Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”what is the catalyst to stop the selling?“

This was the plaintive cry of Scott Wapner to every trader & guest on his Friday CNBC Half Time show. The answer is so simple. Not just a verbal answer but an exact parallel. The parallel is about a Head of a Central Bank, a man who was both obdurate & utterly insensitive to the collapse in liquidity in his economy. Then looked what happened:

Look at the huge outperformance of Indian Nifty ETF, INDY, over the SPY in the past two weeks. The obdurate RBI Governor resigned on Monday, December 10 and was replaced by a new Central Bank Head known for his ability to bring differing viewpoints together to work with the Finance Ministry.

Look at the huge outperformance of Indian Nifty ETF, INDY, over the SPY in the past two weeks. The obdurate RBI Governor resigned on Monday, December 10 and was replaced by a new Central Bank Head known for his ability to bring differing viewpoints together to work with the Finance Ministry.

We kept thinking about this parallel while listening to the almost unanimous rejection of what Chairman Powell said & how he said it. Think about it; think about the rally that would explode if Fed Chairman Powell were to resign and be replaced by a well known & well liked economist who is noted for his ability to work with differing viewpoints. Who are we talking about? Larry Kudlow, of course.

Frankly, the biggest reason for the complete puke in equity markets is that Chairman Powell has blown up his credibility with markets. That leaves the big question:

2. Obduracy or Arrogance of 1/2-knowledge?

To her credit, CNBC’s Sara Eisen was honest & direct. She said traders behind her were yelling “make this guy stop talking“. The market virtually puked & kept puking at the sight & sound of Chairman Powell talking about their models & uttering tone-deaf statements like balance sheet contraction will remain on autopilot & that Fed policy doesn’t have to remain accommodative at this stage. It was as if the stock market was running away from that spectacle.

What drove Chairman Powell to make these statements? He might have felt bullied by the chorus of statements asking him to stay his hand from luminaries like Stanley Druckenmiller, Jeffrey Gundlach & so many others, not to mention President Trump. Is that why he was so vehement in his press conference? If yes, then, with all due respect, he should not remain as Fed Chairman whose job, above all, is to be a shepherd of the US economy and to act in its best interests at all times.

Or was it an obdurate devotion to backward looking models that the Fed is famous for? Is that why he gave a lecture about their models to the people in his presser? That would be just as incompetent as the fiasco of fed policy in 1970s.

This was also a problem with previous Fed Chairmen but no one spent 20-30 minutes lecturing during their press conferences. And they were very bright & scholarly Ph. D. economists like Bernanke who could not be browbeaten by the Fed’s staff of 700 economists. We fear, unlike Bernanke-Yellen-Greenspan, Powell was intimidated by the knowledge & scholarship of his Ph. D. staff & so he recited the lecture he was taught in his presser instead of speaking simply & clearly.

Contrast his lecture with a simple, clear statement of David Rosenberg the next day –

- “Inflation this time next year is back to zero. So the real funds rate is actually +2% or higher; it is not actually zero; … so the Fed has already moved into a restrictive mode..”

But forward thinking just doesn’t seem to be Powell’s forte. And he seems to not see what almost everyone else sees – that liquidity is disappearing from markets at a rapid rate. That again shows his intellectual obduracy, based on below:

- Danielle DiMartino @DiMartinoBooth – Dec 20 – Read the 2012 transcripts. Powell was skeptical of quantitative easing (QE) back then and focused on an exit strategy in exchange for agreeing to vote for the last round of QE. …Wednesday he repeated that the balance sheet was not up for negotiation.

Ms. DiMartino is absolutely correct. Chairman Powell was crystal clear in his press conference that the balance sheet contraction will remain on auto-pilot. That was destructive to markets and what followed was sheer liquidation.

But that wasn’t the worst of it. That came on Friday.

3. “Fool Us Once … , Fool Us Twice“

The steep decline of the past 2.5 months began in the morning of October 4, 2018 after Powell’s appallingly loose comment about the Fed Funds rate being “long away from neutral“. That was such a loose-lipped statement that CNBC’s Becky Quick said he would never have said that in a speech. We felt she was right and so did markets. So when Dallas Fed President reassured markets that the Fed was data dependent & when Chairman Powell himself said so in his NY speech, the markets responded with a huge rally.

But was that October 3 statement really a loose-lipped comment? That statement now has to be regarded as a core belief of Powell after the studied, prepared comments of his during his presser. But the action in markets and the outpouring of intense criticism must have shaken them some. So they trotted out San Francisco President Williams to tell the markets that the Fed is really data dependent in all matters including the balance sheet contraction.

The Dow rallied by 300+ points in 10-15 minutes after this reassuring clarification. Then they sold the rally and kept selling relentlessly till the end of the day. It is almost you could hear markets saying “Fool me once, shame on you; Fool me twice, shame on me“. Kevin O’Leary, or CNBC’s Mr. Wonderful called it “whipsaw city” and dismissed comments of Williams by saying anything that has to be said has to be said by Powell and not any of his agents.

Unfortunately, the Williams exercise on Friday further damaged the credibility of this Fed and everybody else, the US markets, US economy, the American people will pay for it.

3. Does (-L) lead to “D”?; A Theme for 2019

Some FinTV people tried to spin Powell’s stance as doing his job of managing the economy and not allowing markets to dictate to him. These are the same people who kept saying before October how interest rates were going up for the “right reasons” and how good that would be for markets.

In contrast, smart & real investors kept warning that a steep market correction could actually end up damaging the economy & possibly cause a recession. They are slowly proving to be correct and that makes Powell’s refusal to heed the message of the markets both obdurate & tone deaf.

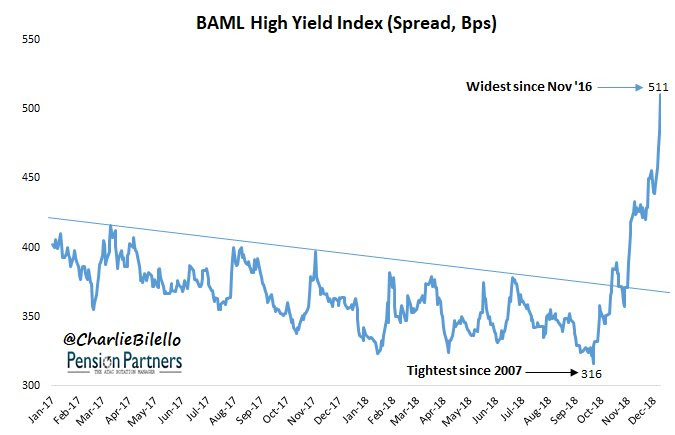

So far bullish strategists were comforted by the muted reaction in corporate credit. No more. Credit just about imploded this week.

- Charlie BilelloVerified account @charliebilello – US High Yield credit spreads move up to 511 bps, widest level in over 2 years. $HYG

If this is not bad enough, what is going to happen next year in Corporate Credit?

- “next year is the first year for trillion dollars annually of corporate debt refinancing, from high-yield to investment grade to leveraged loans; … so capital spending is going to be crowded out; … cash flows are going to be used for debt service & debt retirement ..” ; corporate deleveraging will be the theme of 2019”

How can this be good for PE ratios?

The central problem for David Rosenberg is “the “L” word, the growing loss of market liquidity that has been the root cause of the heightened volatility“. What happens when liquidity is relentlessly removed from an economy as leveraged as the US economy? The “D” word.

Stephanie Pomboy of MacroMavens said on Fox Business in her clip titled “market correction would precipitate a recession“:

- “I think worrying about inflation is a great waste of time in an economy as leveraged as ours is; the tendency is deflation, not inflation; that’s going to be the problem here“

What would do well if we do get a corporate deleveraging with a side of a little deflation? What Stanley Druckenmiller is already positioned for:

Druckenmiller said:

- “I always made it in Treasuries … one of my biggest hits was 2-year Treasury in 2000 at 6.04% (FF rate was 6.5%); they went down to 1.5% – 2%; … now I am starting with 2-year Treasuries at 2.68%; .. but I am long Treasuries; long 2-yrs, long 5-yrs, long 10 yrs; … I don’t like the level but I like the risk-reward; … if the Fed makes a policy mistake; it is not inconceivable to me at all that the 2-year is back to 50-60 bps in a couple of years… “

Putting the best spin on what Chairman Powell said & did this week, in the words of David Rosenberg, the Fed is a very incremental institution that moves very slowly, and that could deadly in this environment. Confidence is precarious even in the best of times. But in this type of a liquidation driven market environment, loss of confidence could be very damaging. Add the corporate deleveraging theme of Rosenberg and it may not take much to get the deflationary contagion start seeping in again. We know the Bernanke Fed, despite the scholarship of Ben Bernanke, was always behind the contagion. So the deflationary contagion spread ahead of Bernanke’s easing and caused the damage it did.

If a scholar of the Great Depression like Bernanke could not move fast enough, what hope is there for an obdurate backward looking model disciple like Powell? Perhaps that is why Greg Jensen, CIO of Bridgewater told Reuters:

- “The biggest theme developing is that you are going to have significantly weaker growth (US GDP up 1% in 2019), near recession-level growth in 2019, based on our measures, and the markets are generally not pricing that in,”

That will be profitable for any one holding 2-yr, 5-yr & 10-yr Treasuries, right?

4. Good or Bad Oversold?

This was a terrible week for US stock indices in a long time – Dow & S&P down 7%, Nasdaq & NDX down 8.4%, Russell down 8.4% and so on. On the other hand, interest rates fell hard across the curve – 30-yr down 12 bps, 10-year down 11 bps, 5-year down 10 bps & 2-year down 9.6 bps – all this in a week that featured a rate hike and a resolute commitment to QT. It was like the Treasury market was laughing at Chairman Powell.

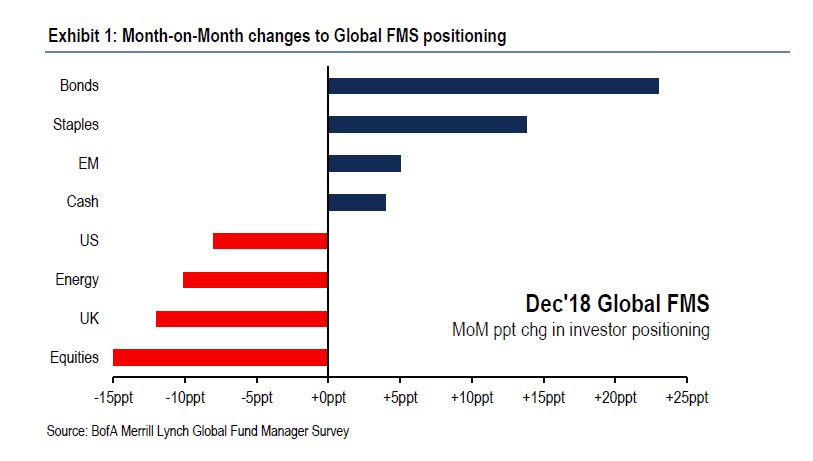

But does a near 10% outperformance of TLT over QQQ/SPY in one week suggest an extreme move?

- Babak @TN – BoA GFMS: “the biggest ever one-month rotation” into bonds and out of equities #sentiment

And there is no shortage of tweets/comments suggesting a near term top in Treasury bonds and a near-term bottom in stocks. For example,

And there is no shortage of tweets/comments suggesting a near term top in Treasury bonds and a near-term bottom in stocks. For example,

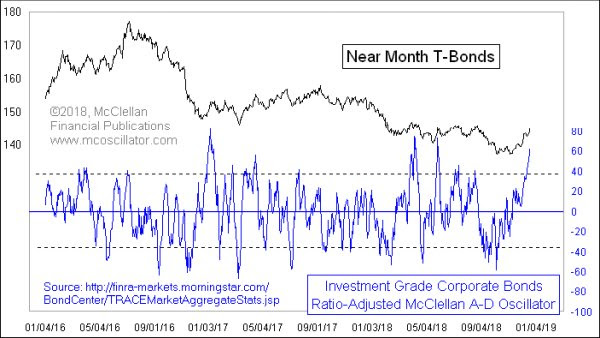

- Jesse Felder @jessefelder – T-Bond prices have had a nice run upward since the lows in October and November 2018, but now we are seeing an important indication of a blowoff top, suggesting bond prices will not be able to continue higher from here. https://www.mcoscillator.com/

learning_center/weekly_chart/ t-bond_blowoff_top_signaled/# When:23:21:03Z … by @McClellanOsc

- Jeff York, PPT @Pivotal_Pivots – $XLK today, landed on it’s 2018 Yearly Pivot(YP). The high in 2018 was at the Yearly R2 Pivot. Yr2 to YP move=Textbook. YP is where Fair Value is @PivotaPivots.

Then you have @TommyThornton talking about $SPX & $NDX bullish statement at 5% & Helene Meisler warning bullish sentiment on $VIX in 93. So a vicious bounce in stocks could be at hand. An explicit comment came from CNBC’s Michael Santoli:

- Michael SantoliVerified account @michaelsantoli – Short-term tactical call just now from the #MysteryBroker: “The stock market is going to rally 150 to 200 S&P 500 points starting either today or Monday. My technical indicators are short-term at levels that always cause a vicious rally. The shorts are going to be covering.”

This makes perfect sense especially in normal oversold conditions. On the other hand,

- Peter Ghostine @PeterGhostine – I;nm now able to narrow down the objective on the Russell 2000 to 1,172. That’s almost 10 percent from current levels. #NYSE #STOCKS #StockMarket #OptionsTrading

Frankly, the action of Friday and this week reminds us of another triple witching Option Expiration Friday, October 16, 1987. But Christmas week cannot be anything like that. That would not be fitting. And this Monday is only a half day. So hopefully Algo havoc, if any, is to the upside.

Then the day after Christmas the year-end rally is supposed to begin. The stock market is so oversold that it may not take much ammunition to rally hard. If it does not materialize then what does it mean? Deflation according to the Abby Joseph Cohen dictum we recall from October 2000.

If this coming week were Diwali or another Indian festival, we could say Buy Gold, as Carter Worth of CNBC Options Action did on Friday. We will not because we are not sure it would be appropriate for Christmas.

5. A Treat for the Mind

As you enjoy various treats this weekend, see if you can spare 59 minutes for the clip below.

Kudos to Erik Schatzker of Bloomberg TV for both content & the timing.

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter