Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.“in a word – yes”

Somehow the world got clearer this week. First the largest economic region in the world:

- Howard Ward @hwardward – The eurozone’s waning fortunes reflect a drastic turn of events from just two years ago. We are not immune from what happens in Europe. The Eurozone is largest economic block.

So drastic that the EU Commission slashed EU’s projected rate. Now look from east to the southwest of us:

- Scott Barlow @SBarlow_ROB – RBA cuts Australia GDP forecast as China slowdown worsens | Financial Times

As the FT wrote,

- “The central bank said in its monetary policy statement on Friday that it had lowered its forecast for gross domestic product growth for the year to the end of June from 3.25 per cent to 2.5 per cent. The RBA warned that a correction in the property market, which has seen national house prices fall 8 per cent from their 2017 peak, is “a significant area of uncertainty””

Now to the source of many of the world’s troubles. The host of the clip below asked ECRI’s Lakshman Achuthan – is Chinese economy slowing relentlessly? “In a word – Yes“, replied Achuthan.

The trouble with understanding commodity indicators comes from risk appetite & market movements. For example, Copper rallied by 1.4% this week while global economic forecasts were being downgraded. Achuthan addressed this by separating exchange-traded indicators from non-exchange traded indicators and said that these non-exchange-traded indicators are still falling with no uptick in sight.

Ok but isn’t the US economy immune from this global slowdown?

- David Rosenberg @EconguyRosie What an ISM non-manufacturing PMI report! The share with growth plunged from 94.4% in Sept to 50% now. Lowest since January 2016. The share contracting came in at 44.4% – only surpassed this cycle at this time of year back in January 2010 and 2016.

But falling rates should be good for housing growth, right?

- David Rosenberg @EconguyRosie The definition of pushing on a string is when mortgage rates dive to 10-month lows and mortgage purchase applications still manage to drop for three straight weeks and down 1.8% from year-ago levels.

What about retail sales?

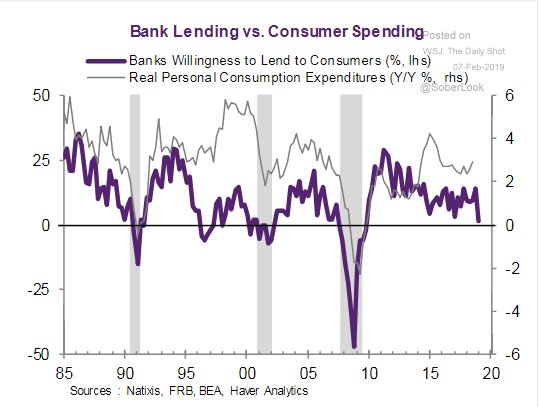

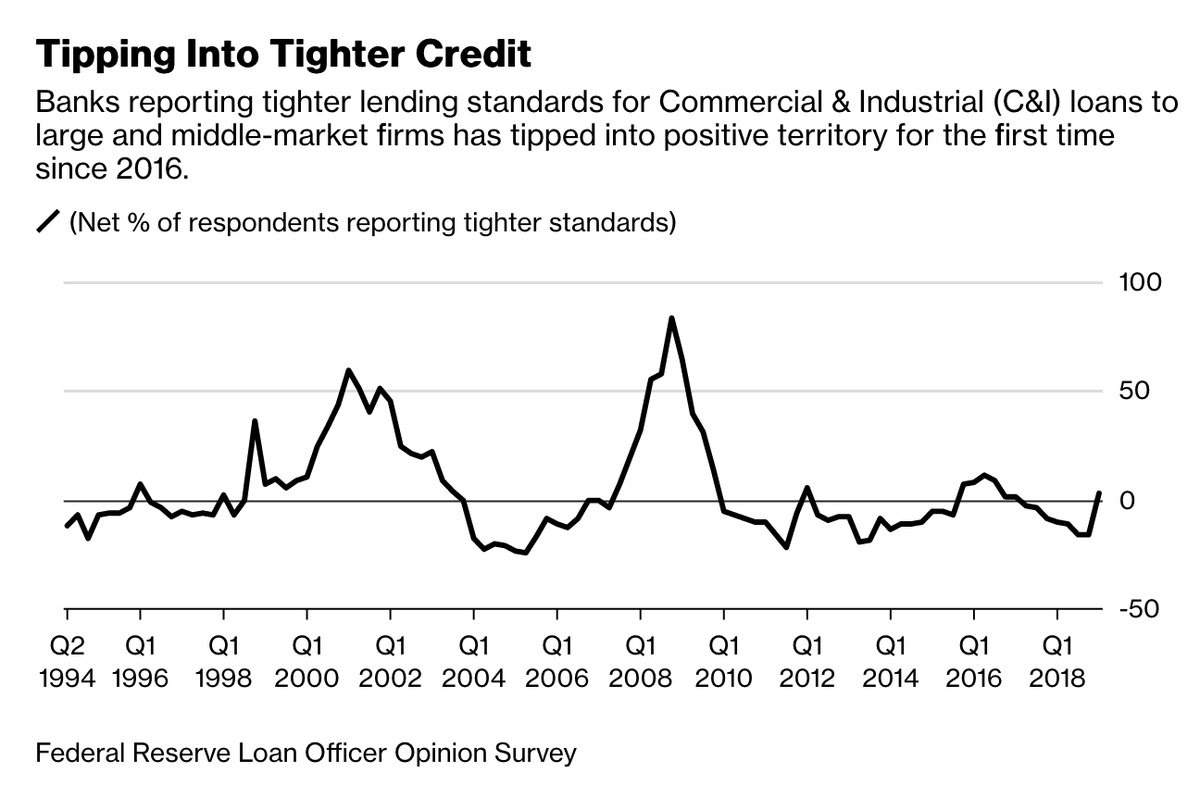

- Lisa AbramowiczVerified account @lisaabramowicz1 – Feb 7 – Banks are becoming less willing to lend to American consumers, which may ultimately mean they can’t spend as much: Natixis research https://blogs.wsj.com/

dailyshot/2019/02/07/the- daily-shot-retail-sales- slumped-in-january/ …

- “The Federal Reserve’s Senior Loan Officers Survey released earlier this week showed banks tightened lending standards over the last three months at the fastest rate since the middle of 2016″

Is there one bank that reflects all of the above?

Is there one bank that reflects all of the above?

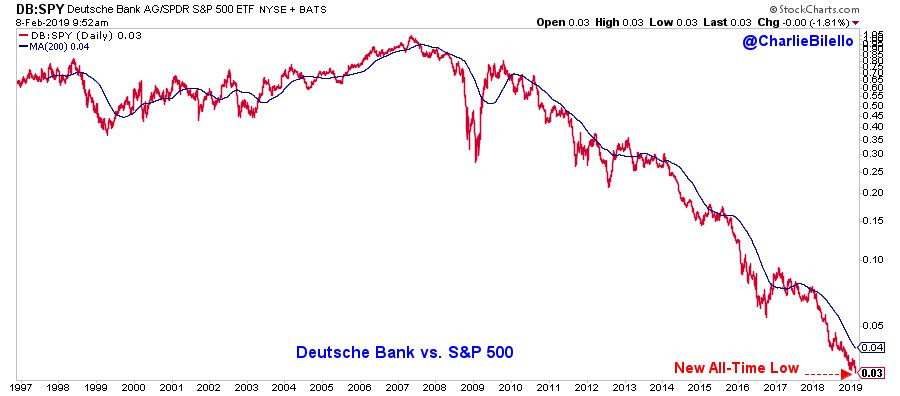

- Charlie BilelloVerified account @charliebilello – 10-year German Bunds at 9 bps. Deutsche Bank vs. S&P at new lows…

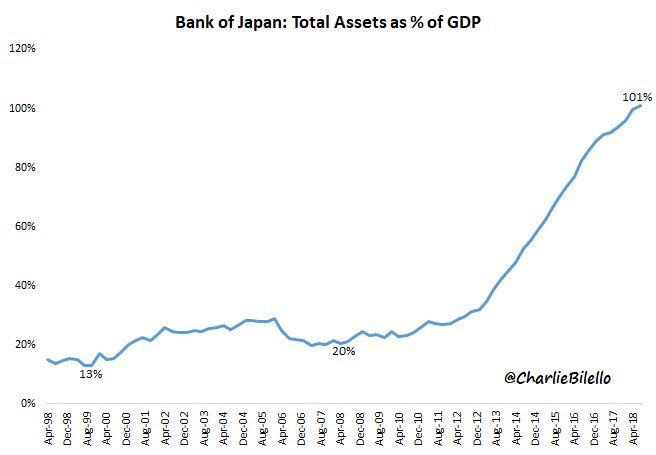

The entire 1-9 year German Bund curve is now NEGATIVE. The 10-year Bund rate could go negative with another week like this past one. The Japanese 10-year has already gone negative. So what? Bank of Japan will do more QE & buy more assets?

- Charlie BilelloVerified account @charliebilello – The Bank of Japan’s assets as a % of GDP is now above 100%. 5 years ago it was 40%. 10 years ago it was 20%. #BOJ

But we don’t need to worry about that because our Fed is still focused on QT, right?

But we don’t need to worry about that because our Fed is still focused on QT, right?

- Jeffrey GundlachVerified account @TruthGundlach– Fed says it is currently discussing using QE as a regular tool, not just during “emergencies” or when the Funds rate is at the “zero bound”.

Man, even a rustler in the wild west could not change a “T” brand into a “E” this fast. So why doesn’t the FOMC cut interest rates in the March meeting? Oh yes, that paramount focus on maintaining “credibility” of the Fed !

Why are we so sure about the Fed not cutting rates soon? Because the 1-year Treasury yield stays resilient while the the rest of the Treasury curve keeps falling below the 1-year yield. The 5-year yield closed 9 bps below the 1-year yield while the 7-year yield closed at the 1-year yield.

And yes, Treasury rates melted across the curve this week with 30-year & 10-year rates falling by 5.6 bps, the 5-year falling by 6.7 bps and even the 2-year falling by 4.5 bps.

Next Friday marks the end of the 3-week window for the bipartisan panel to deliver “border-wall” funding. And two weeks after that comes the increase in tariffs to 25% on Chinese goods. And this week’s new wrinkle is the planned removal of current zero% tariffs on a range of Indian exports to the US.

Might there be a method to all this? Better to get all this now to slam the US & global economy in the next month & next quarter. Elevate the pain to such a level that the bounce back in Q4 & 2020 can be robust with the Fed lowering rates aggressively & a worried Congress working with the President to pass a blue-collar infrastructure program.

So what do stock investors do in the mean time?

2. US Stocks

Finally we found a bullish strategist who said clearly – we will go into a bear market if we don’t get a rate cut. His thesis is simple – the global synchronized slowdown we are seeing will result in central banks turning to easier money globally. He points to 1995 & that year’s tariffs against Japan & EM weakness led by Mexico. So what led the huge 1995 S&P rally – two rate cuts by the Greenspan Fed.

.

A realistic way to describe the week was

- Greg HarmonVerified account @harmongreg – Somehow the $SPY closed up on the week

That “somehow” was a 8-handle vertical love in the last few minutes.

The reaction to this vertical flash was not universally positive. For example,

- Bob Lang @aztecs99 – spx rallied up to finish green, vix fell again and closed below the 200 ma, volume was poor and there is a lower low and lower high today. going to be tough going over the next couple weeks for the bulls it seems.

Look what Lawrence McMillan wrote in his Friday summary:

- “In summary, the intermediate-term outlook remains bearish. The short-term outlook may not be so bullish any longer, either, although there is only the lone sell signal. If $SPX breaks below support at 2620, that would be very negative.”

The action in $VIX bothered some:

- SentimenTraderVerified account @sentimentrader – It has rarely been a good sign when the VIX drops so much during a downtrending market.

-

- Thomas Thornton @TommyThornton – $SPX cumulative breadth with upside DeMark Sequential, Combo Countdown 13 exhaustion signals. A market pullback is expected. More on today’s Hedge Fund Telemetry Daily Note.

3. Dollar, EM & Commodities

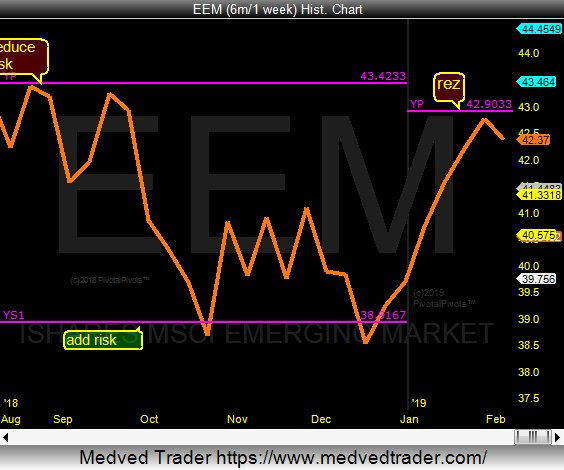

The Dollar had a terrific week. $DXY was up over 1% on the week and regained the key 96 level. What did that do to the conviction that EM was going to trample the S&P 500? EEM fell 1.3% on the week with Brazil, China, India & Korea all down.

- Mark Newton @MarkNewtonCMT – Emerging Markets and Commodites breaking down were a couple of today’s KEY developments- $EEM broke January’s uptrend with THursday’s close under the lows of the prior 5 days as the USD moved higher for the 6th straight day

There is another way to look at EEM:

- Jeff York, PPT @Pivotal_Pivots – $EEM is starting to pivot at the 2019 Yearly Pivot(YP). The 2018 low as on the YS1 Pivot. Ys1 to YP=textbook move @PivotalPivots.

The Indian Reserve Bank surprised markets with a rate cut. That did lead to a one-day up move. But did that complete a bad set up?

- Peter BrandtVerified account @PeterLBrandt – Factor Trading has taken a 35 contract position in Nifty futures $NIFTY Long or short — what’s your guess?

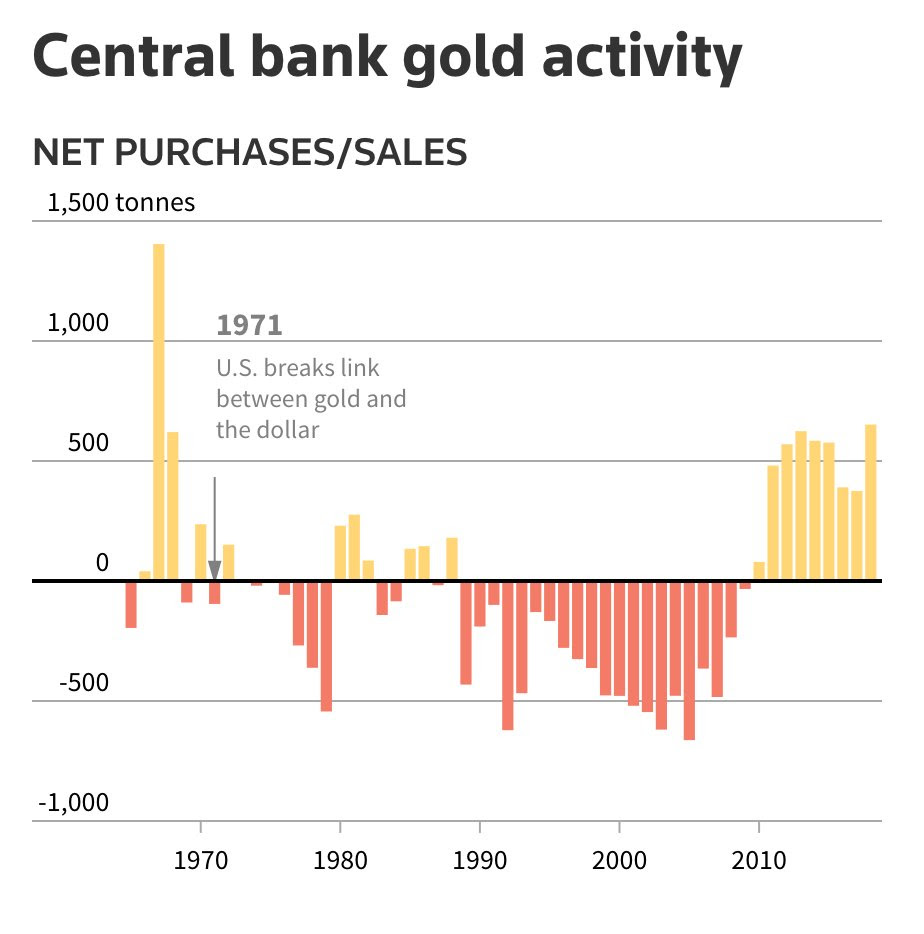

Oil, today’s symbol of risk appetite, fell 4.8% with OIH down 4% & XLE down 3% on the week. On the other hand, Gold was merely down 45 bps with Gold Miner ETFs down about 70-80 bps on the week. Is there a steady buyer underneath?

- Jesse Felder @jessefelder – Reserve managers may not know how long it will take for China’s currency, or the euro, to nibble away at the dollar’s pre-eminence. But they are taking small precautionary steps to diversify their exposure away from the greenback. https://www.breakingviews.com/

considered-view/central-banks- gold-fever-is-anything-but- reckless/ …

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter