Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Man of Respect & Putting Fire Ahead of Alarm

Mario Puzo would have called Fed Chair Powell a “man of respect”. Absolutely sensible realism without unnecessary verbiage. Some went farther:

- Todd HarrisonVerified account @todd_harrison – Wed Mar 21 – I can already say Jerome Powell is the best Fed Chair I’ve seen yet. Seems like a straight shooter who was dropped in an extremely difficult position.

#FOMC

No wonder the initial stock rally got sold off into Wednesday’s close. Powell made it clear that the contraction in the Fed’s balance sheet would continue barring something big. And he made it clear there was no Yellen put, at least not at strikes within a short distance of current levels.

At the same time, he was not needlessly hawkish on inflation:

- Pedro da CostaVerified account @pdacosta – Wed Mar 21 – “No sense in the data that we’re on the cusp of an acceleration of inflation.” – Fed’s Powell

His presser led some to state with conviction:

- Inverted Yield Curve @sleevesrolled – 2 hikes max in 2018. this and one more. bet it.

Notice that Chairman Powell raised only the Federal Funds rate and not the Discount Rate. Why?

- Randy Woodward @TheBondFreak – Wed Mar 21 – Probably no big deal, but worth noting that the Fed did NOT raise the Discount Rate, leaving it at 2%, taking the spread back to 25bps over Fed Funds Target, where it was during the financial crisis. Wonder if this has anything to do with Libor-OIS spreads.

In other words, Chairman Powell severely lowered the strike of the implied Fed put under the S&P , pooh-poohed inflation rise and hinted at some concern about the trajectory of the economic growth.What would you guess happened to the markets on Wednesday afternoon? – The natural guess would be a reversal in the S&P that has assumed synchronized global growth, a fall in the US Dollar, rise in Gold and a fall in Treasury yields in a bull-steepener.

That is exactly what happened post FOMC on Wednesday afternoon and continued into the close on Friday. And what happened to rate hike expectations for the June 2018 FOMC meeting?

- Lawrence McDonald @Convertbond – Since the Fed Meeting The probability of a June rate hike has plunged, from 90% to near 73% – while gold has surged from $1307 to $1350. When you’re trading gold, you’re actually trading eurodollars, the Fed rate hike expectations curve.

Speaking of Eurodollars, a See It Market article about TED spread (spread between T-bill and ED, the Eurodollars futures contract) reported that:

- “Speculators are so confident about higher rates that they are short almost $4 trillion ED futures“

The FOMC meeting set the ball rolling on stocks. It’s acceleration on Thursday was due to the fear about Trump Tariffs and Chinese retaliation. The best description for this brouhaha came from Rick Santelli who said “we are putting fire ahead of the alarm“.

The reality was described well by Geopolitical Futures (see our adjacent article on US-China Trade Reset for a more detailed discussion);

- “The tariffs and penalties the U.S. is proposing apply to only about 10 percent of Chinese exports to the United States and just 2 percent of Chinese exports to the world. That is not exactly a scorched earth policy; in fact, it’s more like a slap on the wrist.”

According to them, the U.S. “wants to reset the conversation with China on its own terms. And China does not have much choice but to go along“. We totally concur.

So assuming Geopolitical Futures & Rick Santelli are correct in dismissing this week’s fear of a US-China trade war, why did stocks go down so hard? Before we answer, we would like to think back to November 28, 2016 when we wrote Benefiting The People vs. Stock Market – Narendra Modi & Donald Trump. More specifically to the sections about President Trump:

- “We all realize now that Mr. Trump has been put in power by the forgotten & nearly discarded majority of the American people. These are people who are interested in getting new & better jobs, in seeing their real wages rise. They are also savers who are interested in earning once again some real interest on their savings. Generally speaking, these are not the people who populate the investor base of the US stock market.”

- “So it is quite possible that a year or possibly two from now, the decisions of the Trump Administration might benefit ordinary Americans rather than the US Stock market. It is also likely that the US stock market could get hurt while ordinary Americans get jobs & earn real wages.”

- “The past 20 years in America have been dedicated to delivering benefits to the US Stock Market & its investors. We wonder if the election of Donald Trump heralds a significant & dedicated change to delivering benefits to ordinary Americans instead of US stock market investors.”

We keep hearing that President Trump is beginning to think of the US Corporate CEOs as ungrateful. His election gave them a huge rally meaning a huge jump in their stock-based compensation; he gave them a huge tax cut and yet they refuse to back him in his mission on which he ran and in his commitments to his voters. From what we gather, President Trump feels he has done more than enough for US Corporations and US stock market investors with a rally no one expected in November 2016. Now forget about them as he turns his focus to his election commitments.

That also explains why he chose John Bolton as his National Security Advisor, a man the GOP congressional leadership disrespects & dislikes intensely. Well, to hell with them, he would probably say if asked. John Bolton is the man he needs to end US participation in the Iran Deal and to punish Iran.

As we argued three weeks ago in our article President Trump’s Tariffs Announcement – Oh Yeah, Baby?, he is making a turn into a FDR like figure who roared against the interests of the rich. And that means to hell with the stock market if necessary.

We think the US stock market is beginning to sense this significant change, a change that is deeper than any one trade dispute. If we are right, Kevin O’Leary’s Oh Yeah, Baby might be heard from the people who voted from President Trump instead of those who loved his stock market rally while hating him.

So our new posture is better aligned towards:

- Mella Andrews @Mrs_Northy – Markets trying to find a short term floor, long term they remain toast tho

$SPX

2. Interest Rates & Credit

Read what Jeffrey Gundlach wrote on Thursday about the turn in Treasury yields:

- Jeffrey GundlachVerified account @TruthGundlach – Thu – So when risk markets got to that important crossroads they opted to take the southern route & 30 yr UST exactly held 3.22 key closing level.

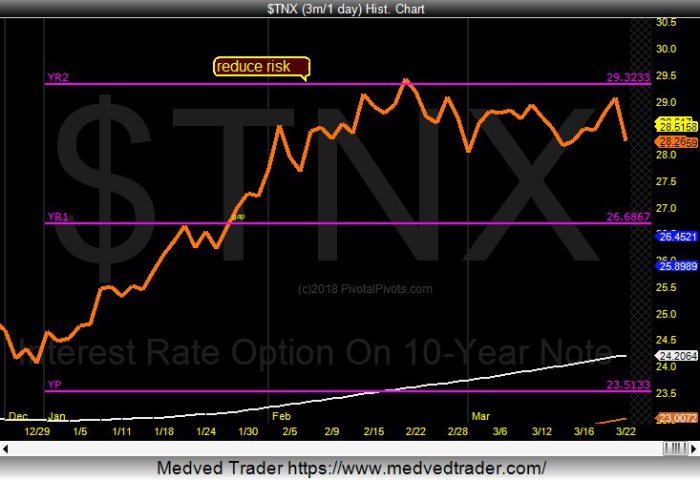

The 30-year yield hit 3.22% only once, the but the 10-year yield hit 2.95% twice. Does twice mean double & where could the new southern route take the 10-year?

- Jeff York, PPT

@Pivotal_Pivots – Yields on the 10 yr.

$TNX are making a double top @ 2.93% the YearlyR2 Pivot(YR2)@PivotalPivots They may now fall to the Yr1 Pivot @ 2.67%.

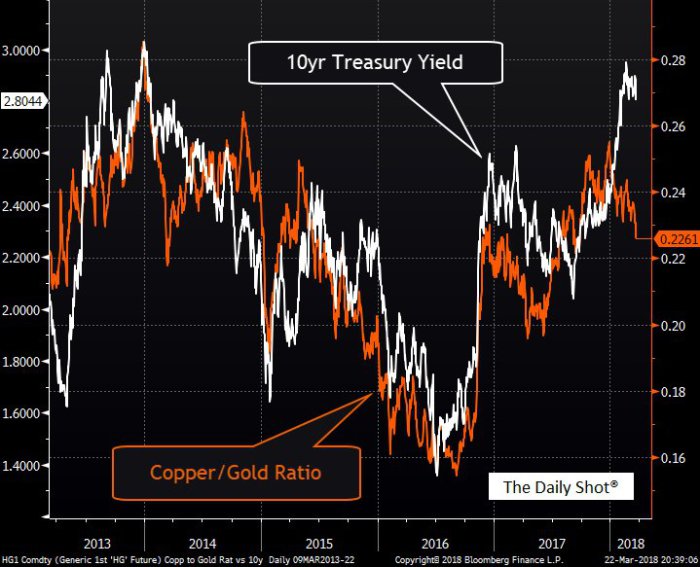

But to get there, the 10-year yield has to break 2.80% first, something it has been unable to do. One indicator that suggests it might do so is Gundlach’s favorite indicator:

But to get there, the 10-year yield has to break 2.80% first, something it has been unable to do. One indicator that suggests it might do so is Gundlach’s favorite indicator:

- (((The Daily Shot))) @SoberLook – Chart (

@TheTerminal): Copper/gold ratio vs. the 10yr Treasury yield –

Remember Gundlach was concerned that the rise in German yields would drag Treasury yields higher. But that was so pre-February wasn’t it?

- Lawrence McDonald @Convertbond – Since Feb, Ten Year Bonds Bunds: 76bps to 52bps (-24bps) Treasuries: 2.95 to 2.83 (-12bps) *German bunds are a bond bull’s best friend ? Via

@BearTrapsReport

Remember 50 bps on German 10-year was Gundlach’s critical level on the way up. What if the 10-year Bund yield breaks through this important 50 bps level on the downside?

Note that the economic surprises index in Europe is falling faster & lower than the US economic surprises index. And the US index is not looking so hot either.

- Keith McCulloughVerified account @KeithMcCullough – Wed Mar 21 – In sharp contrast to all of 2017 when

@Hedgeye US GDP nowcast was higher than both the Fed and Wall St. consensus … Now we’re slightly below and falling vs. the Fed and consensus

Aren’t falling interest rates are usually bullish for stocks? Yes they are unless credit is falling at the same time:

- Raoul PalVerified account @RaoulGMI

$HYG Is in danger of forming a large rounded/H&S top. Signals in the credit cycle are beginning to pop up all over the place…

When did we last see falling Treasury yields & falling US High Yield Bond prices? – 2008, the same year we saw VIX exploding to heights unseen since then.

3. US Stocks

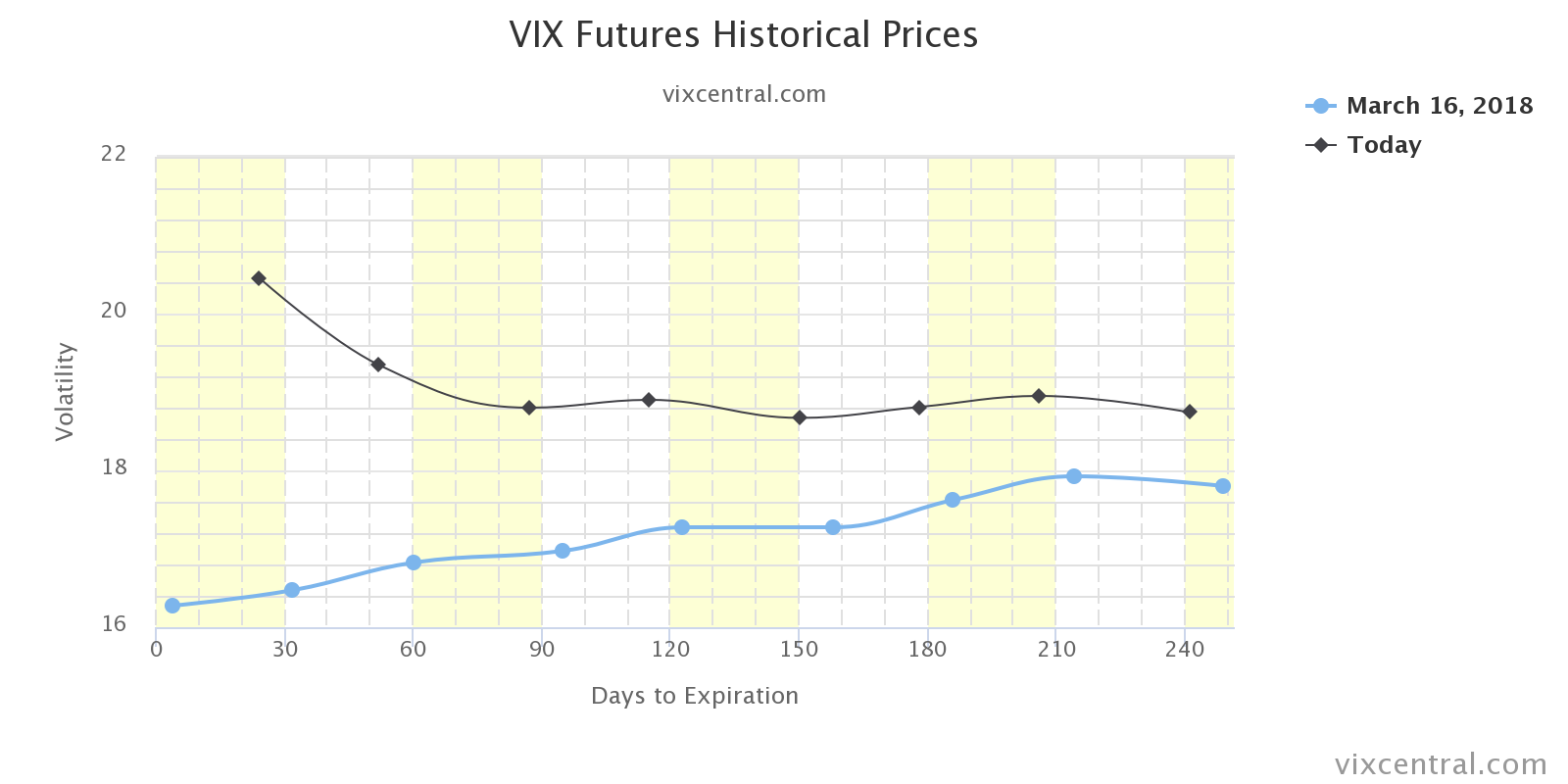

Once again, the VIX curve exploded from its normalized stupor of prior week to what you see below:

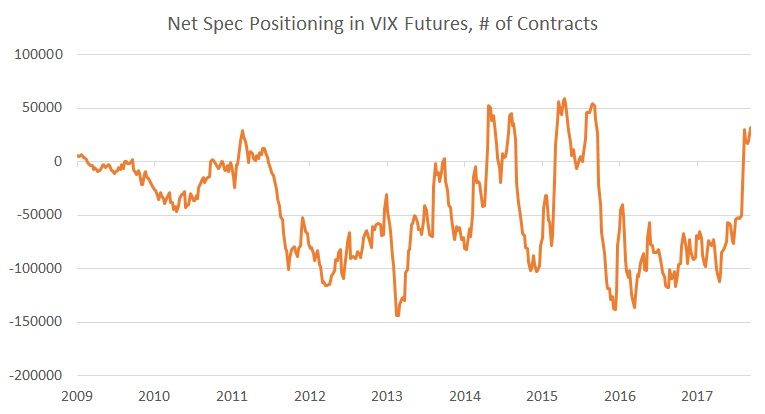

Actually the above is misleading because it doesn’t include Friday’s close of 24.87 which makes the inversion much more stark. Not only did $VIX explode up 70% this week, but the positioning rose as well;

- Movement Capital @movement_cap –VIX traders close to an ATH in net long positioning https://freecotdata.com/stocks/

The markets are very oversold, fear measured by CNN Fear & Greed closed at 7 and we see long VIX positioning close to all time highs. This should persuade many about the worst being in the rear view mirror. And we saw many smart traders sell their S&P puts into the close on Friday.

The markets are very oversold, fear measured by CNN Fear & Greed closed at 7 and we see long VIX positioning close to all time highs. This should persuade many about the worst being in the rear view mirror. And we saw many smart traders sell their S&P puts into the close on Friday.

We don’t mean to question these smart guys but something Art Cashin said on Friday afternoon bothers us. He mentioned the close on Friday was so ugly because of mutual fund selling to meet redemptions by individual investors. The intense & loud brouhaha about China Tariffs, the nasty sell off of 724 points on Thursday followed by another intense selloff on Friday afternoon might have made enough individual investors say enough & bail.

What could happen over the weekend to lessen these fears? Clearly the Sunday morning shows would go to town bemoaning the chaos in the Trump Administration and the looming trade war against China. So we wonder whether a large number of redemption orders would hit mutual funds over the weekend making the opening on Monday bloody. Then you also have the old dictum of you don’t get a bottom on Friday.

That possibility keeps us worried about Monday’s open as well as a key wave level;

- Thomas Thornton @TommyThornton – If the Dow Jones

$INDU$DIA closed here it would lock in the downside wave 3. That price objective is pretty deep but you never know!

Note that the synchronized global growth thesis of this rally was questioned on Monday, two days before last Wednesday’s FOMC & Thursday’s Trump tariffs:

- Ralph Acampora CMT @Ralph_Acampora Mon Mar 19 – Material Sector (XLB – 58.44) is rolling over. The next level of important support is at 56.62. It is challenging its uptrend that started at its January 2016 low,

Well, XLB closed the week at 56.02, decisively below Acampora’s 56.62 level. Semiconductors were taken out & shot on Friday. Scariest were the Banks. We keep hearing how US banks are at their healthiest since 2008 but we keep noticing the scary declines in Deutsche Bank. We don’t know much but we do know that if a major European investment bank gets in trouble, US banks WILL suffer from two of the worst Co-words – Counterparty & Contagion.

But is all this already factored into this week’s selloff and the $VIX explosion? We certainly hope so.

To get into sectors, see what a change one FOMC meeting creates! What looked really bad on Monday began looking good on FOMC Wednesday:

- Ralph Acampora CMT @Ralph_Acampora – Mon Mar 19 – Consumer Staples (XLP – 53.16) – is making a new lower low and challenging its major uptrend that began in early 2009. Next area of critical support is at 52.43. Watch very carefully – a top is forming.

On Wednesday:

- Thomas Thornton @TommyThornton Warming up to the consumer staples sector with downside DeMark exhaustion signals as mentioned yesterday on Hedge Fund Telemetry Daily Note

$XLP

It would be improper to close the US stocks section without featuring an opinion on the stock of the week, right? Not just any opinion but an opinion of a guru who told his followers to Short the Dow Jones last Friday?

It would be improper to close the US stocks section without featuring an opinion on the stock of the week, right? Not just any opinion but an opinion of a guru who told his followers to Short the Dow Jones last Friday?

- Peter BrandtVerified account @PeterLBrandt – Facebook

$FB is completing one of the most classic distribution H&S tops in the history of the stock market

4. Nikkei

Is two company or a crowd?

- Mark Newton @MarkNewtonCMT –

$NKY watch Europe and Asia as many indices flirting with breakdowns of FEB LOWS- NIKKEI today violated Feb lows, & now down 4000 points from late Jan highs- so ongoing relative weakness v US

- Peter BrandtVerified account @PeterLBrandt – Look out for the setting sun

#Japan#NIKKEI$NK_F

5. Gold

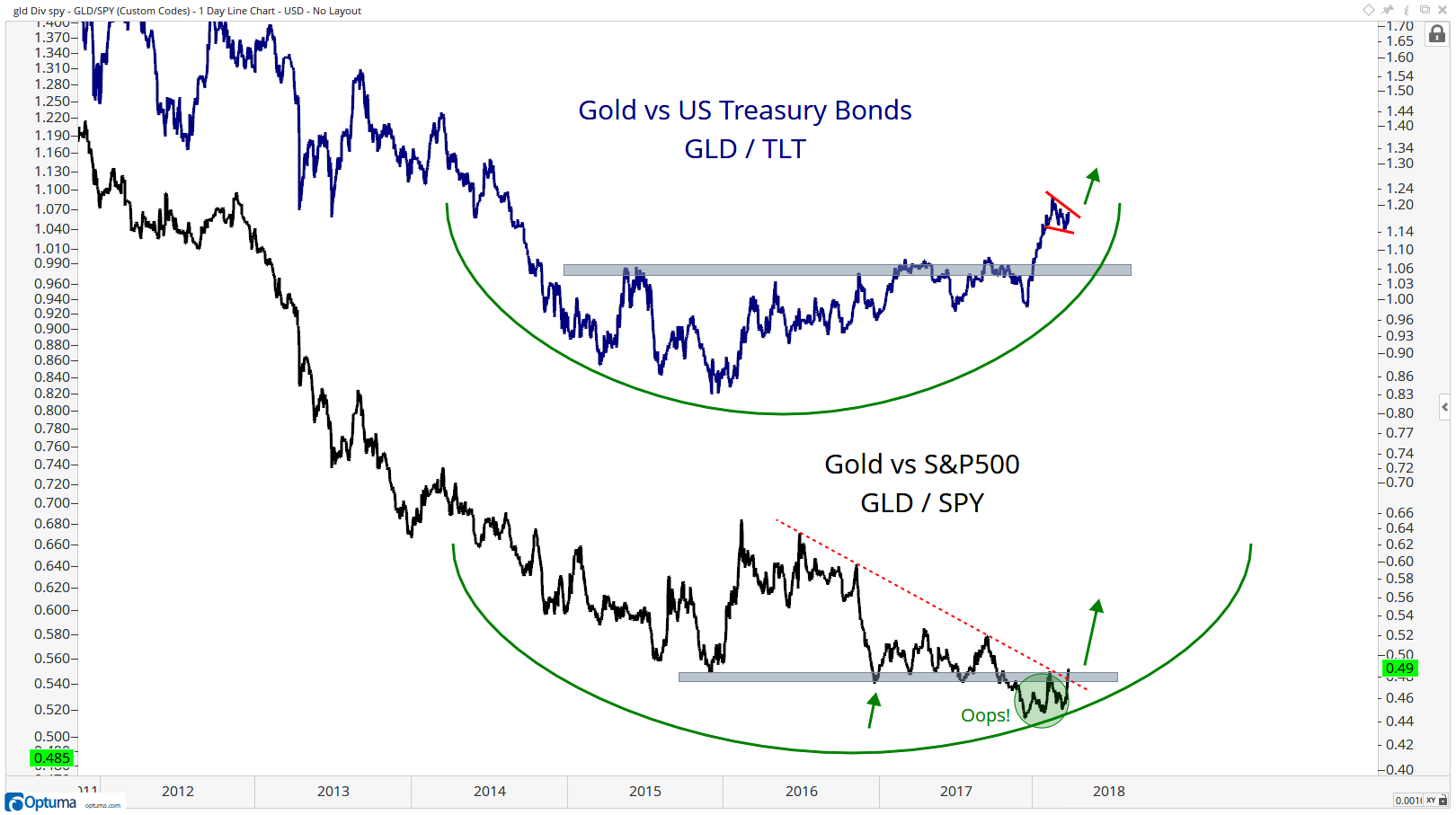

Dollar weakening and interest rates coming down? Shouldn’t this be good for Gold? Previously disinterested J.C. Parets though so and wrote Gold Is Breaking Out Vs Stocks & Bonds.

- “The first thing that stands out to me here are the massive bottoms on both of these charts.

- “We’ve been pointing to the multi-year breakout in Gold vs Bonds since coming into the year. That was a very bullish development that has kept us interested in precious metals throughout 2018. On the bottom of the chart we have Gold relative to US Stocks, specifically the S&P500. This has all the makings of a failed breakdown and the path of least resistance in the GLD/SPY ratio seems much higher if we’re above those late 2016 lows.”

- “Again, if Gold is in an uptrend, it is going to be outperforming its alternatives. I think that’s exactly what’s happening here. We still want to be long Gold if we’re above 1300. That hasn’t changed. That 1550-1580 level looks like the next stop. We will reevaluate at that point, but a retest of those all-time highs above 1900 is definitely in the cards.“

If Gold is attractive, how attractive must Gold miners be?

- fred hickey @htsfhickey – When gold was $1350 last September, the GDX ETF was over 25.50 or 15% higher than it is now. Miners are just gettin’ started

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter