Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TACs is our acronym for Tweets, Articles, & Clips –our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. Explosion

Greece put away, China stabilized, and a lot of cash piled up on the sidelines in fear. All it needed was a spark. It got dynamite and stocks exploded in the best week of the year. Not all stocks but stocks that promised high growth as well as growth with discipline. The result = 15% plus rallies in Google & Netflix in the after-market hours. The word rally is so improper. What we saw was a buying panic. Google was cheap but Netflix was not. Wait it was cheap when compared to where it could go. So babaaaboom! And analysts said you ain’t seen nothing yet.

- Julie VerHage ?@julieverhage – Big Investors Are Holding the Highest Amount of Cash Since Lehman’s Collapse http://www.bloomberg.com/news/articles/2015-07-14/big-investors-are-holding-the-highest-amount-of-cash-since-lehman-s-collapse …

Remember all those charts & prognostications about the market making a big move in one direction or the other. Is that in store for us on the upside? Next week, we have Apple and the week after Facebook. And in that week after, we have Chair Yellen.

2. FOMC

This week, Chair Yellen sounded as clear as she wanted to sound. And this time, the markets seemed to listen and concur. The Dollar rallied 2% in a week the Euro was supposed to rally. And Gold, Oil collapsed. Jon Hilsenrath also agreed and wrote:

- “The Fed is now heavily invested in moving short-term interest rates higher in 2015. It is the plan she and other officials have emphasized repeatedly they expect to follow. A first quarter U.S. economic contraction and turbulence in Greece and China haven’t persuaded them to shift their stance from this. So what would convince them to wait until 2016, as the International Monetary Fund is urging them to do and as several Democrats did during Ms. Yellen’s testimony Thursday? It would take a notable downshift in their forecasts for growth, jobs or inflation to move it away from that strategy.”

This sounds so much like March when the Dollar was soaring, Oil was collapsing and everyone was primed for Chair Yellen to sound the trumpets. But she went the other way to deflate the Dollar rally. This time seems similar with Dollar rallying hard & Commodities breaking down hard.

There is one difference though – In March the economic outlook for Q2 & later was more bullish. Now, as Jeff Gundlach said, “the Fed’s forecast for 2015 is the lowest it has been since they started predicting what 2015 would be“. And what happens when the Fed talks about raising rates in a ho-hum economy – the yield curve steepens & the long end rallies hard.

That is the unheralded story of this week – a week in which loved stocks exploded by 15-20%, a week in which Nasdaq went to two consequtive all-time highs. Yes, in this week, TLT rallied by 2.2% more than Dow’s rally of 1.8% and EDV rallied by 3.7% more than S&P’s rally of 3%. The 30-year yield fell by 11 bps and the 30-5 year curve flattened by 13 bps with the 5-year yield rising by 2 bps for the week.

If all this, Dollar rally, commodities breakdown, and yield curve flattening, continues next week, then will Chair Yellen send the same hawkish signal on July 29th she did this week? We doubt it. So why did she sound so hawkish this week? The Fed is a political animal and Chair Yellen knew the Congress wanted her to sound hawkish. And she did sound so just right.

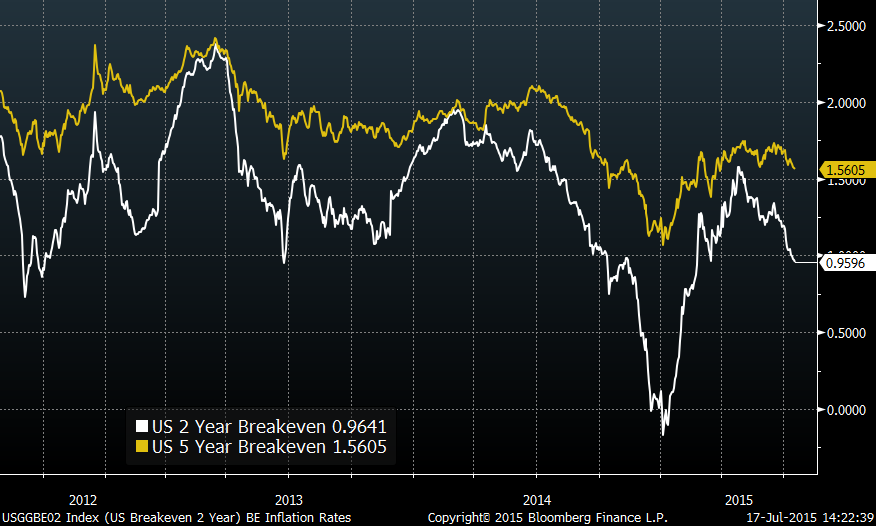

We hope she proves us wrong and sounds a hawkish note in the FOMC statement on July 29th. But that’s not how we plan to bet. Look what’s happening to inflation expectations already:

- Charlie Bilello, CMT ?@MktOutperform – Inflation expectations moving lower with Crude.

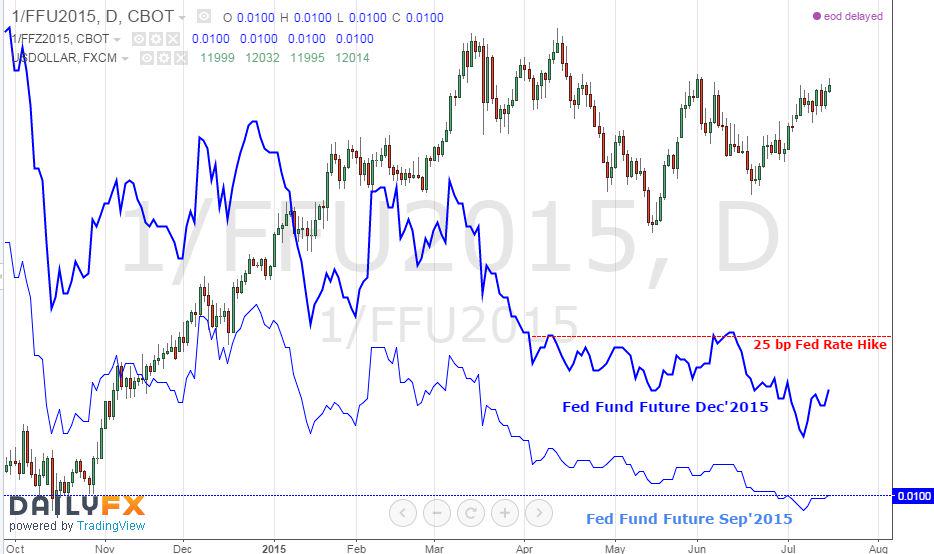

And look where the Dollar could go?

- John Kicklighter ?@JohnKicklighter – This is where the $USDollar’s untapped potential lies. To get to 13yr highs, the mkt needs to believe Fed will hike

3. Greece

As we said last week, the Greece situation changed when the US got involved via IMF. This week Secretary Lew flew to Europe to meet with EU & German officials. What has happened so far is merely the first act of this play. The real game may be about to begin in earnest.

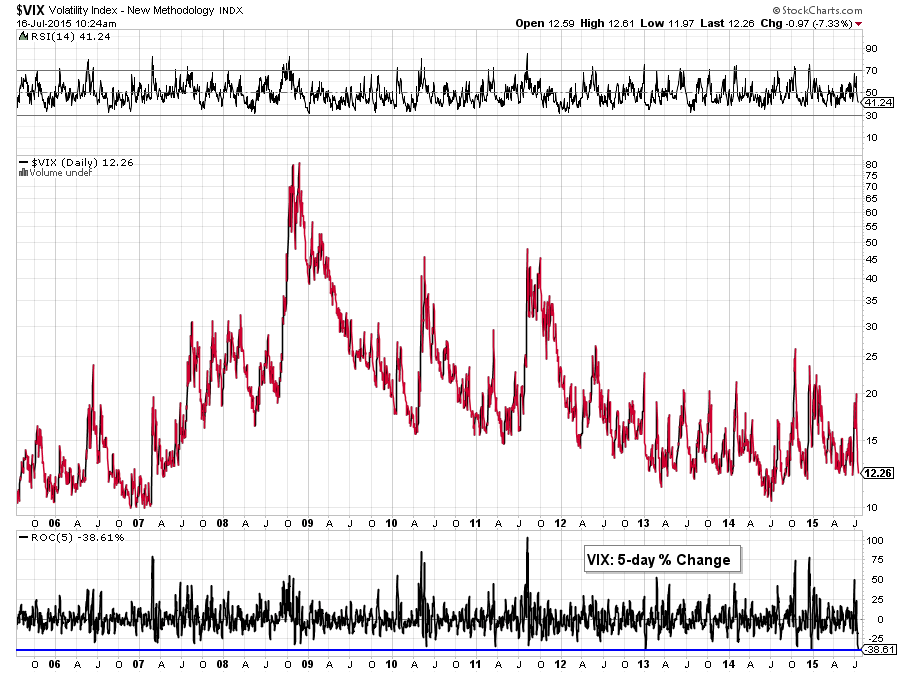

But look what the ending of the first act did to concerns:

- Charlie Bilello, CMT ?@MktOutperform – $VIX down 39% in the past 5 trading days, one of the biggest 5-day declines in history

4. Stocks

Speaking of explosion:

- Joe Kunkle ?@OptionsHawk – $QQQ – Similar to S&P, the Nasdaq bounced exactly on trend support, and now it is busting out in a big way

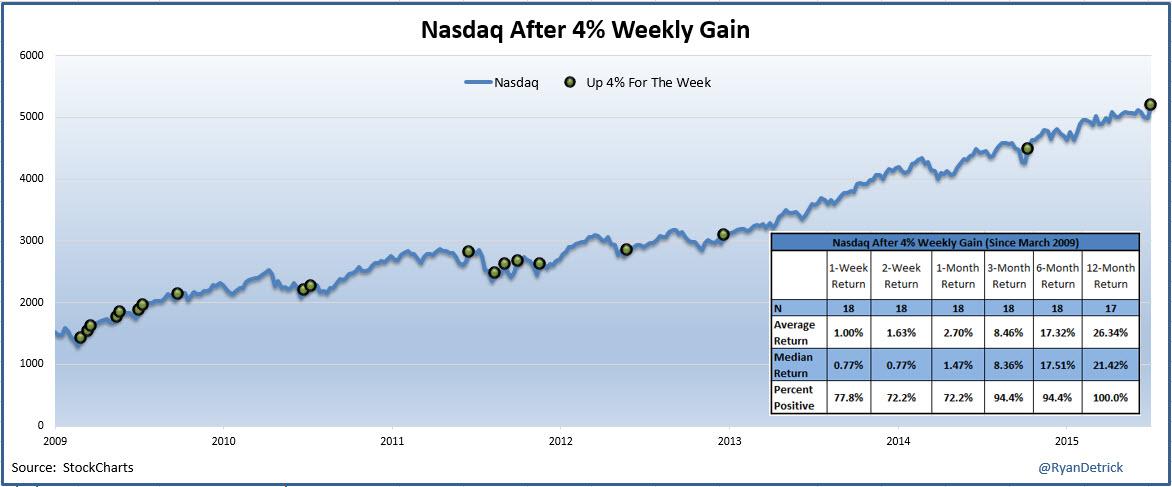

- Ryan Detrick, CMT ?@RyanDetrick – Nasdaq up 4% this wk. Is this near-term bearish? Maybe not. Up +1% week later and +3% month later. $COMPQ $QQQ

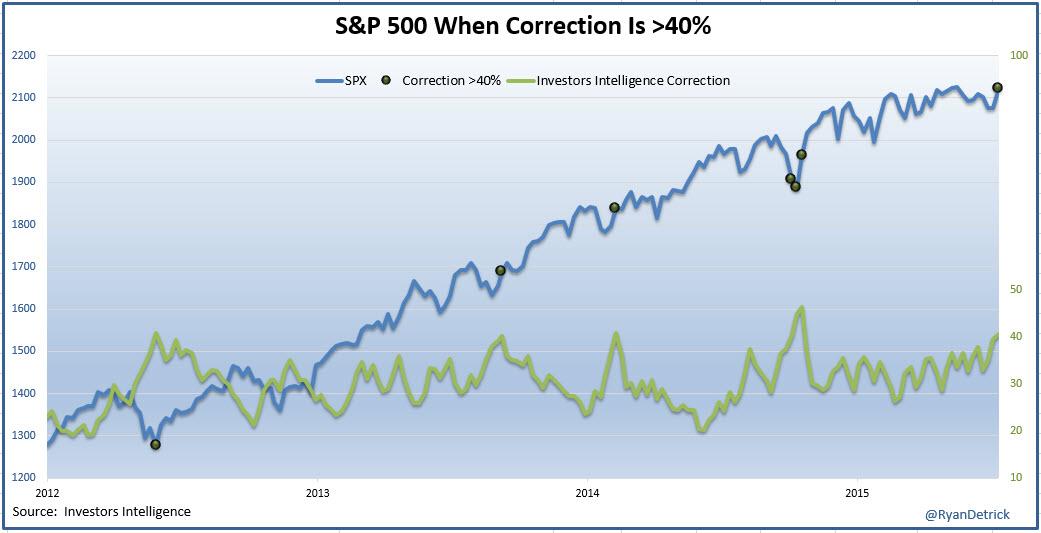

- Ryan Detrick, CMT ?@RyanDetrick – Here’s a chart of when Inv Intelligence correction is >40%. Rather rare and looks like nice buying opps. $SPY $SPX

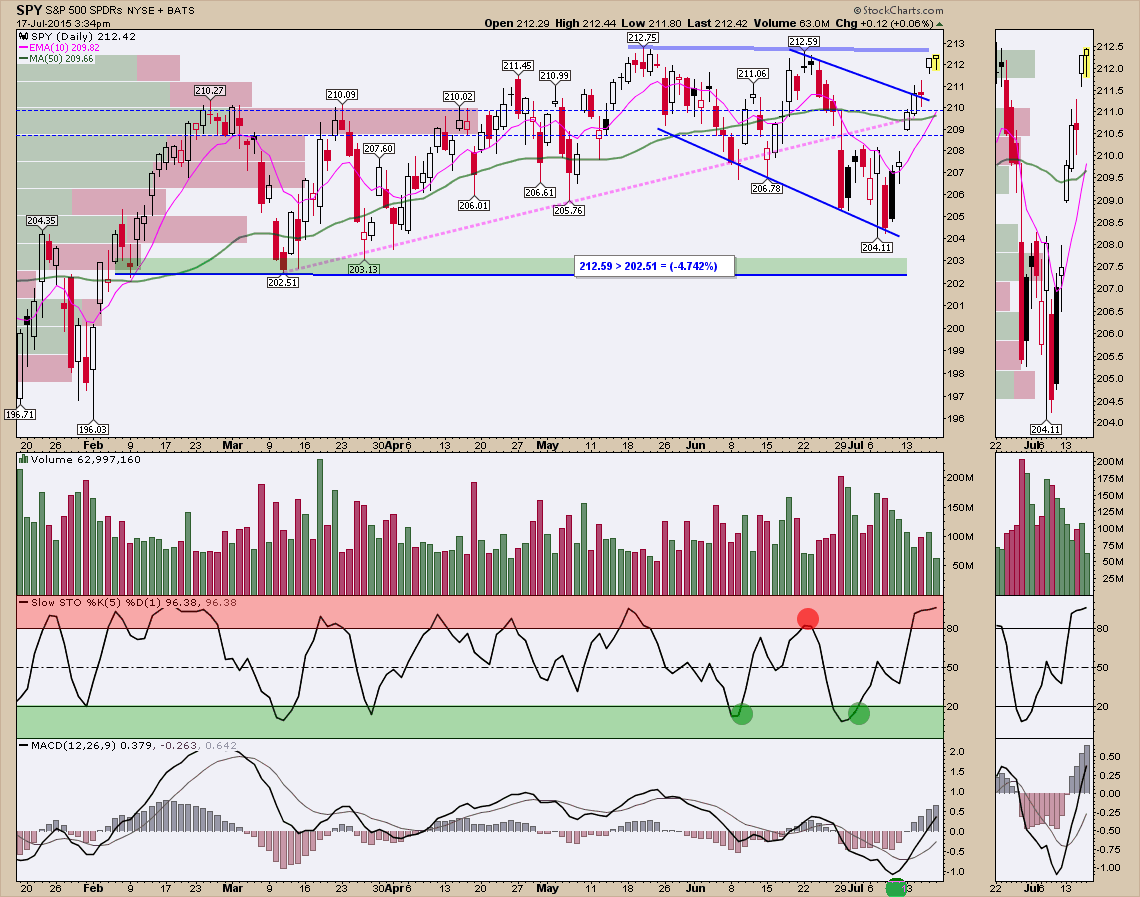

Will the indices keep their rally and decisively break out? Or do they fail again?

- Cousin_Vinny ?@Couzin_Vinny – $SPY triple top pass or fail Frustrating – note on lower volume and FRI OPEX. Monday a new day, new week.

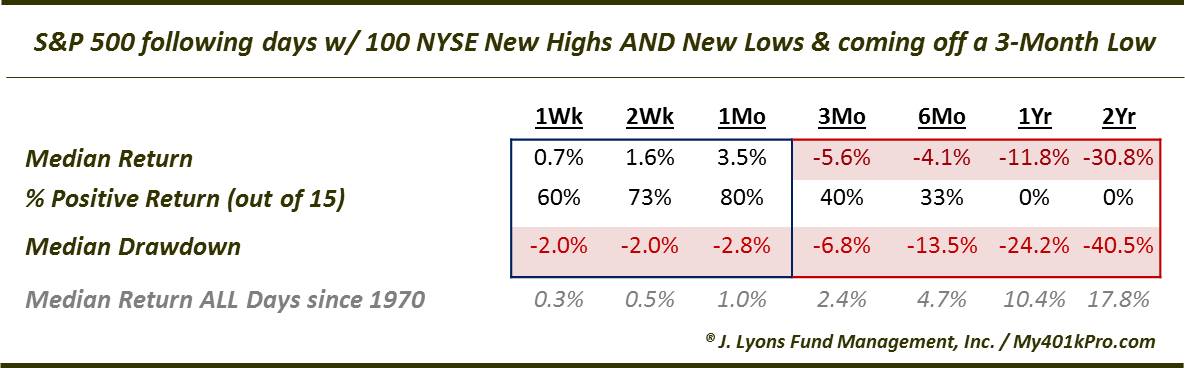

One indicator suggests not but the sample size is rather small:

- Dana Lyons ?@JLyonsFundMgmt – Stat Of The Day:Yest was 16th day w >100 NYSE New HI’s & LO’s coming off 3Mo $SPY Low (Mar,Nov,Dec 00 & Aug 07)

Rtns:

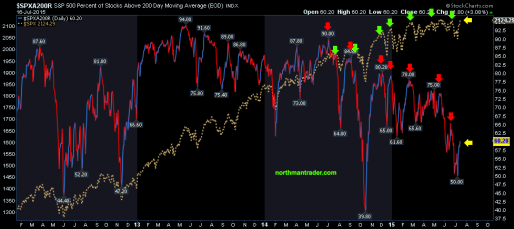

The one negative indicator that caught our eye was from Northmantrader.com:

- The interesting part of this rally, and all of the 2015 one for that matter is that each price deviation has come on fewer and fewer stocks above their 200MA:

4. Gold

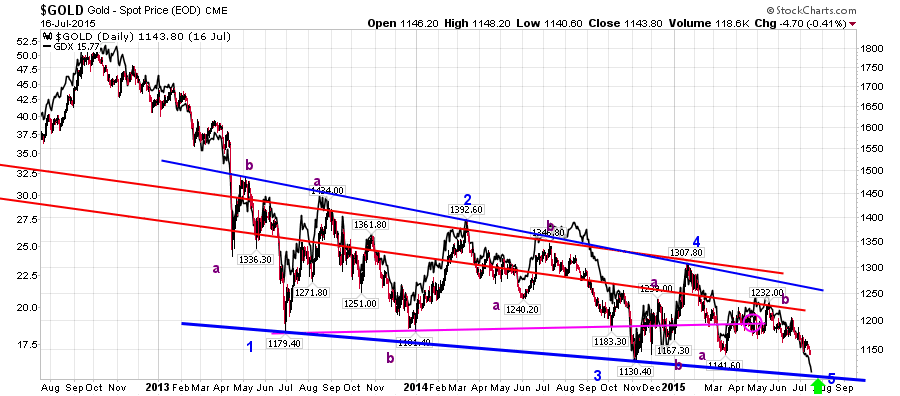

Was the price action in Gold & the miners ugly on Friday? A guy who has been right on Gold & Silver since last year seems committed to the downside:

- J.C. Parets ?@allstarcharts – … I’m a seller of any and all strength. I think we see $1000

But Tom McClellan argues differently in his article Gold Priced In Euros Has Gone Quiet:

- “The dollar price of gold has been in a steady decline recently, and this is as I have been expecting ahead of the major 13-1/2 month cycle bottom which is ideally due in August. The real price bottom can arrive a month early or late, and still be considered to be “on time”, so we are in the window now for that bottom.”

- “Eventually gold is going to leave the area of €1050/oz and go somewhere. Pretty soon it is going to encounter its declining tops line, which is working to “catch down” to where prices have already gone. That trendline break, if and when it comes, should precede a similar break in the dollar price chart, and would be a good point to notice for those willing to take the time to pay attention to gold prices in two different currencies.”

That also is the message of:

- Anthony Allyn ?@3Xtraders – $GOLD is about to enter oversold territory as it throws over in wave 5 – in a #bullish ending diagonal triangle

If there is to be a bottom in Gold around August, wouldn’t Chair Yellen have to retract her hawkishness in the July 29th FOMC statement?

5. Oil.

Oil took a hard dive down this week, harder than Gold did.

- Raoul Pal ?@RaoulGMI – Oil & Gas drillers are a total mess and are likely to halve again from here. Strong $ is not good for the global econ

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter