Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. “Long away from” rapprochement? Also Trust Severely Shaken?

No, we are not talking about yellow vests & Macron in Paris. We are talking about now “being a long way from” rapprochement with China. Remember how the markets were quasi-sure about getting good news for Monday from the Trump-Xi dinner? How smart & plugged-in asset managers like Rick Rieder of BlackRock had added risk last week because they thought this past Monday would be a happy day?

Well, Monday morning was euphoric and despite the fade of the early morning 400+ point rally, Monday remained a happy day. But Tuesday was horrible. Tuesday’s decline was more than 3 times the rally on Monday. No one understood the reason for that vicious sell off. Then Wednesday, a market holiday, brought the news of the arrest on prior Friday of Meng Wanzhou, the CFO of Huawei and daughter of its founder.

This was a sucker punch between the eyes for the US stock market. All of a sudden, the steep fall on Tuesday made sense, especially when NSC Advisor Bolton confirmed he knew of Ms. Wanzhou’s arrest on Friday, a day before the Trump-Xi dinner. That made Tuesday’s steep fall a possibly insider knowledge based event.

Thursday morning’s fall was even worse than Tuesday until the stock market bounced from November lows of 2630ish and, according to celebrated observer & author Nomi Prins, report of a ” … new wait-and-see mentality” on interest rates at their upcoming meeting in less than two weeks” created a big rally that reversed much of the losses.

Friday’s Non Farm payroll was almost tailor made for a rally on weaker but not too weak employment report. The US stock indices rallied and the Dow was up over 130 points after the open, the rally supported by gentle positive comments from Larry Kudlow. That rally was faded first slowly & then viciously after Peter Navarro was very hawkish on CNN.

The deep divide between the Kudlow-Mnuchin camp & the Navarro-Lightheizer camp is now fully exposed. As a result, it would be much harder to get swayed by soothing words of Kudlow. A bigger blow to trust has been the insider game; the previously unimaginable notion that a huge market moving event like the arrest of Huawei CFO could be kept from markets for 4-5 days.

Trust has now been irreparably damaged, we think. Further we have all come to realize that the US-China issue is NOT a skirmish that can be fixed but a huge clash between two totally opposite semi-existentially strategic compulsions.

The US is determined to remain the uniquely dominant superpower in the World. Next generation technology and Intellectual Property that generates the technology has to be protected against the new challenger at all costs.

China is determined to become so strong that it can create its zone of supremacy in which the US cannot enter. This zone includes the southern Pacific and the eastern half of the Indian Ocean. This requires complete supremacy in the critical straits of Taiwan Straits, South China Sea and later the Malacca Straits. This requires China to obtain critical technologies by any means necessary.

This brings us to Huawei & ZTE, two companies deemed to be national resources of China.

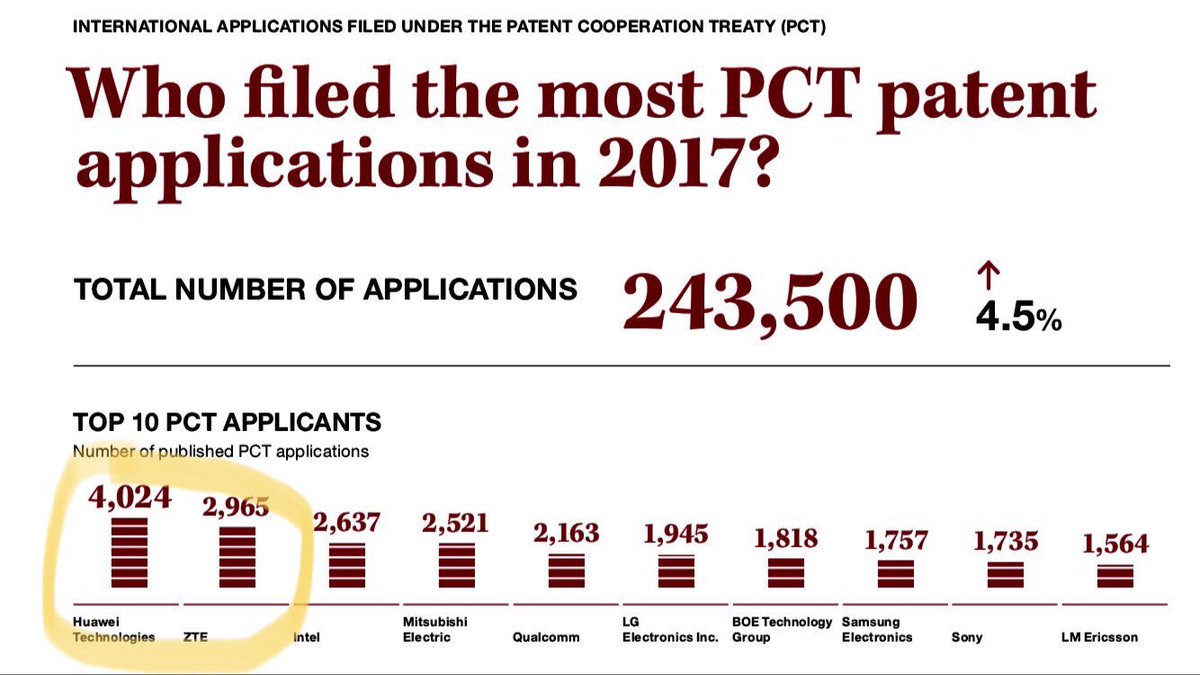

- Lawrence McDonald@Convertbond Dec 6 – Huawei & ZTE, Chinese telco suppliers targeted by US. For China, they aren’t just big firms but pillars of its “new economy”: two biggest filers of patents globally last year, 15% of China’s applications. Hard not to see this as big escalation of tensions. v @S_Rabinovitch

The US has tried to go after Huawei & its senior executives by traditional methods. The warrant that was used to get Canada to arrest Ms. Wanzhou was issued in August 2018. This warrant was a big step because it accused Ms. Wanzhou of financial fraud. But there was no way to serve it & arrest Ms. Wanzhou because she had stayed away from US territory. Her planned travel through Vancouver allowed the US authorities to approach Canadian officials & have Ms. Wanzhou arrested. The next step is extradition to America if the Canadian Judge allow such extradition.

The markets now understand that the US-China issue is way beyond purely financial issues like Trade Deficit & tariffs. It is a battle that approaches the intensity of a conflict between strategic imperatives of both US & China that might be analogous to the FDR & Henry Stimson conflict with 1930s Japan.

The level of this conflict persuaded even Jim Cramer to say on Friday on Mad Money that this conflict is bigger than the economy and much bigger than corporate tariffs. If nothing, the elevation of the US-China conflict to a battle for hegemony will be negative for the medium-term PE multiple of the S&P and especially of the Tech sector.

And this Huawei arrest is a chilling warning for executives who travel all over the globe. Heck, even Jeffrey Sonnenfeld, professor at Yale Business School, said on CNBC on Friday “I am cutting back on my own travel right now“. An article in FT discussed this in more detail:

- “There’s a lot of concern among well-connected Chinese, or Chinese executives of companies that the US has criticised,” said Shaun Rein, managing director of CMR China, a market research group. “They feel it is a step too far, that it is targeting individuals.”

- “If Washington is now in the business of nothing short of taking hostages in the form of detaining business executives, not just in Canada but potentially anywhere in the world, for the purpose of having them extradited on to US soil and tried for sanction violations there, what Chinese businessman is going to travel any longer, not just to the US but any jurisdiction that would be minded to easily kowtow to the forces in Washington?” wrote Roland Hinterkoerner of Expertise Asia, a corporate consultancy.

- “They looked at Russia, with the travel ban and asset freeze in the US. They are worried how it hits them,” said Joerg Wuttke, former head of the European Chamber of Commerce in Beijing. “There was anxiety already.”

The decision on bail for Ms. Wanzhou is expected on Monday. That, in itself, should make Monday’s trading even more volatile.

No wonder the semiconductor sector, most exposed to China, got torched this week.

2. “Macro Economics not as important as this”

When was the last time we heard an economist, especially an economist working at a huge global asset manager, say such a thing? Never. And what could be more important to an economist than macro economics?

The answer according to Tony Crescenzi of Pimco is Brexit, Italy & US-China. Based on next week’s vote and based on a European Court ruling, Britain could go from one extreme of Hard Brexit to the other extreme of No Brexit after potentially a new PM, a new election and/or a new Brexit referendum.

All the three factors mentioned by Tony Crescenzi are uncertainties that just can’t be measured. How is that positive for either PE multiples or corporate confidence?

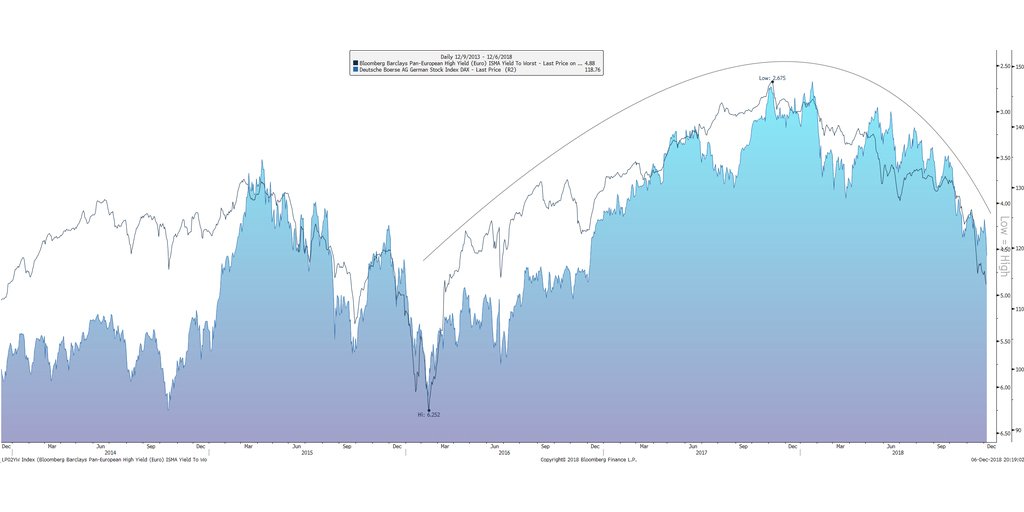

- Real Vision Research @RealVisResearch – The European High Yields are underperforming European equities, while such dislocation may extend for a period of time, it generally corrects with equities catching up to the more senior capital. #ThinkTank #JointheDots

- Gowri Gurumurthy @gowrinyc Junk bonds had the worst day since February 9 with a loss of 0.6%. CCCs led the downward spiral suffering the worst losses since Feb. 2016. @TheTerminal

No wonder the Banks got torched with Citi down 10% and Bank of America down 9% on the week.

3. Fed, Treasuries & Curve Inversion

Yields along the Treasury curve fell hard this week with 30-yr yield down 16 bps, 10-yr yield down 15 bps, 5-year yield down 13 bps, 3-year yield down 10 bps & 2-year yield down 8 bps. Both the 5-3 curve & 5-2 curve inverted this week to minus 2.3 bps & minus 1.8 bps resp.

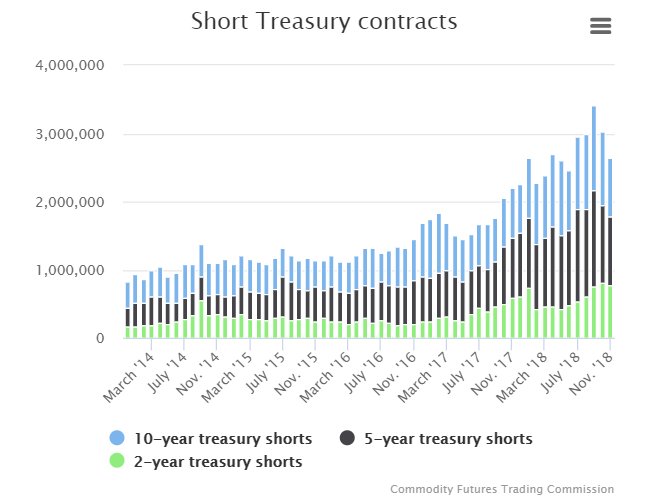

Why did the 5-2 year curve invert? Simply put – more buying in 5-year Treasury vs. in the 2-year Treasury note. From where did the buying come? From the bonfire of the biggest short position in history, of course.

- Amy ResnickVerified account @Resnick_PI – Treasury shorts fall out of favor https://www.pionline.com/

article/20181207/INTERACTIVE/ 181209905/treasury-shorts- fall-out-of-favor … #chart #rates #shorts

- “Short positions in five- and 10-year Treasury futures contracts fell 30% in November from the end of the third quarter after reaching record highs at the end of September. Short positions in two-year contracts also hit a record high in October and fell 5% over the following month.”

No wonder the 5-year yield fell by 18 bps & the 2-year yield only fell by 8 bps over the last two weeks thereby converting a positive spread of 6 bps to minus 2 bps. What’s the next inversion?

- Raoul PalVerified account @RaoulGMI US 2 year yields are still at 2.75 and one month Libor is at 2.35. I think that inverts in the next two months. It’s game over for the business cycle. Buy bonds, wear diamonds…

Any message for the Fed?

- Raoul PalVerified account @RaoulGMI Dec 4 – While you were all watching the mid part of the curve, the 2s 10’s swap curve is at zero and about to invert. Less noise than treasury curve. Also 1’s 2’s swap curve about to invert (is at 6bps). That’s a good signal the Fed have gone too far.

But will the Fed listen? For 2019 probably?

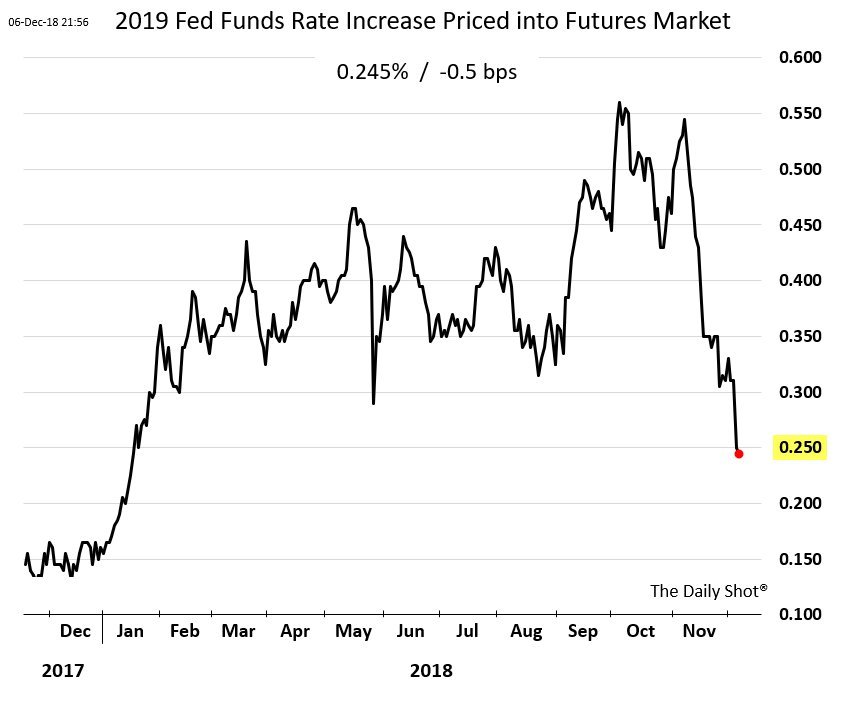

- ((The Daily Shot))) @SoberLook Chart: The fed funds futures market is now pricing in less than 25 basis points rate increase in 2019 –

But what about December’s FOMC meeting? Dr. Bullard says No to a rate hike in December. But Dr. Brainard says yes to “near-term rate hikes”. Guess she doesn’t agree with David Rosenberg!

But what about December’s FOMC meeting? Dr. Bullard says No to a rate hike in December. But Dr. Brainard says yes to “near-term rate hikes”. Guess she doesn’t agree with David Rosenberg!

- David Rosenberg @EconguyRosie Housing is in contraction mode. Core capex orders in decline. Banks shedding assets. Jobless claims on the rise. Payroll data reveal a soft income underbelly. Recession coming next year and it’s too late for the Fed to prevent it.

The bigger question is whether the Fed keeps draining liquidity via monthly QT until this recession hits.

A more important question is what “sensible” people should be doing instead of getting caught up in the recession vs no recession debate.

- Will Slaughter @MilwaukeeBonds Dec 4 – The main implication of an inverted yield curve for investors is that bonds are likely to outperform stocks for the next several years. Instead of arguing about whether there will be a recession, sensible people will be busy reallocating towards high quality fixed income.

Finally a sensible description of why Chairman Powell may actually turn dovish from Nomi Prins via Daily Reckoning:

- “For now, he’s more worried about a crash. The Fed is realizing that economic growth is slowing and that raising rates too much, too quickly, could spook the markets at a critical time and cause a recession. That’s why you should expect more dovishness to come from the FOMC meeting on Dec. 18-19, which will lift markets into year-end. You can also expect the Fed to proceed very cautiously next year.“

4. Stocks

This was a horrid week. The 4 big indices Dow, S&P, Comp & NDX were down 4.5% – 4.8% this week. Russell 2000 was down 5.9%. Dow transports were down 8%. Banks, semiconductors & Transports were torched.

But the most stupefying reality is:

- Igor Schatz @Copernicus2013 A little weekly vol but otherwise we are flat over past 2 weeks $SPY

As CNBC’s Michael Santoli said after Friday’s close, we have seen repeated tests of the lower end of S&P’s range. So what is next? Do we break the support finally & open the trap door? Or do we bounce first again?

Different answers below:

- Peter Ghostine @PeterGhostin A bounce to 267.46-268 should now be underway before the downside resumes.

- Thomas Thornton @TommyThornton – $SPY 252, $QQQ 156 potential targets

- Ryan Detrick, CMT @RyanDetrick Dec 5 – S&P 500 down 3% in December is quite rare. Before yesterday? Happened in 2008, 2000, and 1987. Scary years, but worth noting S&P 500 closed the month of December higher all 3 times.

5. Gold

- Peter BrandtVerified account @PeterLBrandt – The classical charting definition of this pattern is a horn or sloping bottom. This is a bullish pattern unless the Nov 16 low is penetrated.

6. Crash

J.C. Parets has been warning about the possibility of an upcoming crash in the stock market. Nomi Prince said Fed Chairman Powell is worried about a crash. Then we saw the below on Saturday morning:

- Raoul PalVerified account @RaoulGMI – The probability of a stock market crash is as high as I remember it. The chart patterns are extremely concerning. Safest expression of view – 2 yr bonds and Eurodollars, riskier expression is shorting equities and suboptimal expression is long dollar. Caution!

#GMIcrashpattern

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints.com