Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Growth Trajectory

Friday’s NFP report seemed to solidify perceptions of growth in the US Economy, especially the inflation producing components of growth.

- Charlie Bilello

@charliebilello – Average Hourly Earnings rose 2.9% over the last year, the highest YoY wage growth of the expansion.#payrolls

Not just wages;

- Lakshman Achuthan

@businesscycle – Wage gr at 91-mo high, job gr at 45-mo low. ECRI’s Future#Inflation Gauge near 102-mo high. Will Fed sit tight?

Some did away with the question mark:

- Pantheon Macro @PantheonMacro – “Steady payrolls and accelerating wages mean more rate hikes.” @IanShepherdson on U.S. Employment, December #PantheonMacro

But what type of growth is this?

2. Bernstein vs. Rosenberg!

Mohammed El-Erian said on CNBC on Friday “inflation doesn’t keep me up at night“. David Rosenberg wrote a free report stating simply that Donald Trump cannot change demographics, meaning that inflation is not a major concern of his.

But Rich Bernstein, his ex-colleague from Merrill Lynch, said on CNBC Squawk Box – “I disagree with that completely“. He added “… the deflationary trend is over; that was the story of last summer”. He said ” we are hard pressed to find investors who have embraced cyclicality & have made reflation the core of their portfolio“. We could be wrong but isn’t that what Stanley Druckenmiller said he did right after the election on Wednesday, November 9?

Rick Rieder is also in Bernstein’s camp and stated flatly on BTV that “dynamic has changed“. The new dynamic is “reflationary” and that we have moved “from a goods recession to goods growth“. He added that “better growth, better inflationary condition will overwhelm some appreciation in the Dollar“.

A man who sort of falls in both camps is Tom Lee, known so far as the most bullish of them all. He told BTV that the “bond market is signaling inflation confusion and a flattening long-term yield curve“, So he is looking for a “5 to 7 percent selloff” in stocks in the first half on 2017. But, “looking beyond the first-half selloff”, he “sees inflation expectations recovering, reversing four years of disinflationary trends“.

Bernstein & Rieder differ about the implications for interest rates. Bernstein said “if inflation goes to 2%-2.5%-3%, then it is not unreasonable to see 4%-5% yields” on the 10-year. Both Rick Rieder & Mohammed El-Erian don’t see yields shooting up.

Larry McDonald (@Convertbond) actually made fun of this reflationary “consensus”:

- Lawrence McDonald

@Convertbond – Theme Consensus 2017: “The Great Reflation” 2016: “The Great Divergence” = Dollar sell off 2015: “The Great Rotation” = Bonds rallied

Recall what David Rosenberg said last week?

3. “Its All about the Fed”

Remember what happened after the Fed raised interest rates last December? Remember what happened after the first taper in December 2013? Now compare that to what has happened since the Fed raised interest rates on Wednesday, December 14, 2016:

- Dow up 86 bps; S&P up 1%; Nasdaq up 1.5%; Russell 2000 up 81 bps;

- TLT up 3.3%; EDV up 5.4%; 30-year yield down 17 bps; 10-yr yield down 14 bps; 5-year yield down 12 bps; 3-year yield down 9 bps; 2-yr yield down 5 bps; the 30-2 year curve bull-flattened by 12 bps;

- Dollar flat; Gold up 2.7%, GDX up 12%, GDXJ up 13%; VIX down 14%;

Isn’t this the same message the markets delivered after the rate rise last year? Since when is a flattening of the yield curve a sign of reflation? Perhaps the markets are siding with Trump advisor Larry Kudlow who admitted on Friday that tax reform may not come till almost year end 2017 & could actually become 2018 business. May be that is why Art Cashin has been pooh-poohing the consensus of 3 rate hikes in 2017.

Rick Rieder dismissed this week’s decline in rates as “an exception”. But does he dismiss as “an exception” the action of the past 3 weeks since the rate hike on Wednesday, December 14, 2016? We don’t know because BTV anchors didn’t ask him.

4. Bonds & Credit

Despite the rise in yields on Friday, Treasuries outperformed stocks this week just as they did last week and as they have done since the rate hike on December 14. But Louise Yamada is not one to be impressed with such short term moves. She was explicit in her comments on CNBC Futures Now on Tuesday. She counts the rise above 2.5% for the 10 year as the first step; the second & more important step for her would be the 10-year yield breaking 3%. She already sees the long term trend line from 1981 as broken. She sees the 2-year yield as leading the charge to higher rates. She didn’t comment on the flattening of the curve that might come about with the 2-year yields going higher.

On the other hand, Market Anthropology wrote this week:

- we continue to believe favors the short side of the dollar over time, which is again strengthening its inverse correlation with gold as well as Treasuries. … Looking for a continuation of the extreme release higher in yields, consensus expectations have now pivoted 180 degrees from the July lows. Technically – as well as from an intermarket perspective with the US dollar index, the markets set-up quite similar to the early 2002 pivots in the dollar and yields, which propelled both nominal and real yields to new cycle lows.

- (((Tom Graff))) @tdgraff – Jan 5 – I am long and happy to be long bonds. But short-term, I think the bear narrative will remain more popular.

David Rosenberg said on CNBC on Friday that Q4 growth is likely to come in around 2% and he sees the traditional Q1 weakness before us. Kudlow said on Friday that he sees a slower economy if tax reform is postponed to year-end or 2018 because the uncertainty will lead to postponing investment decisions by corporations.

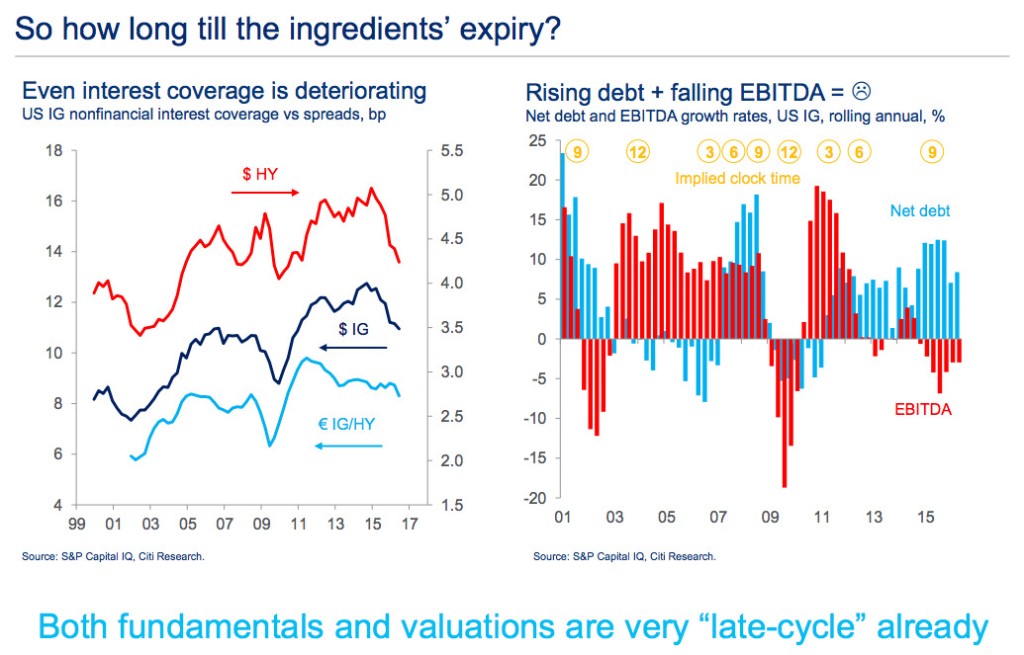

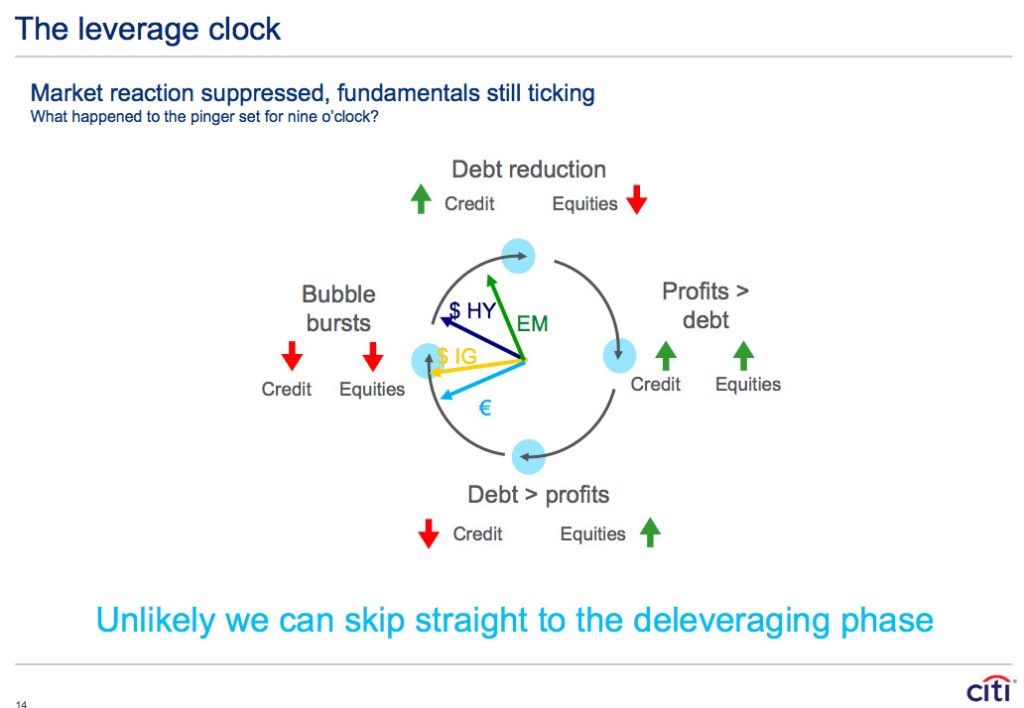

To top this, Matt King of Citi says “fundamentals of the bond market are deteriorating, with interest coverage ratios (a company’s earnings before interest and taxes divided by the company’s interest expenses) deteriorating“.

He adds “… Net debt has been increasing, while growth rates for earnings before interest, taxes, depreciation and amortization are negative. … In fact, emerging markets bonds and high-yield debt are already past this point“.

5. Exhaustion & DeMark

Tom DeMark himself made a verbal appearance on BTV on Friday and said:

- “I don’t see any market leading right now; they are all going to turn down. The broad indices, IWM, Russell, Small Caps, Mod Caps, I think, have essentially topped and they had led the rally to the top. They churning now”.

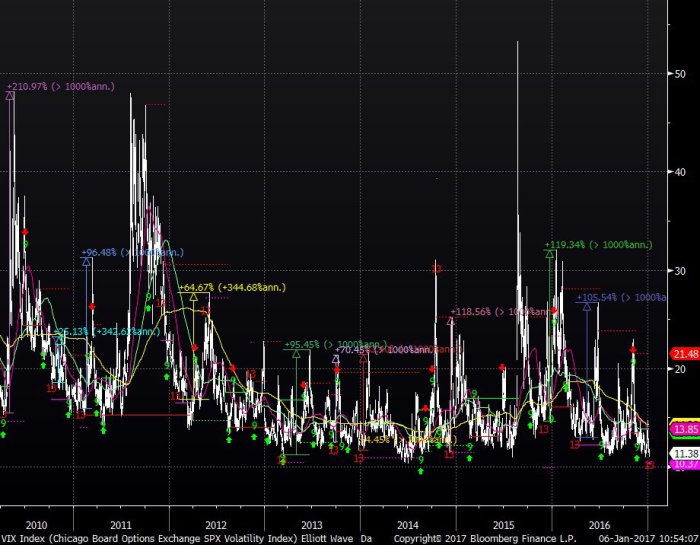

Can tops be made without a bottom in VIX?

- Thomas Thornton @TommyThornton – Important $VIX downside Demark exhaustion. 13th in last 10 years. Avg upside return 97% within avg 35 days on last 12

Jon Najarian of CNBC Fast Money tweeted that Feb 21 calls in VIX were being bought on Friday & January Strangles were being sold against these calls.

5. Correction Not Exhaustion Top

Tony Dwyer of Cannacord Genuity is expecting a 3-5% correction due to extremes he sees in sentiment & buying exhaustion; his S&P target for year end is 2,340 which he gets with a 18 multiple on $130 of operating earnings.

Tom Lee expects a correction to 2,150 in S&P before a rebound in second half to 2,275 a bit below Friday’s close of 2277.

Louise Yamada said that the “markets had been in an interim cyclical bear market” for two years, but that the recent stock rally is a “valid Breakout into a new leg up“”. She sees the S&P hitting 2400 by year-end with the Dow hitting 22,000. She can see a pullback before the rally to 2400.

If you are tired of the ho-hum cautious stuff above, watch & listen to a real bull below. Richard Ross of Evercore calls this a “high quality breakout that has legs“ taking the S&P to 2430-2500. What about waiting for a pullback to get in?

- “… in a strong tape, you don’t want to dance through the rain drops; you want to get into the storm & let the tide take you high”

What does he like? – FANG – Facebook, Amazon, Netflix, Google and financials. This is just the synopsis. But you have to see a bull in action, right?

Sorry folks, but Rich Ross seems to be such a piker, right? What have his stocks done since the Fed raised rates on December 14? Goldman only up 1.8% & Amazon only up 3.2%. Guess Ross doesn’t like to bet on the real bulls, stampeding bulls – Gold miner stocks. GDX, GDXJ, ABX & NEM all up 12-14%.

What if this goes on for years & not just for the past three weeks?

- Chris Kimble @KimbleCharting – Head & Shoulders top? S&P about to under perform mining stocks for years to come? https://www.kimblechartingsolu

tions.com/2017/01/gold-bugs-po ised-outperform-sp-years-come/ … $GDX $SPX $GDXJ

If Ross’s name were Jerry instead of Rich, we could say:

[embedyt] http://www.youtube.com/watch?v=B359hCC3HQU[/embedyt]

6. Gold

As we have seen recently, Gold has been positively correlated to Treasuries. So what does Friday’s sell off mean? One view says:

- David Larew @ThinkTankCharts – Gold – on a near term buy signal and consolidated today – Monday should be revealing –

7. Kudos to Jim Cramer

We usually listen to Cramer’s views on markets because he does seem to have a smart handle most of the time. But rarely has Cramer been as astute & smart as he was on Friday. Cramer predicted that New York Giants will play in the Super Bowl because of their defense. We would never make a prediction like this ourselves because of the fear of jinxing them. So we appreciate Cramer’s vote.

Thanks Jim.

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter