Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Noise to Signal Ratio

Italy has the 4th largest bond market in the world & Italy has 2 Trillion of Debt. A market of this size should not move like a biotech stock, at least according to Larry McDonald of Bear Traps Report. But it did this week – from + 19 bps on May 22 to 2.76% on May 29 to + 90 bps on May 30, according to him. Was this volatility a signal?

No said Savita Subramanian of BAML in the eye of Tuesday’s hurricane on CNBC Half Time Fast Money:

- ” … noise to signal ratio super high right now; I love the US market & our target is 3,000. We have penciled in 16% as earnings growth this year; US is the bright spot in a sea of pain; earnings revision ratio for US is greater than 1; for all other regions it is less than 1; … US has grown more equipped to deal with wth strong $ and trade friction than in years … “

Four hours before she spoke, a more definitive statement was issued by Mohammed El Erian on CNBC Squawk Box. This was the not usual erudite Harvardian El Erian who hedges his statements. This was an emphatic El Erian:

- “The mistake people made is to confuse a coincidence of a pick up in growth around the world with something that had legs, … We were just in a lucky coincidence. … People are now realizing the only economy with real legs to it was the U.S. economy… ”

What about the ballyhooed global synchronized growth? El Erian said:

- “The U.S. was policy-led, deregulation, tax cuts. Europe [was] just in a natural healing process, … developing countries were bouncing back … China was in for a “soft landing.”

He didn’t stop there. He looked ahead:

- “We’ve had deregulation, we’ve had tax cuts — whether you like it or not it does boost growth,” he said. “If we can just get the infrastructure done, then the U.S. will break into a higher growth. [3%+ growth]”

That, as we have written before, requires Republicans to keep both Senate & the House in November 2018. Of course, the markets have known what El Erian said:

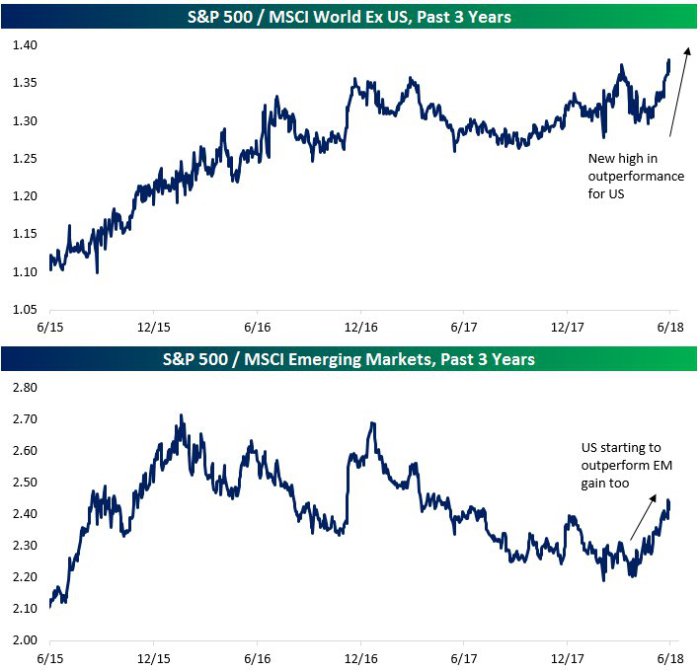

- Bespoke @bespokeinvest – US equity market relative strength vs. rest of world has really picked up lately:

Savita Subramanian was also correct, at least this week, about US being equipped to handle trade friction. The selloff on tariffs decision of President Trump only lasted one day and was forgotten with the “amazing job creating economy” as Jim Cramer described Friday’s NFP number.

Savita Subramanian was also correct, at least this week, about US being equipped to handle trade friction. The selloff on tariffs decision of President Trump only lasted one day and was forgotten with the “amazing job creating economy” as Jim Cramer described Friday’s NFP number.

Contrast that with China:

- Keith McCulloughVerified account @KeithMcCullough – Wed May 30 – CHINA: who’s going to bailout

#ChinaSlowing? Chinese stocks hammered for a -2.5% loss and fresh YTD lows

If you look back at the week, you hardly find any evidence of real market impact. SPX & Dow moved only 50 bps; Nasdaq, the star, was up 1.8%; TLT was up 53 bps; Dollar was unchanged; Gold was down 22 bps & VIX was only up 1.8%. And the Italian 10-year bond closed the week at 2.674%, some 22 bps lower than the far safer & far more liquid US 10-year at 2.899 %. So this week’s turmoil didn’t really have much to do with Italy, did it?

We wonder whether this week’s action was simply a reduction of extreme positioning in markets. Look at the evidence according to Movement Capital – e-mini S&P 500, the most crowded long, got hit hard while Nasdaq, with spec positioning at the lows, flew this week. Treasuries which had a massive short rallied & Oil fell hard. No wonder Italian 10-year yield continues to be lower than the US 10-year yield. That’s the way it was and so it remains, but to a smaller extent.

In other words, a lot of noise but not much of a signal!

2. Fed & Treasuries

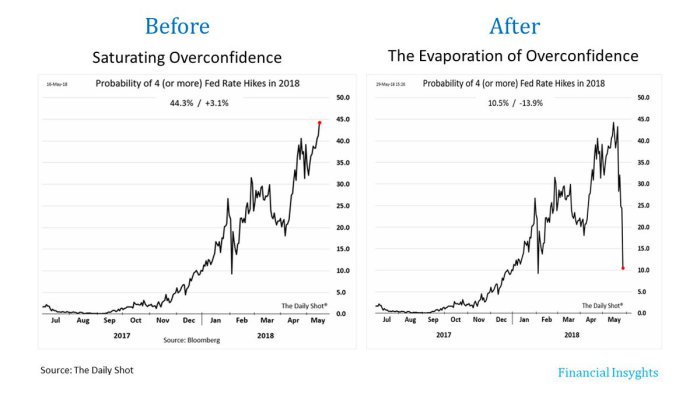

The Fed likes to think of itself as a deliberative body that frowns on quick fast changes to its posture. But market’s expectations of what Fed might do can get crazy volatile as we all saw last week & this week:

- Peter Atwater @Peter_Atwater Fri pre-NFP – What a difference two weeks can make…

Guess what a difference one number makes ! After the 223,000 payroll number, 3.8% unemployment, 0.3% hourly earnings, the same probability swung up to 29%.

Guess what a difference one number makes ! After the 223,000 payroll number, 3.8% unemployment, 0.3% hourly earnings, the same probability swung up to 29%.

In contrast, our own Fed liquidity indicator (Leveraged Closed-end funds vs. Unleveraged index ETF) showed a clear uptick in Fed induced liquidity on the week:

Similar up moves are evident in other leveraged closed end fixed income funds vs. their unleveraged index etfs including high yield credit:

Similar up moves are evident in other leveraged closed end fixed income funds vs. their unleveraged index etfs including high yield credit:

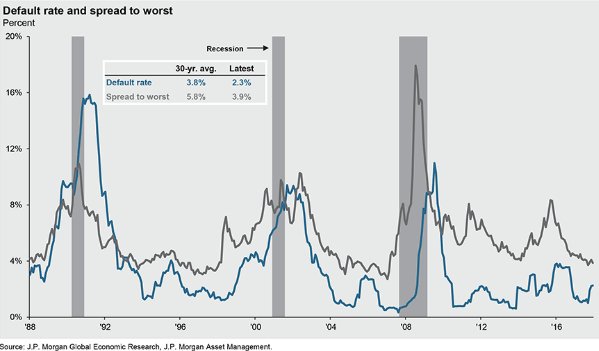

- Urban Carmel @ukarlewitz High yield: spreads falling, default rate low

Not only did the rate hike probabilities fluctuate for the expected December rate hike, September rate hike was also brought into question. Paul Richards, president of Medley Global Advisors & ex-UBS guru, said on BTV on Tuesday:

- “September has become the question mark … now you’ve got this whole bunch of geopolitical risk. They, and the ECB in October, are going to have to make decisions, right at the time you’re going to have Italian elections. This geopolitical risk is really going to start putting September in question”.

This worry about September and Friday’s NFP data does make the June rate hike a near certainty in our opinion. After all, it could well be the last chance for Fed to raise rates this year.

Given all of the above, no one should be surprised to see the Treasury curve flatten this week with 30-year yield down 4.3 bps, 10 year down 3.2 bps, 5-year down 1.8 bps and the 2-year yield down only 0.8 bps.

Kudos to Todd Gordon of TradingAnalysis.com who predicted last week that TLT will get to $122. It got there this past Tuesday. This is the 2nd time his brave & bold predictions have come true. Talk about Fast Profits!

3. Stocks

Fed rate hike expectations reduced, Treasury yields fell & US economy demonstrated its strength. What’s not to like & why shouldn’t S&P go up next week? It’s that thing called momentum that has to keep proving itself.

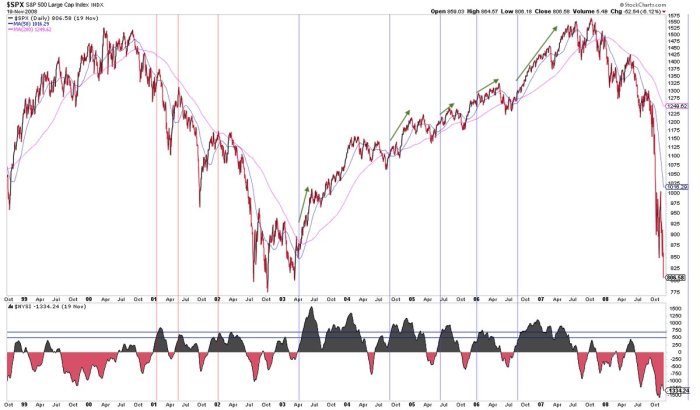

- Urban Carmel @ukarlewitz –

$SPX up 2 wks in a row for only the 3rd time in 4 months. It hasn’t been up 3 wks in a row since the Jan top. Next week, a momentum tell

Then you have that pesky thing called seasonality:

- LPL Research @LPLResearch –

@RyanDetrick asks if it’s time for a#JuneSwoon http://pnw-b.ctx.ly/r/609f4#LPLChartOfTheDay

Then you have the 13th, the FOMC meeting on June 13 not to mention the June 12 th meeting between President Trump & North Korea’s Kim Jong Un.

Then you have the 13th, the FOMC meeting on June 13 not to mention the June 12 th meeting between President Trump & North Korea’s Kim Jong Un.

On the other hand, you have the right leadership:

- Ryan Detrick, CMT @RyanDetrick – Small caps making new highs are impressive, but even better is breaking out relative to the SPX. This bodes well for continued strength.

That fits with what Real Vision newsletter said this Thursday:

That fits with what Real Vision newsletter said this Thursday:

- “Just last week the Russell broke out to a new all-time high. Meanwhile the S&P 500 is meandering around the 2,700 level, still about 5% below its January highs. Importantly, the Russell often leads the broader markets, which means new all-time highs could be coming across the board. For example, since 2013 the Russell has spent 3+ months below its all-time high four separate times. Each time it broke out to new record highs, the S&P 500 also made a new high within three months. Will the S&P break out soon and make it five for five?”

That in turn fits with:

- Urban Carmel @ukarlewitz More –

$NYSI crossing over 500 after being negative. Not a short-term indicator. When$SPX above 200-d, bull market has continued to a new expansion high

Whether the S&P breaks out or not, Russell 2000 had a Friday breakout:

- Peter BrandtVerified account @PeterLBrandt – Donchian Weekend Rule: It is significant when a market breaks out or reconfirms a breakout on a Friday

$RUT_F$NQ_F$QQQ

The S&P may have a statistical swoon in June, but statistically it should have a positive return for the month of June:

The S&P may have a statistical swoon in June, but statistically it should have a positive return for the month of June:

- OddStats @OddStats –

$SPX just put together its best May since 2009. But how have June returns in the past been, following a May that was at least as good as this one? June following a May with a 2.00-2.99% return has been positive 4 of 4 times.

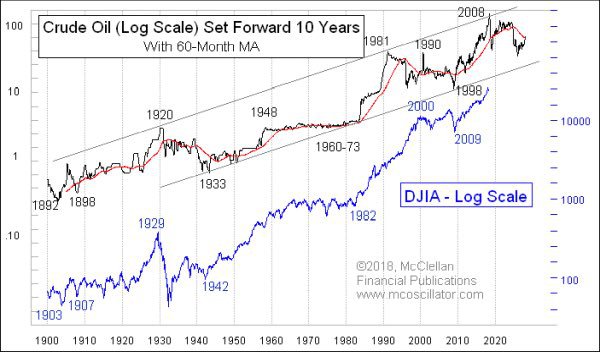

But could a positive return in June also signal a top? Tom McClellan seems to think so based on his crude oil – S&P chart fitting:

- Jesse Felder @jessefelder – ‘Crude oil gives us a 10-year leading indication for what the stock market is going to do. It is a phenomenon which has only been working for the entire 122-year history of the DJIA.’ –

@McClellanOsc http://www.mcoscillator.com/learning_center/weekly_chart/waiting_on_the_echo_of_crude_oils_big_drop/#When:21:26:33Z …

- “If the DJIA was going to match the oil price pattern exactly, then we would see a price top for the stock market in June 2018 and a sharp drop to a bottom due in January 2019. But as we have seen, the match is not exact.”

- “My guess at the moment is that the DJIA’s Jan. 26, 2018 top is the early answer to oil’s June 2008 price top. And so a 6-7 month decline should unfold, leading us to a stock market bottom due sometime in late summer.“

- “The deeper message for us to take from oil’s action right now is that after the 2018 decline, there WILL be a big price rebound for stocks into 2019 and beyond.“

Speaking of oil, WTI fell 3% this week and broke below $66.

- Peter BrandtVerified account @PeterLBrandt – Crude Oil

$CL_F is violating a 10-month trendline (tho I’m not a big fan of TLs) and attempting to complete an arguable H&S top with stunted right shoulder.$OIL

4. Still “one of those” to Them?

Recently, we heard Becky Quick say on her CNBC Squawk Box show that any person who is rational should have expected 3% yield on the 10-year note. Her tone of utter conviction struck us as interesting. Becky was almost jeering at those who had the irrationality to consider that Treasury rates could do anything this year except keep going up.

As often happens with CNBC anchors, especially women anchors, such utterances of utter conviction tend to be contrarian signals. Any one who bought Treasuries, short or long duration, on that morning of May 14 made money during the past two weeks.

That’s good but not what our title of this section suggests. Becky’s tone of total conviction reminded us of a week 5 years ago when 3 FinTV women anchors, all blond by the way, expressed the same derision for “one of those”, which in this case stands for those men who actually like Treasuries. For those who don’t understand the reference, below will explain:

[embedyt] http://www.youtube.com/watch?v=4XttdO1yipo[/embedyt]

We used this same clip 5 years ago and remarked:

- “It seems that Alix Steel, Becky Quick & Sara Eisen react just like Seinfeld’s blond date when some one tells them they are invested in Treasuries.”

As we see Becky Quick hasn’t changed. Sara Eisen, now at CNBC, doesn’t seem to remark about Treasuries. Her derision, these days, is focused against President Trump and “one of those” guys like us who like & support him.

In contrast, Alix Steel, still at BTV, seems to have made the most strides. She has actually made positive comments about Treasuries and used charts to show that. As anchor, she seems much more at ease in discussing macro. Kudos to her.

There is a positive side to this “one of those” discussion, a side that pleases our inclusive nature. On Friday, a non-blond female anchor chimed in with contempt of investors in Treasuries. CNBC’s Melissa Lee asked BlackRock’s Jeff Rosenberg,

- “You think, there is still a place in investor portfolios for bonds, short term bonds?”

What a question? Don’t all individual investors need a place for short term bonds in their portfolios? Jeff Rosenberg answered in some detail and concluded by saying he thinks short term bonds are very attractive now. Naturally, Melissa Lee didn’t even care to respond; we doubt she even heard Rosenberg’s answer; kinda like Seinfeld’s date wouldn’t have even bothered to hear why Seinfeld prefers salad.

We do wonder which of her Fast Money traders has instilled in her such contempt of Treasuries. Is it Guy Adami or perhaps the Najarian brothers? Enquiring minds would like to know.

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter