Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Rinse & Repeat

We declined to opine or share any views last week about what might happen this week. That was sensible because we could not have imagined what happened this week. Goes to show you that outcome of the “certainty” about a feared event is actually stranger than imagined fears.

Actually all of us should have figured it out last weekend. Didn’t the same thing happen after the Brexit vote and the Trump election? First a hard decline and then a V-shaped strong rally as if the feared event was actually a bullish signal. Every one was worried about a market decline after the Healthcare bill was pulled last Friday. And we got a hard decline of about 180 Dow points on Monday morning. And then a complete reversal as if the markets collectively said “d” and bounced.

That bounce was enough for Richard Ross of Evercore ISI to call for a further 5% rally in the S&P to 2470.

Despite the conviction of Ross, the bounce was pretty weak in the Dow and S&P. But the Nasdaq rallied 1.4% & reached a new all-time high and the Russell rallied 2.3% on the week with the Transports.

It was also enough for Tony Dwyer, the bullish strategist who has been advising caution for the past few weeks, to say “time to start getting offensive“. His point was that energy is as oversold as you can get and other offensive sectors, outside tech, have corrected sizeably. His recommendations – Energy, Financials, Industrials, Healthcare.

We may call this week’s action Rinse & Repeat of post-Brexit & post-Trumpwin but it is a far weaker bounce than the previous two. It is as if the markets rallied to neutralize an oversold condition but not much more. Stocks looked like they wanted to break higher but didn’t; Treasury yields look like they wanted to go higher but didn’t. Treasury yields moved up one day and lower the next day to close within 1 bps of last Friday’s close. Perhaps, the markets are waiting for the twain to meet:

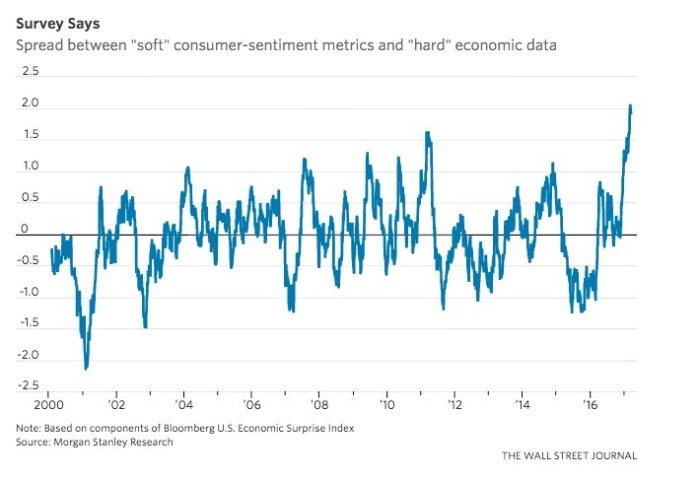

- Irrelevant Investor @michaelbatnick The spread between how good people feel and how good things actually are is breaking out to a 16-year high. https://www.wsj.com/articles/

senti ment-vs-reality-the-economy-is-telling-two- …different-stories-1490905057

Hedgeye said they were sure that the hard data would go up to meet the soft data and that’s why they think “this stock market rally has legs.”

Hedgeye said they were sure that the hard data would go up to meet the soft data and that’s why they think “this stock market rally has legs.”

On the other hand, Jack Bouroudjian, a fervent bull of past, warned on Thursday “something is happening and the bond market is giving us a signal“. That would suggest that the twain below might veer towards each other if not actually meet:

- “The spread between stocks and bonds is very high in the top chart. If the S&P breaks support and TLT breaks above resistance, the large fish mouth spread could start a narrowing process”.

What did “steady hand” Lawrence McMillan say:

- “In summary, the market has a little more work to do in this resistance area [2370-2400] up to the all-time highs. If $SPX can’t overcome this resistance, then another test of the 2322 level may be necessary. Hence, we are not totally bullish for the short-term. However, the intermediate-term continues to look positive, as long as $VIX remains in its benign state and breadth continues to be better than the market in general”.

2. Treasury Yields

Is this really a time to get back into “offensive sectors” as Tony Dwyer said? Who are we to argue with some one who has been so right for the past year or so? But we venture to suggest that the choice of offense vs. defense may well rest on the direction of bond yields.

Simple folks like us will wait for next week’s Payroll number but others have already made some decisions:

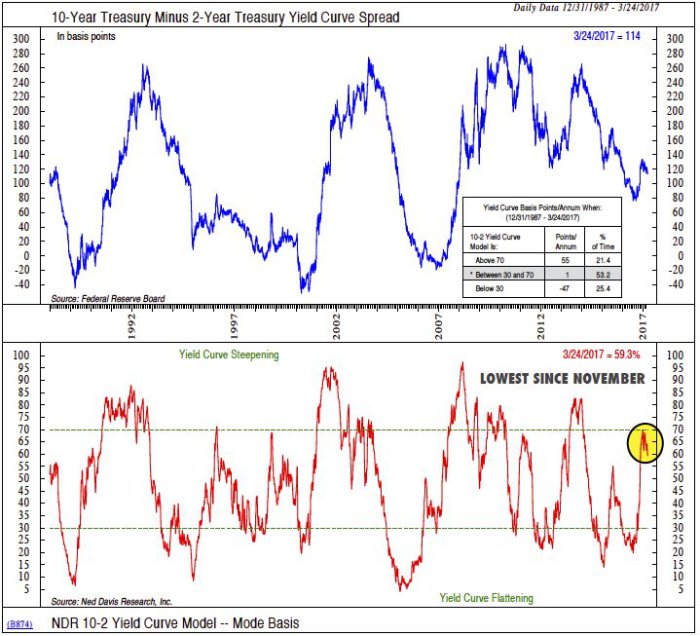

- Ned Davis Research @NDR_Research Closing US yield curve steepener. Models neutral, trends near breaking, curve flatter each tightening cycle since 55 http://bit.ly/2odGrWg

Raoul Pal came on CNBC Fast Money and said simply – “I like Dollar and I like Bonds“. His point was that the Fed always hikes us into a recession & tapering QE was a hike as well. Meaning the Fed has been tightening since 2014. He also said recent high inflation comparisons stem from collapse of oil in February 2016 and so he expects to see lower year/year inflation data in second half of this year.

Raoul Pal came on CNBC Fast Money and said simply – “I like Dollar and I like Bonds“. His point was that the Fed always hikes us into a recession & tapering QE was a hike as well. Meaning the Fed has been tightening since 2014. He also said recent high inflation comparisons stem from collapse of oil in February 2016 and so he expects to see lower year/year inflation data in second half of this year.

On the hand technician Rich Ross of Evercore ISI is convinced that yields are going higher & so financials should be bought.

3. Gold & Silver

Both Gold & Silver rallied this week by 1.4% & 2% resp. But the miners underperformed the metals again. They did respond quickly and sharply to the kinda dovish comments of NY Fed President Dudley on BTV on Friday morning but faded afterwards.

4. Oil – Rich vs. Worth

Oil bounced hard this week with USO & BNO both up over 5% and OIH, XLE up 3.4% & 2% resp. Tom Lee made a big statement this week by stating “energy is making a generational bottom“. As we said earlier, Tony Dwyer said that “energy is as oversold” as you can get. And Rich Ross was ebullient on energy and sees a move to $53 at a minimum:

On the other hand, Carter Worth of CNBC Options Action explicitly called the energy bounce “the biggest trap there is” and added “just because crude goes up for 2-3 days, I don’t think it has changed at all“.

5. Seasonality

As we recall from an article of Ryan Detrick, April is a popular month for market tops, at least intermediate term tops. So we would not be surprised if we see a rally in stocks in early April that leads to an intermediate term top. That also seems to be the message of the chart below:

- tradingpoints ?? @

tradingpoints S&P globex looks like a complex correction with marginal new highs still ahead

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter