Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.“… go long maximum duration risk here … “

What an epic move in interest rates in three days?

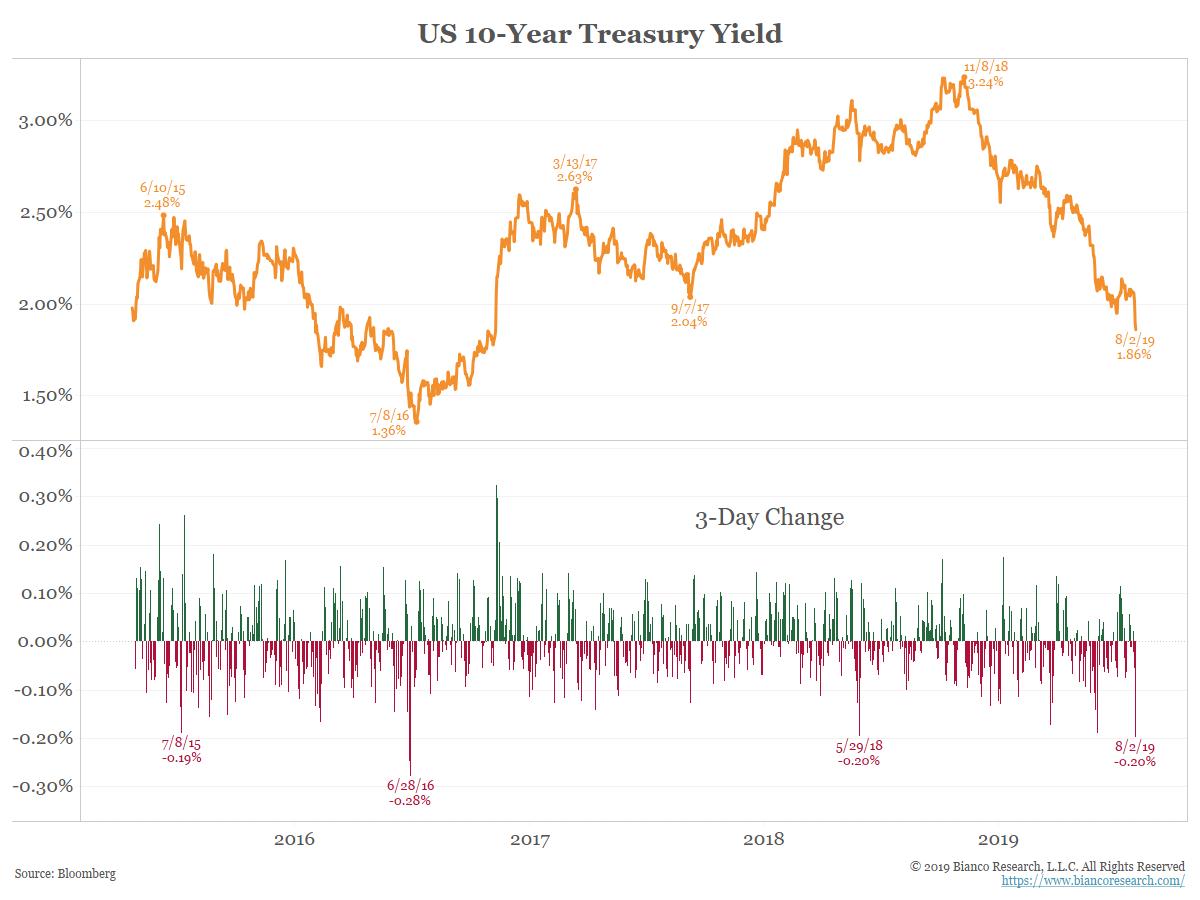

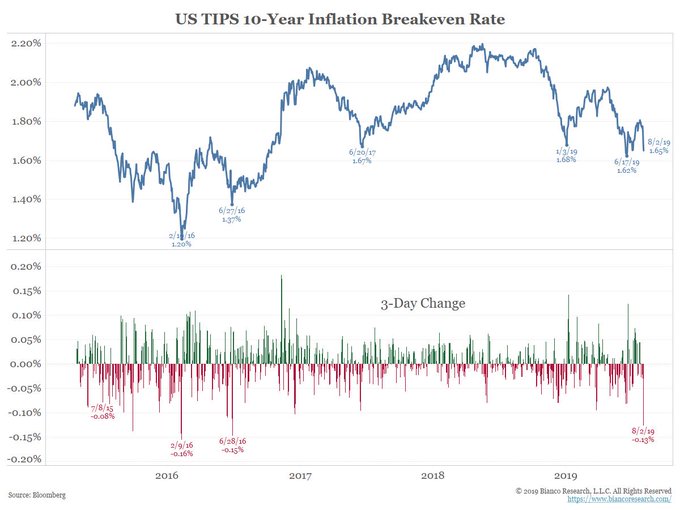

- Jim Bianco? @biancoresearch– How significant has the post FOMC bond mkt move been? the 10-year yield (orange) is down 20 bps, the largest 3-day move since June 28, 2016 (Brexit vote) Similarly, 10-year TIPS breakeven (blue) has collapsed 13 bps, also the biggest 3-day move since Brexit. Yes, an epic move

That’s awesome after the meeting but did any one say “buy bonds” in the morning before the Fed meeting?

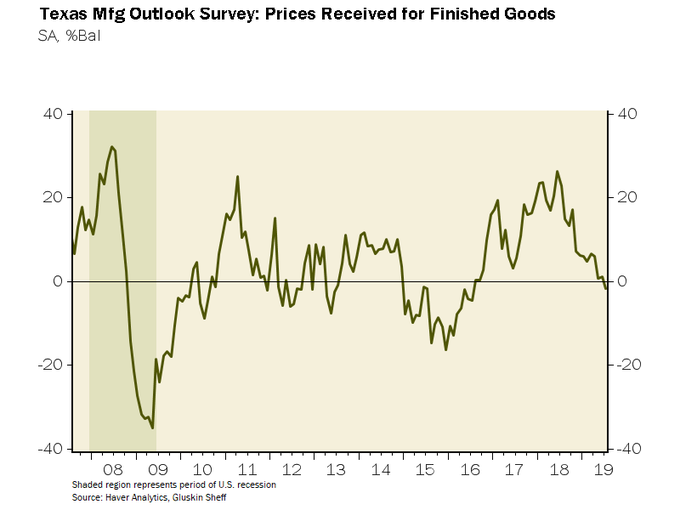

- David Rosenberg? @EconguyRosie – Deflation remains the principal risk. The Dallas Fed mfg price index has turned negative for the first time in 3 years. If bonds sell off on a less-than-dovish Fed, snap them up. And while you’re at it, see “Profoundly Low Interest Rates Are Here to Stay” on page 9 of the FT.

Good. But now what? Isn’t a story termed an “epic” after the story is long over? So does Bianco’s use of “epic” suggest the big move in rates is spent & now investors should book profits? That would be the “rational” thing to do, right? And nobody got poor by taking profits, right? On the other hand, no one got rich & began wearing diamonds by taking profits too early.

That may be what Priya Mishra (TD Securities Head of Global Rates strategy) thought when she told BTV’s Jonathan Ferro on Friday – “go long max duration risk here” and closed with “cling on [to your Treasury positions]; Buy more“.

As we recall, Ms. Mishra was not a bull on Treasuries a couple of months ago. But, like Bob Michele of JPMorgan Asset Management, she seems to have reversed her position and is now so unabashedly bullish that she says go long max duration risk here – meaning buy the longest maturity Treasury bonds and as many as your risk tolerance can support. Wowser! And, kinda like Bob Michele, Priya Mishra is now openly worrying about default risk in credit.

This move began with the Fed statement & Chairman Powell’s presser on Wednesday afternoon. Look back to the past few weeks and notice that the big down movement in rates was so far in shorter maturities with the 5-year yield as the tip of the spear. In contrast, the 30-year bond has been a relative laggard. That makes sense because if the Fed eases aggressively in a decent economy, then growth gets a jolt & inflation expectations rise leading to under performance of the 30-year rates.

But the Powell presser changed that almost totally. His miserly 25 bps rate cut & his “mid-cycle” statement told investors to bet on the economy slowing more & inflation expectations falling more. No wonder the 30-year yield fell by 5.6 bps & the 2-year yield rose by 2.8 bps on Wednesday afternoon, a big flattening of the curve. This continued on Thursday morning until the China tariffs announcement by President Trump and then the short rates also fell of the cliff with the 2-year yield falling 14 bps on Thursday alone.

You could have bought EDV, the 25-year Treasury Zero Coupon ETF, at around $126 on Wednesday morning & enjoyed a 5% run to $132.37 at Friday’s close. Remember what David Rosenberg had tweeted a few weeks ago that the 30-year zero coupon strip will deliver a 35% return if the Fed lowers the FF rate to 1%. Well, that target is almost priced in by the markets for 2020. What did the entire curve do on the week?

- 30-year yield down 21 bps, 10-year yield down 22 bps, 7-year down 21 bps, 5-year down 19 bps, 3-year down 15 bps, 2-year down 15 bps & 1-year down 13 bps. And TLT up 3.9% with EDV up 5.6%. Wowser!

But now what? Isn’t taking profits the smart move as Tim Seymour of CNBC Fast Money said on Friday evening? Probably. But then you have the classic line at the Godfather’s funeral (from min 3:25):

- Tom Hagen – I always thought it would be Clemenza, not Tessio

- Michael Corleone – It’s a smart move, Tessio was always smart

That move was so final. Fortunately, Treasuries are so liquid that it is easy to correct your mistake, whichever mistake you make. So if you wanted to make the “smart” move, what would you look at to pull the trigger?

- Thomas Thornton? @TommyThornton – US 10 year yields and Futures with secondary DeMark Countdown 13’s. Also monthly buy Setup 9. Bullish sentiment is at 89% bulls. Watch for a 4 day closing high in yields to give some conviction of a turn higher. I would sell bonds

2. US Stocks

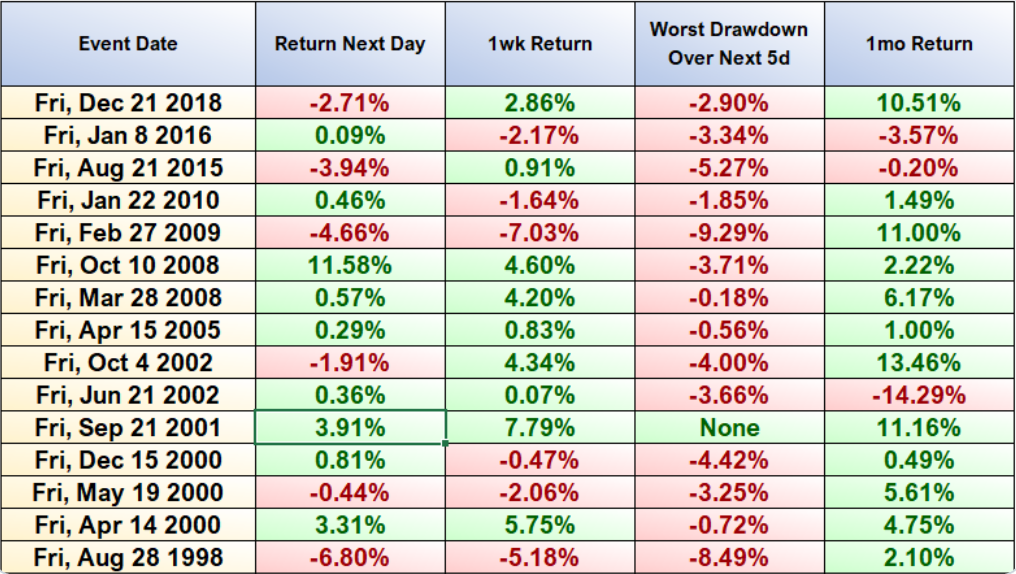

This was the worst week of the year for the S&P which fell by 3.1% on the week. But Nasdaq 100 fell by 4% & Transports fell by 3.7%. It could have been worse had the Dow had stayed near its Friday’s low of down 334 points. But an afternoon rally recovered much of the intra-day loss. We saw couple of smart investors like Hedgeye & @TommyThornton cover some shorts in the carnage. And some pointed out the oversold condition:

- Igor Schatz@Copernicus2013 – At the lows today $SPY was 2.6% below its 10dma.. that’s roughly as much as the market stretched to the downside before a local low and bounce back in May..

And,

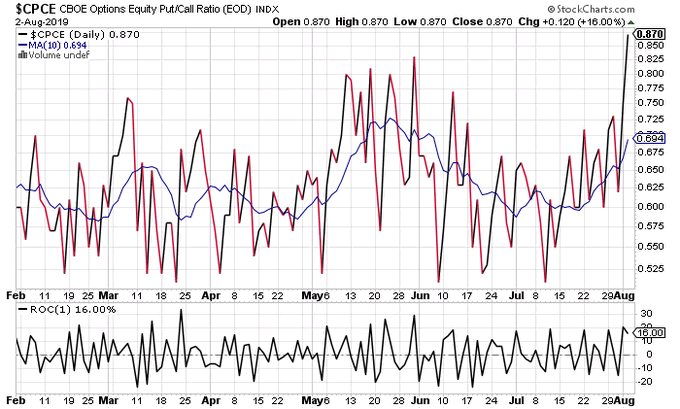

- Marc Eckelberry@AheadoftheNews – Extreme equity put call reading. #pessimism

Then the statistical history from The Market Ear:

Then the statistical history from The Market Ear:- 3 down days – Today was the 3rd straight day of $SPX seeing a daily return of -0.7% or worse.Below the times and returns the last 25 times that happened

Even some DeMarkians are hedging their bets:

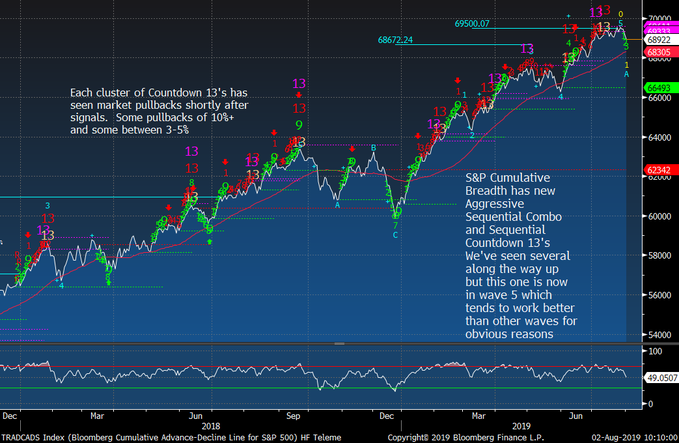

- Thomas Thornton? @TommyThornton –

$SPX cumulative breadth is rolling over after recent DeMark Countdown 13 cluster. Other signals in the past saw pullbacks of 10%+ and some only 3-5%.

- Tony Dwyer? @dwyerstrategy – Clearly, all the negatives are in focus as the market corrects, but there is an offset – Credit has acted well going into it, the 2/10 US Treasury yield curve is positive, and the massive drop in Treasury yields should be VERY stimulative (as long as 2/10 is positive)

Well, the 10-2 spread is still +ve 13 bps and the shock of the China tariffs will wear off. In any case, these tariffs don’t go into effect until September 1. Then you have the positive beef deal with the EU. As we wrote last week, President Trump will turn on the spending spigot as we get into the 2020 election cycle.

On the other hand, remember the warning of Priya Mishra about the markets looking closer at Default risk in the coming months. Remember the August-September 2007 rally in stocks & risk assets as credit worsened. As markets realized that credit is weakening faster than the pace of Fed easings, you know what happened post October 2007.

3. Behind the Curve Fed & Global Risks

We believe the Fed is already way behind the curve. As many bright minds pointed out that the Fed made a mistake by not easing by 50 bps. Now they are way behind & might get farther behind if global data keeps falling.

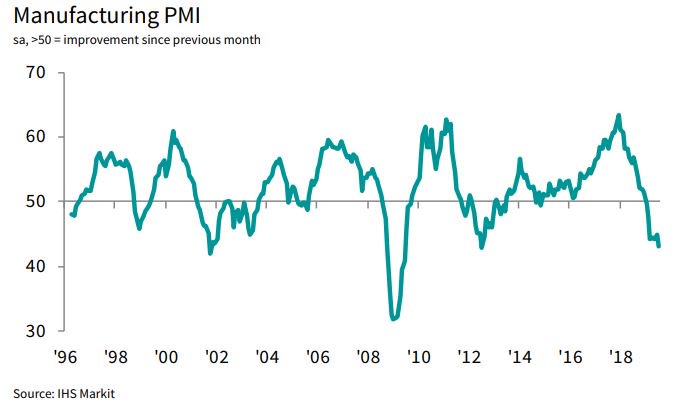

- IHS Markit PMI™@IHSMarkitPMI –Aug 1 – Germany’s manufacturing downturn gathers pace in July, as the PMI drops to a 7 year low (43.2; June – 45.0). New export orders declined at the fastest rate since 2009, while output also fell at a quicker pace. Read more here: (link: http://ihsmark.it/wkBe50vjo9D) ihsmark.it/wkBe50vjo9D (link: http://ihsmark.it/dpOl50vjoar) ihsmark.it/dpOl50vjoar

We believe there is another reason for the waterfall decline in interest rates post the Fed meeting. It is no longer the case of the Fed being wrong. It is the far worse case of the Fed being helpless. We all saw how helpless Chairman Powell looked in his presser. Smart connected minds including Bob Michele of JP Morgan, Jim Caron of Morgan Stanley Asset Management & Jim Bianco had suggested that Chairman Powell is on board for faster rate cuts with his Vice Chairman Clarida & NY Fed president Williams.

But this trio does not have either the respect or the power to drive the committee which seems divided with Rosengren & company refusing to yield. So this FOMC seems helpless to act. And that makes it a very very different than Greenspan controlled Fed in 1995 or the Bernanke controlled Fed in 2007-2008.

This is a highly toxic brew & it has the Dollar breaking out and a flood of money coming into the US bringing deflation into the American economy. This is why we need to watch credit & other indicators during the next stock rally whenever it begins.

This has to spell real bad news for emerging markets, right?

- Lisa Abramowicz@lisaabramowicz1 – Emerging-markets currencies are falling today the most since May 2017.

The plight of EM even has previously disinterested people getting tempted:

- Raoul Pal?Verified account @RaoulGMI I’ve been trying really, really, really hard not to short equities and just stick to bonds and dollars (and copper), but I mean…come on…

$EEM … how can I ignore this set up? This has got collapse written all over it!

- Raoul Pal?Verified account @RaoulGMI –

$BTC#Bitcoin is a rocket ship on the launch pad…very much lining up with the big macro picture…. It appears bitcoin is a great macro asset too right now, and more questions can be answered about it over at broker.cex.io for those who are serious about getting into it.

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter