Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Week’s Visit to Europe & UK

The most watchable foreign trip ever, in our experience. It began with a tongue lashing to Germany & NATO from President Trump, featured a masterly press conference dance between President Trump & Prime Minister May and ended up with England’s native queen Elizabeth getting lost behind President Trump during the honor guard at her palace. We discuss the objectives & ramifications in our adjacent article titled Thoughts – NATO Visit, EU-UK & Putin on Deck – 1930s & Now.

It suffices to say here that this trip had no impact on US markets at all. What about the status of Brexit?

- ian bremmerVerified account @ianbremmer – British soccer humor is the best humor.

2. T or CX?

The momentum of last Friday carried into early this week with Dow up 320 points on Monday & up 143 on Tuesday. Then came the news that the Trump Administration had decided to impose 10% tariffs on $200B of Chinese exports. So Wednesday opened hard down & closed down 219 points. Then Thursday opened higher & closed up 224 points wiping out all of Wednesday’s losses. So once again markets fell hard to news of tariffs only to bounce back harder the next day.

Does that mean tariffs are not a real threat to markets? Some think they are and warn about consequences of ignoring the risk of tariffs:

- Scott MinerdVerified account @ScottMinerd Markets are crazy to ignore the risks and consequences of a

#tradewar. This rally in#stocks is the last hurrah! Investors should sell now, speculators may do better in August.

But Lawrence McDonald, via FT, suggests a deeper reason rather than tariffs:

- Lawrence McDonald@Convertbond .

@johnauthers ‘s Must Read, China A-Shares nearly 30% off their highs: Clampdowns on shadow banking, controls on wealth management products, curbs on local government debt, and limits on real estate lending. Defaults are growing. https://www.ft.com/content/4917fe4c-84f4-11e8-a29d-73e3d454535d… via@BearTrapsReport

Where does the FT article direct the blame?

- … events in China, once more, are moving markets. Specifically, China’s monetary policy is designed to rein in the excessive credit that followed the crisis. That in the process threatens to rein in Chinese economic growth, along with the growth prospects of the halo of economies and industrial sectors that depend on China. The price of copper, for example, has tumbled 17 per cent in the past month.

- To quote Hayden Briscoe of UBS: “Focusing on trade issues misses out what’s really impacting the global economy, and for that you have to look at how China is conducting monetary policy”.

- One positive side of President Xi Jinping’s growing power is that he has more ability to take unpopular action in the short term, which for the past 18 months has meant “clampdowns on shadow banking, controls on wealth management products, curbs on local government debt, and limits on real estate lending”. Defaults are growing.

- Growth in both M2 money supply has reduced, and fixed asset investment, which has traditionally been the backbone of the modern Chinese economy, have slowed steadily. Both are now below 10 per cent, having reached 30 per cent at the beginning of this decade.

- As Mr Briscoe puts it: “How this policy impacts the domestic economy directly translates into global growth, and signs of a domestic slowdown are becoming obvious.” Or at least they would be obvious, were it not for the noise created by tariffs.

- There is plainly a risk, therefore, that tariffs could eventually explode and cause damage to markets everywhere. But for now, global market’s difficulties appear to be down to the prudent actions of Xi Jinping, not the imprudent actions of Mr Trump.

3. US Economy, Treasury Rates

Whether it is tariffs or Xi’s China, global growth seems to be showing some slowdown. Will that impact Q3 in US?

- David Rosenberg on Friday – Q2 is an aberration – fade the pickup. The third quarter is going to shape up completely differently.

Hedgeye seems to concur – “We’re calling for GDP to slow starting in 3Q18“. What about the message of ISM?

- Martin Enlund ?

@enlundm – On our models, ISM ought to be dropping soon: stronger USD, wider credit spreads, higher real rates, weaker stock market momentum, EM spillovers, and so on… Dollar’s trajectory will be important!

Wouldn’t that impact the Fed’s decisions? Yes, stated Morgan Stanley (courtesy of an old friend, a reader & a financial advisor in Boston) in their report titled “A Surprisingly Early End to Balance Sheet Normalization“:

Wouldn’t that impact the Fed’s decisions? Yes, stated Morgan Stanley (courtesy of an old friend, a reader & a financial advisor in Boston) in their report titled “A Surprisingly Early End to Balance Sheet Normalization“:

- “To keep the fed funds rate within its target range, we project the Fed will need to end balance sheet normalization in September 2019, earlier than the market expects. We lower our Treasury supply forecasts by $690bn through 2020, and now see the 10y yield at 2.75% by year-end and 2.50% by mid-2019.”

Last week, Tim Seymour of CNBC FM predicted the 10-year will get to 2.60%. This week, he made an even more definitive statement:

- Tim SeymourVerified account @timseymour – Wednesday Jul 11 – Hope you didnt rush out to refi at the highs. WE may have hit cycle high in yields which is NOT good for the

#SPX

While we all hear the warnings of eventual curve inversion, no one was brave enough to predict when. Until this week, that is:

- Bloomberg TVVerified account @BloombergTV Tue Jul 10 – It’s a no-brainer that the Treasuries yield curve is on a crash course to inversion https://bloom.bg/2KILFIx

- “The curve from 10 to 30 years will likely invert by year-end, the rates strategist wrote in a note Tuesday. The spread between these maturities is now about 10 basis points, its smallest since July 2007. MUFG’s model projects the 10- to 30-year gap dipping to -3.7 basis points in early December, he wrote.”

- The risk of curve inversion is on traders’ radar screens and has some Federal Reserve policy makers on edge given that it has historically been a precursor of recessions. The Fed’s plan to continue with gradual rate hikes, even as global trade tensions mount, is helping fuel the flattening. The central bank could tighten four or five more times by the first quarter of 2020, according to MUFG.

- Herrmann says the spread between 5- and 30-year yields will be the next to invert, with the model putting the gap at -3.4 basis points by mid-March. The much-watched 2- and 10-year curve would drop to -4.4 basis points some time around mid-August of 2019, the MUFG model predicts.

What about the 7-10 year spread, the favorite indicator of Rick Santelli?

- Lawrence McDonald @Convertbond – Forward swaps in rates are already inverted, but 7s – 10s are about to join them…

#USTreasuries#Bonds cc@jimcramer@jimmillstein@elerianm

But despite all this bullish talk, the Treasury curve was essentially unchanged this week, except for the 2-year yield which was up 4 bps. Was that because, as Greg Harmon of DragonFly Capital warned last week, TLT was hitting resistance from underneath? So this week’s flat action in Treasuries could be consolidation. Or if the early look of a MACD reversal proves right, we could get a correction in Treasuries. Markets should tell us next week.

4. Diversion – EM Equities vs. US Stock Indices

“Stocks that are leading are poised to outperform but, on the index level, the expectation of the continuation of the rally is much lower; it is almost 1/2” – said Nancy Davis, CIO of Quadratic Capital , on CNBC FM 1/2. Her conclusion was clear & succinct:

-

- “So either EM has to close the gap and rally back up Or the US is overpriced & needs to sell off to meet the rest of the world“

Look what happened this week – Brazil, China & India outperformed the S&P by 2:1, with EWZ up 2.6%, INDY (India’s Nifty 50) up 2.6% and ASHR (China) up 2.9%. Brazil represents the value, beaten-down play in EM but what might represent the growth part? J.C Parets answered that this week in his article Nifty 50 Makes 5-Month Highs:

- The Bottom Line:Large-cap stocks in India continue to lead and we want to be buying the strongest of them. This breakout in the Nifty 50 has a price target nearly 17% higher at 12,820 as long as prices are above 10,530, so we’ve got room to run in this new leg higher.

But what about the falling Rupee? Guess what the top Rupee forecaster said, per Bloomberg?

- “The negatives responsible for the rupee’s recent slide — elevated oil prices and a strong dollar — have run their course, Aditya Pugalia, Dubai-based director of financial markets at the [Emirates NBD PJSC bank], said in an interview.”

- “I don’t see the rupee depreciating below 69 for some time. INR at 69 should provide a boost to exports. That’s why you see no comments from the finance minister about the rupee. They’re happy as long as the rupee remains within a tight range and isn’t too volatile”

What about a contrary opinion?

- Lisa AbramowiczVerified account @lisaabramowicz1 – The selloff in EM currencies and & stocks will likely continue through yearend, according to a Bloomberg survey of investors, traders & strategists.https://www.bloomberg.com/news/articles/2018-07-12/emerging-market-sell-off-is-only-going-to-get-worse-survey-says

5. US Indices Breakout – True or False?

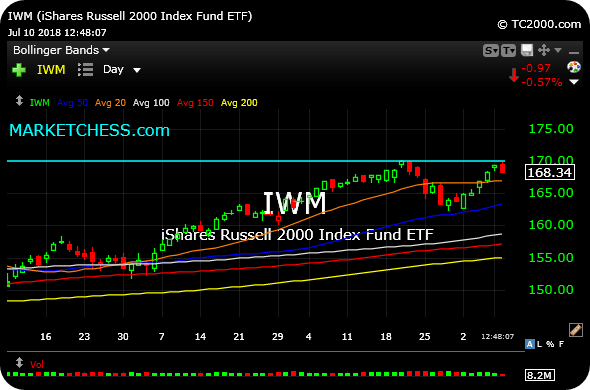

The Russell 2000 was the first major index to make a new high. Then look what happened:

- Chess @chessNwine – Tue Jul 10 –

$IWM Daily. Too early to call a “double top.” But small caps dealing with big, round $170: Not just psychological hurdle now, also technical

Instead of following through, $IWM actually closed down 1.4% from its Tuesday high & down 40 bps on the week, the only major US index to decline this week.

Instead of following through, $IWM actually closed down 1.4% from its Tuesday high & down 40 bps on the week, the only major US index to decline this week.

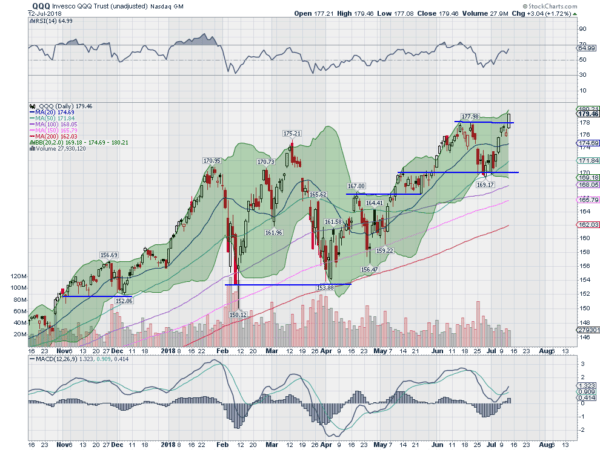

Then came the high in Nasdaq 100 or NDX. Is that a true breakout or a false one?

Greg Harmon wrote in his article Nasdaq’s Next Move:

- “The Nasdaq 100 closed at a new all-time high level on Thursday. They way it did it bodes well for a lot more upside in the Index. … A digestive pause earlier this week was then followed by a strong move higher Thursday. It printed a bullish Marubozu candle on the day, opening at the low and driving higher all day to close at the high. “

- “The Measured Move places a target of 189 on this push higher. And that is not unrealistic looking at the indicators. The RSI and MACD, momentum indicators are solidly bullish. The RSI is rising in the bullish zone and has room before becoming overbought. The MACD just crossed up and is far from extreme values where the price has reversed. The Bollinger Bands are also opening up as the price touches the upside. This allows for a continued Move higher as well.”

- “The contra-opinion will always be there. It sells ads. But for now know that all-time highs beget more all-time highs and enjoy the ride higher.”

He was not the only one:

- J.C. Parets @allstarcharts – NEW POST: Nasdaq 100 Stocks Breaking Out http://allstarcharts.com/nasdaq-100-stocks-breaking/ …

$QQQ$NDX$PYPL$ATVI via@BruniCharting

What about the other side?

- Thomas Thornton @TommyThornton –

$NDX futures has another upside daily DeMark Sequential 13 exhaustion signal today. The other two signals had subsequent drops of 10% and 11% Happy Friday the 13th! More on today’s Hedge Fund Telemetry Daily Note

Just words & pictures or some trades as well?

Just words & pictures or some trades as well?

- Thomas Thornton @TommyThornton – Buying puts in

$QQQ for the first time since March. Buying the Aug 178 for 2.75 and 175’s for 1.95, and the Oct 170’s for 3.25

He was not the only one:

- Igor Schatz @Copernicus2013 – Nasdaq starting to look tired as it bumped against upper gollinfer band with RSI bearishly diverging at new highs.. i am buying 5 week

$QQQ 175-168 p/s here at almost 7×1 payout into seasonally bearish period

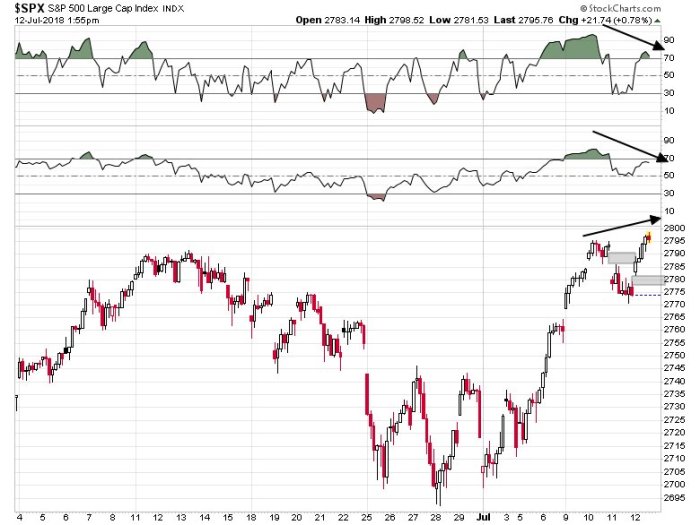

Two weeks ago, we highlighted a tweet by Cam Hui pointing out a bullish divergence. Last week, we featured his tweet calling for S&P 2800. We got that on Friday. What does he say now?

- Cam Hui, CFA @HumbleStudent –

$SPX filled gap and trying to break up, but exhibiting negative RSI divergence Underperforming mid/small caps also cautionary flags$MID$SML$RUT Gap fill potential below

- Mark Newton @MarkNewtonCMT – S&P Fut

$ES_F 4 hr chart shows the negative momentum divergence on this push back to important 2805-10 resistance while counter-trend exhaustion present, not dissmilar from what happened in mid-June at peaks along w/ late June lows– Have a nice weekend All#TechnicalAnalysis

Rick Santelli pointed out that S&P’s weekly close above 2786, June high, represents “breakout country“. And next week is Options Expiration. So we could see some fireworks.

Rick Santelli pointed out that S&P’s weekly close above 2786, June high, represents “breakout country“. And next week is Options Expiration. So we could see some fireworks.

6. Financials

Over the past few weeks, we featured smart gurus recommending Utilities & then Staples as rally candidates from “disliked’, sold-off conditions. Carter Worth of CNBC Options Action was one of them. This Friday, he stepped out & suggested buying Financials, esp XLF. Yes, he had seen major banks sell off in the morning despite good earnings. But he said he was surprised by “how well they recovered intra-day“.

On the other hand,

- Mark Newton @MarkNewtonCMT –

#CITIGROUP$C Broke down to important near-term trendline support#IBDPARTNER but@MarketSmith shows volume expanding on today’s break to the highest levels in over a mth- RS line is down to early June lows- A breakdown looks likely into late July technically-#AVOID#Financials

7. Netflix – 100% Rotten Tomatoes Rating

Netflix reports earnings on Monday. The stock, uncharacteristically, fell hard on Friday. Carter Worth said “fade it” on Friday’s CNBC FM.

Getting to the fundamentals of Netflix & its drive to build content, @Jo_Livingstone wrote in the New Republic:

- “This week Netflix premiered its first original series made in India, a cop thriller called Sacred Games. Adapted from the enormous 2006 novel by Vikram Chandra, Sacred Games is a sophisticated move in Netflix’s quest to net every eyeball on earth. “

This series received a 100% rating on Rotten Tomatoes. We recommend this series to readers. It is totally unlike typical Bollywood productions and more like hard hitting films that appeal to a smaller niche. That makes it ideal for Netflix viewers. The villain is played by Nawauddin Siddiqui whom Ms. Livingstone describes as:

- ” … Siddiqui is an actor of rare magnetism. It’s hard to locate where that charisma lies: He does not wander very much from a hard-set expression of cruel determination. But I could watch Siddiqui set his brows into that furrow all day. The faintly mystical aura of his biography and certain strange wanderings into romantic love do not so much humanize Gaitonde as make him more marvelous, more mysterious.”

What we liked was the realistic portrayal of the women, the way women are described in novels instead of the plastic images of Bollywood. The dialogues are real and hard.

The series does wander a bit in the middle but as Ms. Livingstone wrote:

- “But though I lost my bearings in the sweep of the series’ action, I never lost my attention. … For Nawazuddin Siddiqui’s face alone I would watch it again.”

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter