Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TACs is our acronym for Tweets, Articles, & Clips –our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Milton’s “Fool in the Shower”?

Chair Yellen’s FOMC statement was as dovish as they come, so dovish that it shook the confidence of investors who were ready for a hike in rates. They sold & sold US stocks on that afternoon and on Friday, September 18. So the Fed dispatched James Bullard of St. Louis who forcefully stated that he would have raised rates had he the power do so. Who cares? Then luminaries like Art Cashin & Rick Santelli highlighted the damaged confidence theme on CNBC and Chair Yellen listened. It seems she too had been surprised by the reaction in the US stock market.

So, predictably, Chair Yellen went to the other extreme in her speech on this Thursday evening and virtually promised a rate hike in 2015. “What’s changed in the past week“, asked Ron Insana on CNBC summarizing the feelings of just about everybody.

Insana didn’t realize that Chair Yellen had acted in the textbook fashion, a Fed fashion that Milton Friedman had termed “Fool in the Shower” behavior – behavior of a fool who turns the shower knob rapidly from way cold to way hot & gets burned in the process. In Milton’s day, the Fed needed to wait for awhile to allow their monetary actions to work through the transmission mechanism. Not so today.

Today’s Yellen Fed doesn’t care about effects of their monetary policy on the US economy; they only care about the effect of their decisions on the US stock markets and that too immediately. So when Chair Yellen saw her decision to not hike had backfired in the US stock market, she turned 180 degrees in less than a week and signaled her commitment to a rate hike in 2015. This blow cold blow hot behavior would have mightily impressed Milton’s proverbial Fool in the Shower. But others were not impressed:

- Lawrence McDonald ?@Convertbond – .@KeithMcCullough Markets hanging on every word out of the Fed chair is getting very old

Larry McDonald is a nice guy and caustic sarcasm is not his forte. That requires a plain talking technician:

- Jeff Cooper ?@JeffCooperLive – Yellen: the market went down when I didn’t raise, then the market rallied today when I said I would raise…BUT now it’s red….WTF

Chair Yellen is a nice, dignified lady and no doubt she would interpret WTF as “why the fear”. That is something she would ask and suggest that investors should trust her. But who can trust a Fed whose members babble without abandon & without any common sense. So Jeff Cooper offered a sensible suggestion, a suggestion we have offered for the past couple of weeks. Of course, Mr. Cooper offered his suggestion in his own unique manner:

- Jeff Cooper ?@JeffCooperLive – @Peter_Atwater I have an idea why don’t they just shut thefup

We respectfully and sincerely urge Chair Yellen to follow Mr. Cooper’s explicit suggestion. Her credibility & the credibility of her Fed is in serious danger of being shattered beyond repair. From now on, Chair Yellen should ban all public comments from all Fed-heads until the next FOMC meeting and let the incoming economic data speak for itself. If she needs to send an actionable signal to the Fed Funds markets, she should use Signor Hilsenrath.

Can the Fed-heads remain quiet at least until next Friday’s payroll report? We hope but remain skeptical.

David Tepper has scoffed at the notion of a 25 bps hike impacting the US economy to any measurable extent. He is right. But he also said it could matter to currency markets & other markets. We don’t believe any one has a clue about what the secondary effects of a Fed hike will be on various linked markets. This is why we have felt that the Fed needs to take all the time in the world and wait until the Fed Funds markets demand a rate hike. This week we learned (initially via Zerohedge) of the fear Harvard Management is acting upon:

- “Furthermore, it is hard to know the impact of the eventual rise of interest rates in the US on asset classes domestically and globally. Monetary accommodation in the US has been in place for almost eight years, since the first Federal Reserve intervention on 11 December 2007, the Term Auction Facility (TAF). An extensive number of policy interventions, with a long lexicon of acronyms, followed. As hard as it was to predict the impact of these policy actions, it will be equally hard to predict the effect of their removal. We are analyzing potential effects of higher rates throughout the portfolio, in particular examining the possibility of second order effects if many asset classes (e.g., bonds, high-yielding stocks, high-yield debt, emerging markets and real estate) were to decline simultaneously. An interesting question emerges: could rising interest rates in 2016 have an analogous impact to falling house prices in 2007, where a range of largely unanticipated second-order effects was triggered? We are proceeding with caution in several areas of the portfolio: many of our absolute return managers are accumulating increasing amounts of cash; we are being careful about not over-committing into illiquid investments in potentially frothy markets, … ”

Makes sense to us. Because money managers investors who act like a Fool in the Shower face the likelihood of clients pulling their monies.

2. Bonds

Despite last week’s shock of a dovish Fed, Treasuries sold off a little this week. Even the 2-5 yr Treasury curve saw yields rise 3-5 bps this week. But the action in Treasuries seemed sort of normal and without the unrelenting pressure from China-EM reserves being sold. Did the dovish Fed soothe nerves or was the selling stopped during the visit of President Xi Jinping of China?

Gavekal asked whether we are About to see a Big Time Rally in the Long Bond? Their view:

- “During this cycle the positioning of commercial traders (the smart money) has been a crystal ball for players in the treasury market. Every peak in long bond rates since 2010 has been associated with commercial traders net long options and futures contracts on said instrument. At a net long positioning of about 34,000 contracts, the commercials are the most long the long bond since the end of 2013 before the 30-year treasury bond yield fell from 4% to about 2.2% over the course of 13 months. Given the deflationary tendencies all over the world, we could easily make the case for repeat of the 2014 episode for bonds. We also remind readers, however, that US stocks finished up about 11% in 2014, and that disinflation/price stability can in fact be good for stocks as well as bonds simultaneously”

What about risk appetite in US credit?

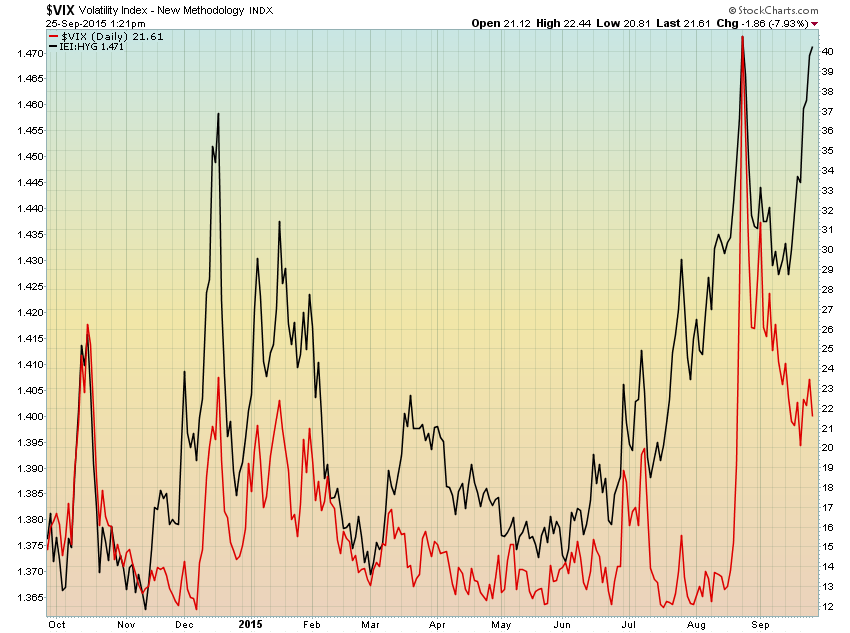

- Becky Hiu ?@beckyhiu – $HYG no Buenos.

- Jesse Felder ?@jessefelder – Another way to look at the disconnect between equity and fixed-income risk appetites right now:

3. US Stocks

What a week this was! Volkwagen, the largest auto manufacturer in the world, the center of the largest industry in the largest & foundationally central economy in Europe seems on the verge of a secular decline in fortune. If you own a Volkswagen vehicle take a look at this VW service centre Melbourne.

And this week did not end well:

- Helene Meisler ?@hmeisler – NYSE breadth kinda stinks today. I’m not really bearish on the mkt but this concerns me that on up days breadth lags

- Andy Nyquist ?@andrewnyquist – Getting bumpy. Reversal of reversals. Lower candle wickyday, upper one today. Indecision. Close will be interesting. Treading lightly.

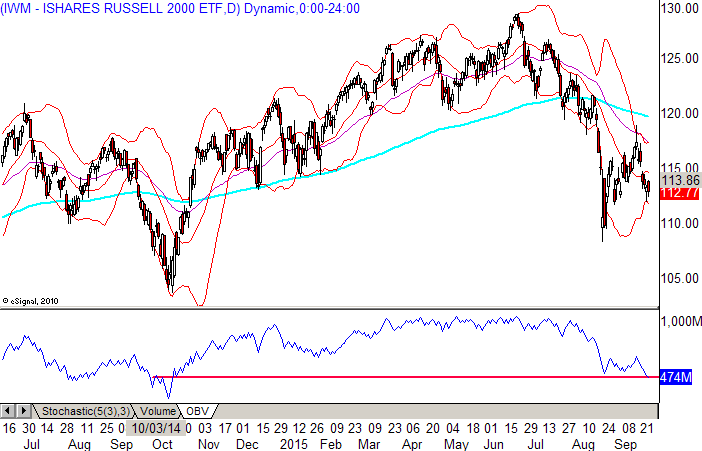

- Alan Farley ?@msttrader – $IWM OBV down to Oct 14 level.

3.1 Fall of the Generals

Add to that Friday’s steep fall in a main general of the US stock market, Biotechs & Drugs.

- investFeed ?@investFeed – The knife is really dropping in biotech today. $IBB #stocks #investing http://www.investfeed.com

The reality is this sector has been technical trouble for weeks. This was highlighted by J.C. Parets on August 12, 2015 in his article Is Healthcare Due For A Collapse? He made a detailed case in that article and it has come true.

(Parets chart on August 12, 2015)

This was a leadership sector in the US stock market, a general. Having proved right about one general falling from his leadership, does Parets now see another general facing the same fate? Yes, indeed.

Parets published an article this week titled Can Financials Correct 30% From Their Highs? The case is detailed and should be read in its entirety. Financials are the largest sector in the S&P and a major decline in the financials cannot but be negative for the broad market. But is there a stock Parets really dislikes?

- J.C. Parets @allstarcharts – Hard to find a nicer failed breakout that this one in Citigroup. Relative strength in $C since 2009 is atrocious

3.2 Fridays, Margin Debt & Cash Dividends

Do Friday’s matter more than other days? Yes argued Ryan Detrick in his article Why Friday’s Stock Market Performance Matters:

- “I’ve always thought Friday was a very important day for the stock market. … Think back to the Financial Crisis (if you want to). What did we see nearly every Friday afternoon? Huge selling of stocks across the board, as no one was confident enough to hold stocks over the weekend.”

- “Fast forward to what we are seeing today and wouldn’t you know it, Friday has been seeing some big drops the past few weeks. In fact, looking at all the days of the week in 2015 (see chart below), Friday is far and away the worst day of the week in the stock market.”

- “Breaking it down more, Friday in 2015 is down 0.21% a day on average so far in 2015. Going back five years, this is the worst day of the week for any year! This is the worst day since minus 0.63% on Wednesdays back in 2008″

- “Now the big question, does Friday weakness matter? I’m going to say yes and here’s why. Going back to 1928, there were just seven other years that saw weakness like we are seeing so far in 2015. The S&P 500 was higher for the full year just twice and the average return during those seven years was minus 10.9%”

Remember Detrick has been bullish until recently. When a bullish analyst turns bearish in Q3, we take notice. And this is not the only warning he expressed this week.

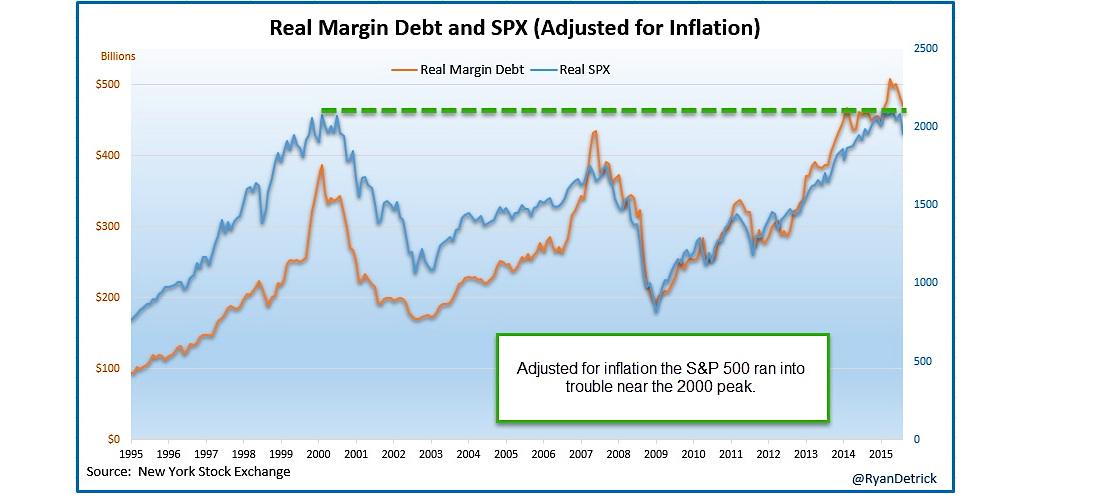

- See It Market ?@seeitmarket – New Post – “Margin Debt Concerns? Here’s What Investors Need To Know” http://www.seeitmarket.com/margin-debt-concerns-heres-what-investors-need-to-know-14796/ … by @RyanDetrick $STUDY

- “Well, this rollover is extremely concerning to me. Should it continue, I don’t see how it can be a positive for equity prices. The one chart I’m watching for clues is the 12-month moving average of margin debt. As you can see, violations of this longer-term trendline have marked some major peaks for equities. This hasn’t given way yet.”

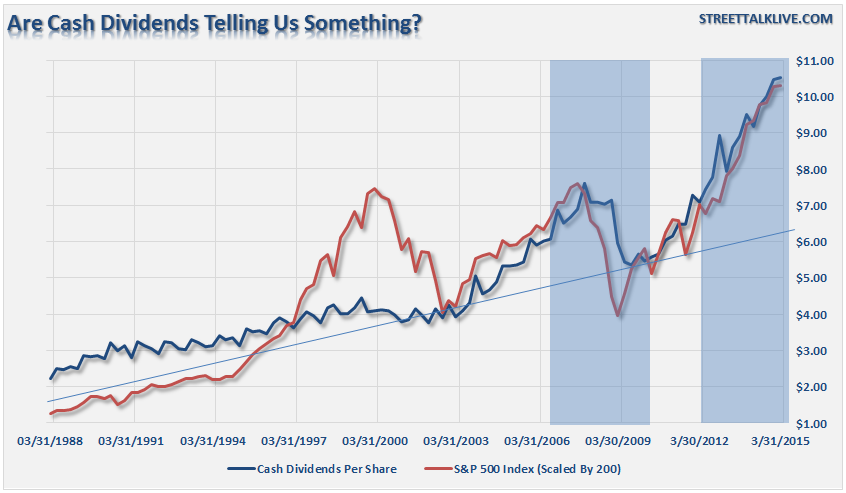

- Lance Roberts ?@LanceRoberts – Currently “cash dividends” are at the largest deviation from the long-term trend ever. http://streettalklive.com/index.php/blog.html?id=2914 …

3.3 Bullish views

- Greg Harmon, CMT ?@harmongreg – 2 observations on sentiment, virtually everyone I know/follow is bearish, & most think this will last a few weeks/a while. do what you will

- Mark Hulbert ?@MktwHulbert – Mark Hulbert: Stock investors haven’t been this bearish in 15 years http://on.mktw.net/1jgXfs6

A detailed case is made in:

- Urban Carmel ?@ukarlewitz – The low was a month ago yet investors are becoming more bearish: the set up for October. New from The Fat Pitch http://fat-pitch.blogspot.com/2015/09/weekly-market-summary_25.html?spref=tw …

His summary:

- “The first drop in equities was more than a month ago, yet price has not come within even 2% of the original low since then. Despite this, bearish sentiment continues to rise as if new lows were being formed. This is a strong positive. The infamous month of October arrives this week: volatility is likely to remain high, but our view is the risk/reward of buying sell-offs is very attractive on a year-end basis“

Two key charts from the article:

- “The Citibank Panic/Euphoria model has moved further into ‘panic’ territory over the past two weeks. It is now at a level where SPX has never been lower over the next 12 months and has most often gained more than 10% (green shading).”

- “Investors Intelligence bulls minus bears reached a new 4-year low this week; in the past 10 years, SPX has been higher over the following months, with the sole exception of the cataclysmic drop in late 2008, a period which has little resemblance to today.”

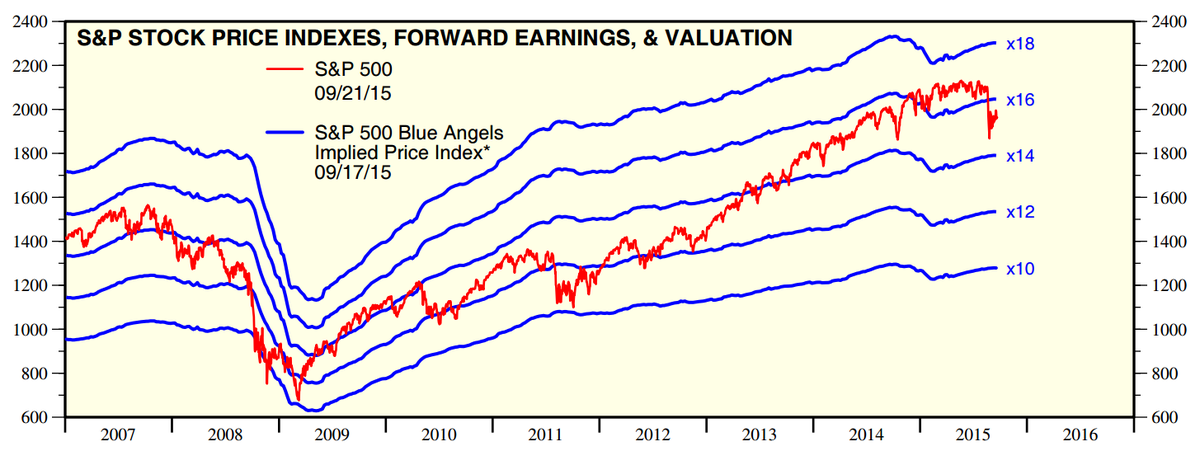

- Anthony Filippo @Vconomics – Great chart by Yardeni Research showing the S&P-500 is still stretched considering zero/negative earnings growth.

- Mike Bird @Birdword – HSBC head of technical analysis says US stocks “putting in a bigger top than eight years ago“ http://uk.businessinsider.com/

hsbcs-technical-us-stock- market-top-2015-9 …

- “All of that turmoil around the world will come back and slow down capex and hiring and consumer buying in the US, and that will make the Fed realise they should be easing and not hiking,…. I think we are on the precipice of a liquidation in emerging markets, and this feels the way that the fourth quarter of 1997 felt”

- The good news for EM investors is that there are signs emerging that the major pain in the emerging markets is nearing an end. About a month ago Bryce noted that it seemed that we may have seen the emotional low in EM stocks. In addition, analysts haven’t been this negative on EM stocks since the financial crisis which is a good thing for forward-thinking investors. As we go through our market internal data, more and more data points suggest that the worse of the EM slide is over (unless we are entering a 2008 situation).

- Finally, the percent of stocks that are at least 20% from its 200-day high has “improved” to 76% from 88% on 8/24. This chart below seems to be tracing out a 2011 style drawdown rather than the 2008 “end of the world” scenario. On October 30th, 100% of all EM stocks in the GKCI EM Index were in a bear market, a level that is almost hard to believe. In 2011 the nadir was 90% and so far in 2015 the nadir is 88%.

- “All in all, the market internal data in 2015 is beginning to look a lot like the internal data we saw in 2011 and fortunately, not like 2008. Baring some major event that shakes sentiment further, it would seem that the future for EM stocks is finally looking brighter”

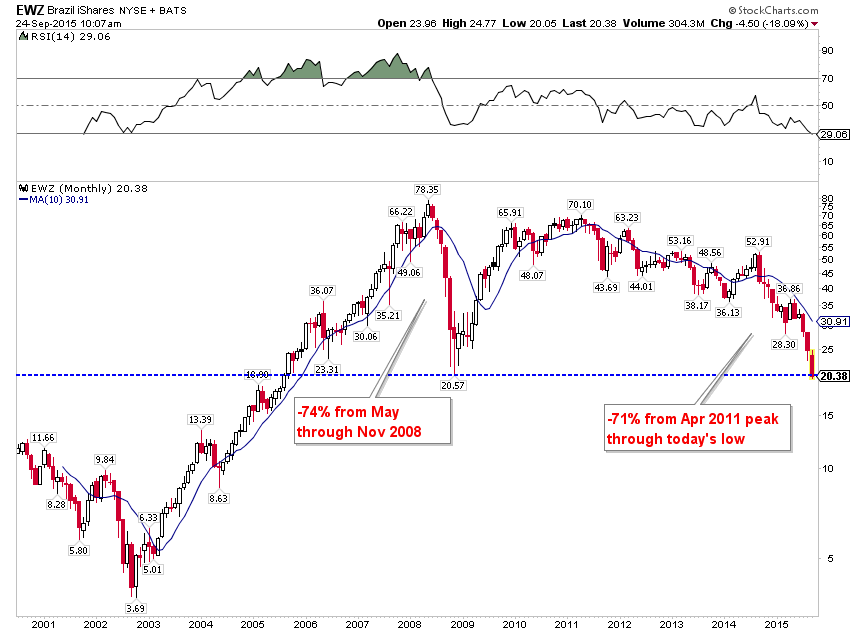

- Lawrence McDonald @Convertbond – Down 80% in dollar terms since #Brazil

- Invesco US ?@InvescoUS – John Greenwood believes Brazil’s economy will continue to be in a prolonged recession: http://inves.co/idi0925d

On the other hand,

- Thursday – Charlie Bilello, CMT ?@MktOutperform – There’s nothing positive you can say about Brazil today which is precisely why it’s an interesting investment here.

- Mark Newton @MarkNewtonCMT – Gold shown again when stripping out effects of USD.. Minor breakout, which could very well lead to Larger move.$GC_F

- Jim Cramer ?@jimcramer – Holy cow if this one’s bottoming anything can bottom: http://bit.ly/1FmvM2d — NOV