Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TACs is our acronym for Tweets, Articles, & Clips –our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. Strange things happen in Wars

Just look at what happened to the war between Merkel-EU and Tsipras-Varoufakis. By Wednesday, it looked as if Tsipras-Varoufakis had lost and lost big. The consensus said Tsipras had gambled foolishly; that he had overplayed his hand and that he would be gone come Monday. Tsipras reached out to Merkel & Hollande with an offer to call off the referendum. It was a great opportunity for Merkel-EU to get Tsipras to cancel the referendum without giving anything. Remember, the mere precedent of a referendum could come to haunt Brussels & Merkel down the road.

But in a classic German overreach, Merkel let a wonderful semi-victory slip away in her quest for total surrender. Now Tsipras-Varoufakis had nothing to lose. So the final battle was on. And, out of the blue, a major ally of EU & Merkel switched sides. The IMF, the respected global leader of world finance, turned and publicly concurred with the core position of Tsipras-Varoufakis, the position that was sheer anathema to Merkel. The IMF issued a report that said Greece needs debt relief and Euro 60 billion of extra funds over next three years. And, above all, the IMF officials said they would not be prepared to put a proposal for a third Greek bailout to IMF’s board unless it included both a commitment to economic reform and debt relief. That is precisely what Tsipras & Varoufakis wanted and why they were prepared to go to war against EU.

Look at Merkel and her Germanic-allies. The IMF, the world’s ultimate reformer of Governments, so far the ally of EU-ECB, the agency which had suffered a default of its loans to Greece, suddenly turned around and went over to the Greek side. If this wasn’t enough, China & Russia supported the Greek position and began discussing how the BRICS bank could be used to help Greece.

Look at Merkel & her Germanic-allies. On Wednesday, Merkel led a united global front against a lone quixotic defenseless Tsipras-Varoufakis-led Greece. Then on Thursday evening, it was Merkel & Germany all alone against Greece backed by the entire world – IMF, China, Russia and all who don’t like German heavy handedness. It was a World War I & II nightmare all over again.

By the way, IMF could not have switched sides without at least a passive encouragement from its largest member – President Obama, who had tried to get Chancellor Merkel to get more money to Greece. Faced with financial chaos in Europe that could affect US, the interests of the US & World Economy demanded support of Greece. This was not leading from behind, this was a knife in Merkel’s back. And the hand used to push in the knife was not an American hand, but a French hand, the hand of Christine Lagarde.

The bottom line is that the world was telling Merkel they would not let Germany launch an unnecessary financial war in Europe the way Germany had launched two military wars in the last century.

Merkel & EU did not want a resolution in Greece, they did not want a ceasefire in Greece, they wanted a regime change in Greece. They wanted to throw Tsipras-Yaroufakis out and get a “technocratic” meaning spineless subservient government in Greece, the same guys who had piled up the debts during the past 5 years. Such “regime change” was so accepted that CNBC Closing Bell anchor Bill Griffeth began a sentence on Wednesday with “when Tsipras loses his job“.

Bill Griffeth seems like a nice guy; he is no Victor Nuland at least to our way of thinking. Some neocons-neolibs still think that the overthrow of Yanukovich in Ukraine made Ukraine better. But Bill Griffeth doesn’t seem to be one of those. He didn’t see what EU’s overthrow of democratically elected Tsipras-Syriza could do to Greece – it would turn Greece into a Ukraine, a virtual civil war that would rage on until Greece miraculously became prosperous again.

Others who know better, like Charles Dallara, argued that Tsipras would remain at the helm with possibly a new coalition. Isn’t that what Netanyahu did after the recent elections in Israel? The combined interests of the EU, Merkel and the World would be better served with Tsipras remaining PM and a forceful champion of a new deal with EU with more funds for Greece and a discussion of how many years Greece would get before it has to repay its loans. The IMF stunned EU with talk of a 20-year freeze on repayments by Greece. That could just be a shock therapy instead of a rational plan.

Now all of this could prove both wrong & stupid if the Greek people overwhelmingly vote Yes. Then Tsipras may have to sign on the dotted line. But if the vote is close, then Tsipras could claim a real victory especially with IMF publicly backing his position. Think of the damage Hezbollah suffered at the hands of Israel in 2006. But, in the eyes of their supporters & in the eyes of the world, Hezbollah won by merely managing to survive that war with Israel.

Tsipras could claim that he had no choice but to say no to EU and by choosing to fight for the people of Greece, he had obtained a more honorable deal for Greece. That is, if he wins or loses narrowly on Sunday.

The big change is that the IMF ( & its largest member USA) is now an independent player in the Greece saga, a player that wants to maintain stability even at the cost of giving German money to Greece via debt relief.

Did you see this coming last week or even during this week? We sure did not. But then weird stuff does happen in wars.

2. Payroll Number, Fed & Treasuries

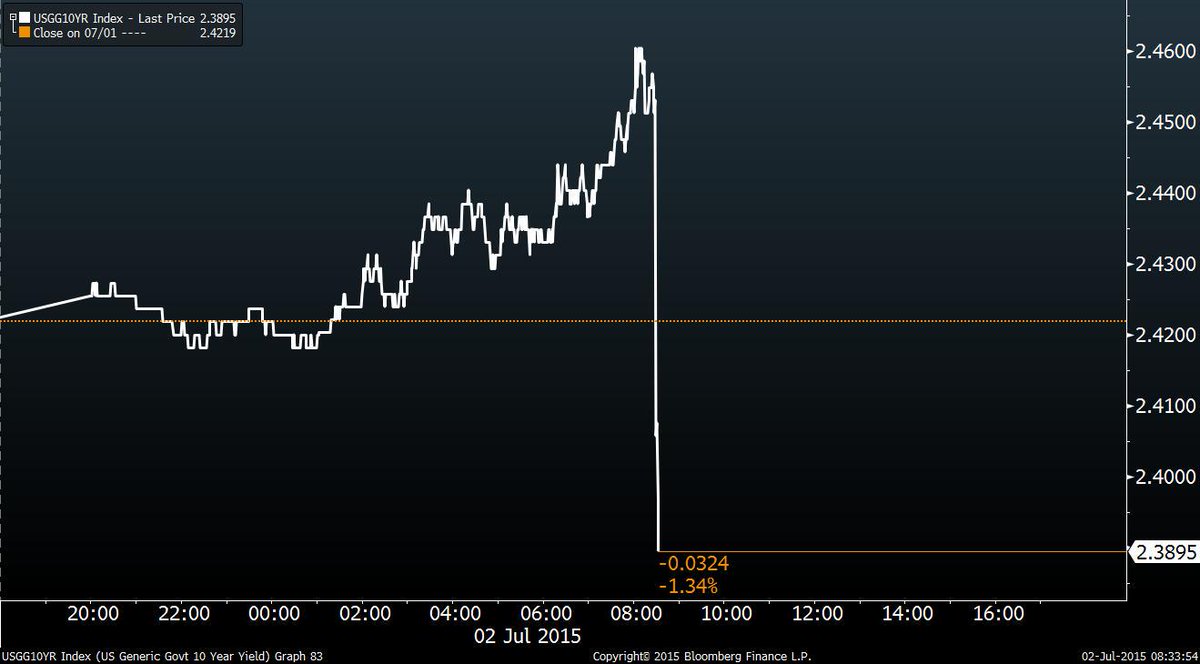

How was the payroll number of 223K? Just look at the 10-year Treasury reaction?

- Bloomberg Markets ?@markets – 10-year yield dives after weak U.S. jobs report. http://www.bloomberg.com/news/articles/2015-07-02/payrolls-in-u-s-rose-in-june-with-little-change-in-wages …

Did the Cognoscenti concur?

Did the Cognoscenti concur?

- David Rosenberg – I have to say, that today’s employment report had the “not too hot, not too cold” label all over it and taking everything into account, the jobs report was a disappointment

- Richard Bernstein on CNBC Squawk Box – kind of a goldilocks number – Fed not in any rush to raise rates

- Bill Gross on Bloomberg Radio – I think they move in September

- Jan Hatzius on CNBC SOTS – jobs number a step back.. unemployment rate not that far away from full employment rate …. by December they will have met both requirements

- Art Cashin on CNBC SOTS – Still in the camp of no rate hike this year

- Northy @NorthmanTrader – A moment of silence for any rate raises in 2015. RIP.

- J.C. Parets ?@allstarcharts – I’m thinking the first rate hike is not until 2017

The big story in Treasuries was the bull steepening of the Treasury yield curve on Friday. The 30-5 year curve steepened by 6 bps on Friday, a clear sign of increased liquidity as we have said often. In this context, it means less & less chances of rate hikes in the near future. The 5-year yield fell by 11.8 bps this week, and the 3, 2 year yields fell by 9.5 & 7.5 bps resp.

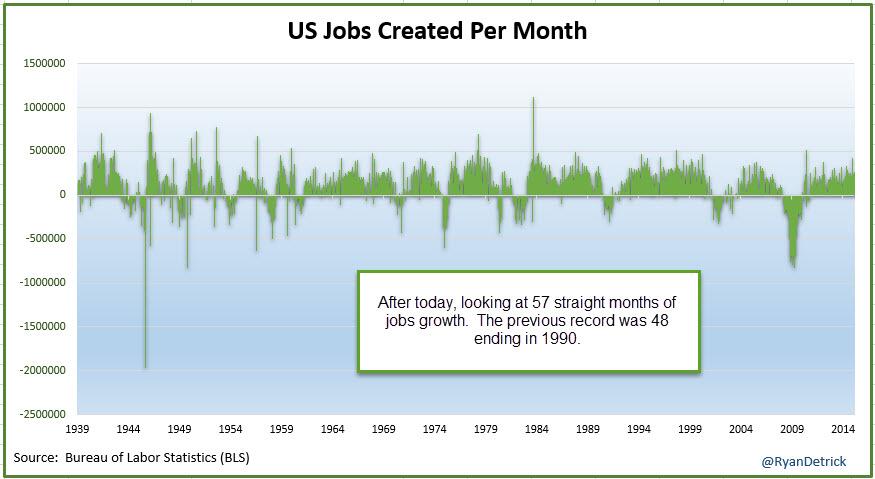

There are still August & September payroll reports before the September FOMC meeting. But is the string of strong payroll numbers getting a bit too long?

- Ryan Detrick, CMT ?@RyanDetrick – Looking at 57 straight months of jobs growth, an all-time record. Previous record was 48 in 1990

But then, there has never been such a period of global Quantitative Easing, has there?

Prior Friday rallies in Treasuries have been sold on Monday since March 2015. Will this week’s rally be different?

- Tuesday – J.C. Parets ?@allstarcharts – Look like the 10yr is heading back under 2.2% – that’s where I think it’s going. Could see 2.1.% before all is said and done $TNX

3. Volatility

The best performing asset class this week was volatility. VIX rose by 20% and VXX by 35%.

- Monday – Mark Arbeter ?@MarkArbeter – After numerous attempts, $VIX breakout looks for real as it moves into new range. Suggests more weakness $SPY, $SPX

But that might be just be par for the seasonality course as Ryan Detrick pointed out in his article – Welcome To July: When The VIX Comes To Life:

But that might be just be par for the seasonality course as Ryan Detrick pointed out in his article – Welcome To July: When The VIX Comes To Life:  Detrick points out in his table that in 2014 VIX rose by 46.5%.

Detrick points out in his table that in 2014 VIX rose by 46.5%.

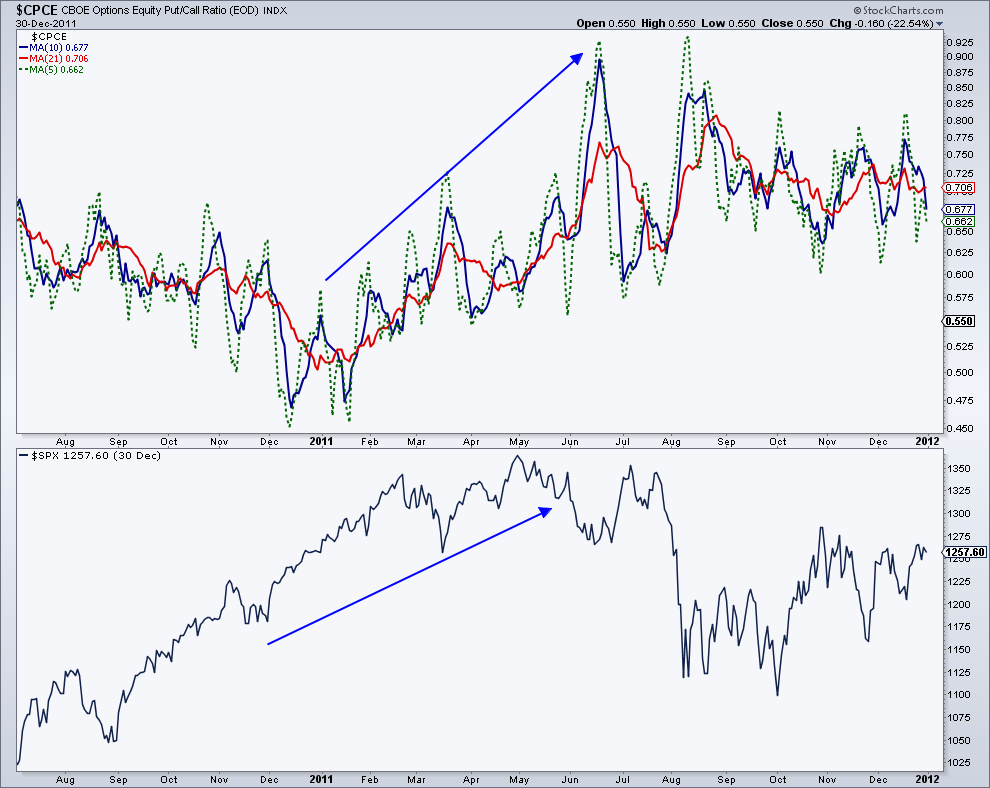

- Thursday – Mark Arbeter ?@MarkArbeter – Market bulls do not want this breakout in CBOE equity-only pc to continue trending higher. $SPX, $SPY.

What if we get a whoosh down as Jon Najarian of CNBC FM said on Thursday? He added buy that whoosh. That fits with:

What if we get a whoosh down as Jon Najarian of CNBC FM said on Thursday? He added buy that whoosh. That fits with:

- Tuesday – fred hickey ?@htsfhickey Difference from March – historically, big seasonal summer rally begins in July ovr 90% of time. Plus huge Managed Money shorts to b squeezed

David Rosenberg concurs:

- Gluskin Sheff ?@GluskinSheffInc – Greece crisis will pass, buying opportunity ahead – David Rosenberg on @CNBC http://ow.ly/P0ccH

4. Stocks

Since this was a down week, we will begin with bullish opinions:

- Thursday – Bob Doll, Nuveen ?@BobDollNuveen – The S&P 500 Index has never advanced for seven calendar years. I think 2015 may mark the first time that happens. http://ow.ly/OX9oQ

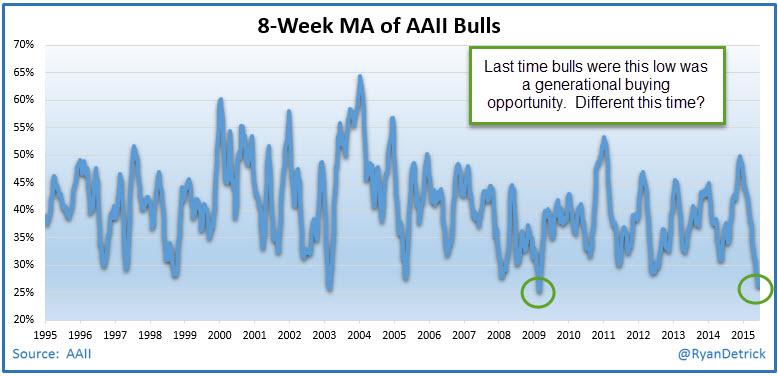

- Thursday – Ryan Detrick, CMT ?@RyanDetrick – Looking for a reason to be bullish? 8-wk MA of AAII bulls is still near ’09 lows. I find that very encouraging. $SPY

Tom McClellan in his article on Thursday:

- “My leading indications say that THE top is not due for another month. So this high-volume day on Greece worries is a sign of an oversold opportunity within what is still an uptrend.”

Now towards more bearish opinions:

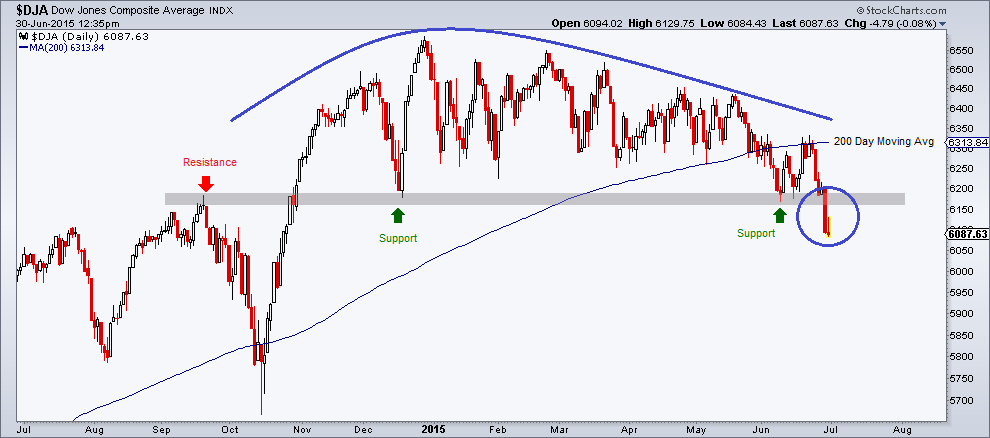

- Tuesday – J.C. Parets @allstarcharts – Here’s the DJ Composite Avg $DJA – looks like decisive break of what was key resistance/support since last September

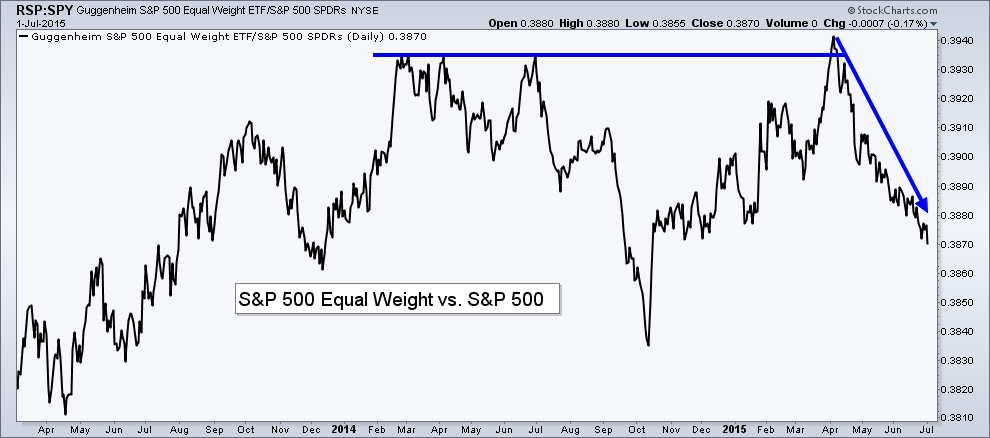

- Thursday – Andrew Thrasher, CMT ?@AndrewThrasher – The ratio b/w equal weight & cap weighted S&P 500 hit a fresh 2015 low yesterday. Smaller cap S&P stocks not leading

- Thursday – Mark Newton ?@MarkNewtonCMT – the 3rd day of this mild bounce following the breakdown, $SPX still can’t get much above 38% of prior pullback

- Thursday – Mark Arbeter ?@MarkArbeter – As you can see, equity-only p/c’s trended higher b4/during 2011 topping process. Was big warning for $SPX, $SPY.

An interesting chart below, even without P/Es:

- Thursday – HedgedIn ?@noalpha_allbeta – awe, they took away the P/E’s

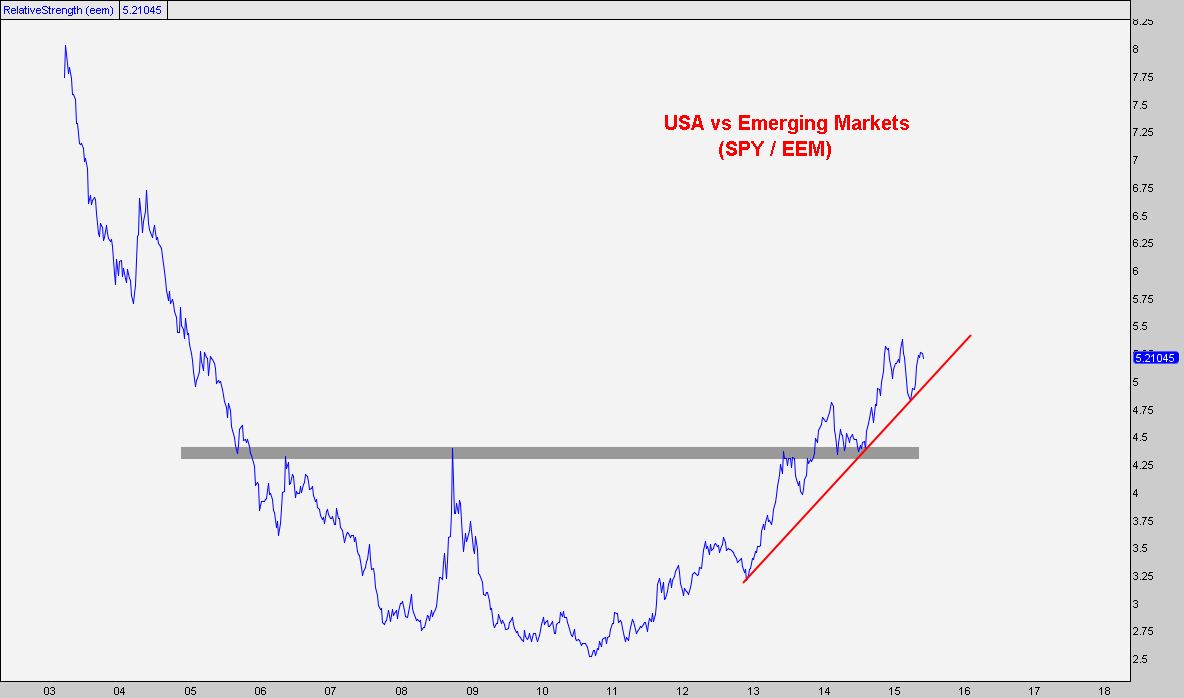

What about all those who say EM will outperform S&P?

What about all those who say EM will outperform S&P?

- Friday – Richard Bernstein @RBAdvisors – #BRICs sinking like lead weights. Brazil & Russia in trouble. China in bear market. India next to go.

- Tuesday – J.C. Parets @allstarcharts – US vs EM uptrend still appears to be intact. Here is a clean trendline to help define that over near term $SPY $EEM

5. Meltdown

We keep hearing how we could see a meltdown in markets, either because of lack of liquidity or otherwise. But no one said what specific conditions we should look for, not until Bill Gross did this week.

- A central bank mistake leading to lower bond prices and a stronger dollar.

- Greece, and if so, the inevitable aftermath of default/restructuring leading to additional concerns for euro zone peripherals.

- China— “a riddle wrapped in a mystery, inside an enigma.” It is the “mystery meat” of economic sandwiches—you never know what’s in there. Credit has expanded more rapidly in recent years than any major economy in history, a sure warning sign.

- Emerging market crisis—dollar denominated debt/overinvestment/commodity orientation—take your pick of potential culprits.

- Geopolitical risks—too numerous to mention and too sensitive to print.

- A butterfly’s wing—chaos theory suggests that a small change in “non-linear systems” could result in large changes elsewhere. Call this kooky, but in a levered financial system, small changes can upset the status quo. Keep that butterfly net handy.

6. Gold

The obvious question:

- See It Market ?@seeitmarket – New Post – “What’s Wrong With Gold?” http://www.seeitmarket.com/whats-wrong-with-gold-gld-14527/ … by @andrewnyquist $GLD $GC_F $EURUSD

The article asks

- Gold is nearing a trading crossroads. Can it rally? Will it be more than a dead cat bounce?

- “One thing we do know is that Gold needs to show us more than it has thus far. So what do bulls need to see now? Plain and simple: a reaction higher. Support needs to hold because only a rally back above the recent highs (1208 Gold and 115.50 on GLD) will neutralize the selling pressure. As well, according to a chart from EquityClock, Gold tends to see strong seasonality in early to mid-July, so perhaps there’s a window for a rally. But equally as bearish, seasonal trends fall off until September

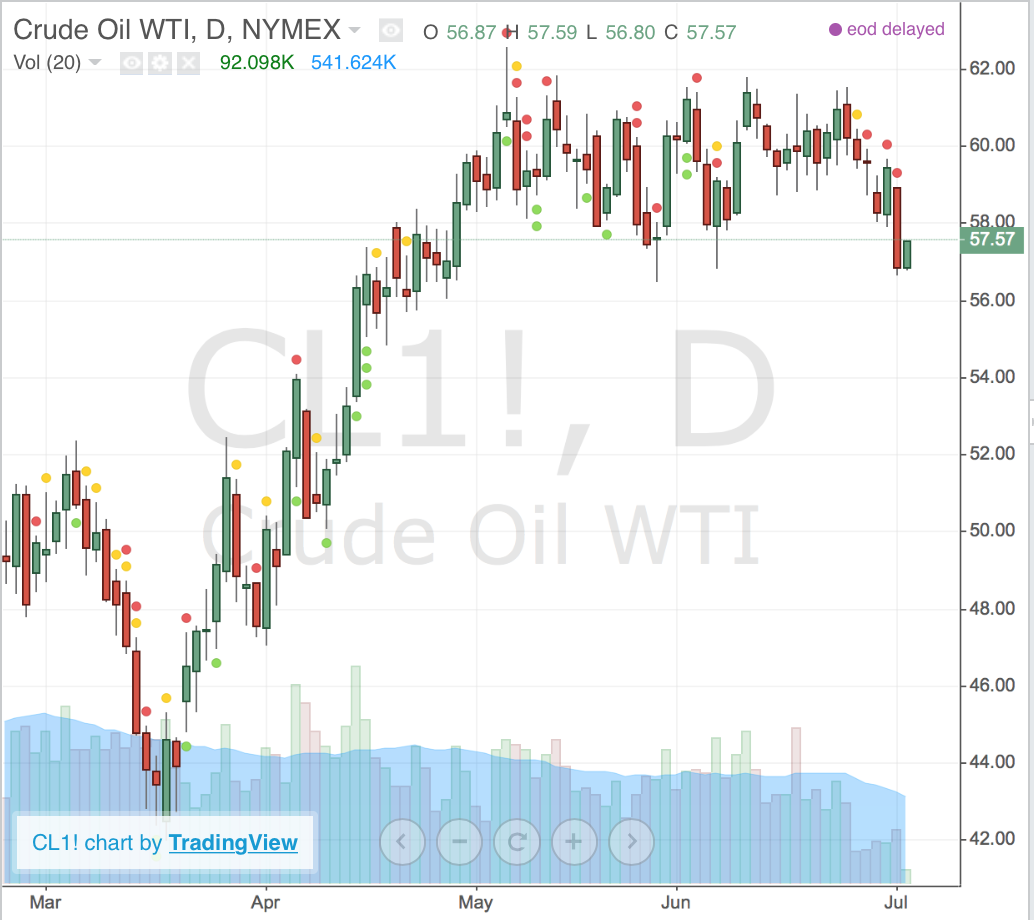

7. Oil

- Futures Magazine ?@FuturesMagazine – The damage is done #crude @EnergyPhilFlynn http://www.futuresmag.com/h44#.VZVGf5DoX9E.twitter

The article begins with:

- “Crude oil prices were trading like the damage is done. In other words, the Greek crisis charade has already done damage to the European economy and the oil demand outlook. While Greek Prime minister Alexis Tsipras decides to go down in flames calling for a no vote and bring Greece down with him the market outlook is cloudy. So instead of oil focusing on better than expected oil demand the market once again started to fret about supply.”

And,

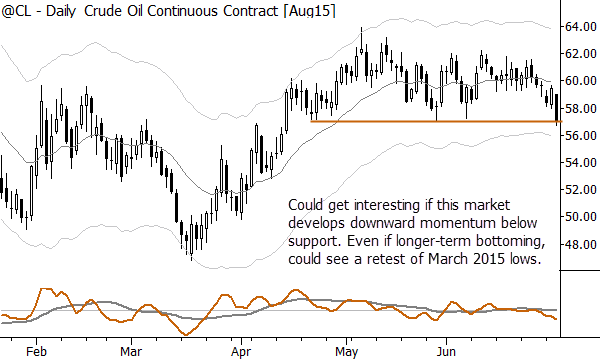

- Wednesday – Adam Grimes ?@AdamHGrimes – Crude oil could get interesting… $USO $OIH $XLE #oil $study

8 A Lovely Photo

- June 22 – GoodGovernance 良い統治 retweeted – Abdullah Saylam @AbdullahSaylam – A snow white, standart, golden tabby and white bengal tiger side by side.

Send your feedback to editor@macroviewpoints.com OR @MacroViewpoints on Twitter