Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”Engraved Invitation to a rate cut” … will “fly” … “removing lipstick from a pig”

Last week we used the “dog didn’t bark” comment from Sherlock Holmes to talk about how Treasury rates fell on Friday, April 19, despite a strong retail sales number. This Friday the dog simply went mute. Because, despite the stunning 3.2% Q1 GDP number at 8:30 am on this Friday, Treasury rates fell hard after a momentary uptick. The 2-year yield fell by almost 5 bps after the number & closed down 4.4 bps on Friday & down almost 10 bps on the week. The entire yield curve bull-steepened meaning short maturity rates fell more than long maturity rates thereby steepening the curve. What gives?

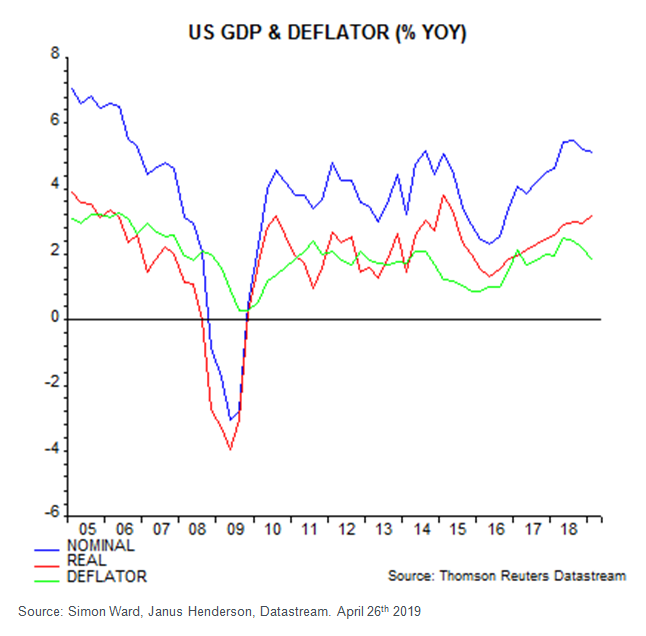

- David Rosenberg @EconguyRosie – The proof of the underlying soft underbelly to GDP lies in the price. That 0.9% reading in the GDP price deflator was the lowest since the first quarter of 2016, but back then, oil prices were melting whereas in Q1 they soared.

Why is that relevant, especially ahead of next Wednesday’s FOMC meeting & the dreaded Powell presser?

Bianco said:

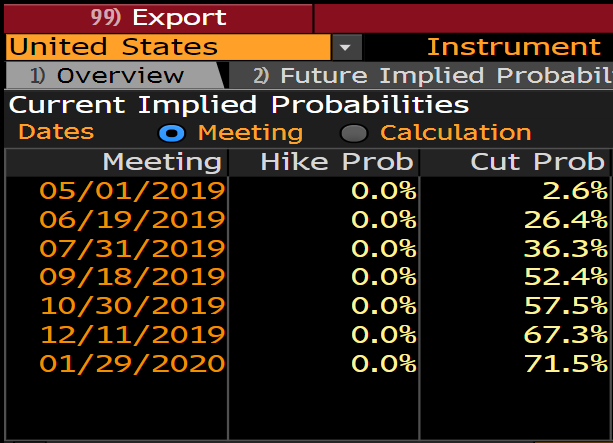

- “… today we got that PCE deflator …. it showed a stunning drop in inflation; this is at the level that Chairman Powell said if inflation really fell a lot, we will consider cutting rates ; guess what? it fell a lot; it has put a rate cut in the equation right now; as a matter of fact, the Futures market got it priced in for September which is only 5 months away“

Yup; a 52% probability of a rate cut during September 18, 2019 FOMC meeting.

- Lisa AbramowiczVerified account @lisaabramowicz1 – Rates traders are now pricing in nearly a 72% chance of a rate cut by the end of January 2020. https://www.bloomberg.com/

news/articles/2019-04-26/ treasury-yields-sink-as-tepid- inflation-keeps-fed-cut-bets- alive …

Actually a day before on Thursday, Julian Emanuel of BTIG said on BTV that the data was sending an “Engraved Invitation to a rate cut” to the Fed. Kudos to him for that call a day before the “fake” GDP data. Why “fake”? What else would you call red lips painted on a pig?

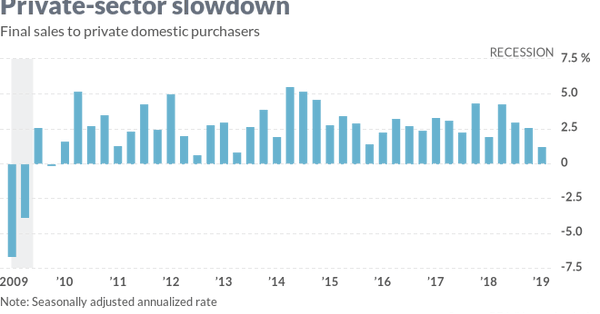

- David Rosenberg @EconguyRosie – This was a low-quality GDP report. All one-offs – lower imports, higher inventories & Pentagon spending. Real final private sales a puny 1.3%. Removing more lipstick from this pig shows cyclically-adjusted GDP contracting at a 2% annual rate; deepest decline in nearly a decade .

Another way is to separate Nominal GDP from Real GDP:

- Jenna & John@StrategicBond – US GDP today – nominal GDP slightly down based on lower inflation vs real GDP up strongly

Isn’t there a simple way to explain why the great GDP number may be real but kinda “fake”? Yes there is:

- Barbara KollmeyerVerified account @bkollmeyer– Behind that great GDP number, the real economy is slumping – https://www.marketwatch.com/story/behind-that-great-gdp-number-the-real-economy-is-slumping-2019-04-26

- The heart of the real economy — private-sector consumption and investment — slowed sharply in the first quarter to a 1.3% annual rate, the slowest in nearly six years. … Consumer spending rose only 1.2% in the first quarter, after healthy 2.5% growth the previous quarter. Spending on durable goods plunged 5.3%, the worst since 2009.

- Business investment also slowed, to 2.7% from 5.4%. Investments in structures, such as factories, offices, stores and oil wells, fell for the third straight quarter. Investments in equipment — computers, airplanes and machinery — barely grew, rising 0.2%.

- “On the outside, it looks like a shiny muscle car,” wrote economist Bernard Baumohl of the Economic Outlook Group. “Lift the hood, however, and you see a fragile one cylinder engine.”

If all this doesn’t call for an”insurance” rate cut, what will? Mathew Hornbach of Morgan Stanley explained on BTV that, in prior rate cuts by the Fed, the FOMC statements included the “insurance” rate cut term and added “you buy insurance before the house burns down“.

And guess who advocated a rate cut by the Fed mid-week? The venerable Art Cashin to the visible amazement of CNBC’s Carl Quintania. Cashin explained he meant a rate cut in a couple of months. Of course, that was before Friday’s nominal GDP data & the price deflator.

Cashin was right because Treasury rates were falling before Friday’s GDP despite new all-time highs in US stock indices. What gives? Remember what @LisaAbramowicz of BTV tweeted last week about foreign investors now buying US treasuries unhedged, meaning without hedging currency risk of the Dollar falling. This Friday Jonathan Ferro of BTV said they are beginning to see more & more European investors buying Treasuries unhedged.

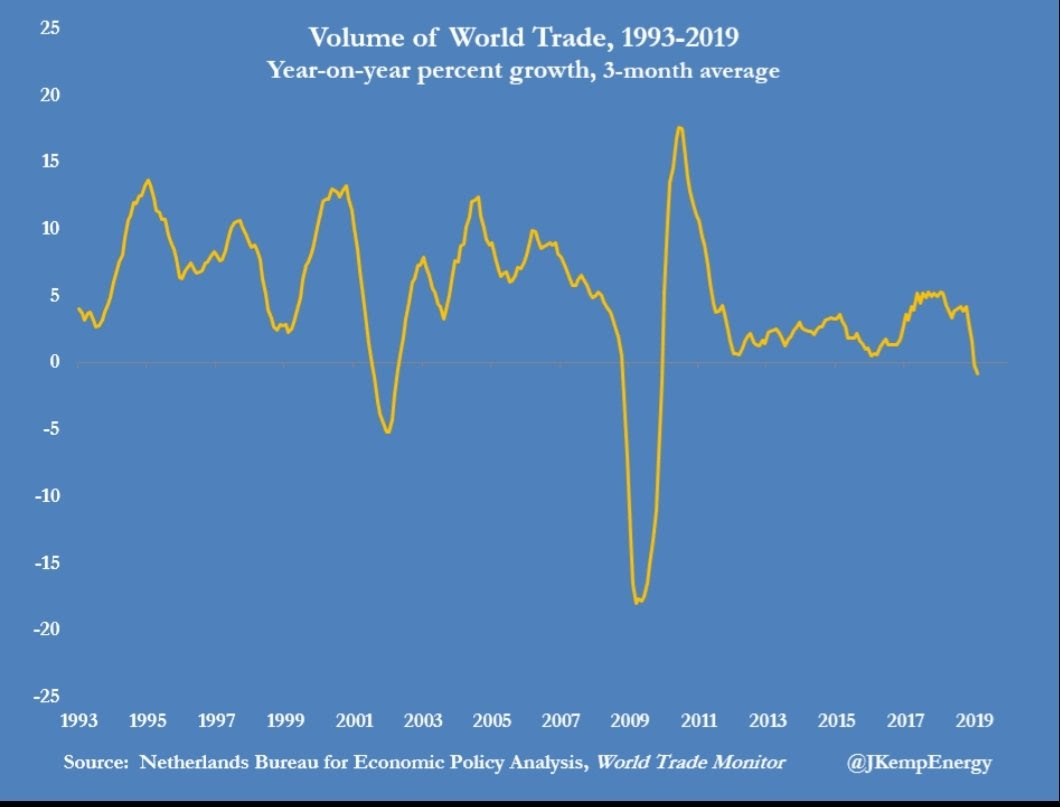

And this week’s data might have hastened that buying. The South Korean data stunned on the downside and Europe continues to weaken. Also the much talked about strength in China is export-based & not import-based meaning Chinese economic greenshoots are not helping other countries. Then, to add insult to injury, China said they were about to hold back on stimulus. Since a picture is worth 1,000 words,

- Ali Al-Salim@alialsalim – Global trade growth dips negative yoy. Weakest reading in a decade.

It is not merely bad, but actually getting worse. Not just getting worse but doing so at the fastest pace in a decade.

- Robert Burgess @BobOnMarkets – World trade volumes are plunging at the fastest pace in a decade https://www.bloomberg.com/

news/articles/2019-04-25/ world-trade-volumes-are- plunging-at-the-fastest-pace- in-a-decade … via @markets

Add to all of the above, a shortage of U.S. Dollars.

- Lisa AbramowiczVerified account @lisaabramowicz1 – This is also part of the dollar-strength story: China’s major commercial banks are running low on the U.S. dollars they need for activities both at home and abroad.

She references a WSJ story with the same title that says:

- “Back in 2013, the four [big commercial Chinese banks] together had around $125 billion more dollar assets than liabilities, but now they owe more dollars to creditors and customers than are owed to them.”

Another reason is what we all know:

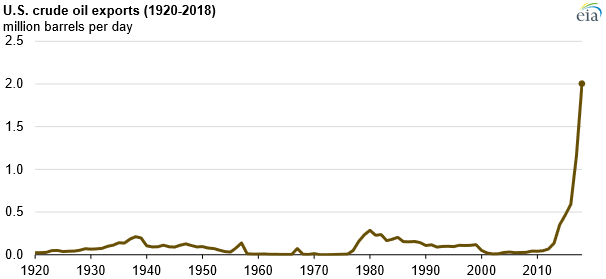

- EIAVerified account @EIAgov– #Flickr Image of the week: U.S. #crudeoil exports (1920-2018) https://flic.kr/p/RMJStr #EnergyTrade

When the US exports oil, what currency does it get & bring back home? Raoul Pal links that to the Dollar shortage.

- Raoul PalVerified account @RaoulGMI – Raoul Pal Retweeted EIA –

It is this, probably more than anything else, that has created a shortage of dollars. It is one of the largest secular shifts to have occurred to the US in quite some time and so incredibly rapidly too. The ramifications will last for a long time…

Well! If you saw all the above & compared global growth to US growth, what would you recommend?

- Raoul PalVerified account @RaoulGMI – Buy bonds, buy dollars. And that’s it.

Remember what Henry McVey of KKR said last week on BTV – that insurance companies & pensions did not expect yields to be as low as they are & now they face a real investment risk. Guess they now have to buy large quantities of bonds as yields go down. That may be why Larry Fink said on CNBC last week – “we are seeing huge excitement in fixed income; people had to rush in to invest in fixed income”.

You have to hand it to President Trump (though many many of our readers would never want to do that) and to Larry Kudlow for being persistent in demanding a rate cut by the Fed. Friday just made their case stronger. Not just the data but the action in the 2-year Treasury as it fell 16 bps below the overnight rate of 2.44%.

- Real Vision Research@RVAnalysis – US 2Y yields – is that a perfect test of the neckline before a move back to the recent lows? The 2s10s curve is attempting to steepen after weeks of consolidation

Fed Chairman Powell is on deck now. What does he face as he decides what to do and say on Wednesday May 1? A treasury curve that is INVERTED from overnight rate, 1,3,6 month rates, 1-year rate all the way to 7-year rate. Yes, even the 7-year Treasury rate is now lower than 1-month rate.

Actually, per Mathew Hornbach of Morgan Stanley on BTV, the Fed is most likely to do a technical rate cut of 5 bps on Wednesday because the overnight Fed funds rate is now at 2.44%, above the declared Fed funds rate.

Having said all of the above, next week has the potential of rocking any & every boat with Chairman Powell on Wednesday and the Non Farm Jobs number on Friday.

2. US stocks

While & with all the above going on, the S&P 500 went to a new all-time high, not just once but twice this week. Friday was a terrific example – all that terrible news from Intel & MMM was ignored & the S&P went to a weekly closing new all-time high. Makes sense, right? If rates keep falling without a recession in sight, then stocks got to go up simply because multiples are inversely related to rates.

So what would happen if the Fed cut rates, either as insurance or otherwise? “Risk assets will fly“, as the BTV round table said on Friday at around 1:25 pm.

- Mark Arbeter, CMT @MarkArbeter – Calm, fluid advance continues for $SPX. Nice slope reset to more sustainable angle. Generally, calm markets are not toppy markets, but last peak in September was certainly quiet.

Mark Arbeter need not worry. The October rout was entirely due to loose & stupid words from Chairman Powell. He has digested that lesson very well, we think. He might now be loose-lipped about lowering rates but not about raising them.

3. A Hall of Fame Anchor with Global Moral Perspective & Zeal

Naturally we speak of Maria Bartiromo, now anchor & global markets editor at Fox Business. We, like just about everyone who follows Fin TV, respects her work ethic & passion for stocks. But there are many Fin TV anchors who love stocks & work very hard. So what makes Maria special?

What she did on Friday morning & what she has done for the past several weeks. And she did it without worrying about ratings or whether the topic would be of interest to the viewers of her show. The topic is known to everyone on Fin TV; it is relevant to every Fin TV network & anchor. But no one else, to our knowledge, has stepped in so actively & passionately to help a man, a businessman, being subjected to human rights abuse just because the decisions he was trying to take were against the entrenched interests of his subordinates & the nation in which he worked.

Naturally we are speaking about Carlos Ghosn & his imprisonment in Japanese jail for the last so many weeks. Not only did Maria follow this aggressively but she also tried to help Mrs. Ghosn help her husband. Watch & listen to her speak with MSU Law Professor Frank Ravitch about the treatment meted out to Mr. Ghosn in the clip titled Will Carlos Ghosn Get a Fair Trial in Japan?

You will see how delicately she tries to lob in a request to President Trump to bring this up with Japanese Prime Minister Abe in their meeting on Friday afternoon. She knew that the Carlos Ghosn topic was unlikely to come up between the leaders of USA & Japan when Mr. Ghosn was the French CEO of a French-Japanese multinational living & working in Japan. But she tried any away. That is zeal.

This also shows the difference between being a French citizen in Macron’s France & an American citizen in Trump’s America. Macron, shamelessly we might add, has allowed Mr. Ghosn to be imprisoned & treated to human rights abuse without fighting for him. In contrast, President Trump demanded & obtained the release of two Korean-Americans from Kim Jong Un of North Korea.

4. Is “Black” a derogatory term at CNBC?

You have to be blind & deaf to not realize how the term “black” has been traditionally used in a derogatory manner. In traditional discourse, the term “white” is used in a positive, complimentary manner while the term “black” is used in a negative, denigrating manner. That is no longer acceptable in 2019 in America. We are living in a period in which statues of even historical figures are being removed from public spaces because of their past racism.

The big story this week is Yankees & Flyers banning Kate Wilson’s rendition of “God Bless America”. And Flyers are also going to cover up her statue outside their arena. They are doing so because they found out that “several songs performed by Kate Smith contain offensive lyrics that do not reflect” their “values as an organization“, according to a CNN story. This has become a sensitive & aggressively debated story.

That is why we could not believe our ears when we heard CNBC’s Melissa Lee use the old saying “pot calling the kettle black” during CNBC Half Time show on Friday. And she meant it in the same way the saying has been used historically used – use of “black” as a negative, derogatory adjective. Ms.Lee is an Asian-American, we believe, & she used the derogatory “black” term to describe name calling by two “white” or European-American traders during that show. We promptly tweeted both Ms. Lee & the CNBC Half Time show hoping Ms. Lee would instantly apologize on air for her use of an anti-black phrase. That would have been so easy & so alertly smart. But she refused to do that.

This goes to show how deep is the anti-black bias in many sections of American society. We don’t think Ms. Lee deliberately intended to be derogatory to blacks with her comment. She merely used that old & clearly intensely racist (“colorist” actually) phrase without thinking. So her bias, in our judgement, is assumptive but not explicit. But why didn’t she recognize her mistake when prompted & apologize on air? Was it her “ego” as an anchor of multiple shows at CNBC or was it simple contempt of her viewers?

We don’t know of course but we do know this stuff seems to happen often at CNBC. We have argued in the past that that can only happen when CNBC’s organizational culture is so insular & so non-diverse that CNBC Anchors often act & speak without any regard to prevailing media norms of cultural, color-based or racial sensitivity. The specific anti-black phrase by Ms. Lee is but one example of the prevailing culture at CNBC. When will President Mark Hoffman realize he has a problem in his network &. more importantly, when will he choose to do something about it?

We began noticing this CNBC culture a few years ago when we heard names of Indian-Americans butchered regularly during CNBC shows by mainly “white” CNBC anchors. We say “mainly” because we also saw Latin-American anchors, who were sensitive about how Latin names were pronounced, butcher Indian-American names without any sensitivity or care. Now we find an Asian-American anchor use a phrase that implies “black” is a synonym for bad/faulty/unpleasnt.

But to be honest we have noticed one difference at CNBC. At least recently we have not seen any such insensitive behavior from male CNBC anchors and all the cases we have noticed & written about recently are about comments or behavior from women CNBC anchors. Is this a way of getting to gender equality at CNBC? Or is it a novel form of mean reversion?

In view of the previous section, we must add that we do not recall a single instance when we had to criticize Maria Bartiromo during her long CNBC tenure for any such insensitive or color-race based negative remark. That shows that some anchors can indeed rise above the prevailing CNBC culture. How we wish today’s women CNBC anchors would learn from their ex-colleague?

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter