Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips –our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. “Oh yeah, they’re going to raise interest rates.”

That emphatic statement was from Jon Hilsenrath on Maria Bartiromo’s show on FBN on Thursday morning. The same line, if uttered on Friday after the close, would have sounded like a sarcastic dismissal or a serious question. Such was the speed & scale of the turn in global conditions on Friday.

- Jeff Cooper @JeffCooperLive – Janet: is there a ribbon for that box we’re in?

The longer version:

- Ashraf Laidi @alaidi 33s34 – “Are these guys for real?”

Frankly, we have no sympathy for Chair Yellen or the FOMC. They have been faint hearted to the point of being petrified of market reaction. And faint heart never won the lady, the lady called market stability. Secondly, they are utterly clueless about how markets work. That is why they did not raise rates on November 3, the day of the stunningly strong payroll number. These twin weaknesses have made them focus on “preparing” markets for the rate hike and forget the propensity of markets to run ahead of their “preparation”. To top it all, they chose to hike in December, the month when calendar pressures are maximum on investors, managers & markets.

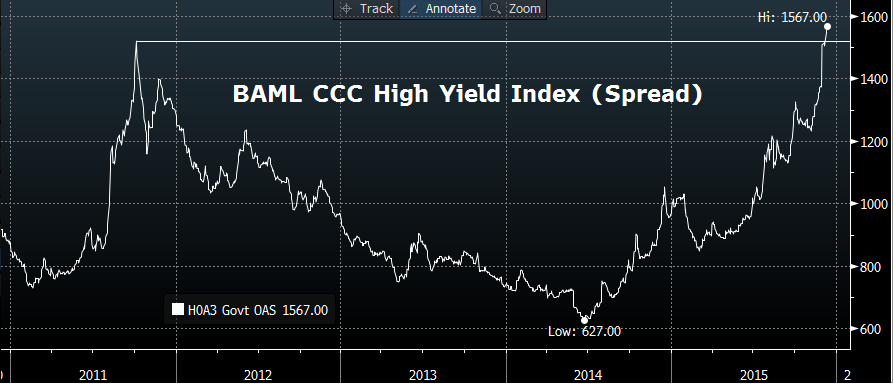

That calendar pressure, in our opinion, was why investors besieged a credit hedge fund named Third Avenue for redemptions forcing it to deny redemptions and announce closure of the fund. That action, as Art Cashin said on Friday, created “echoes of BNP in 2007 and of Bear Stearns Hedge Funds” in early 2008. This in itself was perhaps caused by a precipitous fall in oil this week after the OPEC meeting on last Friday ended in what Cramer called “end of the cartel“. And the oil price is central to a large segment of high yield credit market which began falling hard. This is not a new story but perhaps it became a bigger story due to both calendar pressure on investors to take losses & adjust portfolio allocations and due to big decision from the Fed next Wednesday. Add to this the steep fall in Chinese Yuan and the debacle in emerging market currencies. All the CCCs came together on Friday morning:

- Charlie Bilello, CMT @MktOutperform – Commodities, Credit, and Capitulation. New Post. http://stks.co/j3bDV

Frankly, the seeds of this were sown week ago Thursday with Draghi breaking ranks. Yes, he recovered mightily on Friday and the markets responded to his firm reassertion of control. But, as we said last week, the currency & rate markets only recovered 1/3rd on Friday, December 4 of what they had lost on Thursday, December 3. They took the weekend to decide that Thursday’s announcement was more real than Friday’s reassurance and they came Monday with that resolve. We did think this resolve had manifested itself by Thursday morning especially via:

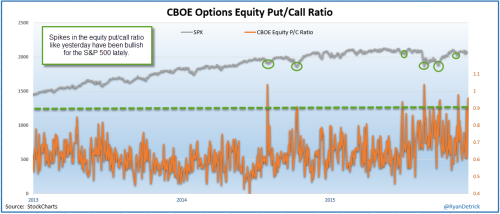

- Thursday morning – Helene Meisler @hmeisler – Ok, this is outright bullish guys: put/call ratio 140%

She was right and the S&P did mount a rally on Thursday afternoon. So we confess the decline on Friday morning caught us by surprise. At this stage, we have no idea what the Fed should do next Wednesday let alone what they would do. We have no idea how the markets may react in response to what the Fed does & says on Wednesday. Gundlach seemed to imply on Friday that if the markets remain in turmoil into the FOMC decision, they will not raise rates. But what if markets have exhausted their energy by Wednesday? Will the Fed raise rates then and assure that they are done for months? Remember last year?

- Bob Lang @aztecs99 – repeat of ’14? before opex last yr, post fed meeting the spx rallied 80 handles in 1 1/2 sessions. nearly an avg of 10 handles an hour

If that happens, then one parallel would keep its current track record.

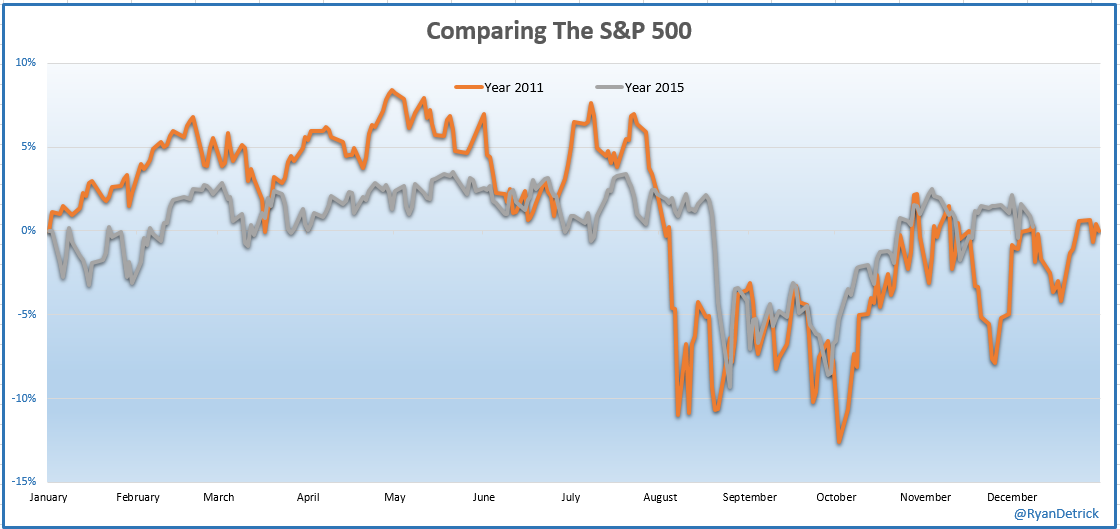

- Ryan Detrick, CMT @RyanDetrick – The last time the $SPX dropped 2% in December? 12/8/11. ’08 before that. $SPY

- Ryan Detrick, CMT @RyanDetrick – The amazing 2011 vs now chart. I don’t really buy it, but sure keeps working more than anything else. $SPY

Given the track record of Monday opening after a Friday rout like yesterday’s, Monday, with Tuesday if necessary, could get 2015 chart down to the bottom of the 2011 chart and then post-Fed boom! This is rank speculation and not a studied, analytical comment. Just goes to show we don’t have the foggiest what happens on Monday & next week.

But the real question is:

2. “drapes are in flames … “

The quote above is a part of a smart description of the two outcomes of the high yield carnage:

- “drapes are in flames – either it will engulf the whole house or it is a big deal but the fire would be put out”

Kudos to CNBC’s Brian Sullivan for this smart remark. Carl Icahn described the high yield market as “keg of dynamite” and said the “meltdown in the high yield market is just beginning“. A more colorful description is below:

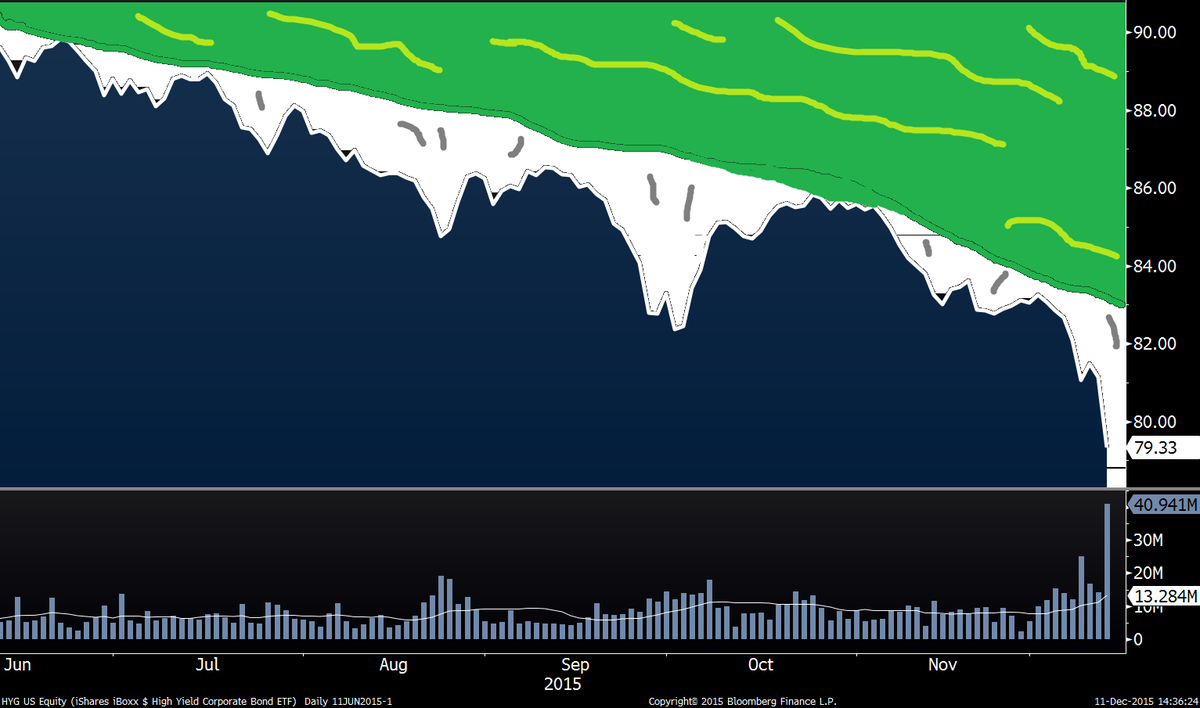

- Alexandra Scaggs @alexandrascaggs – $HYG has formed the rarely seen “entering the jaws of a monster” technical formation

In contrast, Gundlach seemed to suggest an oversold opportunity by recommending “closed end credit funds”. We hope Gundlach is more accurate but the high yield situation does seem to echo the 2008 credit carnage. Tom McClellan is closer to the Icahn camp in his Is this 2012 or 2008? article:

I am persuaded that the market in 2016 will follow the more bearish path. Here are the main reasons:

- 2016 is a second term election year, and so investors will have to grapple with the certainty of an unknown new president.

- We have already seen a RASI +500 failure for both the A-D and Volume RASIs, indicating that liquidity is weak.

- The eurodollar COT leading indication calls for a down move into April 2016, and it does not show a final bottom until October 2016.

- US federal tax receipts have already gone above the 18% threshold, which promises a recession.

- The spread between German 10-year “bunds” and 10-year T-Notes has already turned down from a high level.

- High-yield corporate bonds have been extremely weak, which usually leads to illiquidity that bites the stock market.

If flames do spread, where could they go next?

- Raoul Pal – @RaoulGMI Ok, last last one. Emerging market bonds, double head and shoulders top. A big liquidity crisis event is almost here

3. Abby Joseph Cohen Dictum

A few weeks ago, we recalled the dictum Goldman’s Abby Joseph Cohen had enunciated in October 2000 – that you always get a year-end rally unless you have deflation. We have found this to be empirically valid at least until now. Regarding the deflation argument:

- Jim Rickards on Friday – But the fantastic global credit bubble has now reached its zenith. China and the EM economies are rolling over into a terrible deflation, thereby catalyzing the mother of all margins calls. There will be a global capital expenditure (capex) depression. And its contractionary cascade will cause the entire global economy to shrink for the first time since the 1930s. … But unlike the short-lived recessionary dips of the past, the southward turn still has a long way to go. Brazil is plunging into its so-called hard landing, and China is not far behind — along with its supply chain and developed-market (DM) materials exporters like Canada and Australia.

We don’t recommend, at least not for the faint of heart, tweets of Raoul Pal from Friday. Interested readers can look those up via his tweeter handle. One is most relevant to this question:

- Raoul Pal @RaoulGMI – Something really really bad is happening globally and so few people get it. The US 30 yr yields next to break (down)

And what characterizes the beginning of a deflationary period?

- Raoul Pal @RaoulGMI – He gets it. He has Real Vision.

What stopped earlier feared onsets of deflation? QE from the Fed. Are we there yet or do we need more downside damage? Or perhaps the Fed needs another screaming rant by Jim Cramer? On the other hand,

- David Rosenberg – There are very definitely arguments in support of the view that the U.S. is at full employment and that carries significant implications for the Fed

Does any one argue for reflation?

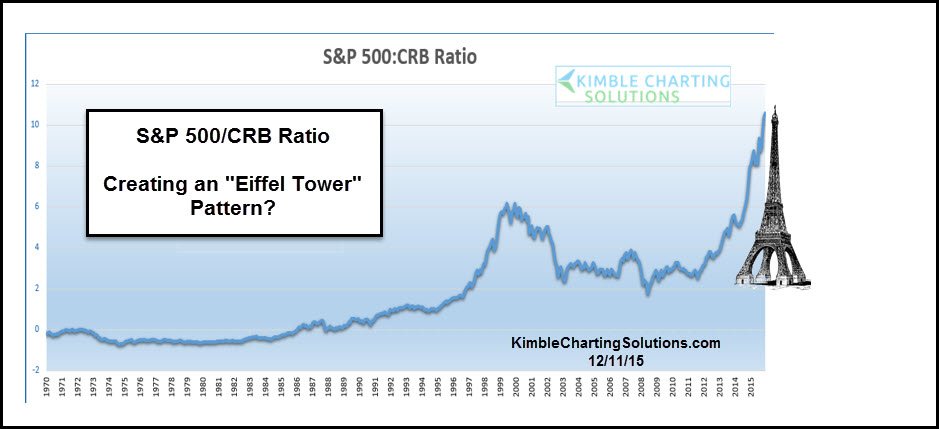

- Chris Kimble @KimbleCharting – Eiffel Tower pattern in play here? If so, could impact stocks in a big way. $SPY http://stks.co/h3b3Y $CL_F

Kimble writes:

- The ratio has almost went vertical the past 4-years, reflecting that the S&P 500 has done much better than commodities, to a degree that we haven’t seen in history!

- We believe that if investors experience the “left side of an Eiffel Tower pattern, they frequently experience the right side too!”

- Important times friends, this could turn into a really big deal, with HUGE OPPORTUNITIES to follow!!!

So, after all this, what does the Fed do, raise rates now or do what a smart guest said he was doing? – “wait for January 4, 2016 – if that ISM number comes in closer to 45, then a recession is coming in 2016“. The answer may depend on whether markets remain in turmoil into the FOMC meeting on Wednesday.

But what is the Treasury market saying about it?

4. Treasuries

They were the stars of Friday. The 30-year yield fell by 10 bps while the 5-year yield fell by almost 14 bps. The 2-3 year rates fell by 6-7 bps prompting:

- Komal Sri-Kumar @SriKGlobal – UST 2yr yield drops 6bp to < 89 bp. Suggestion of cold feet at #Fed on a 12 / 16 rate hike?

But what if Fed’s rate hike on Wednesday is the “one & done” hike into a slowing economy? That would mean 25 bps will be the Fed Funds rate for all of 2016 with a slowing economy? Can the 2-year yield stay at 90 bps in that case or the 5-year yield stay at 1.6%? That may be why uber-bull of 2015, Jack Bouroudjian, said on Friday “Bonds are where we want to be next year“.

On the other hand, Bear Traps Report asked its readers to Sell All TLT on Friday afternoon. Their track record of in tactically trading TLT has been very good.

5. Stocks

To quote Kenny Polcari, a floor trader, “this year is shot; no one is making up this year“. If this remains true, then a foundation of seasonal year-end rally would be caput. A more hopeful note was sounded by Lawrence McMillan of Option Strategist:

- “In summary, the indicators are mixed, but are becoming more negative. A breakdown and close below 2020 would set off some sharp selling, but that might not occur. If the support holds until the position December seasonal patterns can take hold, the downside could be limited”

A timely tweet from a smart trader protected those who listened from jumping in after last Friday’s big rally:

- Friday – December 4 – Tsachy Mishal @CapitalObserver – ISEE equity at 170. Rallies have not fared well in recent months when the ISEE has been this high

Kudos to Tsachy Mishal. What did he say this Friday?

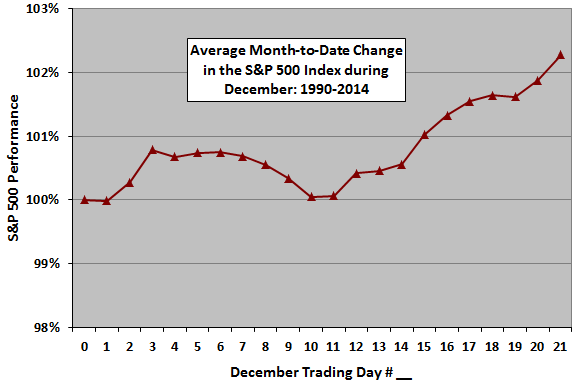

- Tsachy Mishal @CapitalObserver – Seasonal strength doesn’t start until next week

Tony Dwyer, a bull all through 2015, expects the S&P to reach 2350 in the first half of 2016:

- “Once the Fed starts raising rates, it takes 1.84 years to invert the curve; once they invert it, 15 months – that’s 3 year – market peaks 8 months prior to recession – 3 years to recession, 2.25 years, say 2 years, prior to peak, we have still have a pretty good period ahead”

A more detailed case for a rally:

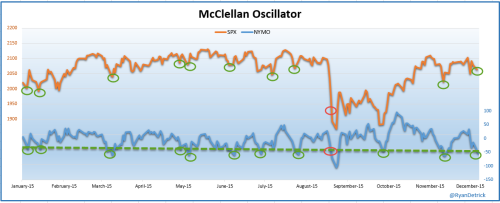

- Ryan Detrick, CMT @RyanDetrick – Recent Post: Three Reasons To Remain Bullish In December http://stks.co/s3J2S via @yahoofinance $SPY $SPX

According to his article:

The McClellan Oscillator (a measure of market breadth) is near oversold levels that have sparked rallies in the S&P 500 over the past year.

Lastly, we saw a major spike in fear yesterday looking at the CBOE options equity-only put/call ratio. Spikes above 0.90 have marked some near-term lows in the S&P 500.

What about the bear case? Deflation as discussed above would be the big bear case.

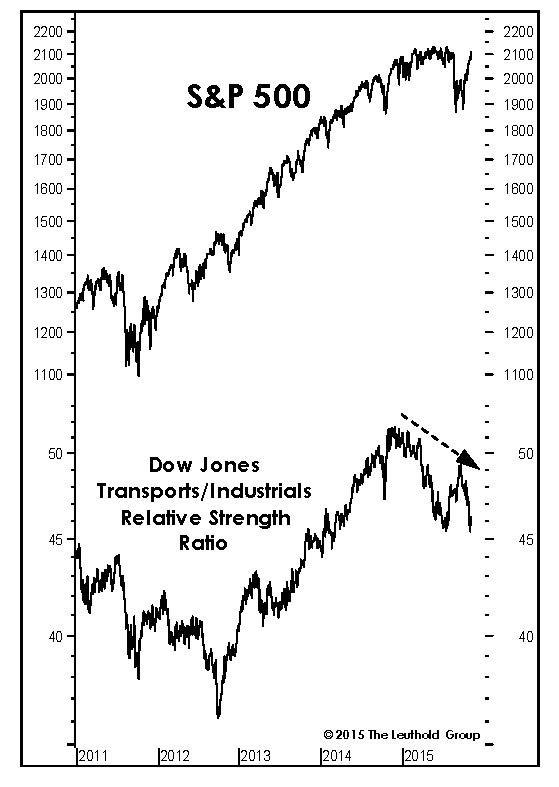

- The Leuthold Group @LeutholdGroup – DJ #Transports warn: diverging pattern akin to those preceding prior market peaks http://bit.ly/1NPp1n7 $DJT $SPY

6. Dollar, Gold & Oil

The Dollar peaked on the day of the Draghi announcement said Jeff Saut to Maria Bartiromo on her show this week.

- Ryan Detrick, CMT @RyanDetrick – As of end of Nov, US Dollar was up 25% the previous 18 mos. That was the most ever. Now down 3% in Dec, which is 2nd lg drop in 4 yrs. $UUP

- Elliott Wave Int’l @elliottwaveintl – Gold is at a deep low, with Large Speculators and Commercials holding extreme positions… http://bit.ly/1NENfER

- Charlie Bilello, CMT @MktOutperform – It’s official: everyone is bearish on Crude.

’85-86: -63%

’90-93: -65%

’96-98: -54%

’08-09: -68%

’14-15: -66%

Send your feedback to editor@macroviewpoints.com Or @Macro Viewpoints on Twitter