Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Big Levels Breached

What a week! First wash out some weak hands with a steep loss on Tuesday morning and then an ebullient rally the next day. Last week we wondered whether Dow would cross 26,000 this week. Not only did Dow breach this big level, but the S&P broke over 2,800 and, on Friday, the 10-year note broke over the feared 2.63% level. And it was all so effortless.

Think, if a VIX rally of 11% can’t create fear, what can?

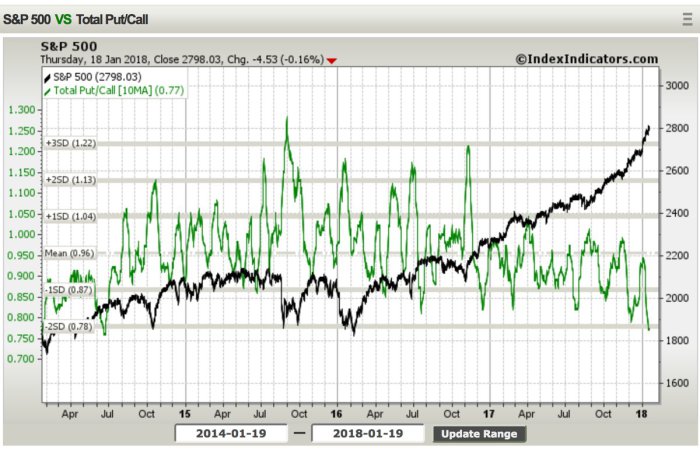

- Jonathan TepperVerified account @jtepper2 Absolutely no fear in markets if you look at the put/call ratio.

Doesn’t tranquility come from an absence of fear?

Doesn’t tranquility come from an absence of fear?

What about higher rates creating trouble for the S&P?

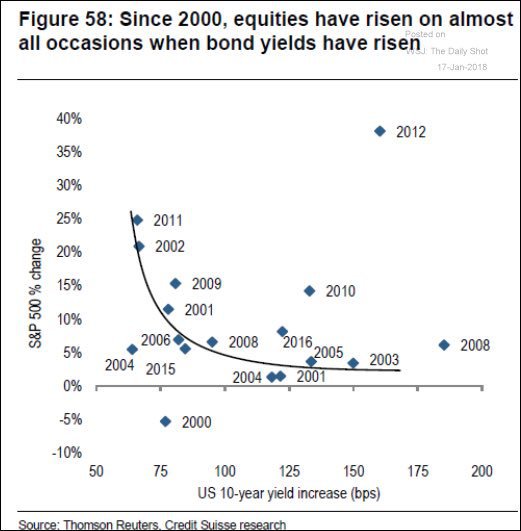

- Liz Ann SondersVerified account @LizAnnSonders For past 17 years, bond yields up = stocks up

@thomsonreuters@SoberLook@CreditSuisse

Even those who think rise in 10-year yield should be negative for stocks need not worry yet:

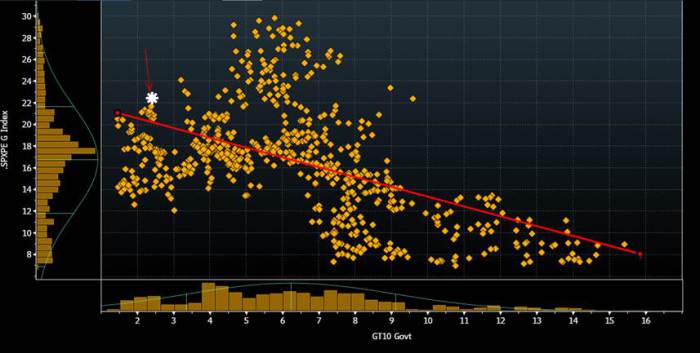

- Richard Bernstein @RBAdvisors –Over 60 years of

$SPX vs 10-year. Don’t confuse appreciation with overvaluation. Current market valuation hardly cataclysmic.

Old rule says you don’t run ahead of the stampede to turn it; you get trampled if you do. So you have to wait until the stampede gets tired from running and backs up some. Lawrence McMillan translates that as:

- In summary, things are bullish. As long as $SPX is above support at 2700 and $VIX is below 13, the intermediate-term uptrend is intact.

When two smart guys say the same thing, should we listen? This is about China & Hong Kong.

- Greg Harmon, CMTVerified account @harmongreg –added

$ASHR with a longer term view

- Peter Brandt @PeterLBrandt –

$FXI clears 2015 high on long-term charts, setting target at 71.74

2. Big Deal

Both Santelli & Gundlach said last week that breaking above 2.63% would take some effort for the 10-year yield. It didn’t. The only question is what is moving faster, stocks or interest rates.

- Jeffrey GundlachVerified account @TruthGundlach Five and Ten year US Treasury yields both challenging 30+ year declining trendlines as the new description of risk environment is “ecstasy”!

He is right. Both the 5-year & the 10-year rose 10 bps in yield this week beating the 6 bps rise in both the 30-year & 2-year. So the belly of the curve has begun to steepen. And not just the belly.

- Charlie BilelloVerified account @charliebilello 20+ Year Treasury ETF closes below its 200-day moving average for the first time since last May.

$TLT

So now the 30-year yield and TLT have joined the 10-year yield in decisively breaking through their 200-day moving averages. If that holds next week, then it could prove important for rates.

- Peter Brandt @PeterLBrandt – 10-Yr T-Notes are completing a massive 6+ year double top with target of 110^20 $ZN_F $IEF $TLT

But not everyone is convinced:

But not everyone is convinced:

- Urban Carmel @ukarlewitz –

$Copper/$Gold not confirming the up move in rates$TNX

Last week, Carter Worth of CNBC Options Action suggested going long XLU, the Utilities ETF vs. the S&P. That didn’t work so well this past week because of the sharp move up in rates. But Carter Worth is not deterred and pointed out why he thinks TLT should rally from here.

The intermediate term picture looks dicey for bonds despite the potential of a snapback rally. As Richard Bernstein wrote in his Bonds’ Day of Reckoning article:

- “Flows into bond funds and ETFs (see Chart 3) indicate investors have generally ignored bonds’ underperformance or perhaps considered the underperformance temporary. However, the business cycle isn’t dead, and inflation has begun to rise as it normally does in a late-cycle environment. Bond investors’ ostrich-like strategy to this shifting environment suggests that bonds’ day of reckoning may be upon us.”

Talk about two smart guys saying the same thing – Bernstein & Gundlach.

3. Commodities

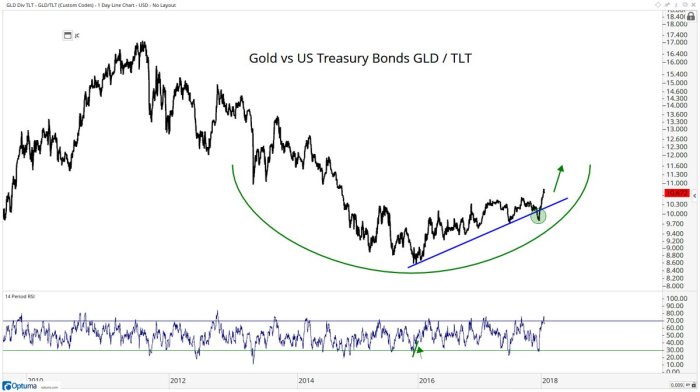

With inflation rising, shouldn’t Gold be outperforming Treasury Bonds?

- J.C. Parets @allstarcharts Look at Gold relative to US Treasury Bonds. Looks like a huge bottom to me. Nice failed breakdown last month that could spark a further squeeze

$GLD$TLT

But if Treasury prices could rally in the short term, could Gold fall some?

But if Treasury prices could rally in the short term, could Gold fall some?

- Peter Brandt @PeterLBrandt

#Factor_Members#Classical_Charting_101 Gold turning down against strong resistance$GLD$GC_F

Oil & Energy stocks gave up some this week with Oil down 1.4% and OIH down 2%.

Oil & Energy stocks gave up some this week with Oil down 1.4% and OIH down 2%.

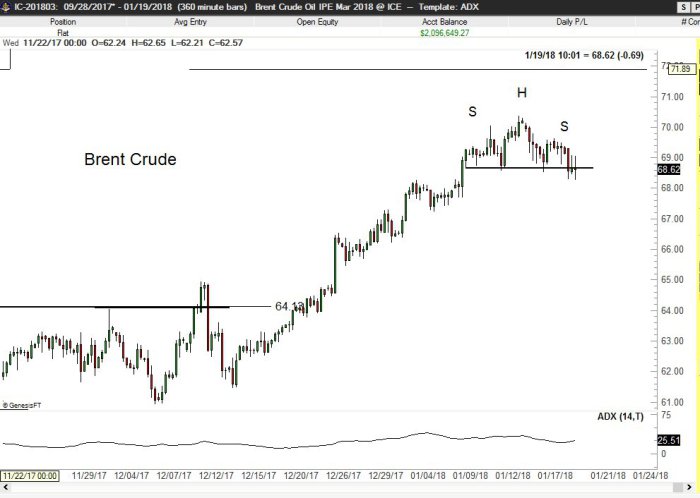

- Peter Brandt @PeterLBrandt – Might Crude be forming a small H&S top??

$CL_F$CO_F$IC_F@BrynneKKelly@chigrl

4. Things happen for the better

4. Things happen for the better

The photo below says it all about Los Angeles Rams. They sit at home while the two QBs they discarded play in the NFC championship game on Sunday evening. Should be a great game.

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter