Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”you are supposed to grab the yield“

For the third Friday in a row, strong data released on Friday morning initially spiked Treasury rates which almost immediately reversed & closed down. Two Fridays ago that happened despite strong retail sales & last Friday it was despite the 3.2% GDP number. This Friday was somewhat more surprising.

On Wednesday, Fed Chairman Powell had come across as hawkish by stating that current low inflation was “transitory”. So on Thursday, the 10-year yield closed at 2.547%, just below the 2.55-2.56% level.

Then came Friday morning with a much stronger than expected 263,000 NFP number. Treasury rates jumped and almost immediately reversed & closed down. The reversal in the 2-year rates was even more striking.

- jeroen bloklandVerified account @jsblokland – Aand it’s gone! US 2-year Treasury #yield now down for the day after better than expected #payrolls number.

An explanation for the rate reversal was given by BlackRock’s Rick Rieder on BTV:

- ” .. asymmetric dynamic that is really important – the Fed, if they raise rates, will go one more time very slowly; they are going to wait for a long time; if the economy slows, the Fed is going to start cutting fast & will go down to Zero. So you have asymmetric risk-reward in interest rates, particularly the front end of the curve. … You can buy the front end of the curve at 2.30-2.40%; it carries really well in a portfolio & it works as a hedge; if the economy slows the Fed is moving quickly”

Actually, a stronger case for “grabbing yield” was made the day before by Bob Michele, CIO of JP Morgan Asset Management . He explained that Japanese investors are buying Treasuries not just for yield but for capital appreciation potential. Michele expects the 10-year yield to fall to 2% -2.25% by year-end, an appreciation that they can’t get in JGBs that are yielding minus 5 bps.

Michele was a bear on Treasuries last year expecting 10-year rate to get to 3.5%-4%. Jonathan Ferro of BTV asked him what has made him bullish now. His first point was that ECB is bullying investors everywhere by keeping rates negative to bail out weaker EU economies. And he added that “the world changed in Q4 2018“:

- “Because of the mid-term election, now no more fiscal stimulus, no tax cut II, no fiscal spending,”

- “Fed was on a mission to get to 3% & run down the balance sheet; they abruptly stopped; that’s the new reality & we need to be a part of it; the Fed is telling us, they are done. I believe them.”

- “Money is looking to come in to the bond market; the 10-year yield could sink to 2%-2.25% by year-end and stay there like a block of cement“

That is why Michele said “you are supposed to grab the yield“.

Think back & you will see that fundamentals under the surface supported the fall in rates after last week’s GDP & the retail sales data the week before that. So was the NFP report similar with strength on the surface & weakness underneath?

2. NFP number details

The headline data was clearly strong:

- Bespoke@bespokeinvest – US April Nonfarm Payrolls +263k vs +190k exp/+196k prev Net revisions +16k Avg hourly earnings +3.2% YoY vs +3.3% exp/+3.2% prev U3 UER 3.6% vs 3.8% exp/3.8% prev U6 UER 7.3% vs 7.3% prev LFPR 62.8% vs 63.0% exp/prev

What did a closer look reveal to David Rosenberg?

- David Rosenberg@EconguyRosie – Manufacturing diffusion index down. Incomes down. Workweek down. Household survey employment down. Full-time jobs down. Participation rate down. This was not a strong report beyond the headline.

And,

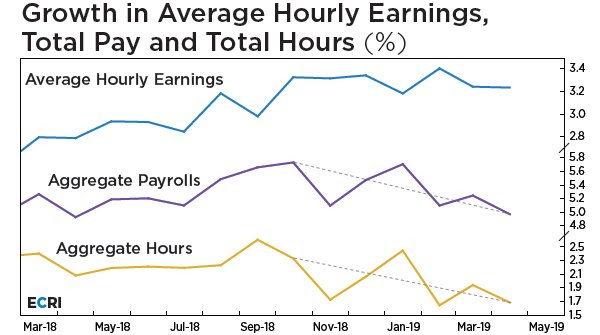

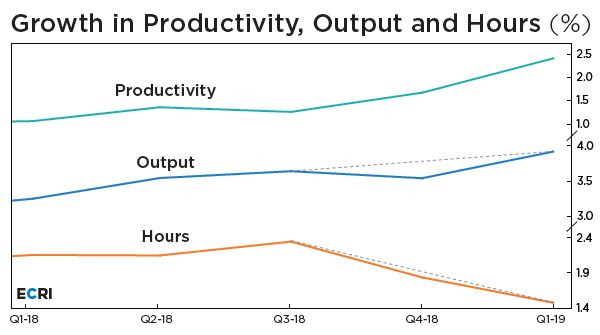

- Lakshman AchuthanVerified account@businesscycle – It’s good news that wage growth has held up over past half-year. But know that it’s because growth in total hours worked has slowed in tandem with growth in total pay, as underlying economic growth has slowed.

Is there one detail that changes the picture?

- David Rosenberg@EconguyRosie – The main feature of the payroll data was aggregate hours worked, which declined 0.1% in April. When you factor in the workweek falloff, it’s akin to a 110k employment slide!

Since a picture is worth many many words,

- Lakshman AchuthanVerified account@businesscycle– Good news: labor productivity growth has risen from 1¼% to nearly 2½% yoy over past half-year. Bad news: three-quarters of that increase comes from decline in denominator – growth in hours worked – due to slowdown#ECRI predicted last year.

How does Rosenberg summarize his view of Friday’s NFP report in his emails?

How does Rosenberg summarize his view of Friday’s NFP report in his emails?

- “How a report that is consistent with negative real income growth, and stagnant industrial production, is viewed as being positive is truly anyone’s guess”

3. Chairman Powell vs. Dissidents & other data

Chairman Powell did, once again, manage to disturb the stock market’s calm, this time with his use of the word “transitory” to describe today’s low core inflation. Not only did the stock market go down hard on Wednesday afternoon & on Thursday morning, interest rates rose as well.

Naturally, Vice Chairman Clarida came on Thursday to explain they were still patient & data dependent and James Bullard soothed investors on Friday by saying may be rates are just a little too tight & hinting a 25 bps lower Fed Funds rate might be fine.

But we do think the Big Question is whether current core inflation level is “transitory” or not. Because if inflation remains low as a structural condition, then there is no doubt that the Fed will ease rates & not just once. On the other hand, if today’s low inflation is transitory, then inflation will rise & everything will change in the behavior of asset classes.

David Rosenberg wrote he will take the other side of that [transitory] bet. He then tweeted:

- David Rosenberg@EconguyRosie – All Powell did was take a feather out of Yellen’s cap. Back on Sept 26, 2017, she gave a speech saying the decline in inflation partly “reflects idiosyncratic shifts”. So he said “transient” instead. Meanwhile, core inflation back then was 1.5%, about where it is today!

Then you have,

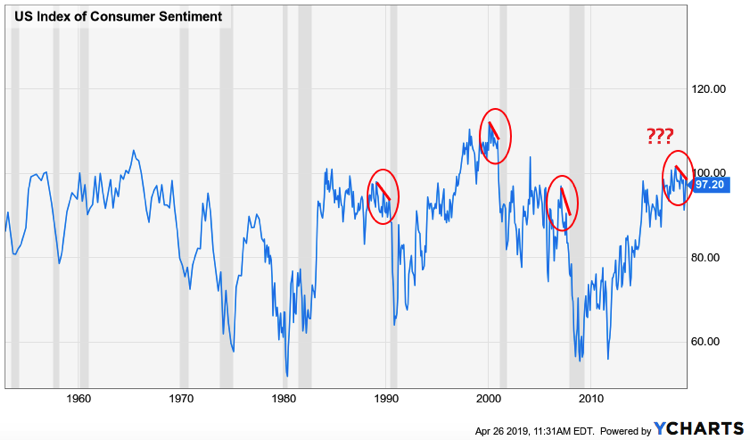

- Michael A. Gayed, CFA@pensionpartners – The last several recessions have been preceded by a period of falling consumer sentiment. Sometimes those declines are sharp and sometimes they’re drawn out but we’re starting to see signs of a year-long downtrend.

The following surprised us given how hard & fast interest rates have fallen:

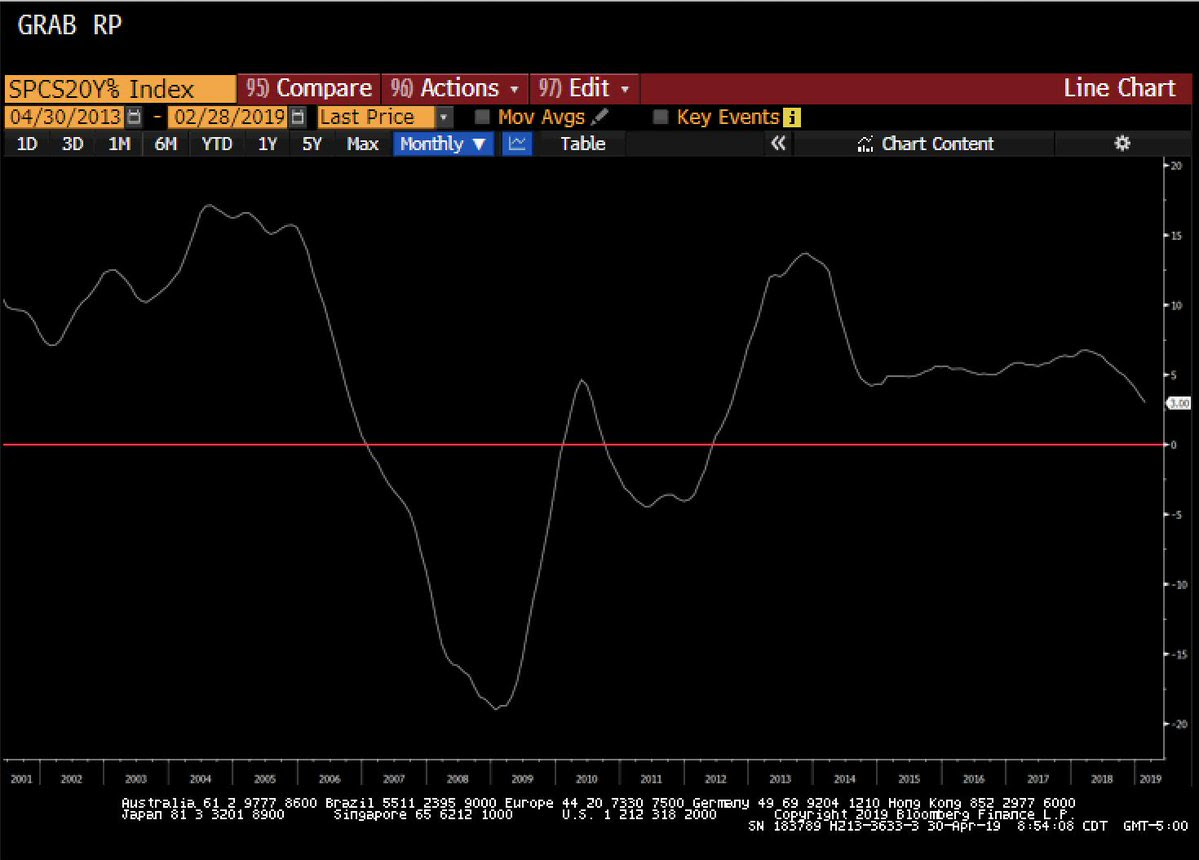

- Raoul PalVerified account@RaoulGMI – Case-Shiller 20-City Composite Home Price Index YoY is in a full down cycle and will head below zero. Rates are too tight. The Fed will have to cut for this and many other examples. GDP growth was, I believe, late cycle inventory build a la 2000.

And we hardly heard mention of the really negative piece of economic data released on Friday morning, an hour & half after the NFP number.

-

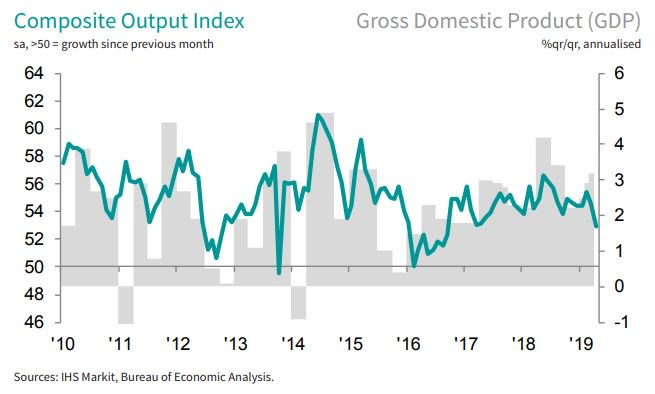

IHS Markit PMI™@IHSMarkitPMI –

US Services PMI hits lowest since March 2017 (53.0 vs 55.3 previously). PMI is down to a level indicative of growth just below 2%. Read more here: http://ihsmark.it/7FvE50tWcbY

US Services PMI hits lowest since March 2017 (53.0 vs 55.3 previously). PMI is down to a level indicative of growth just below 2%. Read more here: http://ihsmark.it/7FvE50tWcbY

Now look what happened on Friday after the initial dip in stock indices post the Services PMI:

The rally in stocks on Friday began after the weak Services PMI was digested. Why? Because of a very basic & obvious fact that any one who remembers 1990s knows:

- Tony Dwyer @dwyerstrategy – As the market takes a pause here, remember the bull story is about WEAKER not stronger data. Fed’s Powell will change his tune based on data, just like Greenspan did after final rate hike Feb 1, 1995. He eased 5 months later as prior rate hikes finally hit economy w

$spx up ~20%

And which stocks caught the wind on Friday – FAANG. All were up 1.5% to 2%. Ah, the magic of a slow economy with down rates!

But look what happened to interest rates on the week, thanks mainly to Powell’s transitory phrase. Treasury rates closed up on the week in a flattening with the 2-year yield up 5 bps, 10-year yield up 2.6 bps and the 30-year yield unchanged.

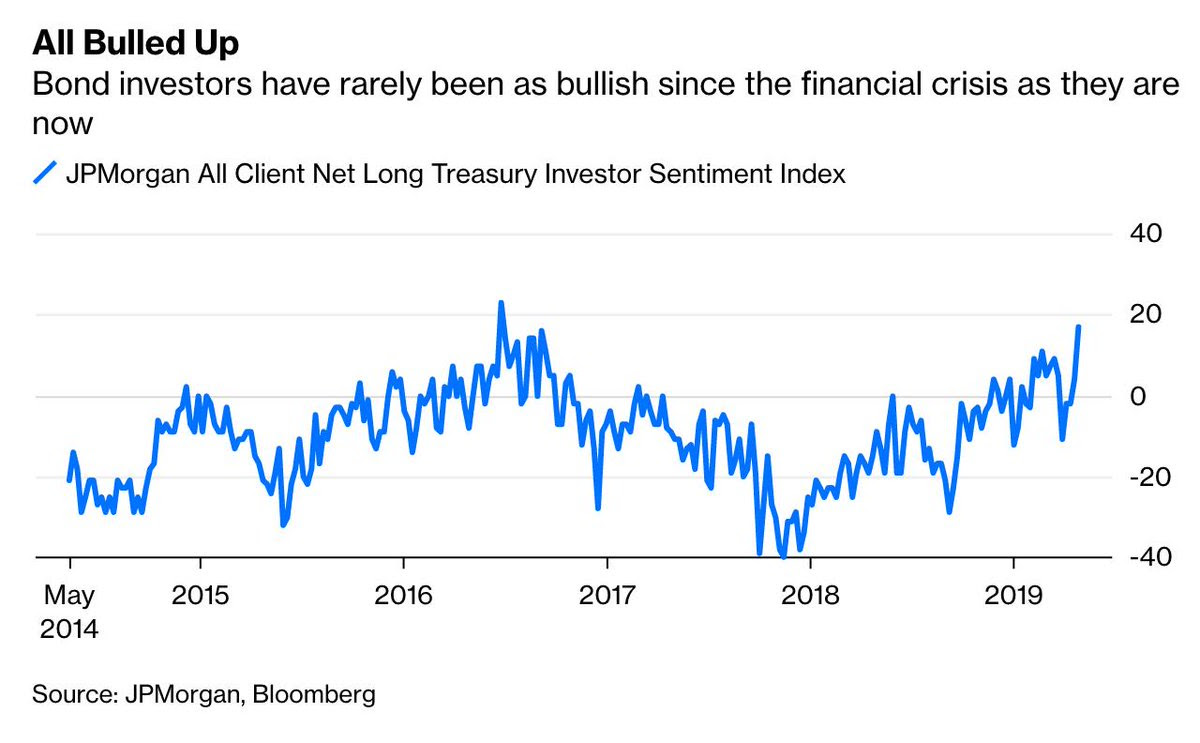

But there may be another related reason, a positioning reason, for the rise in rates:

- Jesse Felder@jessefelder – Investors haven’t been this bullish on treasuries since the 10-year yield went under 1.4%. https://www.bloomberg.com/

opinion/articles/2019-04-30/ bond-traders-dabble-with- irrational-exuberance… ht @lisaabramowicz1

May be a back up in interest rates is what it takes to get a back up in the stock rally as some have predicted and as some see:

May be a back up in interest rates is what it takes to get a back up in the stock rally as some have predicted and as some see:

- Lawrence McMillan summary – Overall, the $SPX chart remains bullish, but we are seeing some sell signals. As we’ve noted many times in the past, in situations such as this, one must still rely heavily on the $SPX chart. So, we remain bullish until support is broken on the $SPX chart.

It is likely, of course, that Thursday’s drop to S&P 2,900 and the bounce from there could have been the pause that buyers were looking for. Anything is possible given the momentum of this year’s move. But we still think a sustained rally from here will require a Fed rate cut, not merely for stocks, but for supporting a slowing economy, curing dollar illiquidity & steepening the yield curve.

Below is a detailed discussion (from min 4:00 onward) on this topic.

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter