Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Big Progress!

We are glad we did not jump to any conclusions in haste last week. Clearly the US strike in Syria was very carefully calculated to do insignificant damage and avoid all other forces including Iranian. Now it becomes clear that the real message, as in the 2017 strike on Syria, was for Kim Jong Un of North Korea. The message was the determination & ability of President Trump to strike a Government supported by Russian military in Assad’s capital in spite of Russian S-300 anti-missile defense system. How was that message received?

Loud & Clear. On Friday after the close, North Korea announced suspension of all nuclear & missile tests as well as the closure of their major test site. President Trump welcomed this announcement:

- Donald J. TrumpVerified account @realDonaldTrump North Korea has agreed to suspend all Nuclear Tests and close up a major test site. This is very good news for North Korea and the World – big progress! Look forward to our Summit.

This announcement and the revelation that Secretary of State appointee Mike Pompeo had secretly flown to North Korea over the Easter weekend to meet with Kim Jong Un points to a much higher probability of a successful de-nuclearization of North Korea in the near future.

Is this perhaps what the South Korean stock market was hoping for?

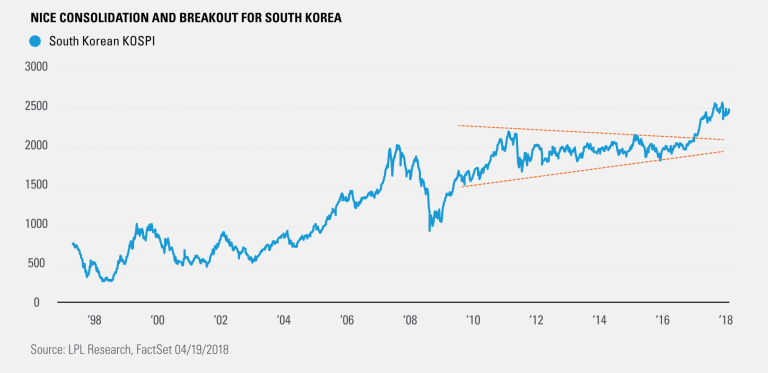

- Ryan Detrick, CMT @RyanDetrick More – “The longer the base, the higher in space.” NEW POST taking a look at why South Korea and Taiwan could be major reasons for continued emerging markets strength. https://lplresearch.com/2018/04/20/the-longer-the-base-the-higher-in-space/ …

- “With all the concerns and worries regarding North Korea, we find this to be an encouraging sign for the second-largest country component of EM and believe there to be potential for future gains.”

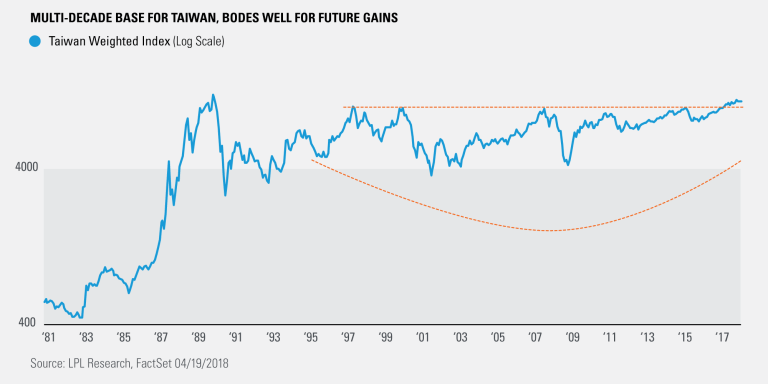

What does Detrick say about Taiwan?

- Taiwan has completed a picture-perfect saucer bottom* that lasted nearly two decades. There’s an old saying in technical analysis, “the longer the base, the higher in space.”

Look at the chart above and ask whether this chart even notices this week’s huge military exercise by Chinese Military to simulate invasion of Taiwan? Or ask whether it suggests confidence that President Trump & US would succeed in their actions towards China the way they seem to be succeeding against Kim Jong Un?

In stark contrast, both China ETFs, ASHR & CAF, fell by 3.5% this week and the ytd decline in the Shanghai stock market reached 13%.

2. Irresistible Force revived

The irresistible force of Q4 2017 seems to have gotten a second & even more powerful wind, the force being the rising 2-year Treasury yield of course. The data & the comments of both Chairman Powell & ex-dove Brainard propelled it forward this week.

- David Rosenberg @EconguyRosie – Inflation thumbprints all over the Philly Fed. The workweek soared to its highest level since October 1987; production bottlenecks too — vendor delays soared to an all-time high! Prices-paid to 56.4 from 42.6, highest since March 2011. Prices-received jumped to a ten-year high.

Add the rally in Oil prices and you know inflation expectations are spiking again.

- Charlie BilelloVerified account @charliebilello – My segment today on

@cnbc discussing the rise in oil, higher inflation expectations, and the end of easy money… https://www.cnbc.com/video/2018/04/19/crudes-rally-is-giving-a-signal-to-the-bond-market-chart-watcher-says.html …

But we are not sure this is really due to inflation expectations. Simple folks that we are, we have never seen the 30-10 year yield spread contract when the Treasury market smells inflation. And the 30-10 year spread closed the week at a ridiculous 19 bps, down 1 bps on the week.

But we are not sure this is really due to inflation expectations. Simple folks that we are, we have never seen the 30-10 year yield spread contract when the Treasury market smells inflation. And the 30-10 year spread closed the week at a ridiculous 19 bps, down 1 bps on the week.

Our simple belief is that the Treasury market is being pushed higher, especially at the short end, both by the Fed and by fear of a buyer strike of future higher issuance.

The biggest divergence we see is the rising spread between the US & German 2-year yields. That spread closed at 301 bps this week with the German 2-year yield up by 1 bp & the US 2-year yield up by a whopping by 10 bps.

The German 2-year yield we get, especially given:

- Lisa AbramowiczVerified account @lisaabramowicz1 – ECB’s Mario Draghi says euro-area growth cycle may have peaked. So what ammunition does the central bank have to counter a downturn if this is as good as it gets?

The US 2-year yield we also get given the explicitly stated determination of Fed. But put these two together & you get a situation that seems nuts or a harbinger of instability ahead. And next week we could see the US 2-year rising above 2.50% and the US 10-year rising above 3%, both red lines.

3. US Stock Market

The best comment comes from:

- Cousin_Vinny @Couzin_Vinny –

$SPY I keep thinking my Magic 8-ball will give me some directional info – just gives me smart ass answers.

The next comment we favor is:

- Todd HarrisonVerified account @todd_harrison – Market sure feels complacent to these old eyes. But I’m sure it’s nothing.

$VIX$SPX$NDX

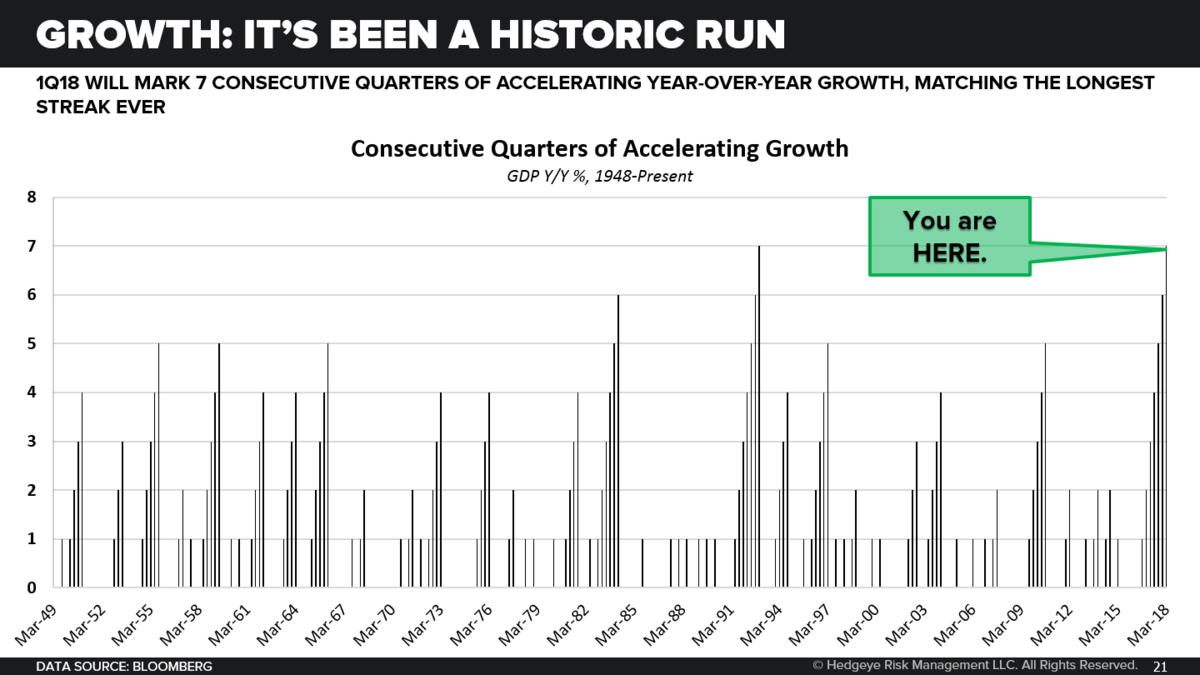

But some have no doubts. Hedgeye announced on Monday that their Tactical Asset Class Rotation Model went to 100% cash. Their reasons, as far as we can tell, are that both Europe & China are slowing, inflation pressures will lead to rates in US rising in Q2 and the US Dollar has bottomed. And their key US growth chart is:

If these conditions all come true, then 100% cash allocation, until rates rise beyond where they should, makes sense.

If these conditions all come true, then 100% cash allocation, until rates rise beyond where they should, makes sense.

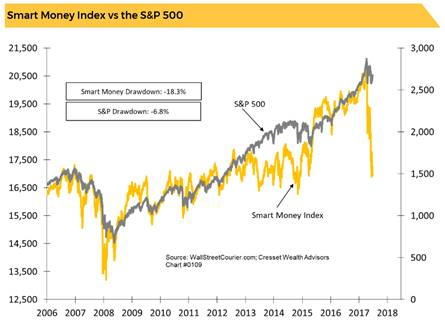

Adding to the negativity is veteran strategist Jack Ablin who noted that “smart money” is already selling.

This brings back June 2008 to him:

This brings back June 2008 to him:

- “The Smart Money Index turned downward as early as June 2008, long before the September market swoon, and bottomed in October of that year, five months before the S&P rebounded,”

Is there any positive signal at all? The chart below from Almanac Trader, Jeff Hirsch:

He wrote this week:

He wrote this week:

- ” … signs of strength can be seen in advance-decline lines (plotted in the above chart). S&P 500, Russell 2000, NASDAQ and NYSE Comp advance-decline lines have all been moving higher during the month of April. During yesterday’s trading, April 17, the NYSE Comp advance-decline line actually closed at a new high for the first time since late January.”

We have an important set of earnings next week, with $NDX closing in the near vicinity of its 100-day. So perhaps the market could speak more eloquently than the 8-ball did on Friday.

4. Dollar & Commodities

- Peter BrandtVerified account @PeterLBrandt – The U.S. Dollar is poised to provide a significant buy signal

$DX_F$UUP

But that doesn’t seem to be negative for Silver:

But that doesn’t seem to be negative for Silver:

- Peter BrandtVerified account @PeterLBrandt – Factor_Members Silver has cleared the 10-wk rectangle for a buy signal and now will challenge the 9-month symmetrical triangle

$SI_F$SLV

Another signal seems to be outperformance of Silver over Gold:

Another signal seems to be outperformance of Silver over Gold:

- J.C. Parets @allstarcharts – This is a new development that I think is worth watching – the potential start of Silver outperforming Gold and new regime of higher prices for precious metals

$SI_F$GC_F$SLV$GLD

Commodities had a terrific week with CLF up 11%, FCX up 9% and MOS, POT-NTR up 3%+ besides the rally in Oil & oil stocks. Combine that with bond yields shooting higher and we are reminded of what Jeffrey Gundlach said a couple of months ago – that before a recession begins, you get a serious rally in commodities. Is this such a rally? Leading indicators say no but the action in cyclicals like Semiconductors & banks suggest caution.

Commodities had a terrific week with CLF up 11%, FCX up 9% and MOS, POT-NTR up 3%+ besides the rally in Oil & oil stocks. Combine that with bond yields shooting higher and we are reminded of what Jeffrey Gundlach said a couple of months ago – that before a recession begins, you get a serious rally in commodities. Is this such a rally? Leading indicators say no but the action in cyclicals like Semiconductors & banks suggest caution.

The US-China disagreements are real, deep and meaningful. And that cannot be very positive for either growth or multiples. Larry McDonald of Bear Traps Report is already on record as saying current market action he is reminded of the Summer of 2007. He didn’t say how but nothing from late 2007 generates happy memories.

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter