Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”Fight the Fed dots“

The Fed dots being the projections by the Fed of their planned rate hikes in the next couple of years. The Yellen Fed has always been too hawkish in their Fed dots, meaning their forecasts of future rate raises have been over-optimistic. So it has paid to wait until their aggressiveness is built into the markets and then fade that.

It paid off once again this week. The entire Treasury curve rolled down in yield and flattened. It was already moving that way and it accelerated on Friday morning after the weaker than expected CPI. Just look at what happened to the 30-year yield after 8:30 am on Friday.

The 2-year yield closed below 1.50% and the 10-2 year curve flattened by 2.5 bps on Friday to 78 bps. What would happen if the Fed continues to raise rates first in December and then 3 times in 2018. The federal funds rate will be 2-2.25%. And what if the furious buying in long duration Treasuries continues unabated in 2018? Can you spell Inversion?

The 2-year yield closed below 1.50% and the 10-2 year curve flattened by 2.5 bps on Friday to 78 bps. What would happen if the Fed continues to raise rates first in December and then 3 times in 2018. The federal funds rate will be 2-2.25%. And what if the furious buying in long duration Treasuries continues unabated in 2018? Can you spell Inversion?

What we call “furious”, Larry Fink called “unprecedented” in his appearance on CNBC Squawk Box on Wednesday. What is his grave fear?

- “… I just did a world tour and I’m going on another one starting next week. The demand we’re seeing for long assets is unprecedented … we have a very aggressive Federal Reserve, People are assuming another tightening this year and another three next year. Could we see an inverted yield curve like next year [or] early 2019?”

He called it his “greatest fear” even though he doesn’t assign a high probability to it:

His view seem to be seconded by Lacey Hunt of Hoisington Management:

- “With monetary restraint continuing to weigh on economic growth for the remainder of 2017 and 2018, inflation, which receded sharply this year (PCE is up 1.2% year-to-date and 1.4% year-over-year), will continue on a downward path. Coupled with extreme over-indebtedness, these factors are the dominant factors causing both cyclical and secular growth to weaken. Additionally, these negative impulses are presently being reinforced by the problems of poor demographics and productivity.”

- “These existing circumstances indicate that a Fed policy of QT and an indicated December hike in the federal funds rate will put upward pressure on the short-term interest rates. At the same time, lower inflation and the resultant decline in inflationary expectations will place downward pressure on long Treasury bond yields, thus causing the yield to curve to flatten. Continuation of QT deep into 2018 would probably cause the yield curve to invert.”

When was the last time you heard Larry Fink call Janet Yellen or the Yellen Fed as “very aggressive”? Never would be our answer. So why is the uber-dovish Yellen being so aggressive? We wonder whether she is doing so to refurbish her legacy as she prepares to “run out of Dodge“, as Rick Santelli put it sometime ago.

By the way, look what happened to the U.S. Dollar immediately after the 8:30 numbers?

With real rates falling and Dollar weakening, how would you expect Gold to react?

With real rates falling and Dollar weakening, how would you expect Gold to react?

Gold rallied 2.8% on the week to close at $1,305. We will find out soon whether this was a true breakout above $1,300 or a false one just as we will find out soon whether the breakout above its 200-day moving average of the 10-year Treasury yield of last week was a false breakout or a true one.

Gold rallied 2.8% on the week to close at $1,305. We will find out soon whether this was a true breakout above $1,300 or a false one just as we will find out soon whether the breakout above its 200-day moving average of the 10-year Treasury yield of last week was a false breakout or a true one.

Consumer credit and corporate debt levels may have something to say about that. Well, we got two not so positive signs this week:

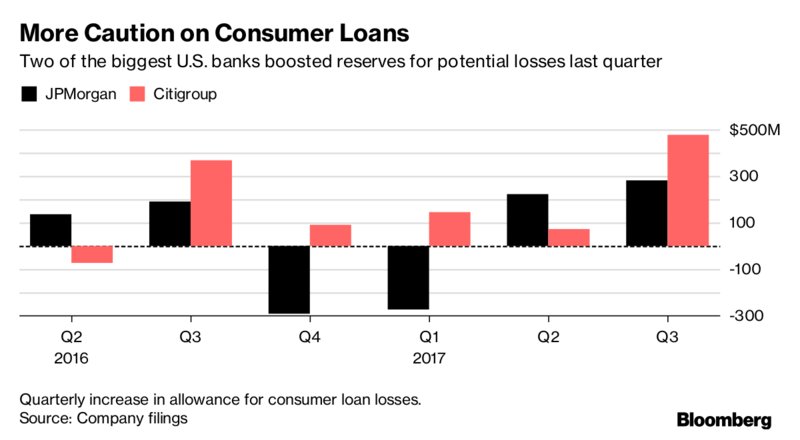

- Jesse Felder @jessefelder JPM and Citi just boosted their reserves for consumer loan losses by the most in over 4 years https://www.bloomberg.com/news/articles/2017-10-12/jpmorgan-citigroup-expect-more-credit-card-users-to-fall-behind … ht

@lisaabramowicz1

How well is corporate credit doing? On one hand, spreads fell to a new low this week. This trigger was cited by Tom Lee, a one-time uber-bull, to upgrade his stance from his current “cautious” to neutral. His new neutral target for the S&P is 2475, some 75 points BELOW Friday’s 2553 close. Interesting definition of “neutral”, isn’t it?

But is today’s easy liquidity masking serious weakening of credit fundamentals? One such warning was given by Craig Moffett of Moffett Nathanson about a historic blue-chip. Speaking about the sharp fall of 6% in the stock on AT&T, Moffett said AT&T will carry “$182 billion of debt” after closing the current deal. Add to its “operating loans for cell towers, etc., unfunded pension liabilities & health care” and the debt will be “a quarter trillion dollars levered at 3.7 times“. That’s merely one side. If the business is growing well and cash flows are increasing, then debt can be supported right? Not so, according to Moffett:

- With “wireless business shrinking at 2.5%; wireline business shrinking at 6% and Direct TV-Entertainment business now shrinking too, how sustainable is that level of debt? If the debt is not sustainable & you have to delever, it’s from the dividend, right?“

When do CNN employees start hating AT&T CEO more than they hate President Trump?

But AT&T is not the only one in this mess. General Electric, another historic blue-chip, was beset with concerns about its own unfunded pension liability & about the sustainability of its dividend. And if AT&T can’t afford its 5.5% dividend, if GE can’t afford its 4.2% dividend, can Macy’s afford its 7.5% dividend?

What is the cure? For both corporate profitability and consumer incomes?

2. “Lower taxes, bigger paychecks, and more jobs“

The above title is a direct quote from President Trump’ speech in Harrisburg, PA this week.

Larry Lindsey is fortunate enough to have $60,000 to bet on his being proved correct over debbie downers like Larry Summers. While we don’t have that liquidity or courage, we do think some type of a tax cut gets passed in early 2018.

But forget us. You would be do much better to listen to some one far more “wonderful” than us and, more importantly, some one betting a lot more than even Larry Lindsay on his conviction of getting a tax reform in Q1 2018. And what probability does Mr. Wonderful assign to his bet being correct? 75% as he says below. He said the S&P will rally by 5-6% with the tax cut but small caps will rally by 15-20%.

How will CNN employees react if the AT&T dividend gets saved due to a Trump tax cut? Will they start praising him or continue their blistering tirades against him? We would bet on the latter!

But what happens in the interim? David Rosenberg spoke about a fall in the “r” word on Friday:

- “Given what the ECRI leadind index is telling us, the 3-month U.S. earnings revision ratio probably has further to fall in the months ahead”

And Lawrence McMillan of Option Strategist used the words “sell signals” after quite a long time:

- “In summary, we now have sell signals from the put-call ratios, but until $SPX shows some weakness, even a short-term correction is not possible. The intermediate-term outlook remains positive, but the overbought conditions could produce a sharp, but short-lived correction.”

Frankly, we are at a juncture where a “correction” is a consummation devoutly wished by bulls & bears alike.

3. Is 2017 like 2007?

Given current valuations, this is a question that keeps coming up. This week it was raised via:

- See It Market @seeitmarket NEW Blog: “10 Years Later… Is The Stock Market Topping Again?” – https://www.seeitmarket.com/10-years-later-is-the-stock-market-topping-again-october-17360/ … by

@Pivotal_Pivots$SPY$DJIA

- “Today marks the 10-Year anniversary of that very 2007 top. And the stock market is once again at risk of correcting as it approaches the very same price pivots. Both the S&P 500 (SPX) and the Dow Jones (DJIA) are approaching their 2017 Yearly R2 Pivot Points! Deja vu? Price fails at the Yr2 pivots 82% of the time. The average pullback is roughly 100 SPX points or 1,000 DJIA Points.”

- “All of the major US stock market indexes are at or near strong yearly resistance pivots, where the odds of a big pullback are high. I would not be surprised to see 100 point pullback on the S&P 500 or 1000 point drop on the Dow Jones very soon! Keep some powder dry!”

That was answered via:

- Cousin_Vinny @Couzin_Vinny $SPX looks nothing like 2000 2007 check

$NYAD$UST vs$SPX bottom panel dropping like 2004 https://theclosingprint.com

4. Emerging Markets

Falling real rates in America and a falling Dollar! Can emerging markets ask for anything more? They probably could but they didn’t need to this week. EEM blew away S&P this week with a 2% rally compared to S&P’s 16 bps rally. But what about the Indian market that had been falling due to the problems we described in our Economic Pain in India article of last week? Specifically, what about the prediction of Peter Brandt featured by us in that article?

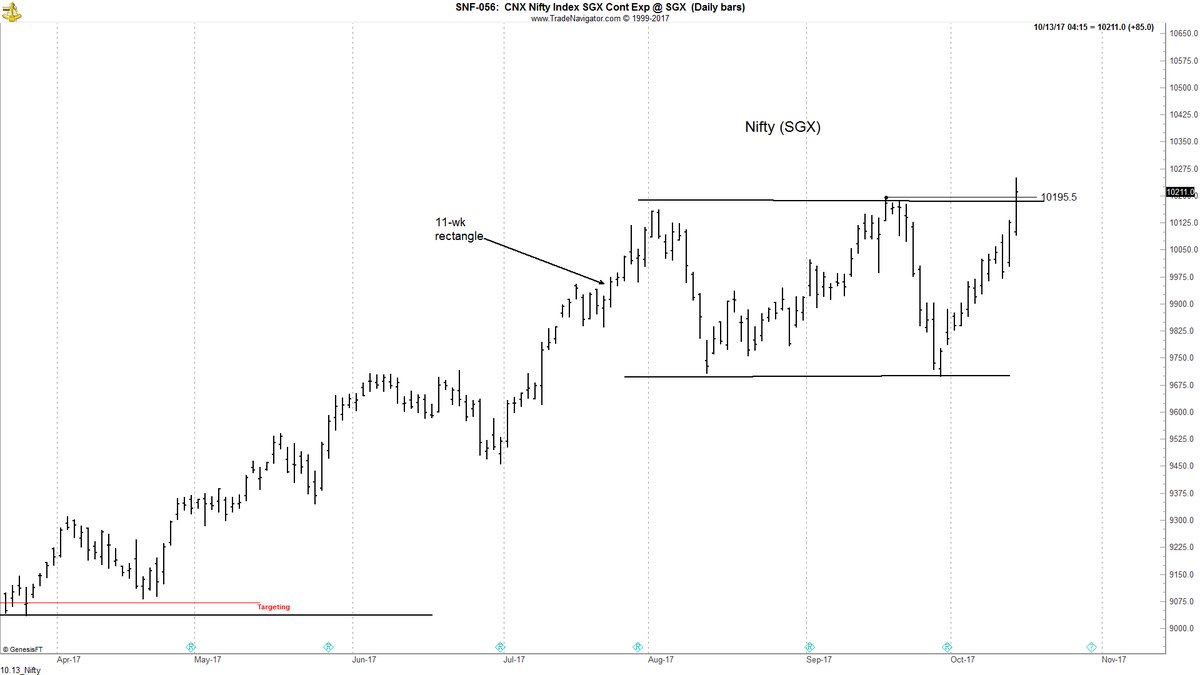

- Peter Brandt @PeterLBrandt – Fri October 6 –

$Nifty forming rectangle in preparation for next move up toward 11,250#India

Mr. Brandt answered it himself:

Mr. Brandt answered it himself:

- Peter Brandt @PeterLBrandt –

#FactorMembers$SNF_F#NIFTY$NIFTY$IH_F completes bullish rectangle. Long.

Technical stuff is fine but what about the slowdown in profits from the confusion generated by the new Indian tax plan? One answer was given by a Bloomberg article titled Businesses Are Getting a Handle on India’s New Tax Regime.

Technical stuff is fine but what about the slowdown in profits from the confusion generated by the new Indian tax plan? One answer was given by a Bloomberg article titled Businesses Are Getting a Handle on India’s New Tax Regime.

- “Corporate India is forecast to swing back to profit growth as businesses resume stocking up shelves after getting a better handle on the new countrywide tax regime. … Earnings for the three months ended in September will increase 10 percent from a year ago, according to CLSA India Pvt. forecasts for the 104 companies it tracks, a turnaround from the 18 percent decline in the previous three months. Citigroup Global Markets India Pvt. expects profits for the 131 companies it covers to increase 13 percent.”

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter