Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.“I am glad I am alive for it”

What a wonderful statement of support for the Tax Bill released on Friday at 5:30 pm by Republicans! For an investor, that too a foreign citizen investor, to get ecstatic about a tax cut bill is pure wow. Only Mr. Wonderful Kevin O’Leary could say something like this on CNBC, a network that has been demonstrably anti-Trump. No wonder they hid this & other statements of O’Leary from CNBC.com.

Actually Mr. O’Leary was being more sensible than wonderful. He gave specific examples of his companies which will see their tax rates drop from 32% to 21% and get a similar increase in their cash flow. No wonder he said he will increase his already overweight position in US small caps after the bill passes.

What could be a clear sign of the inevitability of this Bill’s passage? When one of the most stubbornly anti-Trump reporters at a stubbornly anti-Trump network throws in the towel?

- Sahil KapurVerified account @sahilkapur – Corker’s flip pretty much seals the deal for the tax bill. At this point they might get all 52 Republican senators.

Whether it is or isn’t fully priced in, passing of this Bill would certainly clear the runway until end of the year. Actually, the runway was clear anyway according to Lawrence McMillan of Option Strategist:

- “… one should not overlook the bullish seasonality that exists between now and the second trading day of the new year. In summary, the intermediate-term outlook remains bullish and will continue to do so as long as $SPX is above support and $VIX is bumbling along at low levels.”

That is nice but kinda insipid. How about a nice juicy target like the one William Tell would have liked:

- Peter Ghostine @PeterGhostine – Dec 12 – I’m looking for $SPY to rally 10 more points in the coming few weeks. Technical objective: 275.73-279.26.

You know, there is always something that makes you look back and feel stupid. In our case, it is:

- ContangoCovfefe™ @Data_Junkie_ – i mean XIV is only up 145% ~YTD

Well! Nothing to do now except follow the advice below:

Well! Nothing to do now except follow the advice below:

- Boris Schlossberg @Fxflow – My trading motto for 2018: Don’t get mad. Get better.

2. Ekla Chalo Re (“Walk Alone”) – Mahatma Gandhi’s Advice

This was Gandhi’s favorite advice & exhortation. And no one followed it better than he himself. Perhaps now we have another lone walker – the 30-year US Treasury Bond. As Gundlach said both pre-FOMC and post-FOMC this past Wednesday, the 30-year yield is walking to its own tune that is different & distinct from the rest of the Treasury curve.

Witness its action on Friday – the 30-year yield FELL by 2.4 bps while all the other major Treasury yields rose; 2-year yield rose 2.9 bps; 3-year rose 3.3 bps, the 5-year rose 2.6 bps and even the 10-year rose by 0.7 bps. The long Treasury ETFs, TLT & EDV (zero-coupon), rose 1.3% and 1.8% on the week matching the Dow (up 1.3%) and NDX (up 1.8%) & thoroughly vanquishing the S&P (up 90 bps) and Russell 2000 (up 53 bps).

This is a relentless flattening of the yield curves – 30-5 by 9 bps on the week; 10-2 by 7 bps and the 30-10 by 6 bps. More interesting is the crunching of the intra-range 10-7 year which flattened by another 2 bps on the week to 7 bps. That’s getting very close to total flatness & Rick Santelli thinks this could be the first curve to invert.

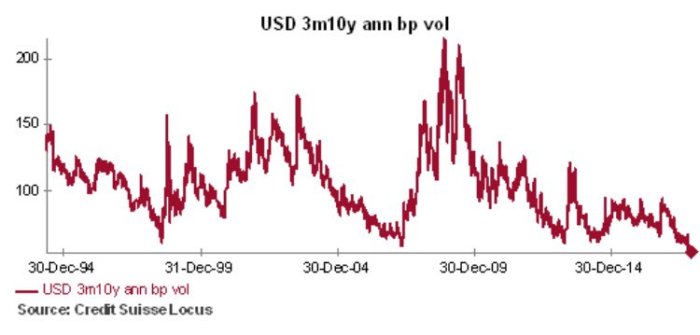

Is the flattening a result of the lack of volatility or is the reverse true?

- globalmacro @_globalmacro- rate vol update

What could be a major trigger for such a Bond volatility spike?

What could be a major trigger for such a Bond volatility spike?

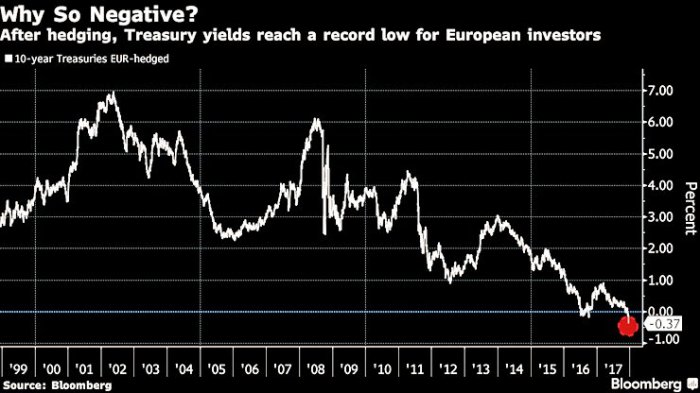

- Holger Zschaepitz @Schuldensuehner – Treasury Yields Have Never Been This Negative for Euro Investors. https://www.bloomberg.com/news/articles/2017-12-14/treasury-yields-have-never-been-this-negative-for-euro-investors …

Given such unappealing yields, could European investors dump Treasuries? But for that to happen, wouldn’t German yields have to rise from their deeply negative levels, such as negative 71 bps for the German 2-year?

Given such unappealing yields, could European investors dump Treasuries? But for that to happen, wouldn’t German yields have to rise from their deeply negative levels, such as negative 71 bps for the German 2-year?

Jeffery Gundlach keeps pointing out that German economic data is coming in stronger than US data &, so at some point, Draghi will have to get German rates moving up. But Draghi keeps insisting that the “some point” is not any time soon.

Actually, Gundlach is now pointing to signs that traditionally drive US Treasury yields lower, like weakening of US High Yield Credit:

- Jeffrey GundlachVerified account @TruthGundlach – Since Jan SPX up big & way above MA’s all year, yet JNK unchanged and below 50, 100 & 200 MA’s with a death cross even. Unusual! Must watch.

3. Yield Curve Flattening & S&P 500

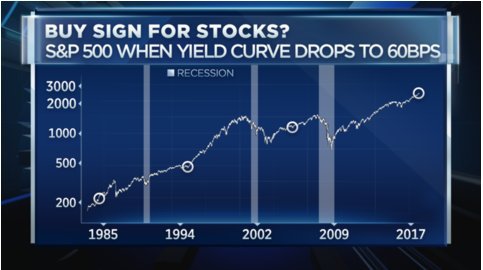

This is a time when people have already begun exchanging Merry Christmas wishes. So this is not the time for FinTV anchors to scare investors with ghosts of yield curves past. JP Morgan is already making this clear, according to:

- zerohedge @zerohedge – According to JPM, a steeper yield curve is bullish for stocks. A flatter yield curve is also bullish for stocks

Doesn’t that make you merry? If not, the following should:

- CNBC’s Fast MoneyVerified account @CNBCFastMoney – The yield curve is the flattest it’s been in 10 years, but @dwyerstrategy‘s chart shows that the flat yield curve could actually be a big buy sign for stocks

It isn’t nice to appear sarcastic, is it? So we make amends by including the clip of Tony Dwyer:

It isn’t nice to appear sarcastic, is it? So we make amends by including the clip of Tony Dwyer:

In his comparison of 2017 & 1995, Mr. Dwyer did point out that 1996 began with a correction. Was he predicting or “just saying”? He did not say.

4. Stocks

How clear does the coast look?

- Mark Arbeter, CMT @MarkArbeter – Updated Chart: New $SPX highs for monthly MACD. Generally see bearish divergence(s) at tops, increased price volatility. None yet!

What message is Nasdaq 100 is sending?

What message is Nasdaq 100 is sending?

- J.C. Parets @allstarcharts – so both the equal-weighted nasdaq 100 and cap-weighted nasdaq100 are going out at new all-time daily and weekly closing highs? Is that enough confirmation or are you going to make up some BS about volume? $QQQ $QQEW

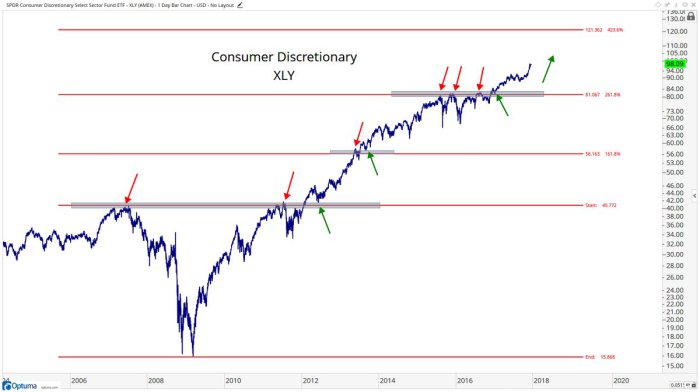

What about consumer discretionary stocks?

- J.C. Parets @allstarcharts – Dec 14 – here’s how I see the Consumer Discretionary sector. Another 20% coming? $XLY

But does no one see any danger signs?

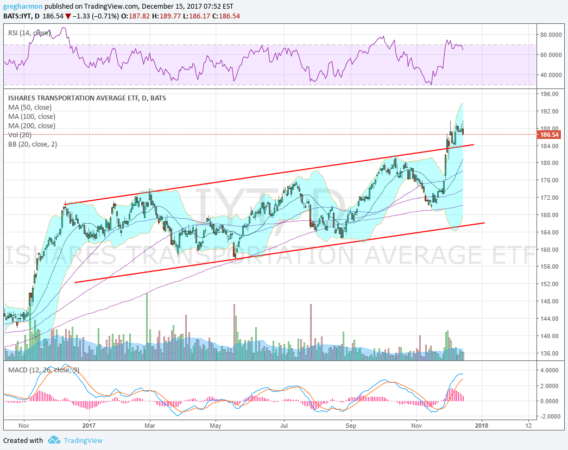

- Greg Harmon, CMTVerified account @harmongreg – Dragonfly Capital – A Crash in the Transports? http://dragonflycap.com/a-crash-in-the-transports/ …$IYT

Actually, the “signal” was not confirmed on Friday’s close:

Actually, the “signal” was not confirmed on Friday’s close:

- “This is a signal of a potential reversal lower. It needs to be confirmed by a lower close Friday [It was not]. But with the RSI pulling back from overbought territory and the MACD turning flat, momentum is waning if not falling. These support a pullback. If it does happen a retest of the channel break would be a normal, healthy digestion. Below the October peak would add some concern, and under the November low would raise the sell signal. No crash yet in the Transports, but watch a little more closely.“

5. Disney-Fox Merger for Scale

We have been writing & speaking for some time about the enormous upside opportunity for media companies that broadcast Indian Cricket & Entertainment. This week, none other than the brilliant & gutsy empire builder Rupert Murdoch spoke about Cricket in India. Speaking to Maria Bartiromo, Mr. Murdoch said he was taken aback by Facebook’s $600 million offer for digital rights to India’s Cricket League. He didn’t let that happen & bought both TV & digital rights for $2.55 billion, according to NDTV.com.

That Facebook offer was a wake-up call & he realized he needed scale, big scale, to fend off social media giants like Facebook. For its part, as Maria Bartiromo said, Disney & its smart CEO Bob Iger, had coveted for years the crown jewel in Murdoch’s overseas empire – Murdoch’s Indian TV network.

This need for scale & the desire for the Indian TV network brought about the landmark Disney-Fox merger. Listen to Mr. Murdoch himself explain his thought process:

Unlike NFL & NBA, India’s Cricket League is linked closely with Bollywood both in terms of star presence and in its mission to deliver an integrated Sports-Entertainment experience. So wherever Bollywood has reached, Indian Cricket reaches & conversely. The league drafts the best & most scintillating cricket players in the world besides new emerging Indian talent. And all that is driven by advertising. No wonder Facebook felt totally at home in competing for streaming rights to Indian Cricket.

Thanks to this sports-entertainment integration, compensation of cricket stars & actors is sky-rocketing:

- RepublicVerified account @republic – Priyanka Chopra to charge 5 crore for a 5-minute performance at an awards show?

Crore is a British adaptation of the Sanskrut word Koti which means 10 million. So 5 crores is 50 million Rupees which at 65 Rs/$ is $770,000. Not a bad compensation for 5 minutes. Convert this amount at 40 minutes of anchor face time in a hour long Fin TV show and what do you get? A cool $6.2 million dollars for a one hour Fin TVshow; kinda puts a $6 million a year compensation for top Fin TV anchors in perspective, doesn’t it?

And this is with over 600 million Indians without running water. What could happen to revenues & star compensation in 10 or 20 years as 200-300 million poor Indians come out of poverty? That’s why we think Indian stars, Film or Cricket, will be the highest paid in the world in 20 years, if not sooner.

And Indian stars deliver a lot besides TV shows like Quantico, serious film roles & modelling. Watch the clip below if you don’t believe us:

[embedyt] http://www.youtube.com/watch?v=BDSsW194IJU[/embedyt]

6. Origin of Fair Skin – a single gene from one person?

A year or two ago, Becky Quick of CNBC wasn’t appreciative when we pointed out to her (via email of course) that Latin & all European languages including English come from one language group called Indo-European and that Sanskrut is the oldest Indo-European language extant. That is why famous German Indologists have termed Sanskrut as the mother of European languages.

We can’t blame her though. Given the current primacy of Europe & America and the relatively pathetic depths to which India had sunk, which European would happily accept that their language came from an Indian language?

Man, is Becky going to be stunned now! Not just Becky but all “white” folks who read our articles, especially the ones with Irish heritage. Because, as it turns out, the essence of being European – the Fair or White skin complexion, might have originated from India or the Middle East. And not just generally from that area but from one single person with the “fair skin” gene.

This stunning discovery was made at Penn State University and reported on IrishCentral.com in an article titled How Irish fair skin can be traced to India and the Middle East. Some excerpts from the article are below:

- “A major US study at Penn State University found that Europeans’ light skin stems from a gene mutation from a single person who lived 10,000 years ago.

- Scientists made the discovery after identifying a key gene that contributes to lighter skin color in Europeans, and the Irish fall into this category.

- … one amino acid difference in the gene SLC24A5 is a key contributor to the skin color difference between Europeans and West Africans. This is undoubtedly where the Irish get their light skin from.

- The mutation in SLC24A5 changes just one building block in the protein and contributes about a third of the visually striking differences in skin tone between peoples of African and European ancestry.

- The mutation, called A111T, is found in virtually everyone of European ancestry. … all existing instances of this mutation originate from the same person.

- The pattern of people with this lighter skin color mutation suggests that the A111T mutation occurred somewhere between the Middle East and the Indian subcontinent.”

Frankly, all Irish should feel proud that only an Irish website felt confident enough to publish this Penn State study. No other European website carried this story.

The Irish article does suggest another study to the Penn State professor – “discover where Irish redheads come from after this“.

7. A Much More Important Discovery-Study

There is no book or story as revered in India as “Raamaayan” or the Story of Ram (pronounced Raam). Ram is revered as an Avatar of God on earth and his important work in that Avatar was to destroy the powerful, wealthy & previously unconquerable demon kingdom whose capital was Sri Lanka. The story belongs to a second stage period in early Indian history long before there was any knowledge of Greece & Europe.

Bhagvaan Ram traveled down to the Southern end of India from near today’s Delhi in North India through undeveloped forests & hills. There he was joined by a large army of a of early ape-like humans. This large army reached the Southern tip of India (Dhanushkodi, a big pilgrimage destination that we visited last year).

The northern tip of Sri Lanka is visible from there but separated by a body of sea water. With the help of famous architects Nal & Neel (as in Kashkari’s first name?), the army built a walkable bridge of large stones which float on the sea surface because of the divine power of Bhagvaan Sri Ram.

Yes, this was described in Raamaayan, an epic that dates back to pre-Greece period. So far only the devoted believed such a bridge was built despite the physical evidence that remains. Other more-“educated” dismissed it as legend or myth. Until this week.

The Science Channel, an American Network, released a video this week with satellite images of this rock-bridge and analyzed the rocks with the help of geologists & archeologists. What they found has electrified India and may actually have political impact.

- Science ChannelVerified account @ScienceChannel

Are the ancient Hindu myths of a land bridge connecting India and Sri Lanka true? Scientific analysis suggests they are.

#WhatonEarth

The American satellite experts & geologists have concluded that the series of rocks that look like a bridge is man-made and 7,000 years old. The sandy shoal now seen under the rocks is only 4,000 years old. They state that the rocks were brought there from somewhere else and describe the effort involved in carrying large quantities of rocks to form a 30 mile bridge and placing them in the Indian Ocean as a “superhuman” task. Remember this was 7,000 years ago.

Just watch this 2-minute explanation by American team of Satellite analyzers & geologists and marvel:

- [embedyt] http://www.youtube.com/watch?v=Mifj1F6rWV0[/embedyt]

This is a very important validation of original Indian epics as genuine descriptors of history in addition to sacred religious texts.

8. What a week!

What an amazing coincidence that all the above events about India happened in the same week as the landmark merger of Disney & Fox entertainment assets that was itself triggered by an offer by Facebook for streaming rights of Indian Cricket? The same week in which Jeffrey Gundlach reiterated his conviction that Indian stocks, via INDA, an iShares ETF, should be held for 20 years to pay for your grandchildren’s college education. We concur totally.

The next 20 years should be absolutely great for the US-India relationship, a relationship that is coming together in military, diplomatic, commercial, and entertainment spheres.

And on top of all this a 21% tax rate for LLCs for the next 8 years. What a time to be merry!

Send your feedback to editor@macroviewpoints.com Or @Macroviewpoints on Twitter