Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips –our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.China

As 2016 began, the biggest danger to world markets was a devaluation by China. During that panic phase commodities were trashed & stock markets swooned. The world’s monetary authorities were not going to allow unraveling of their cherished creations. So a deal was presumably made and commodities, EM currencies bottomed. Then. after the Shanghai G20 meeting, what had begun as an oversold bounce became a real rally.

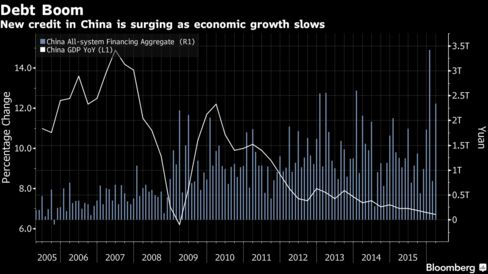

We now see what that deal was. China was to pump money into their system, Draghi was to increase & broaden his QE & Yellen was to take Fed hikes off the table at least for the first half of the year. China did its part so well that it is now scaring smart investors like George Soros who gave a blunt speech at the Asia Society this week. His message according to Bloomberg & Valuewalk:

- “The broadest measure of new credit in the world’s second-biggest economy was 2.34 trillion yuan ($362 billion) last month, far exceeding the median forecast of 1.4 trillion yuan in a Bloomberg survey and signaling the government is prioritizing growth over reining in debt. … China’s economy gathered pace in March as the surge in new credit helped the property sector rebound. Housing values in first-tier cities have soared, with new-home prices in Shenzhen rising 62 percent in a year”

- “Other banks have to lend to each other and that’s an additional source of uncertainty and instability, … The problem has been deferred and it can be deferred for another year or two but its growing, and growing at an exponential rate … Most of money that banks are supplying is needed to keep bad debts and loss-making enterprises alive”,

- “Debt growth, or leverage in the country has expanded significantly, with Bloomberg Intelligence estimating that debt relative to economic growth had grown past 200%. US debt to GDP, by contrast, is near 104%”

There are signs that Chinese markets are beginning to give up some of the recent euphoria:

- Jesse Felder ?

@jessefelder – As Global Stocks Rally, China’s Markets Send More Ominous Signal http://www.bloomberg.com/news/articles/2016-04-21/as-global-stocks-rally-china-s-markets-send-more-ominous-signal …

So what happens to the metals & other commodities if Chinese markets send stronger negative signals? Does that depend on China’s partner?

2. Fed

No one is talking about the FOMC meeting on April 29. That may be because Chair Yellen has taken rate hike risk off the table for this meeting. But has she taken out the risk of a more hawkish than expected comments?

Look what Jeff Gundlach said in his interview this week to Finanz und Wirtschaft:

- “I have been waiting for about two years for the Fed to capitulate on their interest rate increase dreams. Now, I think they did. Federal Reserve Chair Janet Yellen basically capitulated on March 29th … So you’ve gotten about as much capitulation as you can get“

Now what did Gundlach mean by that last sentence? Did he mean the fall in interest rates has gone as far as it can or did he mean Yellen’s verbal capitulation has been as much as we are going to get. The second suggests that Yellen will sound less completely dovish as she did on March 29. And both will mean a rise in the U.S. Dollar. Note that Yellen has a fundamental reason for talking tougher:

- Charlie Bilello, CMT ?

@MktOutperform – US Inflation Expectations end the week at their highest levels of the year .https://pensionpartners.com/the-deflation-myth/ …

Is this fear of tougher talk from Yellen a reason for the perk up in the U.S. Dollar?

3. Dollar

- J.C. Parets ?@allstarcharts – I think this Dollar rally continues and hurts this entire EM, Energy, Metals trade that has led the stock market higher since late January

Is there a level to watch?

- Helene Meisler ?

@hmeisler – I am certain I will mush this but over 95 (red line) DXY gonna catch some attention, dontcha think?

DXY did close above $95 on Friday. But it needs to hold & rise above that next week to be credible. Kudos to Mark Arbeter for calling this on Wednesday:

- Mark Arbeter, CMT ?@MarkArbeter – Interesting spot for $. Bull wedge, oversold at support, +momo divergence, commercials more bullish. $UUP, $dollar

This small rally in the Dollar has already weakened one sector:

- Andrew Thrasher, CMT ?@AndrewThrasher – Double top & momentum divergence has weakened this commodities basket ETF $DBA

4. Bonds

Treasuries had a bad week with yields across the 30-5 year curve up 14-15 bps. This was a parallel move across the curve with the 30-5 year & 30-10 year spreads flat on the week. And or because, the German 30-year yield also rose by 15 bps with the German 10-year up by about 8.5 bps. The German 10-year yield is now almost 300% higher than its 2016 low of 8 bps. The UST-Bund 10-year spread jerked around spasmodically by jumping up 9 bps on Wednesday & then giving it almost back on Thursday to close the week up 3 bps. So whatever spooked the Treasuries also spooked Bunds. And the Yen-Dollar got torched on Friday to close down 2.6% on the week.

Whatever spooked interest rates also spooked J.C. Parets:

- J.C. Parets ?@allstarcharts – A U.S. Treasury Bond Market Crash Is On The Table Folks. Just an FYI…..

A crash needs large positions & complacent sentiment, right?

- Tom McClellan ?@McClellanOsc – A lack of fear, or bearish optimism, in T-Bond market. This is lowest reading since 2004.

The stage seems set for Yellen to light a match or to douse any embers that might be ready to burn. She is the decider.

In spite of the rise in Treasury yields or perhaps because of that, High Yield bonds did well this week with HYG & JNK up 1.1% & 1.3% resp. This is double the performance of SPX & Dow this week. But what about fundamentals of the high yield space?

- Financial Times ?@FT – Moody’s has downgraded more companies to junk status this year than in all of 2015 http://on.ft.com/1Vn6MhG

And,

- Jesse Felder ?

@jessefelder – Junk defaults are now at recessionary levels :http://www.alhambrapartners.com/2016/04/22/chart-of-the-week-high-yield-defaults-on-the-rise/ …

What did Gundlach say about high yield bonds in his interview this week?

- “Just like oil, the high yield market has enjoyed the easy rally. I think it’s basically over. I don’t see how you are supposed to be all fond off high yield bonds, since they are facing enormous fundamental problems. I thought people would learn their lesson but the issuance in the years 2013/14 was vastly worse than the issuance in 2006/07. Also, in the bank loan market covenant lite issuance rose to 40% in 2006/07. In this cycle it climbed to 75%. The leverage in the high yield bond market is enormous and you’re about to have a substantial increase in defaults. I wouldn’t be surprised if the cumulative default rate in the next five years were going to be the highest in the history of the high yield bond market“

5. Oil

We won’t waste time or space in trying to talk about Doha except to say markets act in a mysterious manner. Oil & Oil stocks had a huge rally this week. If you are looking to invest in oil stocks, you might want to visit https://www.energyfunders.com/oil-and-gas-investments/. This huge rally has occured despite:

- Antony Filippo ?@Vconomics – Crude oil stockpiles getting awfully close to maximum capacity (PADD storage capacity estimated by Bloomberg)

Next week we will see whether Chair Yellen has any impact on oil.

6. Stocks

Doesn’t SPX spell resilience? It certainly did this week. After growth generals like Google, Microsoft, Starbucks all got carried out, the S&P with Dow & RUT kept on marching. May be it is simply “goldilocks” as we discussed last week. Kolanovic of JP Morgan had spoken about capitulation by CTAs & other macro investors. May be that is what we are seeing.

- FxMacro ?@fxmacro – Discretionary Macro HFs appear to have capitulated shifting from a short to long equity position during April month after CTAs capitulated

And,

- Charlie Bilello, CMT ?@MktOutperform – Active Managers reported their highest net exposure to equities since last April: 82.5%. $SPX

So what happens if Yellen spikes the Dollar, causes a sell-off in Treasuries? Do stocks sell off or do they rally because of a stronger economy signal? Of course, we see smart people opining with both hands.

Carolyn Boroden was one of the few who said weeks ago that the Feb 11 bottom was a big one and the rally off of that could get to new highs. What does she say now?

- Carolyn Boroden ?

@Fibonacciqueen –$SPY know that the current decline is only similar to prior declines within the uptrend so trail stops down if short

This message of consolidation leading higher is echoed by:

- Mark Newton ?@MarkNewtonCMT – TRAN outperformance also meaningful $DJT sitting near prior highs,but consolidating in a manner that can lead higher

- Mark Newton ?@MarkNewtonCMT – SmallCaps making a comeback-Breakout of trend from last year in $RTY v $SPX.$IWM outperformance should continue

On the other hand, J.C. Parets wrote earlier this week:

- The problem is that 1) all of our upside targets have now been achieved where we wanted to take profits and 2) breadth in the market now stinks. … I’m still in the camp that we roll over and if/when we are below former support levels, we can start to lay out short positions. In the meantime, we wait. A bullish development here would be to see the list of NYSE Common Stocks Only New Highs increase and take out last month’s high water mark. I think this is the lower probability outcome

Speaking of rolling over:

- Northy ?

@NorthmanTrader – New highs eh? Ok. Show me. https://northmantrader.com/technical-charts/ …$NYSE

What does the Fed usually achieve after the FOMC statement & the presser? Mostly a collapse in volatility. But is there adequate room below for VIX to collapse on Wednesday? Or is the VIX ready to spike up if Yellen delivers a more hawkish than expected statement?

- Mella ?@Mella_TA – $VIX – say it ain’t so

It was strange watching the NDX get clobbered to close down 1.5% on the week while IWM rallied 1.4%. Will NDX bounce back as IBM did after its post-earnings fall or is its underperformance a signal?

-

Ryan Detrick, CMT ?@RyanDetrick – Huge outperformance in small caps (+0.6%) vs Nasdaq (-1.4%) right now. Saw similar action only twice since 2000 (Nov ’07 and Mar ’01). Wow

Wow is not how we would describe it. Our preference would be something like “all hell breaks loose” to paraphrase Gundlach:

- “In the financial markets, 80% of the time it’s a coin flip. But the other 20% of the time you have very high confidence and it’s not a coin flip. For instance, I don’t think the stock market is a coin flip. Especially in the United States stocks are very expensive, particularly low volatility stocks. … The riskiest things are now stocks and other investments perceived to be safe. One of the most popular categories in US investing are low volatility stock funds. But there is no such thing! If you think that a stock like Johnson & Johnson (JNJ 113.37 -0.18%) can

‘t go down, you’re wrong. And if people own funds that invest in stocks which they think are immune from decline and they start to decline, all hell breaks loose“

7. Gold, Silver

Silver had a great week up 4.5% while Gold was flat. Of course Gold miners like Newmont had a terrific week too. The action in Silver was called on Tuesday in:

- Peter Brandt ?@PeterLBrandt – Tuesday – It’s official, #SILVER $SI_F is a bull market. Next stop 1850. See previous Mar 17 report https://goo.gl/9OFPcD

Thanks perhaps to Soros warning about China on Wednesday evening and to Draghi on Thursday morning, Silver hit an 11-month high of $17.70 and Gold touched $1,270. And that was sold. The selling resumed on Friday afternoon and Gold fell to $1230 ish & Silver broke below $17.

What happens next week may well depend on what Chair Yellen says on Wednesday. Normally, real rates going up & Dollar firming is not good for Gold & Silver. But these days are hardly normal.

- Ian Fleming ?@SchweizerGeld – Another gold bear turns big-time bullish: BNP Paribas predicts $1,400 bullion http://bit.ly/1pq6NDE @BlanchardGold

BNP Paribas at the start of 2016 was predicting gold would fall below $1,000 and average $960. So why the reversal?

- “Gold seems to have recovered its safe-haven status, … Gold can play a portfolio-diversifying role during periods in which faith in U.S. financial assets is being challenged.”

- “We have been recommending gold as a portfolio hedge,” confirmed BNP’s Prashant Bhayani. “As a hedge we think it makes sense, especially with the negative-interest-rate world we’re in right now.” Bhayani also sees central banks as important buyers of gold going forward”

The same article also quotes:

- Three investment banks, while not saying the bottom will drop out, think the top is in for gold. ANZ sees gold staying at $1,250 for the rest of 2016 and maxing out at $1,350 by the end of 2017.

- And Macquarie thinks gold could recede to $1,199, while UBS has issued an average price target of $1,225 for this year, although it conceded some upside potential to $1,325. “Overall, we think that gold fundamentals are broadly stable,” it said.

Next Wednesday is shaping up as a really interesting day. Which Yellen will show up?

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter