Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Single Focus

The US stock market demonstrated a single minded focus on the investigation of the Trump campaign. That was the catalyst for the 370 point decline on Wednesday. Then came Deputy AG Rosenstein’s announcement of a Special Counsel on Wednesday after the close. This was interpreted as a semi-positive or at least a kind of stabilization punt. So stocks rallied on Thursday morning despite Brazil crashing by 16%. This rally accelerated after an earlier clip surfaced of ex-FBI Director Comey saying he had not seen any obstruction of a FBI inquiry in his career. The rally continued with even more vigor on Friday until about 3 pm when news broke of a close senior adviser of President Trump being named “a person of interest”.

As we see it, nothing matters to the US stock market at this stage except the perception of risk to President Trump in this investigation. That is beyond analysis. So we won’t bother too much with opinions about US Stocks. Except to note that the US indices closed down 40-60 bps on the week while TLT rallied up 1.8%, Gold rallied 2.2%, Silver up 2.6% & Dollar down 2% against the Yen & Euro.

That brings us to Treasuries & US interest rates. Even simple folks like us get that this political uncertainty is going to postpone capex & create more headwinds for consumer & business spending. So technical analysis might help in gauging how far US interest rates might go? On Wednesday, Rick Santelli used his whiteboard to lay out the possibility of a 1.8%-2% range for the 10-year yield. But the 10-year yield did bounce from touching the 2.20-2.21% range to close at 2.23% on Friday.

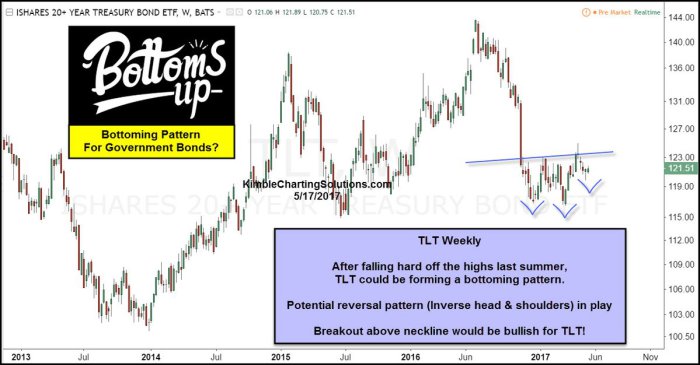

- Chris Kimble @KimbleCharting Potential bullish inverse head & shoulders in play. Bottoms up reversal here $TLT https://www.kimblechartingsolutions.com/2017/05/bonds-bottoms-action-reversal-pattern-play/ …

$SPY$GLD

What does a regular H&S formation suggest?

- Raoul Pal Retweeted

Julian Brigden @JulianMI2 All fits together with call on US yields. TLT up from 118.88 we flagged 20th March but could just be starting. Target 130+ i.e. sub 2% 10yr

Julian Brigden @JulianMI2 All fits together with call on US yields. TLT up from 118.88 we flagged 20th March but could just be starting. Target 130+ i.e. sub 2% 10yr

What happened to the US Dollar this week?

- Mark Newton @MarkNewtonCMT

$DXY US Dollar technical deterioration probably a bigger deal than this week’s Equity weakness, – Lows premature – Next 2-3 weeks key

What about sentiment about the $?

- Nicola Duke @NicTrades – US Dollar DSI sentiment is 6% bulls Manage your risk