Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Irma la “Nuclear” Anti-Douce

The term “douce” from the classic Jack Lemmon-Shirley McClaine movie “Irma la Douce” means gentle, sedate.The Irma facing Florida is as anti-douce as you can get. When Florida officials called it a “nuclear” hurricane, search for other terms ended. We have never seen a potential danger as Irma poses, a hurricane as big as Texas in size, with hurricane 4 level winds that have been sustained longer than ever before. There is nothing to do this weekend but to pray for the people of Florida, South Georgia & South Carolina. No one has any idea what we will all wake up to on Monday morning.

2. Resilience or Complacency

On one hand, the Dollar literally fell through the floor and sovereign interest rates melted down all over the world. But the S&P remains just about 1% below its all time high despite all the tensions. First North Korea exploded a Hydrogen bomb over the labor day weekend. That seemed to ratchet up tensions with UN Ambassador Nicky Haley saying North Korea is “begging for war”. But that tension affected stocks for only one day, perhaps because President Trump made a smart deal with Democrats to get debt ceiling & continued resolution fight postponed.

Then Draghi spoke dovishly on Thursday morning and the Euro rallied, the Dollar broke down and rates collapsed both in Europe & US. The 10-yr Bund yield fell 5 bps to 30 bps and the 10-yr yield fell to 2.03% before rallying a bit. On Thursday, the worst stock in the Dow was Travellers due to the sell off in property-casualty insurance companies.

Then came Friday with media fright about hurricane Irma. And what stocks rallied the most on Friday? The same property-casualty insurers that had crashed on Thursday. Chubb & Travellers rallied by 4% on Friday. Was that because of positive comments from a brokerage firm or because the rampant fear of Irma created hope that the actual damage might be less than the feared catastrophe.

If all this was not enough, the Chinese Yuan rallied on Friday with its biggest gain in years:

- “The offshore yuan market is crazy today, and we are really heading into unchartered territory,” said Stephen Innes, head of trading Asia Pacific at Oanda. “Real money is likely being repatriated back into China, and the central bank is not stepping in to stop this“.

As money poured into China, copper broke down hard and so did mining & resource stocks like Freeport, CLF crashed by over 6% each. And yes this was despite the Dollar again falling hard on Friday. Guess this is one more evidence that copper, iron & other mining stocks are far more dependent on China than on the US Dollar.

So how did the week end? With the daily sentiment index (DSI) for bonds at 80, for the Dollar at 10 and for the Euro at 93. These are levels that normally should lead to at least a short term reversal.

That could be the message from the S&P 500 and EM stock indices that have demonstrated impressive resiliency in the midst of all this turmoil in the weather, geopolitics and currency & interest rate volatility.

3. Calm before the Storm?

As we said, the Dollar, Interest Rate & Gold should, really should, show a bounce. If they don’t, then these could be really bad oversold-overbought conditions that suggest something malignant. What could that be? How about growth slowing?

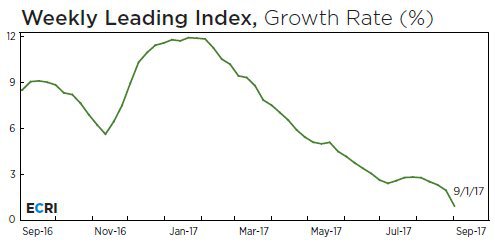

- Lakshman AchuthanVerified account @businesscycle – U.S. Weekly Leading Index falls, growth rate declines to 0.9%, a 75-week low. #economy https://goo.gl/8jGsJe

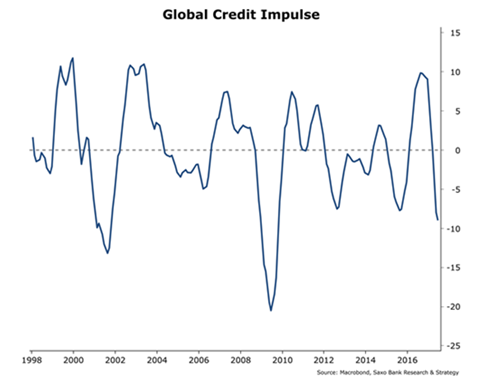

If that is not enough, look at the chart from Saxo Bank:

- “What our credit impulse model says is that from the peak in Q4’16 there is a high probability of a big slowdown in the global economy 9-12 months later – so from October 2017 to March 2018. This call for a significant slowdown coincides with several facts: the ECB’s QE programme will conclude by end-2017 and will at best be scaled down by €10 billion per ECB meeting in 2018. The Fed, for its part, will engage in quantitative tightening with its announced balance sheet runoff. All in all, the market already predicts significant tightening by mid-2018.”

So what are their calls?

- “US 10-year yield to fall to 0% (Zero percent) by end of 2018, early 2019″

- “Oil prices to fall by 50% over the next 10 years.”

This is the sort of stuff that suspicions of “malignant” conditions can lead to. That’s why we hope for a near-term bounce in the Dollar, Rates & a correction in Gold.

4. The Next Fed Chair?

If you see a possibility of such a malignant condition hitting within the next 4-6 quarters, would you choose a new Fed Chair who might upset the apple cart by being hawkish for the sake of some theoretical normalization? Or would you lean towards reappointing Janet Yellen who radiates dovishness? Forget Gary Cohn or John Taylor, we say. Keep Janet Yellen after dutifully appearing to consider several candidates.

Because if Saxo Bank is even remotely right about a deflationary environment in 2018=2019, you would need both a QE 4 and a tax cut. And that might be easier with Janet Yellen as Fed Chair vs. a new unknown.

5. A devout wish

Summoning our inner Pangloss, we hope that Irma bypasses Miami-Dade and its actual bite proves to be way less than its bark; then we hope that leads to a joyous stock rally into next week’s option expiration with Dollar rising, rates rising and Gold giving up some of its gains because “malignancy” gives us the creeps.

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter