Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”Tale Risk”

Back in March 2014, Nobel Laureate Robert Shiller introduced his concept of “Tale Risk”, a smart & cute modification of the statistical/investing term “tail risk”. The term was created by Shiller to describe how a powerful tale or narrative, often about a new leader, can change the confidence of a nation & result in great upside. Shiller was speaking about Abe of Japan in his article when he wrote:

- “Fluctuations in the world’s economies are largely due to the stories we hear and tell about them. Since Prime Minister Shinzo Abe assumed office in December 2012 and launched his program of monetary and fiscal stimulus and structural reform, the impact on Japanese confidence has been profound. … He sticks to the script, telling a story of taking aggressive and definitive action against an economic malaise that has plagued Japan for decades. He inspires confidence; I felt it immediately … Nationalism, after all, is intrinsically bound up with individual identity. It creates a story for each member of the nation, a story about what he or she can do as part of a successful country”

A week later on March 29, 2014, we applied this “Tale Risk” term to the Narendra Modi, the candidate for leadership of India. Shri Modi won his election with a massive mandate in June 2014 and look what has happened to India & Indian stock market during the past 31 months.

Tale Risk is the perfect way to describe what the stunning & historic victory of Donald Trump can do to American confidence. Bill Ackman said he woke up Wednesday morning “bullish about America“. Ackman added “He [Donald Trump] is going to get a lot done & nothing has been done in USA for a very long time.” The day before Stanley Druckenmiller said he had sold all his gold, shorted bonds, gilts, bunds et all and gone long growth. Druckenmiller said “this economy is so over-regulated & people are just drowning in red tape, that the removal of that & … serious corporate tax reform … I am very optimistic on the economy“. Druckenmiller spoke about a 4-handle on GDP growth rate in 2017. Jeffrey Gundlach went a handle higher on Friday and “nominal GDP could be 5%” sometime next year.

All this while the votes in Michigan are still being counted and before any clue about the team of President elect Trump! This, folks, is pure “Tale Risk”. As we have seen in the case of Modi & India, such “Tale Risk” can create a sustainable & powerful change in asset classes & markets. Allow us to speculate about some changes we might see.

2. Bring’em home!

We mean the trillions that have been kept away from America by corporations. Donald Trump has virtually promised to get all the parties & players together to bring home these trillions for investment in America. Druckenmiller spoke of “a blended rate of under 10% to repatriate capital“. That would be just great for the US Dollar. Rick Santelli concurred and said “there are no triple tops & if DXY breaks 100, we will see 101, 102 ... US is definitely a magnet now“.

If Donald Trump can get repatriation done & capital rushes to America, what happens to areas of the world that have been living off of capital inflows? EEM fell by 3.8% this week during the best week for US equities in years, a weekly underperformance of 7.6% vs the S&P. Brazil & Mexico ETFs fell by 8% & 12% resp. It could get a lot worse for EM assets:

- Michael

@mnicoletos – In the past 2 days all#EM Currencies vs. the#USD sold off materially (blue) There should be a follow through in EM Equities as well (Red)

- Jesse Felder

@jessefelder Emerging markets bonds look even uglier than stocks and probably more important:

The outperformance is not merely over EM.

- J.C. Parets

@allstarcharts – Here is the US vs “the World without US”, S&P500 vs ACWI ex-US$SPY$ACWX – looks like an uptrend to me. US stocks over international

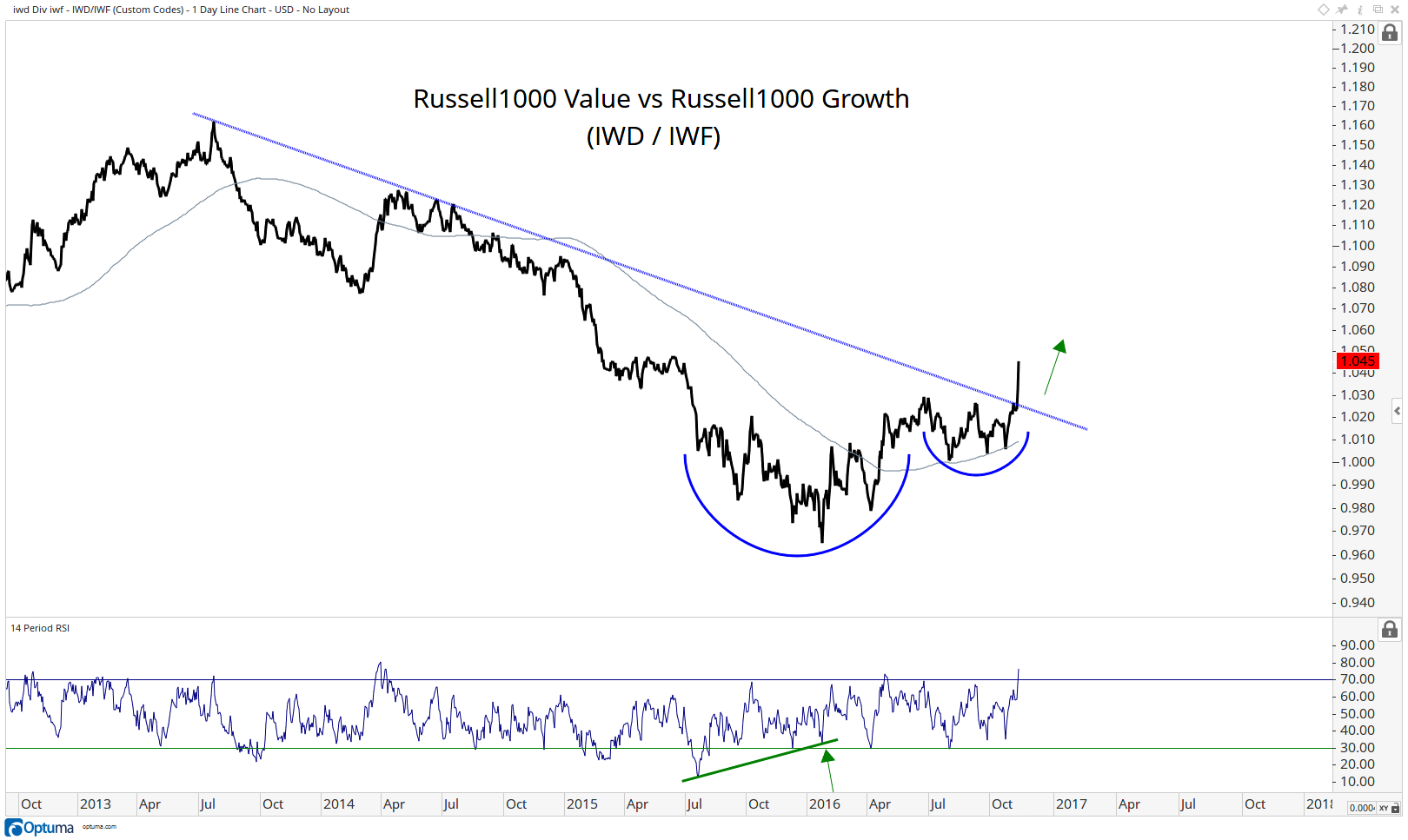

Gundlach said he favors industrials, materials & financials over financial engineering stocks, FANGs etc over the intermediate term. Another way of saying this is from J.C.Parets:

- “monster move in Value stocks vs Growth stocks … Some might call this pattern a cup and handle or some other fancy name, but what I see is a series of higher lows, higher highs and now a penetration of a downtrend in place for over 3 years. With momentum in a bullish range, this is an uptrend all day which suggests buying value stocks over growth stocks moving forward“.

What about Treasuries? The 10-year yield tracks nominal GDP fairly closely. So what happens to the 10-year yield if nominal GDP reaches 5% as Gundlach suggests? Should it surprise anybody that TLT had its worst weekly loss ever, meaning since its inception in 2002? TLT was down 9.3% this week with the 30-year & 10-year yields up 39 & 37 bps on the week. This folks is called Tale Risk.

But even Brazil & Mexican ETFs didn’t get hit as hard as GDX & GDXJ, Gold Miner ETFs, that were down 17.7% on the week. Gold & Silver were down 6%. In contrast,

- Charlie Bilello, CMT

@MktOutperform – Copper up 14 days in a row, the longest streak in history. 22% advance.$HG_F

3. Respite or a pause that refreshes?

The US economy is still leveraged and a fast up move in rates has been self defeating. That may be why Gundlach thinks 85% of the up move in yields may be behind us. He is looking for a tradable rally in US bonds unless 2.35% is taken out in the 10-year yield (with 1.8% for 5-year & 1.2% for the 2-year).

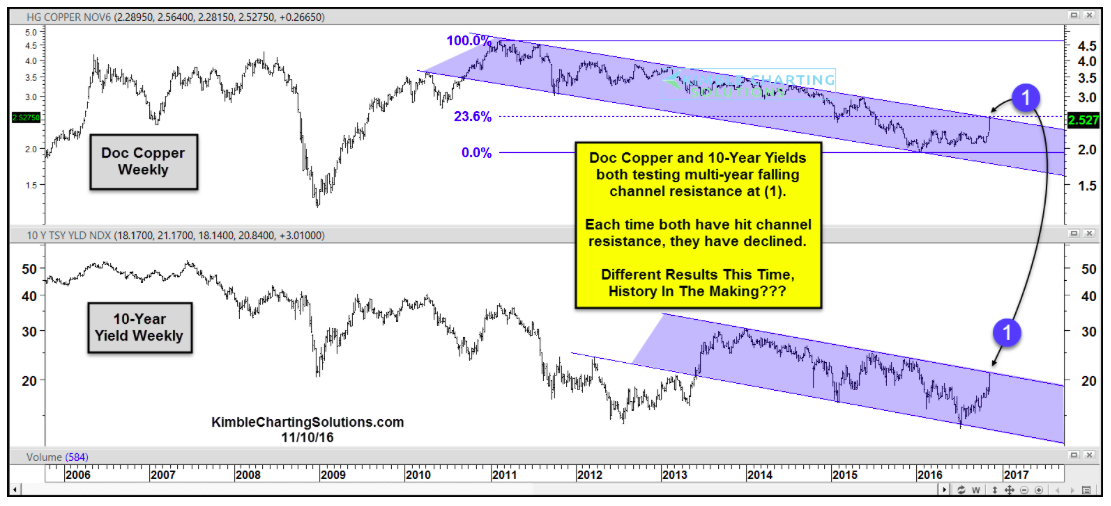

In that vein, Chris Kimble of Kimble Charting wrote on Thursday about Copper & 10-year yields touching up against falling resistance:

- the rally has pushed Doc Copper and treasury yields up against falling resistance. Copper is also pressing up against a key Fibonacci resistance level (23.6%). If long copper here, it’s probably a good idea to take some profits and raise your stops (note that our subscribers have been long), as this is a big resistance area. … From a longer-term perspective, a breakout here for either (or both!) would change the investing playing field

Guess what happened on Friday to copper?

- Ryan Detrick, CMT

@RyanDetrick – Huge reversal in#copper today. Closed down 1.6%, more than 8% off the intra-day highs. That ends the record 14 day win streak.#GolfClap

The Treasury market was closed on Friday. So what happens to Copper & Treasuries on Monday? But what about stocks next week?

- Ryan Detrick, CMT

@RyanDetrick –#StatOfTheDay The S&P 500 is up 3.5% this week. Going back to ’12, when >3% or more, the following week has been higher 9 of 9 times.

What does the guru of trend exhaustion say?

- DeMark told MarketWatch that he’s forecasting the S&P 500 index SPX, -0.33% to hit 2,213 by next Wednesday, followed by a correction. “Expectation is for U.S. stocks to endure at least 11% decline after top recorded,” he said.

By the way what about the FOMC meeting in December? Gundlach said if they don’t raise rates in December they will never raise rates. He is right. Because of Trump’s Tale Risk, we are formally ending our “0 before 50” stance. In fact, we would like to see a preemptive rate rise before the next FOMC meeting, perhaps before Chair Yellen’s testimony on November 17. It would be a thanksgiving gift and it would take away the risk of a weak NFP report in December impacting the Dec FOMC meeting. The election has given the Fed a great gift, a way out of the trap in which they had caught themselves. We hope they have the courage to take it.

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter