Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. Sudden Massive Reversal Or Just a Flash Crash?

The term “reversal” sounds so subdued in print, right? But when you see something climb merrily up a steep mountain and all of a sudden that thing loses its footing & plunges, that sight is something else, right? That is what happened to the absolute star of the market, NVDA, on Friday. All the Semis & FANGs followed and the NASDAQ plunged 2.5% on 105 million shares.

Not only was that decline a key outside reversal in QQQ but it also accompanied a key reversal in VIX. These are usually suggestive of a trend change. That was the opinion of Larry McDonald of Bear Traps Report who wrote “Today will mark a key sector rotation inflection point. Market leadership is shifting from the loved to the un-loved.” That was certainly the story on Friday with beaten-down & discarded retail stocks like Nordstrom (JWN), Kohls (KSS) & Macy’s up 5.7%, 7.2% & 4.3% resp.; Oil Services up 3% and Agri stocks like Mosaic & Potash up 4% as well. Beaten down Banks rallied hard on the week and Steel stocks closed up 20% or so higher from their May lows.

Larry McDonald came on CNBC Fast Money on Tuesday and made a strong case for buying discarded retail stocks like Nordstrom, Kohl’s & Macy’s. His basic case was based on the level of capitulation seen in their model and his trigger was that bonds of these retailers were massively outperforming their stocks. It proved to be a prescient call because the Nordstrom family announced their intention to take JWN private.

Steel stocks were already outperforming & Freeport joined the rally on Friday leading to:

- J.C. Parets @allstarcharts – materials finally breaking out of this huge base

$XLB talk about sector rotation

But Friday also featured a flash crash in Amazon from 980 ish to 930 ish like the flash crash in stocks a few years ago and the flash crash in 10-year Treasury yield before that. But those flash crashes were instant & precipitous events that took all the energy out of the decline; meaning those declines reversed & the previous trend resumed for awhile at least. So if the action on Friday was merely a flash crash that shook the exuberance out of loved stocks & sectors, then the beloved stocks & sectors should resume their leadership in a couple of days. The enormous volume seemed driven by Algos puking out kinda the Quant crash of August 2015. Recall that action subsided after the Quants were washed out in a couple of days.

So which one of these will prove right?

2. Russell 2000

This was the star of the week among major indices, domestic & international with an up 1.2% move vs, down 2.4% for QQQ, down 29 bps for S&P and down 45 bps for EEM. Does that suggest a pair trade? At least one guru thought so:

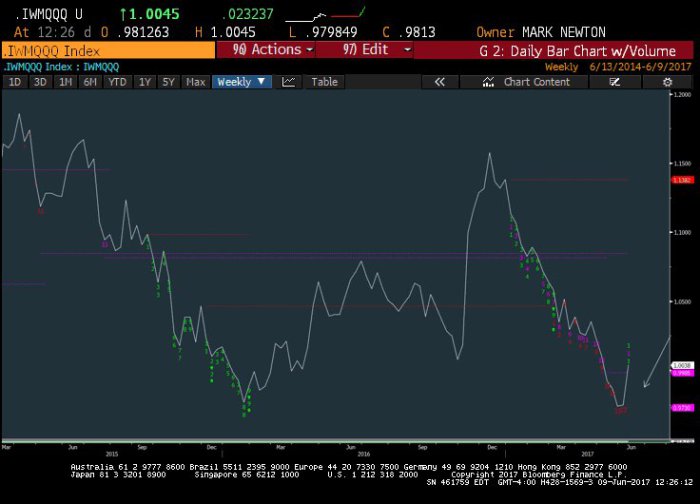

- Mark Newton @MarkNewtonCMT – $IWM v $QQQ Weekly charts also CONFIRMED TD 13 BUYS on Russell outperformance- similar coinciding with Daily- Small-cap outperformance

Later in the afternoon, Carter Worth of CNBC Options Action told his viewers to go Long IWM. Feeding this move could be the positioning:

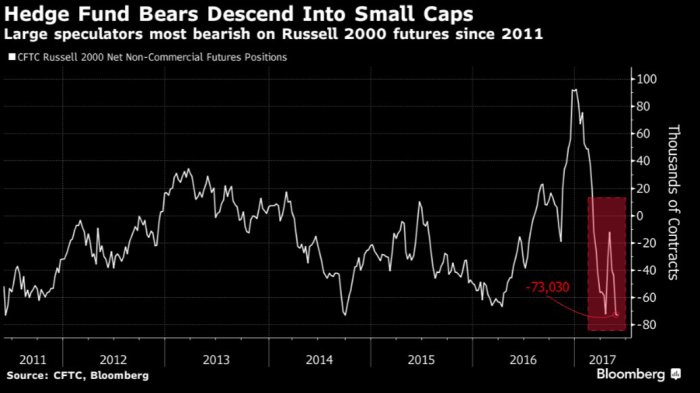

- Dani BurgerVerified account @daniburgr – June 5 – Large specs are the most net short Russell 2000 futures since 2011

But how much of a move is suggested? None of the above opined about that. But someone else did:

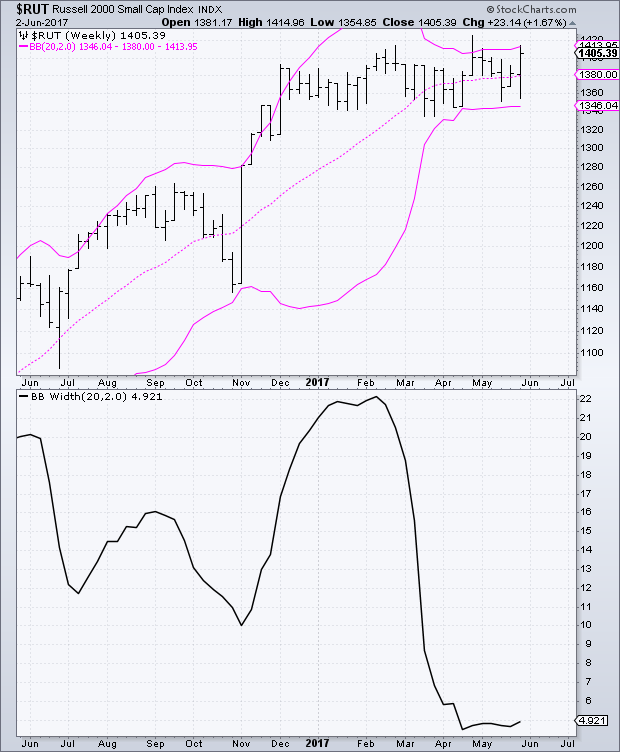

- See It Market @seeitmarket – Russell 2000 Bollinger Bands ‘Squeeze’: A Massive Move Is Brewing – https://www.seeitmarket.com/russell-2000-bollinger-bands-squeeze-a-massive-move-is-brewing-16935/ … blog by

@SJD10304$RUT$IWM

This analysis cannot determine the direction of the move but it does the expect the move to be realized by 8/25/2017.

3. Macro Factor?

A “colossal macro centered rotation” was the term used by Larry McDonald for Friday’s rotation. But what macro factors drove this rotation? Larry McDonald did not say. Was it the factor that we called “upsetting the cart” trigger for the past two weeks?

If you notice the sectors & stocks that rallied hard on Friday, you see that these sectors tend to rise on easier liquidity. Anything particular that created easier liquidity this week? Just some one named Draghi who, in his presser on Thursday morning, was “phenomenally dovish” to use the expression of Ira Harris in his conversation with Rick Santelli. The Euro fell hard post Draghi and the US Dollar closed up about 60 bps this week.

This week more technicians saw positive formations in the US Dollar:

- Matt @commander10

$DX_F Dollar Index triggers this inverse H&S on 4h chart, located at a long-term support zone.#bullish$uup#dollar$dxy

Another used Hemachandra-Fibonacci levels:

- Nicola Duke @NicTrades – Dollar Holler for the USD

$DXY is bouncing from 0.236 Fibonacci from 2011 low and 0.618 retrace from the May 2016 low.

And isn’t a strong Dollar a tail wind for Russell 2000 and a headwind for Nasdaq 100? And what should Commercial hedgers be doing if they expect a Dollar rally?

- J.C. Parets @allstarcharts Commercial Hedgers are dumping Gold and Silver again and hard. 7-mo high net short position in gold. Silver historically high net short too

4. MOJO, Uncertainty, Divergence & Mini-TARP

Another factor supporting the Dollar this week could be the steep reduction in fears about the i-word touching President Trump. That is a positive for investors. But:

- Peter Atwater @Peter_Atwater – The big difference I see btw today and the peak in confidence in 2014 is its narrowness. It’s just investors. There’s little corporate MOJO

That was discussed and confirmed somewhat by David Woo of BAML in an interesting discussion on Thursday on CNBC Squawk Box. He spoke to 120 CFOs of Southwestern companies in a talk in Dallas and reported that 90 CFOs said they were holding off investing or hiring until they see some degree of certainty about tax reform. This has got to be get reflected in economic data in this & next quarter. This also explains to him the divergence in the bond & equity markets.

Woo thinks the fixed income markets have concluded that tax reform is officially dead and that explains the low rates in addition to other more global factors. The equity market have concluded that tax reform no longer matters. Woo thinks that both markets will prove correct at different times – the fixed income market will prove correct first; then the crunch in Q3 with debt ceiling and tax reform attempts will create a mini-TARP type selloff that will force Republicans to get their act together & pass a tax reform bill.

If this happens, we should see a rally into July followed by a hard & quick correction ahead of a Q4 rally. At least the first half of this is consistent with Tom McClellan’s view of a late June price bottom followed by a higher high in July.

5. Capo de Tutti Capi

Nothing matters as much to US & global markets as the Federal Reserve and they are on deck for Wednesday. Clearly the markets have priced in another 25-bps rate hike & some talk of reducing the size of the balance sheet later this year. And the FOMC has hardly ever disappointed the markets when a rate rise is so priced in.

But events are challenging their resolve, aren’t they? The Jobs number disappointed big time; other data seems lukewarm at best; firms are taking down Q2 GDP numbers; the 10-2 yield curve is flattening like a pancake and the US Dollar is beginning to rally. Tax reform seems more & more unlikely this year and who knows what shape it will finally take.

So is it likely that we see a more dovish Fed that the markets are expecting? They could raise rates by 25 bps & then talk dovishly. They could either walk back the certainty of another rate hike or walk back the contraction in the balance sheet or perhaps both by reasserting data dependency.

What they choose to do would probably be the biggest macro factor of all. That makes this FOMC meeting one of the most interesting & most important of the year. And that meeting may answer the question we began with – whether Friday’s reversal was a macro rotation or merely a flash crash.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter