other direction; I think the time for being overtly bearish of crude oil has probably passed; I think the time for being bullish lies a long way into the future; I would like to think that crude oil will stablize down here; lets just say it has been a great thing for the economy, no ifs ands or buts about it; & I doubt that we are going to see a great good deal lower on Oil prices from here; the vast majority of the move is probably well behind us thankfully”

Then you have:

- Elliott Wave Int’l @elliottwaveintl – Oil’s 6-Month-Long Drop: Is It Over? Here’s our take: http://bit.ly/1uvEvCY

As their promo portion said:

- Our Energy Specialty Service doesn’t look quite as far down the road. Steve’s latest update says:

- “…Crude is oversold by most any measure and primed for a relief rally, but there’s nothing yet to suggest that the decline has ended. Ideally, the market will move [to]…”

- So at least in the short term a bounce is due.

A comparison to 1986:

- Ned Davis Research retweeted John LaForge @Phomax – #oil @NDR_Research Wonder if this is 1986? Saudi wash-out, $15-$25 range for 12 years. Post-2014 $50-$70 range?

Larry McDonald called this rally in oil a bear market rally on Friday on CNBC Closing Bell and said “oil goes to $45 in the next six months and base“. David Rosenberg came to a similar price range on Wednesday but from a positioning perspective:

- “those net specs long on the NYMEX who were at 500,000 are down at 280K; there has been a large demand destruction happening on the financial side; that is the principal cause for this latest swoon in the price of oil; we are not going to get to a fundamental bottom until those net speculators have been eliminated alltogether or at least get within 100K contracts of flat; $40-$45 by the time those net speculators are out of the system”

If oil stabilizes around current levels, it would mean. according to David Rosenberg:

- “Our estimates of the first and second round impacts of the decline in oil prices is that it boosts U.S. real growth by 50 basis points and by 10 basis points in Canada.”

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter