Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips –our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Fed

It is fashionable in some quarters to ignore the Fed Chair, to mock those who follow what the Chair says. Every one has a right to their viewpoint but we would rather listen to that of a great macro investor. Read what Stanley Druckenmiller says in The Greatest Money Manager Alive Attributes The Majority His Success To Just This One Thing.

Secondly look at what has happened to the asset class most sensitive to capital flows which are in turn dependent on what the Chair says the Fed will do or not do.

- Pippa Malmgren

@DrPippaM – Emerging Market Currencies Have Best Month In 18 Years As Yellen Buoys Sentiment

And that best month has followed the bottom in emerging markets in late January:

And what term is used to refer to a benign Fed?

- ValueWalk

@valuewalk – Kolanovic Eyes Goldilocks Market Strategies, Reduces Recession Chance http://www.valuewalk.com/2016/04/kolanovic-goldilocks-market-strategies/ …@MarkMelin#hedgefunds

Given all this, isn’t it smart to ask when the Yellen Fed may raise rates? Many suggest June but will Chair Yellen really raise rates a week or so before the Brexit vote? Especially if the vote seems as tight as it is now? Didn’t Larry Fink term “Brexit” as “the biggest crisis in the world this week“? Our answer is no. Since political conventions & the election rule out July-November, that pushes the next hike to 2017.

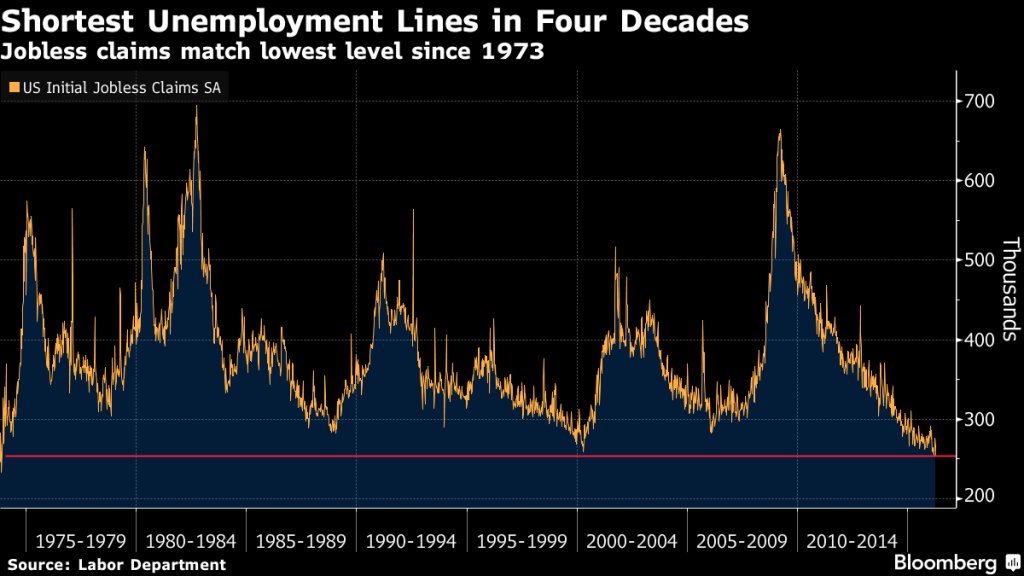

We have been in the “zero before 50 bps” camp for some time now. That has looked tenuous with the strength in jobless claims & payroll numbers:

- MrTopStep @MrTopStep Thursday – Jobless Claims in U.S. Decline to Match Lowest Since 1973 – https://mrtopstep.com/jobless-

claims-in-u-s-decline-to- match-lowest-since-1973/ …

Lakshman Achuthan of ECRI took a different view in his presentation at the 25th Annual Hyman P. Minsky Conference this month:

- “Sure we’ve seen relatively decent job growth. But year-over-year growth in nonfarm payroll jobs has been trending down since early 2015. …. That’s why growth in the U.S. Conincident Index (USCI) has been falling rather steadily since the start of 2015, and is now hovering near a 2-year low. …. These concerted declines in output, employment, income & sales growth, resulting in a USCI growth downturn, constitute the hallmark of a growth rate cycle downturn, meaning a full-blown cyclical slowdown, on top of the long-term structural decline in trend growth. … Under these circumstances, can the Fed hike rates much further? In fact, will they actually have to backtrack and cut rates the way the European Central Bank (ECB) did in 2011?“

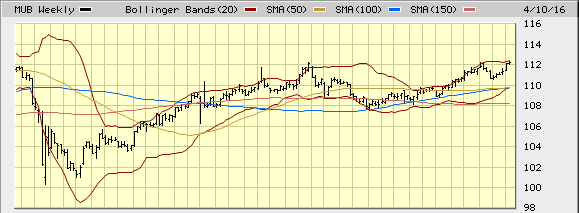

Guess, ECRI is in our “zero before 50 bps” camp. Isn’t it a perfect environment for safe credit yield trades? As Rick Santelli pointed out MUB, the muni ETF, traded this week at a 3-year high at the level before the onset of Bernanke’s taper tantrum:

2. Treasuries & Bonds

Perhaps the concerns expressed in the ECRI presentation above are keeping long rates benign in addition of global pressure. The 30-year Treasury yield rose only about 0.8 bps this week despite a rise in 5.5 bps in the German 30-year yield and a 5.7 bps rise in the 5-year Treasury yield. And TLT fell by only 14 bps on the week despite a 1.6% rise in S&P 500 and a 3.1% rise in Russell 2000.

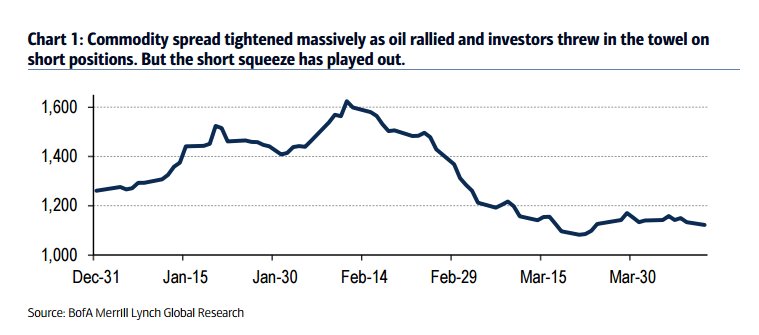

The high yield ETFs kept pace with the S&P this week with both HYG & JNK up 1.2%. But what is a rally to some is a false “paradise” to others:

- ValueWalk

@valuewalk – BAML: Don’t Be Lulled By CB Created HY “Paradise” ”http://www.valuewalk.com/2016/04/central-bank-high-yield-paradise/ …@TheBubbleBubble@MarkMelin$HYG$JNK

Will this paradise be maintained or lost? The BAML team says the latter. Their case is similar to what ECRI described above:

- “Although we still find it difficult to envision an imminent recession, weak macro and corporate data suggest weakness that has not been priced in during the last 2 months … Although accommodative central bank policy has created a ‘search for yield’, in our view this impact will be short-lived as the underlying reason for lower rates –namely poor macro fundamentals—will ultimately create a risk-off investor sentiment … Although we thought the fears of an imminent recession were overblown, the data for Q1 is suggesting that a slowdown was perhaps more pronounced than what we had expected going into the year … The poor performance of the US economy in Q1 can’t be attributed to unusually cold weather (Q1 2014), port closings (Q1 2015), or significant inventory adjustments, … The soft data has been spread across the consumer, manufacturing and trade”

What is the key sentiment in the above? If you like stocks, it is the clause “find it difficult to envision an imminent recession“. Isn’t that the definition of Goldilocks? A non-recessionary economy, a lack of any fear of Congressional action, a benign Fed & ultra-low interest rates – we have all four at least until the summer.

So why worry?

- 24/7 Crypto FX

@365CryptoFX – Bull’s complacency$VXX http://dlvr.it/L42RT2 ~ via http://RobotsFX.org

3. Stocks

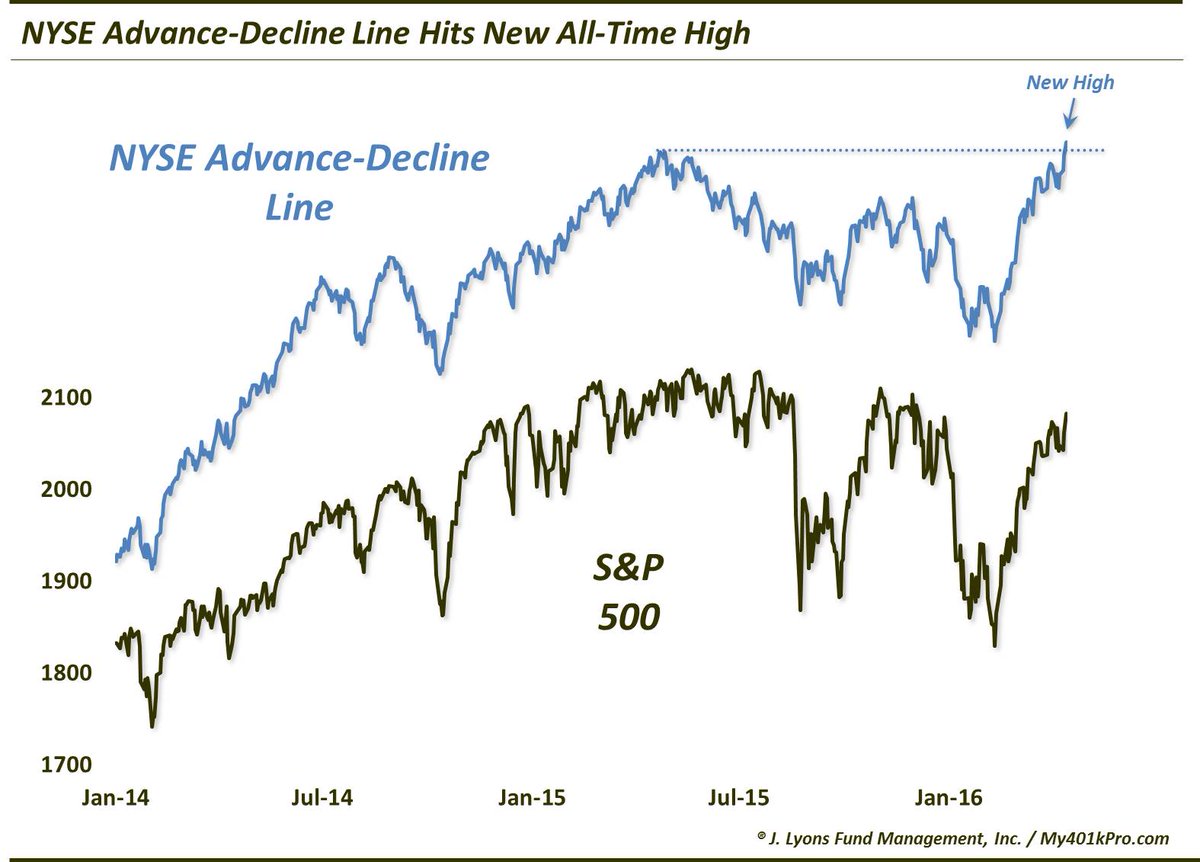

Two weeks ago, we asked – “Since both Treasuries & stocks are overbought & overloved, which one sells off first?” Last week, stocks fell by 1% and TLT rallied by 1%. This week, stocks rallied by 1.6% & TLT fell by 14 bps. But that should not comfort bears because “S&P is a coiled spring” according to Ari Wald of Oppenheimer who raised his target to 2250 for year-end. His principal reason – the Advance-Decline is breaking to the upside. Wald’s favorite sector – Industrials.

A more detailed discussion of the new high in the Advance-Decline line comes from:

- Dana Lyons

@JLyonsFundMgmt – ICYMI>ChOTD-4/14/16 Did NYSE A-D Line Just Breathe New Life Into The Bull Market?$SPY Post: http://jlfmi.tumblr.com/post/142814834840/did-this-just-breathe-new-life-into-the-bull …

- “As we noted in the post, the NYSE A-D Line has negatively diverged at every cyclical top in the S&P 500 in the last 50 years (by the way, that day, May 21, marked the precise all-time high close in the S&P 500 to date…golf clap).”

- ” … based on the historical relationship of the NYSE A-D Line and S&P 500 around cyclical tops, the evidence would suggest that the S&P 500 has not yet made its final high for the cycle. Remember that the A-D Line has topped before the index at every cyclical top in the last 50 years, without exception. The fact that the NYSE A-D Line hit a new high yesterday tells us that A) the A-D Line has not yet diverged and, therefore, B) the S&P 500 has not yet topped”

- ” … if history holds true to form here, the S&P 500 all-time high close of 2130.82 on May 21, 2015 will not be the final high of this cycle“

- “At a minimum, the new high in the A-D Line does breathe some new life into the broader stock market at a time when it was sorely in need of air. Thus, perhaps it buys the bovine a little more time, even if it is on its last legs”

A similar message comes from Lawrence McMillan of Option Strategist in his Friday summary:

- “In summary, the indicators are all bullish right now. There isn’t a sell signal in the lot. Admittedly, some could roll over to sell signals rather quickly if the market began to weaken, but even that would not be enough to change our bullish opinion. Only an $SPX close below 2040 could do that at this time”

And some put on new bullish positions:

- Peter Brandt

@PeterLBrandt –$INDY#NIFTY50 Bull market is back on track. Factor establishes long futures position at SGX

Back in February, we noted that we couldn’t find a really bullish call. This week we couldn’t find a really bearish call. Does this parallel mean something? Time will tell. But we do know that this was an options expiration week and next week we have the aftermath of the Doha meeting on oil and earnings.

Last week the financials looked awful. This week they were the best group in the index with Citi up 11% on the week. That hasn’t convinced some:

- Antony Filippo

@Vconomics – Really no reason to own financials. They’ve been under-performing and trading at a “discount” for quite awhile.$SPX

4. Doha & Dollar

Not only is Sunday’s Doha meeting important for Oil, but it may be crucial for the Dollar as well. So writes Kathy Lien of BK Asset Management:

- “This weekend’s meeting of OPEC and non-OPEC members in Doha is important for currencies because when oil bottomed at the beginning of the year it set a peak for the U.S. dollar. If you recall, the greenback was trading strongly when oil prices hit a 10 year low of $26.20 a barrel and when oil started to recover, the dollar index lost its momentum and began trading sharply lower. So not only is the dollar’s value important for oil but in recent years we’ve also seen how oil can impact currencies and equities”

We are not sure any one except Iran & Saudi Arabia know what will come out of Doha. So why not look at charts to see if they provide a clue?

- Becky Hiu

@beckyhiu – Quite the double top if this is real stuff.$XOM 85.90

5. Gold & Silver

How we wish we could channel our inner Truman and demand a one-handed gold analyst?

- Tom McClellan

@McClellanOsc – My latest Chart In Focus: Fishhook Signal For Gold http://www.mcoscillator.com/learning_center/weekly_chart/fishhook_signal_for_gold/ …

- So the message to take away from this new fishhook structure in gold prices is that it tells us there is the strong potential for a big decline

- 24/7 Crypto FX

@365CryptoFX – XAUUSD DIAMOND TOP SHORT IT$XAUUSD http://dlvr.it/L4261N ~ viahttp://RobotsFX.org

- “The Gold/Silver ratio is as high as it was in 2003 and during the Credit Crisis. Both peaks were great buying opportunities for gold and silver . Even if the ratio goes higher, it is still signaling a buy for the two precious metals.”

- Chess

@chessNwine –$SLV Weekly. Silver quietly outperforming$GLD. Looks to confirm major inverse head & shoulders bottom with volume

- Silver futures in the July contract settled last Friday in New York at 15.42 an ounce while currently trading at 16.35 up around $.90 for the trading week hitting a 6 month high continuing its bullish momentum, however I have been sitting on the sidelines in this market as the chart structure is very poor meaning as the risk is too high at the present time to enter into a bullish position.

But what about finding new supply of gold?

6. Gold, Growth & Monsoon

Where can you revive a gold mine that existed in 2000 BCE, that was referred in Roman historian Pliny’s work, that is semi-adjacent to a modern technology metropolis? India, of course. According to Quartz India,

- On April 11, Australian miner Citigold Corp said it had formed a consortium with the Essel group, an Indian conglomerate, to bid for the mining assets in Kolar that belong to state-run Bharat Gold Mines Ltd (BGML).

- “Gold from here was said to have been used in the Indus Valley civilisation (BCE 2600-1900). Roman historian Pliny referred to gold mines in the area in CE 77“.

How modern was gold mining in this area?

- “In 1905, India was the world’s sixth-largest gold producer, at an annual 19.5 tonnes, according to the Geological Survey of India. By 2007, production fell to 2.5 tonnes”

- Reshma S Narkhede @ReshmaNarkhede – जत्रा…बोरीवली स्थानक. फलाट क्रं 7.तशी येथे गर्दीच असते पण आज विशेष आहे. या गर्दीत घुसण्याची हिम्मतच नाही #मराठी मराठी आमुची मायबोली, प्रसाद सिनकर and Ministry of Railways

Ms. Narkhede, presumably a gutsy commuter, said in her tweet that she didn’t have the guts to get into that crowd. We don’t blame her. The real story is that Borivali station now has 9 platforms while until a few years ago, it only had 4 platforms – 2 for slow trains in both directions & 2 for express trains. Now it has 9 platforms and still faces the same crushing rush.

And by the way, this Mumbai Western Railway local train system is extremely efficient and no commuter into the main business office districts can avoid using these local trains. And double by the way, getting into the train is much easier than getting out from the train into that crowded platform amidst the rush of commuters jumping in. The model is to rush out behind a full back who in turn follows an offensive tackle. One good thing – you can’t get into a fight because there is no room to fight.

Now to investing in India & how RBI Governor Rajan (pronounced Raajan) describe Indian economy, monetary policy et al:

- “We feel things are turning to the point where we could achieve what we believe is our medium-run growth potential. Because things are falling into place. Investment is starting to pick up strongly. We have a fair degree of macro-stability. Of course, not immune to every shock, but immune to a fair number of shocks.”

- “The current account deficit is around 1%. The fiscal deficit has come down and continues to come down and the government is firm on a consolidation path. Inflation has come down from 11% to less than 5% now. And interest rates therefore can also come down. We have an inflation-targeting framework in place. So a bunch of good things have happened.”

- “Of course, structural reforms are ongoing. The government is engaged in bringing out a new bankruptcy code. There is goods and services tax on the anvil. But there is a lot of exciting stuff which is already happening. For example just last week, I was fortunate to inaugurate a platform which allows mobile-to-mobile transfers from any bank account to any other bank account in the country. It is a public platform, so anybody can participate. It is not owned by any one company unlike Apple Pay or Android Pay or whatever. I think it is the first of its kind. So technological developments are happening and making for a more, hopefully, reasonable life for a lot of people.”

- “I think, first, we’re about 10 years behind in the reform process of when we started and when they started and that reflects in the relative size of the economies — we’re about a quarter to a fifth their size. I think that we could catch up if we do the right things over a period of time.”

- “I think there is a significant amount of flair and creativity in the Indian economy and we have to try and capitalize on those as we are trying to grow. We shouldn’t follow the same path that others have followed. But that means working very hard and creating the appropriate infrastructure, creating the human capital that we need to succeed. Building up a good regulatory environment,light but effective, and, of course, building adequate access to finance.”

- “The monsoon is very big in India for a couple of reasons. It does significantly influence sentiment in rural areas, rural demand. It certainly affects about 50% of our population which is tied in some way to agriculture. Only 15% of value-added is agriculture and that is still falling, but many people have rural links. So the monsoon does impact all that. It has a moderate impact on food prices because good food management can alleviate the effects of the monsoon but if we have a bountiful monsoon than we don’t need effective food management to get lower food prices. We’re all keeping our fingers crossed. The good news seems to be that the meteorological department is saying it is probably going to be a good monsoon.“

7. How Slow is CNBC Fast Money?

- “Last week, we wrote how the word “Videoclips” in the title of these articles was rapidly becoming a misnomer. This Friday convinced us that Tweeter had finally replaced Fin-TV as the most valuable tool for the investor. That is why we are now retiring the old outmoded term “Videoclips” in favor of the new modern “TACs”. The short acronym stands for Tweets, Articles & Clips.”

- “In the old days, Fin TV was responsible for alerting viewers when something unusual happened in the markets. After all, they were the ones with reporters who knew the players. Not this Friday. This Friday morning, Fin TV anchors were asleep at the wheel while the Twitter-sphere began chattering. Even when alerted by us & others, Fin TV anchors paid no heed. This was real proof that they have become secondary players in news dissemination & opinion distribution.”