Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Thanksgiving in its glory!

- Charlie Bilello, CMT

@MktOutperform – Happy all-time high day… S&P: All-time High Dow: All-time High Nasdaq: All-time High Russell 2000: All-time High MidCap 400: All-time High

Remember inertia? How a moving force keeps moving? The US indices kept moving up nicely and this week carried with them emerging markets as well. This procession has been led by flag bearers who rode in front of all – CLF up 34% this week & FCX up 16.5%, right in the face of all those commercial shorts in copper. Banks, Semis, Transports – Winners win & losers lose, right? Of course, especially ahead of huge college football game at noon on Saturday.

- Charlie Bilello, CMT

@MktOutperform – Micro Caps up for the 15th consecutive day, longest streak in history. Went from being down YTD to up 18%.$IWC

- Charlie Bilello, CMT

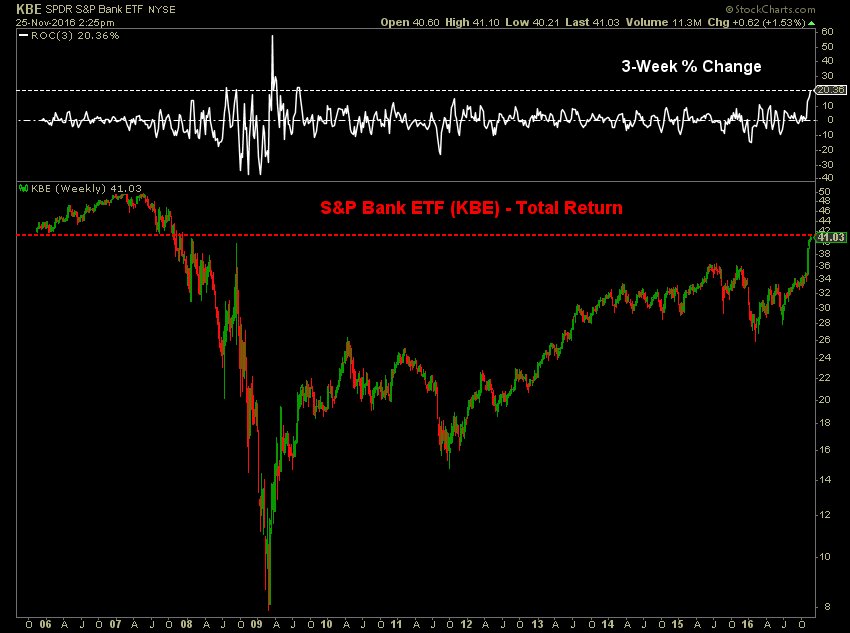

@MktOutperform – Banks up 20% in the past 3 weeks, largest 3-week gain since July 2009. Back to Dec ’07 levels.$KBE

- Charlie Bilello, CMT

@MktOutperform – US 10-Year Yield up 33% in the past 3 weeks (1.78% to 2.37%), the largest 3-week % increase in history.$TNX

- Charlie Bilello, CMT

@MktOutperform – Japanese Yen ETF down 9% in the past 3 weeks, the largest 3-week decline in its history (Inception: Feb 2007).$FXY

2. What’s Next?

Next week is month-end and a Non-Farm payroll week. Frankly, NFP hasn’t mattered much in the last couple of months. Rate hike by FOMC in mid-December is baked in any way and any outlier NFP number might be dismissed as prone to revision.

But next week might get interesting if longs take profits ahead of the Dec 4 referendum in Italy. Before that comes the OPEC meeting on November 30 and the pre-meeting on Monday, November 28.

- ForexLive

@ForexLive – Euro survives first test of the 2015 lows http://bit.ly/2ffYURj

Euro held the lows but yields did not.

- Jesse Felder

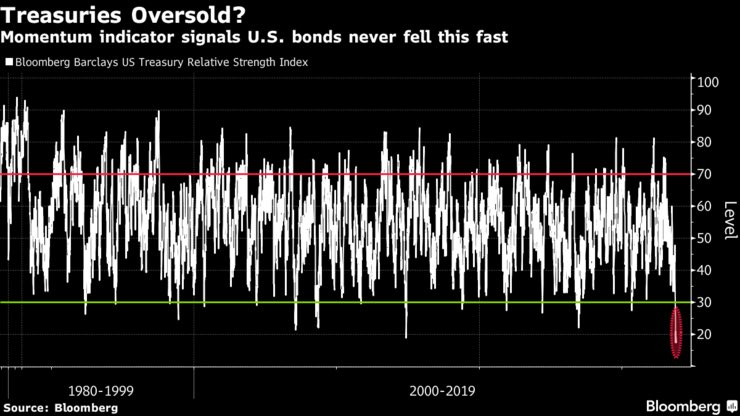

@jessefelder Treasuries Have Never Been as Oversold as They Are Now http://www.bloomberg.com/news/articles/2016-11-23/treasuries-have-never-been-as-oversold-as-they-are-now-chart …

- “The slump in Treasuries this month is breaking all previous speed limits. A gauge of whether asset-price movements have gone too far, too fast is signaling the slide in the Bloomberg Barclays U.S. Treasury Index is the most overdone since the gauge started in 1973. The relative strength index reached an unprecedented 17.48 last week and was at 17.52 on Monday — anything below 30 usually signals a rebound is due”.

David Rosenberg seemed to concur in his note on Friday:

- The 13-week rate of change in yields has hit an extreme level that in the past did touch off a bit of a reversal.

One bit of a non-negative sign is that the 30-year yield did not rise on Friday with the rest of the curve. Over the week, the 30-year yield rose 7 bps while the 10-year, 5-year & 3-year yields rose by 20 bps, 23 bps & 19 bps res. Even the 2-year yield rose by 8 bps, one 1 basis point higher than the rise in 30-year yield.

On the other hand, the weekly closing levels have decidedly penetrated Gundlach’s “watch out” levels – 2.35% on 10-year, 1.80% on 5-year & 1.1% on 2-year. That makes next week critical, we think.

For those who dare consider a bit of a reversal in stocks:

- Babak

@TN NDR Daily Trading#Sentiment at 65.6%, since 1995$SPX fwd pa returns -11% when this metric has been above 62.5%

What about the U.S. Dollar? Tom McClellan discussed that in his article Peculiar Move by Dollar and Small Caps:

- “We have seen episodes before when the US Dollar Index rose while this relative strength line was falling, and the basic point is that they do not tend to end well for the dollar trend. Given the way that these two have related to each other in the past, it is not possible for this current condition to last much longer”

- “The most likely outcome is that currency traders realize how far they have wandered off course, and get to work on the corrective action“

That brings us to Gold.

3. Gold

Talk about losing luster:

- Charlie Bilello, CMT

@MktOutperform – Gold closes at its lowest level since Feb 5, down 8% since the election.$GLD

If you think that is bad,

- OptionsTrader32

@optionstrader32 –$GLD to the lows, 10,000 January 100/90 put spreads bought today. The odds of these working might be higher than you think.

$100 is another 11% below Friday’s close. And there might be a fundamental trigger to cause that steep a drop. But before that,

- Dana Lyons

@JLyonsFundMgmt – FYI, SPDR Gold Shares$GLD Hitting 61.8% Fibonacci Retracement Of December-July Rally

Levels, Schmevels! Especially if somethings hits something!

- Jesse Felder

@jessefelder Rumors of an Indian import ban are behind the gold price decline

Felder referred to a Kitco article titled Indian Gold Import Ban: Fact or Fiction? The article quotes “experts” who say both yes & no. What if there is a sudden ban?

- And while Arora [Nigam Arora, chief investment officer of the Arora Report] thinks if the ban should occur, gold could fall $200 an ounce on a given day, Holmes [Frank Holmes, CEO of US Global Investors] forecasts that it would be more along the lines of a potential $100 decline and then the metal should reset itself.

We have no idea whether a ban will be implemented but we are inclined to think a $200 decline in a day might lead to a buying opportunity.

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter