Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.“dog that didn’t bark” .. “shortage of good assets” … “central banks all the game“

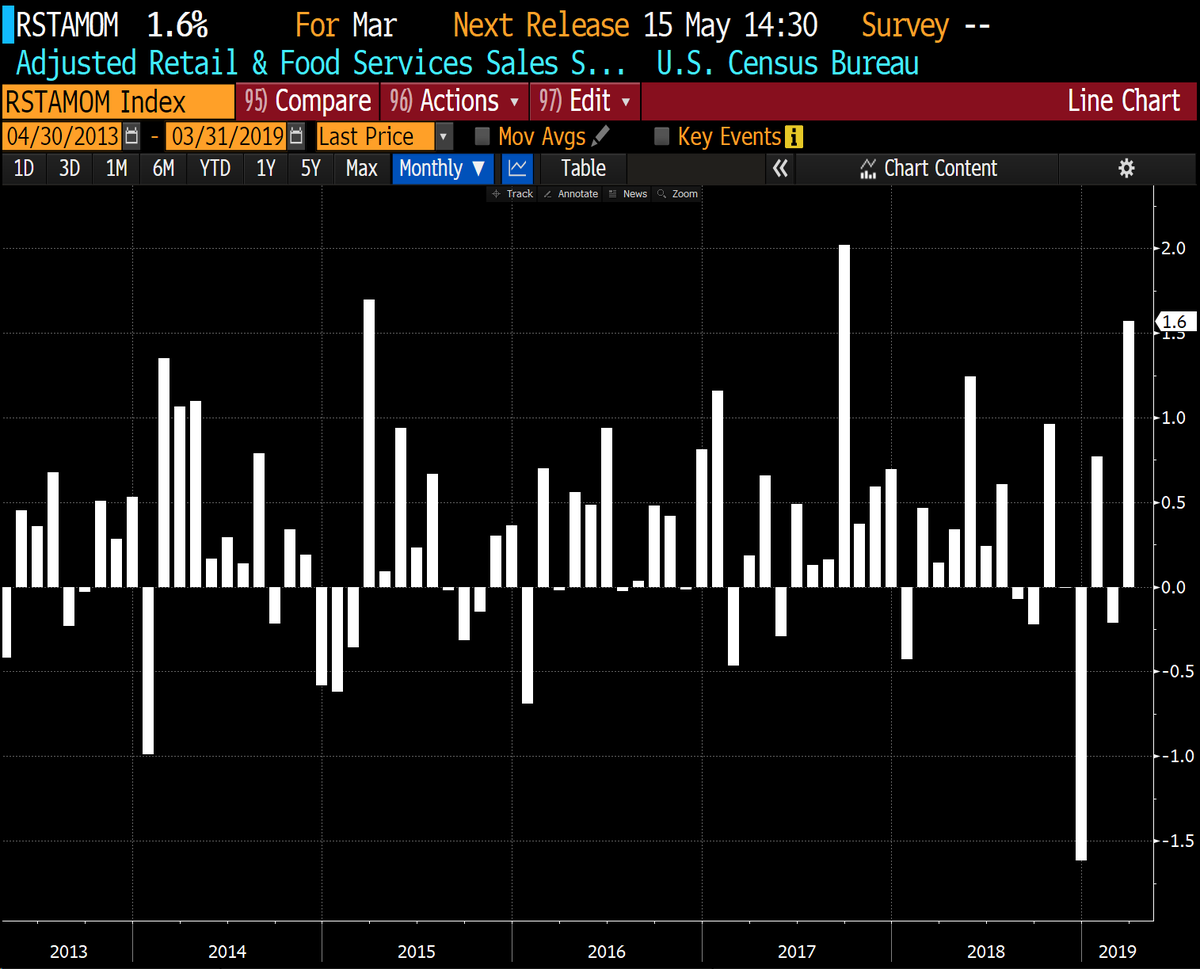

Thursday 8:30 a.m. turned out to be a joyous moment. Even Rick Santelli expressed happiness at the strength of the retail sales numbers & the jobless claims. He pointed to the 10-year Treasury yield that shot up to near 2.59% immediately after the numbers. And many drew the seemingly obvious conclusion:

- jeroen bloklandVerified account @jsblokland – US retail rose 1.6% in March, the most since September 2017. Yes, the #FederalReserve may have become a bit too dovish.

It would have been appropriate for the Treasury rates to run up & stay up. But something funny happened. The 10-year rate began falling steadily from its initial surge and closed down over 3 bps to 2.56% to sit atop the 2.55%-2.56% level highlighted by Santelli.

Was it the global divergence in economic trajectory?

- Mohamed A. El-ErianVerified account @elerianm – If nothing else, today’s macro data confirms “divergence” theme for global growth: Europe PMI’s again weak, including lower eurozone and French estimates; and Germany at 44.5. US data were more encouraging as strong #jobless claims and retail numbers offset a slip in Markit PMI

Or was it the shortage of investment grade bonds in the World that has been discussed by Rick Rieder of BlackRock? How desperate are foreign investors for US Bonds?

- Lisa AbramowiczVerified account @lisaabramowicz1– Foreign investors are earning nothing to own Treasuries on a currency-hedged basis, leading many to buying the debt unhedged. This raises the risk that declines in the dollar will trigger a spiral of selling.

But how did the Dollar behave on Friday? Not only did the U.S. Dollar shoot up but, unlike Treasury rates, it stayed up to close up 50 bps on the week.

- jeroen bloklandVerified account @jsblokland – US dollar index, #DXY, after disappointing Eurozone #PMI data, strong US jobs and retail sales data.

How have Treasury rates backed up since the bottom in the last week of March?

- Lawrence McDonald@Convertbond – US Treasuries from the Recent March Tights, Higher Bond Yields in bps 2s: +26 5s: +31 10s: +28 30s: +22 via @BearTrapsReport

But all of this may not be helpful if the rates are going to be raised by the Fed. How long will rates be held down by Central Banks? Mark Grant said “many many years” and Henry McVey said “through at least end of 2021″.

Mark Grant pointed out to CNBC’s Joe Kernen that 5-year rates in every country in Europe, including Greece, Portugal, Spain, are lower than the US 5-year rate, the biggest economy in the world, the biggest bond market in the world. Consequently said, Mark Grant

- “we are just at the beginning of a cycle where interest rates go even lower … which means you are seeing compression of risk assets… and I see this continuing for many, many years“

Why?

- “… you can’t withdraw this money [on Fed’s balance sheet] without causing a major infraction in the market … Central Banks are All of the game“

Henry McVey of KKR wrote this week of their “high conviction that rates will remain extremely low through at least the end of 2021“. KKR has been stepping on the gas for some time to get into income-generating assets”. Now he told BTV’s Erik Schatzker that

- “what we are seeing from a lot of investors right now, insurance companies & pensions, there is a real investment risk today; these people didn’t expect rates to be as low as they are & they are trying to find ways to generate income …we are in a later cycle; at this stage, you want yielding assets...”

A big statement from him was

- “Tech is leading to a 40 bps decline in annual inflation; every year; that is a major major.. there exists a headwind to inflation coming up; demographic changes, slower GDP growth in China; nominal GDP growth in China used to be 20%; now it is somewhere between 6% & 12%; .. this environment is very hard for interest rates to break to the upside… “

But McVey doesn’t want to take duration risk when US is leading the higher deficits charge. What they have been trying to do is to find collateral that is “linked to nominal GDP, things around housing, aircraft, locomotives, infrastructure, infrastructure is a huge business for KKR … you got to have something to hold on to into a downturn“.

David Rosenberg made the same point about China that McVey made above but in more detail & a bit more intensely:

- David Rosenberg@EconguyRosie – Nominal GDP in China slowed to 7.7% YoY in Q1 from 9.2% in Q4, 9.5% in Q3 and 10.1% in Q2. A far cry from the peak of 11.2% two years ago and has decelerated in seven of the past eight quarters in a visible pattern of growth decay.

- David Rosenberg@EconguyRosie – The real question is why China could only post 6.4% real growth in light of the massive 40% surge in total “social financing”? The credit multiplier clearly is contracting.

But stocks see this as half full instead of half empty:

- Lisa AbramowiczVerified account @lisaabramowicz1– Two ways to read the weaker-than-expected European economic data. 1) Weakness is ongoing despite China’s resurgence, suggesting deeper problems. 2) The data is backward looking and doesn’t incorporate China’s stabilization. Stocks are going with #2.

Fed up is how Rosenberg feels about that:

- David Rosenberg@EconguyRosie – China. China. China. I see nothing on the sharp downward revision to German growth forecasts; the EZ decline in exports & imports; the Japanese 9% export plunge to China; the imploding London home prices or on the US economic surprise index down to a 2-year low. Nada

The argument that we hear is China stabilization leads to German reawakening since China is Germany’s largest customer. Look at the up move in German DAX we are told.

But McVey’s comments about fixed income investors seeing a real investment risk fits in with what Larry Fink said on CNBC Squawk Box:

- “… we are seeing huge excitement in fixed income; people had to rush in to invest in fixed income ; we have not seen that in equities…”

Unlike McVey, that leads Larry Fink to make, in his words, a “market call”.

- “Most investors are globally exposed by being underinvested; … we are seeing money put to work from cash to fixed income; we are not seeing money being put to work rushing into equities; … I think we have a risk of a melt-up, not a melt-down here … despite where the markets are in equities, we have not seen money being put to work; we have record amounts of money in cash; we still see outflows in retail & institutionally … central banks are more dovish than ever …. there is a shortage of good assets ….”

Mr. Fink has an excellent track record in his calls but not necessarily right away.

- Alastair Williamson @StockBoardAsset – Interesting comments by Larry Fink before stock market turning points

And,

- David Rosenberg@EconguyRosie – So we have Larry Fink talking about a “melt-up” which is hilarious since that was the exact term that Jeremy Grantham used in January 2018, just ahead of a 10% correction at the time. Sell, Mortimer, Sell!

Rosenberg is not the only guru to laugh at Mr. Fink’s timing. Liz Ann Sonders of Schwab said on Friday that the past couple of weeks seem too exuberant to her. And, lordy lord, look what Jim Cramer said on his Mad Money Show on Thursday:

- “market is getting too exuberant; people are getting too bullish“

Those who are surprised by that would faint at what Cramer said earlier in the week:

- “Anyone still worried the economy is too strong & the Fed needs to tighten – NO, They should put the concerns to rest at this point; you should listen to last night’s downbeat conference call from the second largest trucking company in the country, J.B. Hunt; you will find yourself praying for the Fed to cut rates, not raise them“

If you are looking for the R-word to justify this obvious blasphemy from Cramer, you know where to find it:

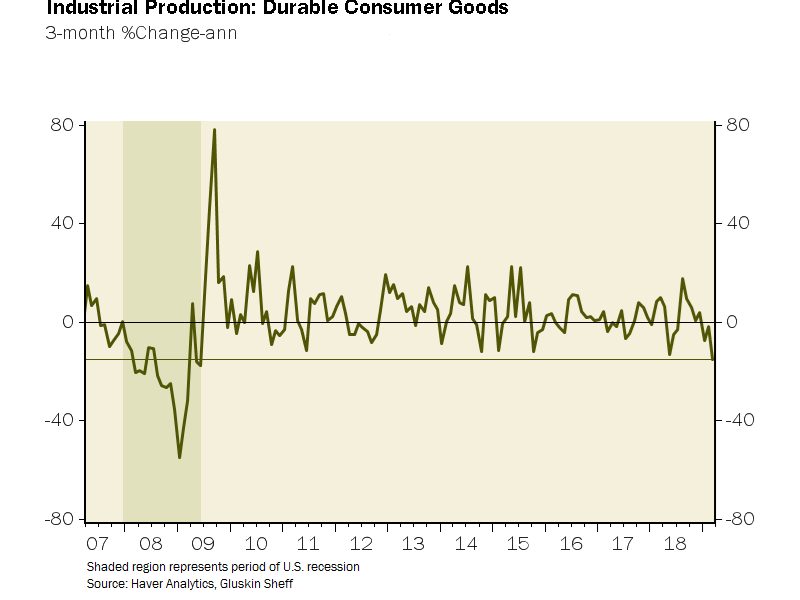

- David Rosenberg@EconguyRosie – The three-month trend in production of consumer durable goods has collapsed to a -15% annual rate – this takes out 2016 and takes us back to the late stages of the 2008-09 recession. Shhh! Don’t tell the stock market that the recession may have already started!

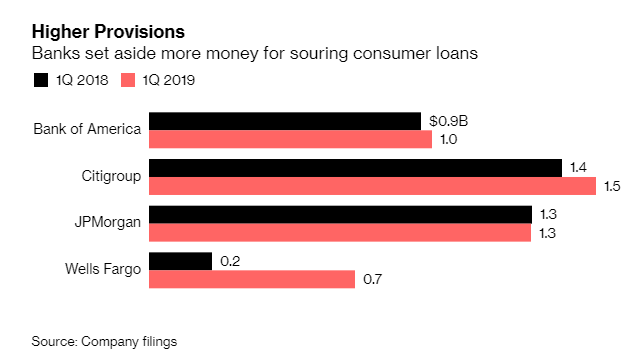

We still hope the Fed cuts the Federal Funds rate by 25 bps. We still think they will have to cut if they don’t want this stock rally to fade. Our early time frame for a rate cut is the June meeting. Look what banks have already started to do:

- Lisa AbramowiczVerified account@lisaabramowicz1 – The biggest U.S. banks are setting aside more money to cover souring consumer loans. https://www.bloomberg.com/news/articles/2019-04-16/big-banks-lean-on-main-street-for-profit-before-fed-s-pause-hits…

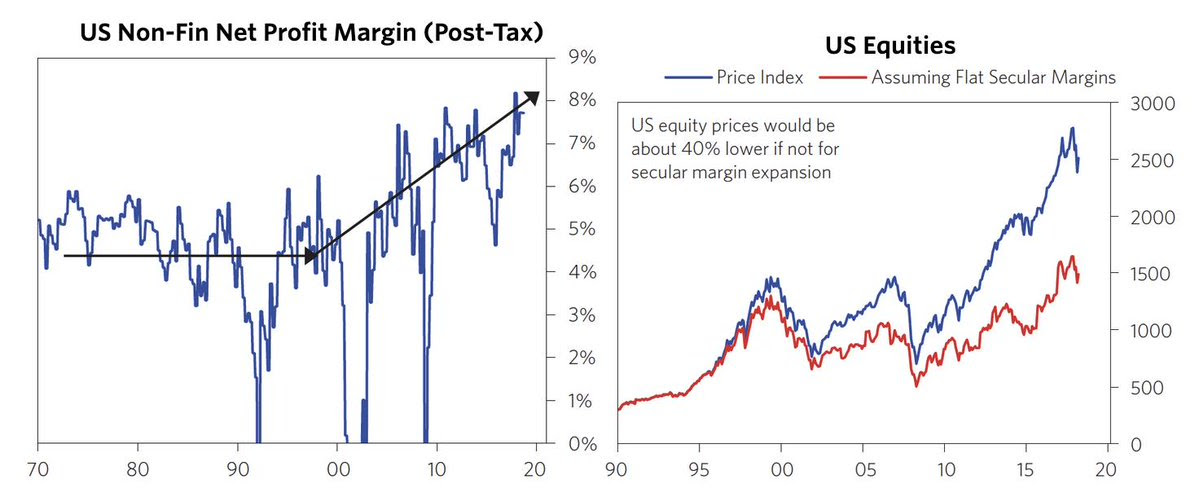

But aren’t corporate profits like mother’s milk for stocks, as we have heard so often from Larry Kudlow? And aren’t profits derived from operating margins?

But aren’t corporate profits like mother’s milk for stocks, as we have heard so often from Larry Kudlow? And aren’t profits derived from operating margins?

- Jesse Felder@jessefelder – Bridgewater: ‘We think there is a decent chance that we are at a major turning point for corporate margins, and if that is correct, US equities have a major valuation problem.’ https://www.bridgewater.com/

research-library/daily- observations/peak-profit- margins-a-us-perspective/…

Sadly, it may be like pay me now or pay me later for the Fed rate cut. Remember what Christian Lawrence of Rabobank said on BTV a couple of weeks ago? He didn’t think the Fed would cut rates this year but expects the Fed to cut rates 5 times in 2020 and the 10-year Treasury yield would fall to 1%.

Sadly, it may be like pay me now or pay me later for the Fed rate cut. Remember what Christian Lawrence of Rabobank said on BTV a couple of weeks ago? He didn’t think the Fed would cut rates this year but expects the Fed to cut rates 5 times in 2020 and the 10-year Treasury yield would fall to 1%.

Didn’t Jay Powell’s grandmother teach him the old proverb – a stitch in time saves nine? Interestingly, nine 25 bps rate cuts would drive the Fed Funds rate to zero, right?

2. US Stock Market

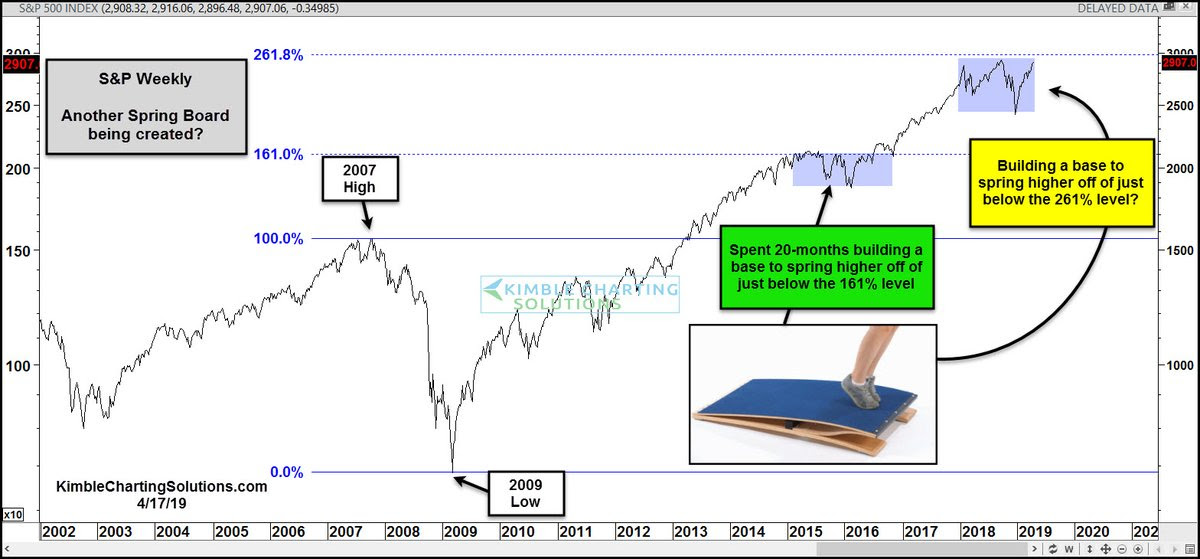

After the negativity of the above section, we owe it to all to share positive vibes in this section. Fundamentals might not help there but technicians are more than willing:

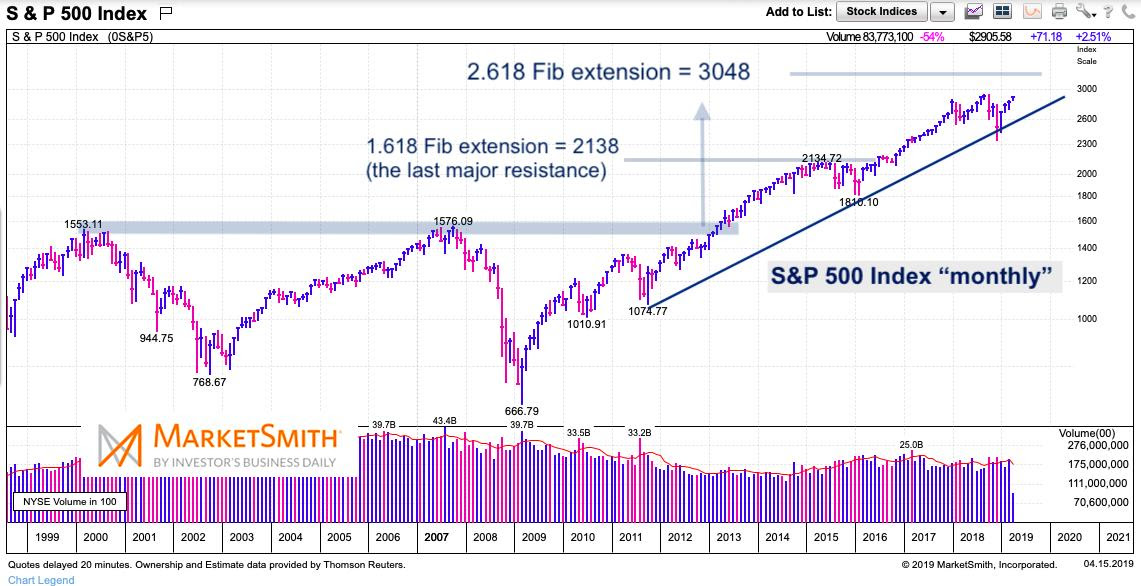

- Andy NyquistVerified account@andrewnyquist – $SPXFibonacci targets often act like magnets. #IBDpartner First it was 2138… Is 3048 next for S&P 500?@MarketSmith –> https://bit.ly/2DD3TpN

What about the recent meandering movement?

What about the recent meandering movement?

- Chris Kimble@KimbleCharting – Is the S&P building a base to push higher off of again, just below a key Fibonacci extension level?https://kimblechartingsolution

s.com/2019/04/sp-building- base-spring-higher-off/…$SPY$SPX

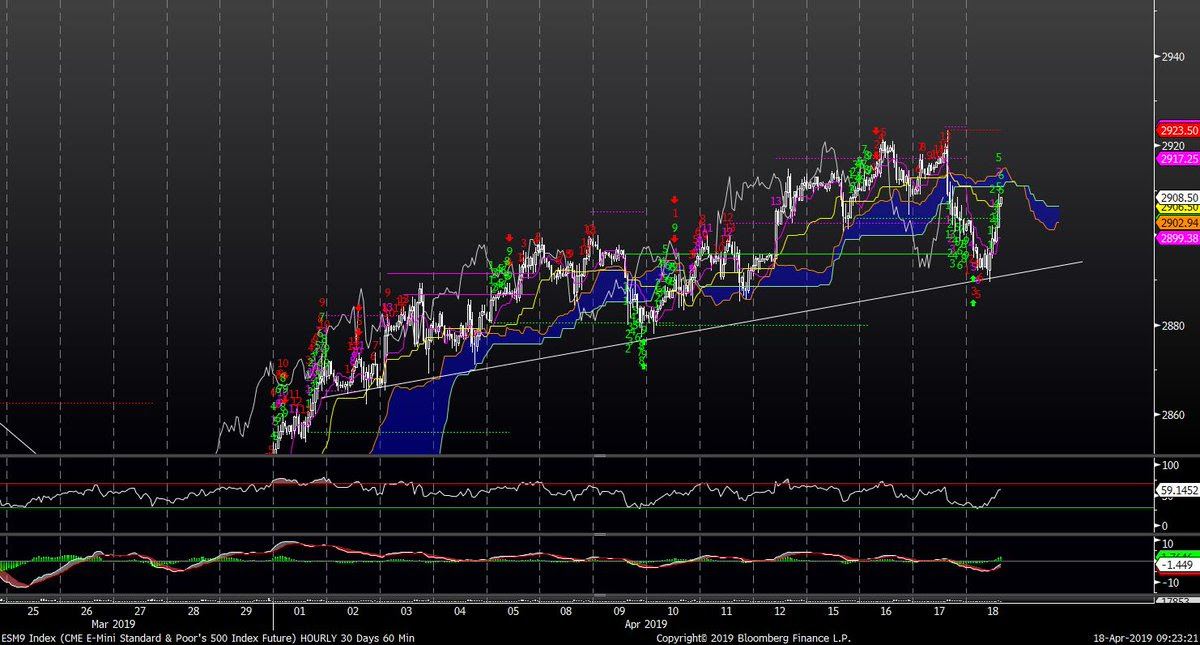

How near are near-term support & breakout levels?

- Mark Newton@MarkNewtonCMT – S&P minor weakness yesterday got right down to support near 2891 before holding and bouncing this am- This area has marked Support lows on hourly charts throughout April & will be important going forward- On the upside, regaining 2910 the next area of focus$ES_F$SPX

Frankly, enough of this meandering. Why doesn’t the S&P get to a new all-time high already? How frustrating to see a perma-bull prevaricate while wishing well to all on this religious weekend?

- Tony Dwyer@dwyerstrategy – First want to wish everyone celebrating Passover and/or Easter a very peaceful and happy holiday weekend. Second, we continue to expect the market to take a breather, especially in the Info Tech sector that has had such an extraordinary move.

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter