Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips –our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Remember Fed Up?

Months ago we began using our “Fed up” term to tell the Federal Reserve to just shut up. It was obvious to just about everyone that the constant babbling by Fed-heads was doing far more harm than the theoretical good they were doing in their imagination. We got so Fed up that we actually began using the “F-word” term instead of using Fed or Federal Reserve.

That was simple common sense. Or at least so we thought. But that is not how Wall Street Economists & Academics think. CNBC’s Steve Liesman announced on Friday that a 100-page paper authored by a large group of Wall Street Economists & Academics came to the same conclusion – that the Fed should just shut up and not communicate to the markets any babble about when they will raise rates. We hope they listen.

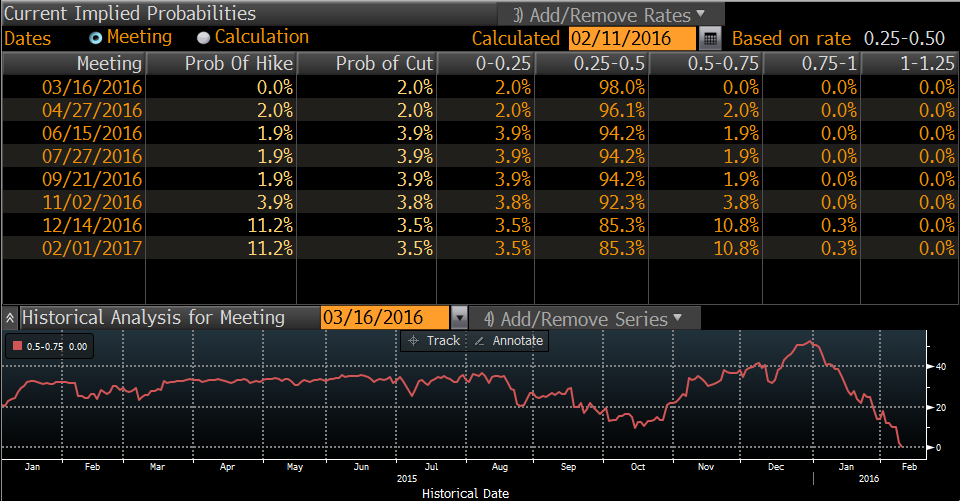

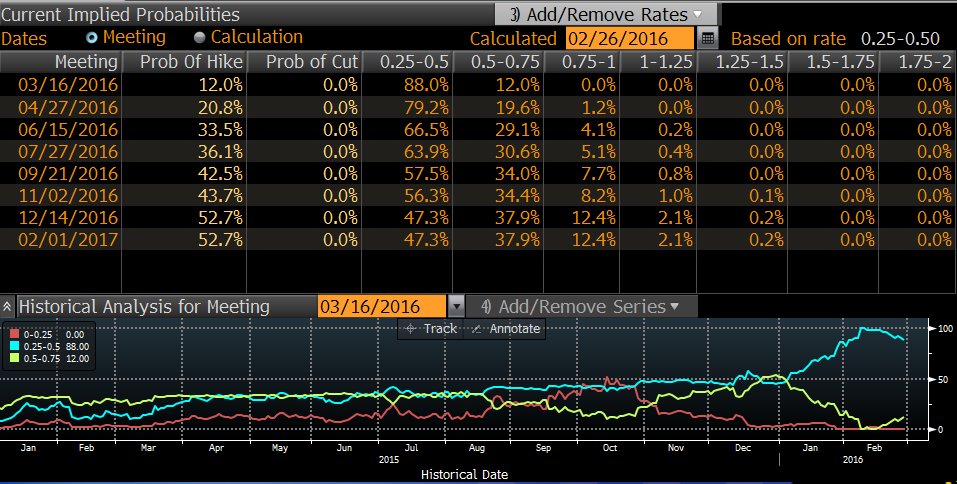

They know and we know that the best read on what they might do is the Fed Funds market. And we all know what drives the expectations in the Fed Funds market. But it feels better when some one demonstrates it with data. What were the expectations of a rate hike a mere two weeks ago?

- Charlie Bilello, CMT @MktOutperform Feb 11 – Dec ’15: Fed projects 4 hikes in ’16. Market Today: 1) Cut odds > hike odds in Mar-Sep. 2) No hike until mid 2018.

Wasn’t February 11 the day the stock market bottomed? What were the rate expectations on this Friday, the day that S&P broke through 1950:

- Charlie Bilello, CMT @MktOutperform – Hike odds back to Dec ’16 (from mid ’18) after S&P bounce. Stock Market Tail Wags Fed Dog. https://pensionpartners.com/

the-stock-market-tail-wags- the-fed-dog/ …

So the Fed doesn’t really have to speak at all, does it?

2. Return of the Divergence?

After a series of bad economic numbers including Services PMI, we got some hot stuff on Friday:

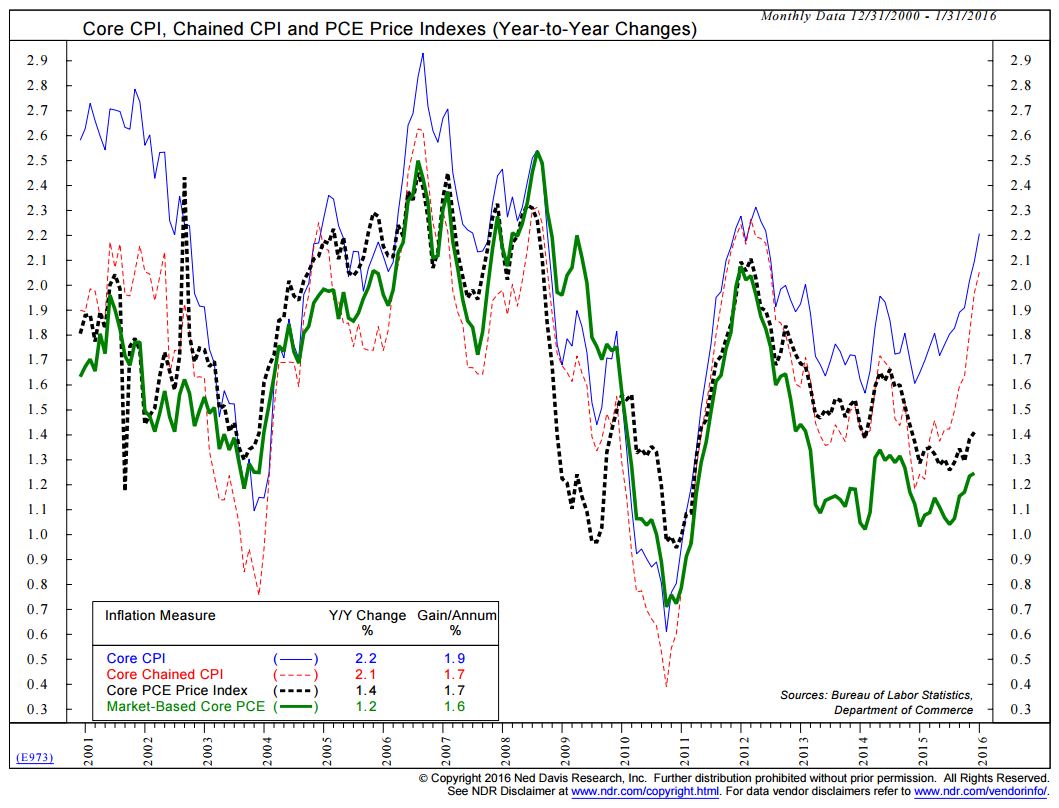

- Willie Delwiche, CFA @WillieDelwiche – Inflation starting to show signs of life: Core PCE inflation following core CPI higher. https://goo.gl/v6Xoe6

And the consumer is doing the consumer’s job:

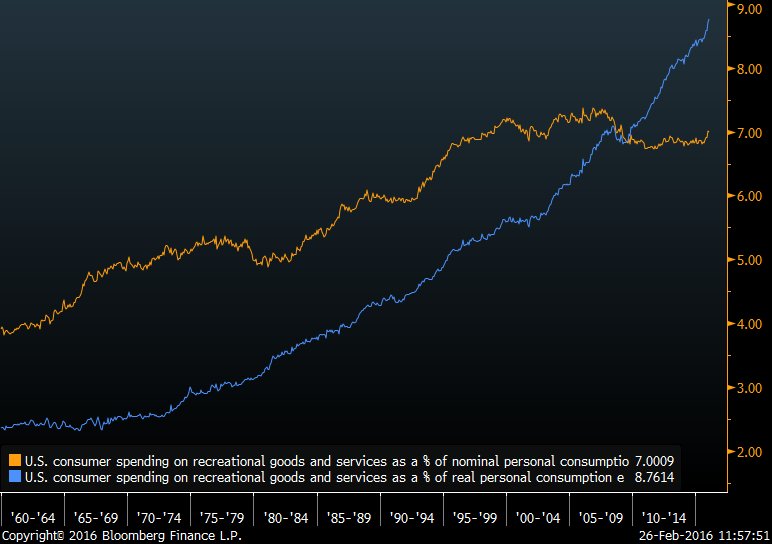

- Matthew B @boes_- Share of real consumer spending on recreational goods and services hit new high in January, up big last six months

Even the GDP number came in at 1% instead of expectation of 0.4%. No wonder the 2-5 year yields shot up by 7-8 bps on Friday and the curve bear-flattened.

As Martin Feldstein had argued a couple of weeks ago, QE works in America because it raises stock prices. QE doesn’t work in Europe because Europeans are not as invested in the stock market as Americans are (yes, despite the feverish rate of monies being pulled out of the US stock market by investors). In Europe, the effects of QE are transmitted mainly via a weakening of the Euro, Feldstein argued. Can that deliver a real bang in this era of currency devaluations around the globe?

- Holger Zschaepitz @Schuldensuehner – #ECB‘s QE has failed as CenBanks favored inflation gauge hits record low under 1.40%. http://reut.rs/1Q3vkYj

Does actual consumer spending match the falling inflation expectations? The answer is in the simple statement that Europe is going the way of Japan:

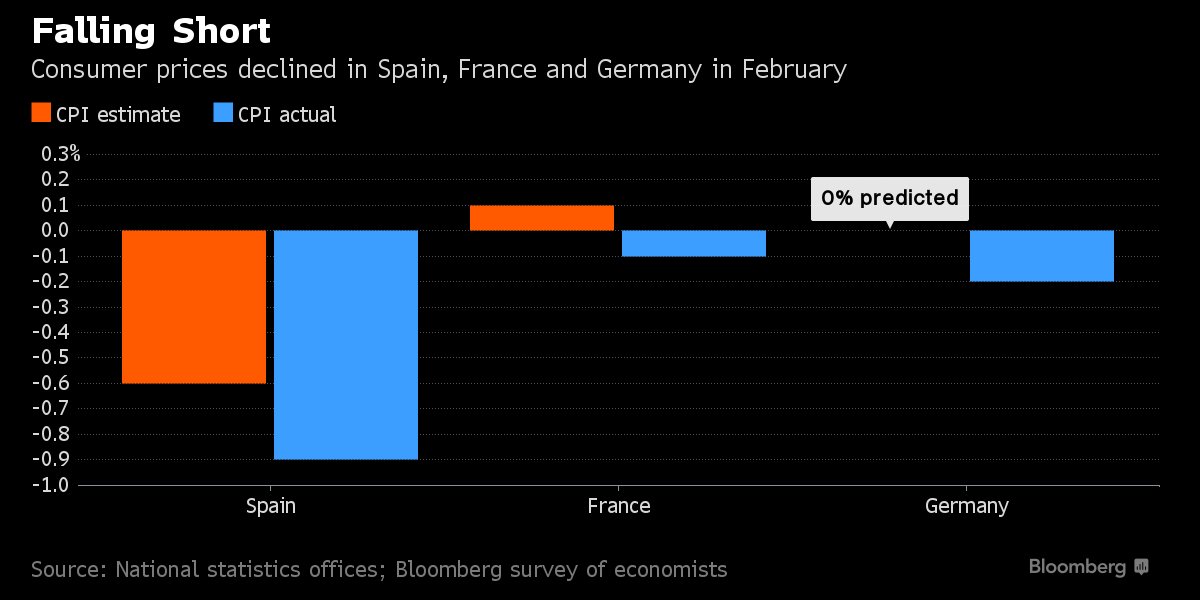

- Bloomberg Business @business – Euro-area inflation seems to be cooling faster than expected – and turns negative in Germany http://bloom.bg/1SZR4Ig

- “The euro zone now faces one of the longest periods of zero or negative inflation in its history,” HSBC Holdings economists Fabio Balboni and Rainer Sartoris said in a note on Friday. This “increases the risk that inflation expectations could become dislodged and puts more pressure on the ECB.”

- Clemens Fuest, incoming president of the Ifo economic institute in Munich, said that loose monetary policy has allowed governments to delay reforms, which could lead to longer-term problems, and the region is “going the Japanese way. … If you look at inflation, interest, rates, growth, it’s as similar as it can be,” he said in an interview last week. “The euro zone is a different animal from Japan. But the response to the crisis and the economic impact is similar to what happened in Japan.”

If Europe is going the way of Japan, then we can expect more & more negative interest rates. And if European rates keep getting more negative and if US rates keep going up or at least stay up at these levels, what happens to the Dollar? And then what happens to the earnings of US corporations? And then?

- Lawrence McDonald @Convertbond – S&P 500 Last 110 Years After consecutive quarters of earnings declines, recessions have followed 81% of the time- JPM v @BearTrapsReport

And what is China doing with its currency in the meantime?

- Bear Traps Report @BearTrapsReport – CNY/CNH spread still tight but #China is doing a stealth devaluation. Slow and steady, trying not to spook markets.

As they do a stealth devaluation, what do they think of Abenomics?

- People’s Daily,China @PDChina – In #Cartoon: #Abenomics‘ stimulus (By Luo Jie/ China Daily)

Can US rates maintain their current levels as the rest of the World goes more & more negative? No argues Scott Minerd of Guggenheim Partners as he delivers first a low target & then a ridiculous sounding target for the 10-year yield:

- “Central banks around the world, reacting to the same recessionary fears, are likely to cause long rates to sink materially lower than where we are today. I see the 10-year Treasury note falling to 1 percent, perhaps even lower, before year-end. According to technical analysis, the current target bottom for the 10-year Treasury note is 28 basis points!”

Believe it or not, this 0.28% target for the US 10-year yield is way higher than another estimate. That estimate assumes that U.S. rates will go negative as well due to the relentless pressure of the rest of the world. In that case, Albert Edwards of SocGen points to the target of his bond trading colleague – minus 0.32% or a full 200 basis point lower than this Friday’s yield of 1.76%.

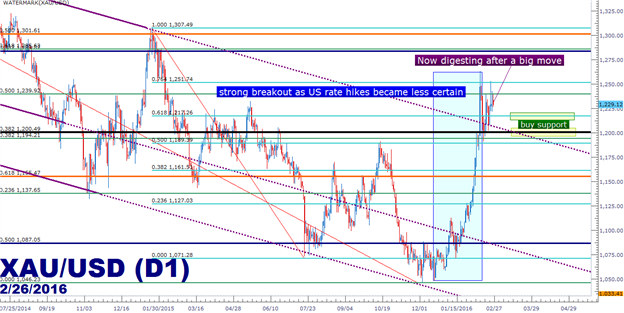

An environment in which central banks are weakening their currencies & talking about negative rates has to be good for something. And that something, according to dailyfx.com, is:

- “We’ve just broken above a 2+ year channel, and now price action is digesting. Traders can look to buy support at Fibonacci levels at 1,217 or 1,200 to look for top-side continuation. If Central bankers around-the-world continue in their current stance of doing the same old thing, this setup could shine in the coming months, similar to the 2008-2011 run.”

3. US Equities

How do we spell relief? S&P 500, at least for this week.

- Ryan Detrick, CMT @RyanDetrick – SPX missed out on back to back 2% weekly gains, but was still up 4.47% the past two weeks. The best 2-week return in more than a year.

We crossed 1950 this week, the bottom of the 1950-2000 level that is expected to be the top of this rally according to many smart analysts/technicians. That is supposed to then lead down, to break the 1810 level that has held so far & then fall to lower levels. What is that lower level? DeMark says 1786 but many others say 1600.

The only outright bullish comment we saw came from LPL Research which argued for an inverse head & shoulders formation that might be triggered if the current break of 1950 holds:

The financials outperformed on Thursday and Friday. Was that a sign that the rally is ending or was that an affirmation of the double bottom in GS near $140?

- J.C. Parets @allstarcharts – regional banks up 2% today with the market down. That’s what we call outperformance and sector rotation. I think this continues $KRE

The market timing gurus are negative for March. Tom DeMark is looking for an ugly March. But he added “If [the market doesn’t fall ] in the next two or three weeks, we’ll have to rethink [the scenario],”

Tom McClellan is also calling for “a sizable down move during the month of March, leading to a bottom due the first week of April “..

- “The stock market is topping out now after a countertrend rally, and ahead lies an ugly March. That weakness should accelerate after a top due March 1-4, and should culminate in a bottom due the first week of April. At that point, expect to hear everyone talking about how this is 2008 all over again, which it is not.”

The above brings to mind a bearish megaphone:

- David Larew @ThinkTankCharts – Chart of the Day – all comments and charts on this twitter account are for educational use only.

Frankly, what happens next is anybody’s guess because the markets are at a fork in the road:

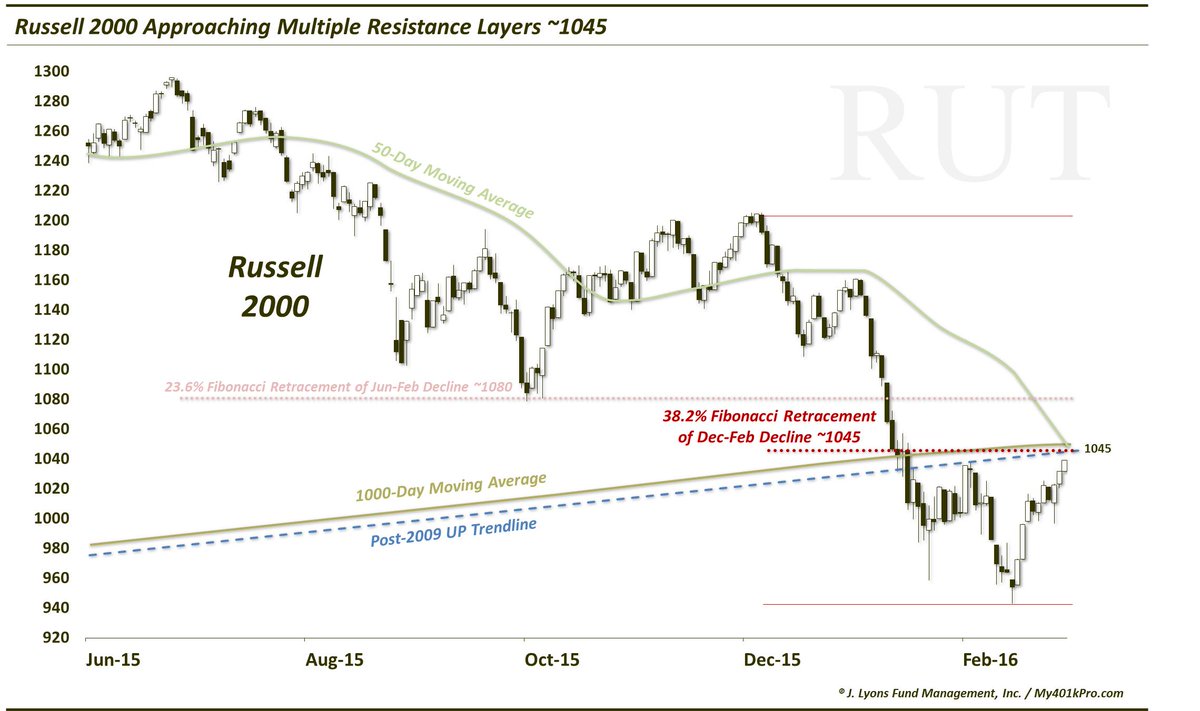

- Dana Lyons @JLyonsFundMgmt – ICYMI>ChOTD-2/26/16 Small–Caps Approaching Rally Test $IWM $RUT Post: https://tmblr.co/Zyun3q22REwm7

and

Chris Kimble makes the same point about DAX – that an important bull market test is in play:

- “The DAX remains inside of a 5-year rising channel, shaded in blue above. The decline since last April, took the DAX down to test its 5-year rising channel and 38% Fibonacci retracement level of the 2009 lows/2015 highs the week of Feb 12th.”

- The 9,000 zone at this time should be viewed as “dual support.” “If this leading index would happen to break dual support in the 9,000 zone, the next support zone comes into play around the 8,000 zone (around 10% below current prices).”

4. EM, Oil, Dollar & Gold

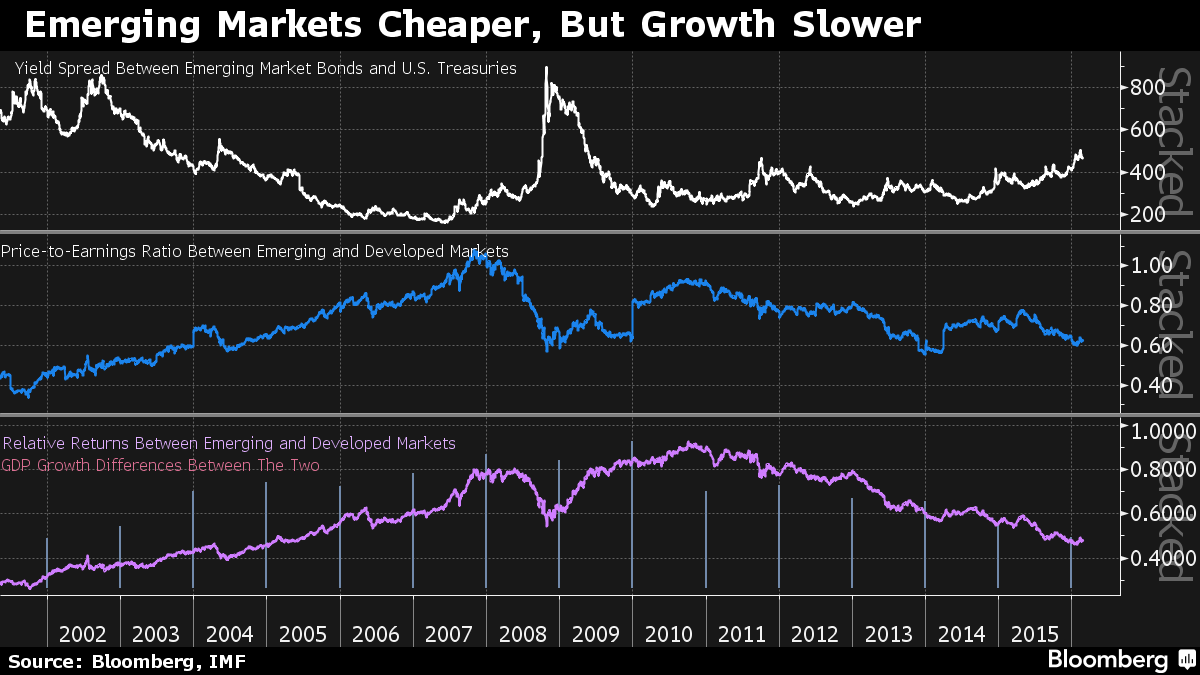

J. C. Parets was one of the early ones to call for EM outperformance of S&P this year. He reiterated this belief in his appearance on BTV this week – “Oil goes higher, metals & minerals go higher, & EM countries that are resource intensive go higher“.

The EM outperformance has been broad:

- Charlie Bilello, CMT @MktOutperform – 8 Global Equity indices Positive YTD… Argentina Colombia Turkey Thailand Russia Indonesia Mexico Taiwan All EM

That fits in with the fundamentals:

- ValueWalk @valuewalk – EM Stocks Are Just Plain Cheap @GaveKalCapital http://www.valuewalk.com/2016/02/em-stocks-are-just-plain-cheap/ … $EEM

On a longer timeframe:

- Jesse Felder @jessefelder – Research Affiliates Sees ‘The Trade of a Decade’ in Emerging Markets http://www.bloomberg.com/news/articles/2016-02-24/pimco-adviser-sees-the-trade-of-a-decade-in-emerging-markets …

Quietly oil had a great week – the biggest week since 2011:

Oil & stocks have marched to the same drum this year. Is that about to change?

- LPL Research @LPLResearch – “Crude Oil & the S&P 500 Have Reached a High in Their Correlation” @RyanDetrick @LPL

- Jesse Colombo @TheBubbleBubble – I am still watching this pattern in the U.S. dollar. If that breaks to the upside, it could lead to another wave up.

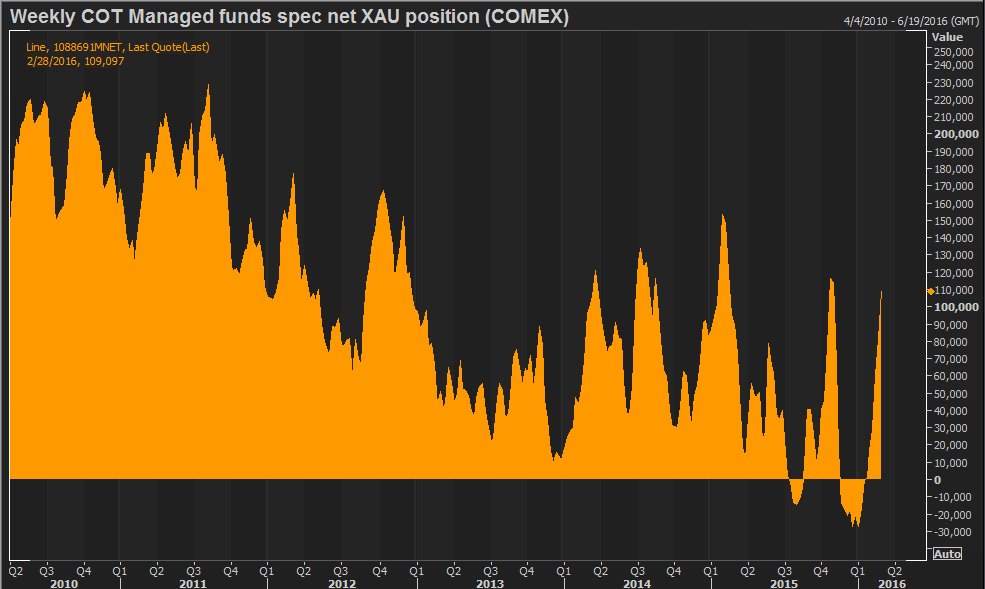

That might lead to an unwind of some speculative gold positions:

- Eric Burroughs @ericbeebo – And spec XAU longs showing some conviction. Ties in with broader picture of risk aversion reaching unwind levels

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter