Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Hercule Poirot dictum!

Hercule Poirot, the celebrated detective, used to encourage his suspects to talk as much as they wanted because in talking, he was sure, they would let something slip. We don’t mean to consider Fed heads as suspects but when they speak they do tend to slip up and say what they probably don’t intend to say.

A case in point is NY Fed President Dudley on Friday. We have no idea what effect he was trying to create but we bet it wasn’t the effect he created in markets. In trying to explain what the meaning of “little pause” is, he unleashed volatility & created a big reversal in yields, Dollar & Gold.

Since pictures are worth thousands of words – look how his words broke down Gold just before 1 pm on Friday:

The reversal in Treasury yields was almost epic especially after yields had fallen hard post the 98,000 NFP number.

The reversal in Treasury yields was almost epic especially after yields had fallen hard post the 98,000 NFP number.

- Lawrence McDonald @Convertbond U.S. 10 Year Yield Colossal, 10bps intraday reversal today, should help the bond bears next week

The reversal in the 5-year yield was worse – 14 bps from 1.78% to 1.92%. To be fair, Treasury yields were reversing already from the troughs hit after the NFP number but the Dudley speech changed the angle of the reversal to near vertical. Kudos to Jon Najarian of CNBC FM 1/2 for pointing out that TLT 121 puts were being bought in size before the vertical move in rates post-Dudley.

The reversal in the 5-year yield was worse – 14 bps from 1.78% to 1.92%. To be fair, Treasury yields were reversing already from the troughs hit after the NFP number but the Dudley speech changed the angle of the reversal to near vertical. Kudos to Jon Najarian of CNBC FM 1/2 for pointing out that TLT 121 puts were being bought in size before the vertical move in rates post-Dudley.

Technicians were talking in the morning about a breakout in Gold and a break below the 2.30% level in the 10-year yield in the aftermath of the stunningly weak NFP number. Then came Dudley and wiped out these breaks by his meaning of a “little pause”.

Dudley seemed to be trying to fix what his boss Yellen had broken on Wednesday by violating the Fed’s cardinal rule of not surprising markets. Yellen did so on Wednesday by stunning the markets with a discussion in the minutes of a contraction in the Fed’s balance sheet later this year. That reversed a 200 Dow point rally on Wednesday into a decline on the day. Dudley tried to fix it on Thursday and then tried to refix his Thursday’s fix via his Friday’s speech. Can’t these guys simply shut up?

All except Chair Yellen of course. She may now have to repair the damage of this week in her speech at 4 pm on Monday.

We all have seen charts for years about the near perfect correlation between the size of the Fed’s balance sheet & the S&P 500. So any discussion about contracting the size of this balance sheet is critical for the S&P and for other markets. Discussing raising rates at the same time as contracting the balance sheet sends a far more hawkish signal than merely raising rates or merely contracting the balance sheet. Even simple minds like us can grasp this. But brilliant Ph.D. economists can’t seem to!

- Holger Zschaepitz @Schuldensuehner This chart show why there is nervousness after #Fed minutes. Unwinding $4.5tn balance sheet this yr would mean reduction in global liquidity

2. Larry Fink vs. Blackrock

How often does a highly regarded CEO of a financial firm speak candidly about where he disagrees with his investment strategists? To his great credit, Larry Fink did so on CNBC Squawk Box on Thursday morning. In doing so, he explained his anti-consensus opinions, opinions that should be heard by every one.

Yes he said that he sees a “51% chance 10-year bond could be below 2%“. He added “my team doesn’t believe that but I do; I actually believe the most crowded trade with hedge funds & people is rates are going much higher“.

Then he said “there are weaknesses in this economy that are surprising people ” and added that “more & more leaders I talk to of companies they are stepping back watching & they are not willing to put a lot of money on the line right now until they see real economic growth;” Listen to him directly:

Guess what was reported a day later?

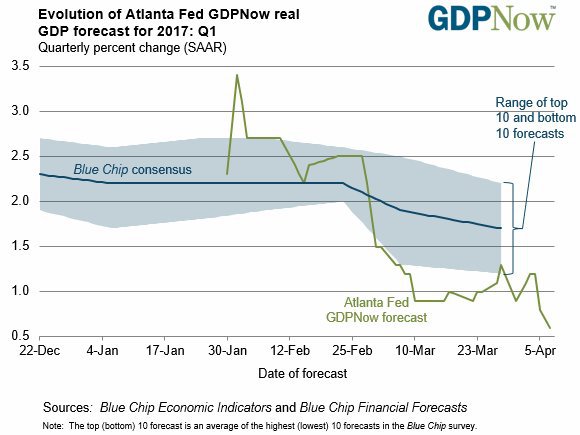

- Atlanta FedVerified account @AtlantaFed – On April 7, the

#GDPNow model forecast for real GDP growth in Q1 2017 is 0.6% https://goo.gl/cet7k2

Jeffrey Gundlach had opined previously that the 10-year yield could fall to 2.25% before rallying & that it would hit 3% sometime this year. This week, he said that he expects the 10-year yield to fall below 2% & then rally but he doesn’t expect it to hit 3% this year.

Based on an article from Advisor Perspectives, below are Gundlach’s opinions about other Fixed income segments:

- Agency mortgage are a “little overvalued.”

- CMBS (AAA-rated) are half a standard deviation overvalued.

- Corporate bonds, which have a very long duration, are two standard deviations rich.

- Junk bonds are more than one standard deviation rich.

- Emerging markets bonds are about one standard deviation rich.

4. Equities

The US indices do not break out on good days and refuse to break down on bad days. It seems we are not the only ones to feel frustrated. As Lawrence McMillan wrote on Friday – “In summary, the market is struggling to establish an identity … the trading range market persists, frustrating most everyone except for option premium sellers”.

Tom McClellan sees a bottoming process underway in his article AAII Survey Readings Nearing A Bottom Indication:

- “The bullish percentage in the AAII survey has been falling during 2017, and is getting close to a low enough reading to mark a good bottoming indication for prices … just now the data are reestablishing a more proper high bearishness reading that fits better with what prices are doing. That should work well with the price bottom which is due next week, as discussed in our latest McClellan Market Report”.

The Bear Traps Report sees the VIX Futures Curve Flattening:

- “The 1 Month v 3 Month VIX futures curve, flattest since (Brexit / Trump election). If hedge funds are paying up for near term protection, typically comes in front of some pain, lower equities. Our model measures the speed of the flattening, it’s accelerating at an alarming rate. Cash is pouring into the front end, meaning market participants want insurance against a possible near term drawdown in stocks. Bottom line: the cost of the April contract is nearly the same for three much insurance on the market. Typically, as in most of this year – the front end is far cheaper than outer months, NOT today”

5. Oil

Crude had the best week among all asset classes with both USO & BNO up 2.8%. Jim Cramer discussed the technical work on his Real Money colleague Carolyn Boroden or @Fibonacciqueen on Tuesday. She sees oil going to $57. Best to hear about her work & calls from Cramer:

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter