Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Simple actually!

Two days of melt-up in one week; $VIX closing the week below $13; Treasury yields rising almost every day of the week; yield curve un-inverted; value stocks outperforming, EM markets outperforming the US indices – Everything the Fed would have wanted to see 2-3 months ago is happening before our & their eyes.

So what do they do on Wednesday? We think they will cut rates by 25 bps just to avoid being blamed for any market turmoil in yet another Q4. But will they signal a hawkish posture after this upcoming rate cut? If they do, hopefully they will be gentle & circumspect about their forward posture.

We think they have but one master – the stock market. And we think they know how to keep that master happy. This 2019 Avataar of QE is not called that; instead they call it “Not QE” . Fin TV anchors have hardly noticed it. Perhaps they shy away from the technical name “Repo” or perhaps they don’t want to jinx anything. But others have.

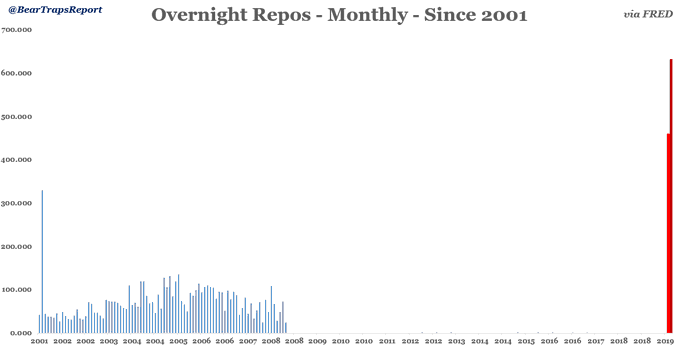

- The Bear Traps Report @BearTrapsReport – – The size of the Fed’s repo operations since September is unprecedented..

As Jim Bianco said in his interview for the The Market,

- “There has been a discussion in Fed circles that even though they are increasing bank reserves we shouldn’t call it «Quantitative Easing» or «QE». Yet, the front end of the yield curve is acting exactly as if it was QE; exactly as if they were doing something that was going to be stimulating.”

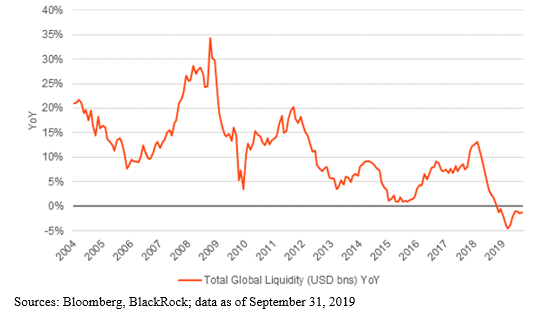

But having already done an “unprecedented” amount of “Non QE” liquidity injection, should the Fed add even more? Yes, adding liquidity is a better alternative to cutting interest rates said BlackRock’s Rick Rieder this week:

- Rick Rieder@RickRieder – That would allow for an effective transition from reliance on rate #policy to a focus on #liquidity conditions: Rates that are too high or too low can hurt an #economy – and so can a shortage of liquidity:#RatesCutBothWays

Guess Rates can cut both ways but liquidity adds only work one way!!! Hmmm!

But you have to admit this could please all stake holders of the Fed. Addition of liquidity should be positive for US stocks, negative for the US Dollar and even raise rates a bit more. Keeping overnight rate steady should help savers, especially senior citizens, get decent interest on their savings. President Trump might be mollified with a stock stock market into Q4 & beyond. Also the Fed doesn’t have talk about it especially if they don’t announce the amount of liquidity they intend to add. And such quiet injection of additional liquidity may even satisfy the naysayers on both sides of Powell in the FOMC.

What does all this including the stock market performance so far remind some who choose Ear over Eyes? The year of the Tepper Corollary – 2013. If the economy weakens, the Fed will ease in addition to injecting liquidity. That is good for stocks. If the economy does not weaken, then isn’t that good for stocks with fears of earnings recession abating.

But as The Market Ear added,

- “if we are to follow the S&P 2013 perfect pattern this needs to start moving higher asap“

Would next week suffice as “asap” for them? On the other hand, DeMarkians are saying Not So Fast:

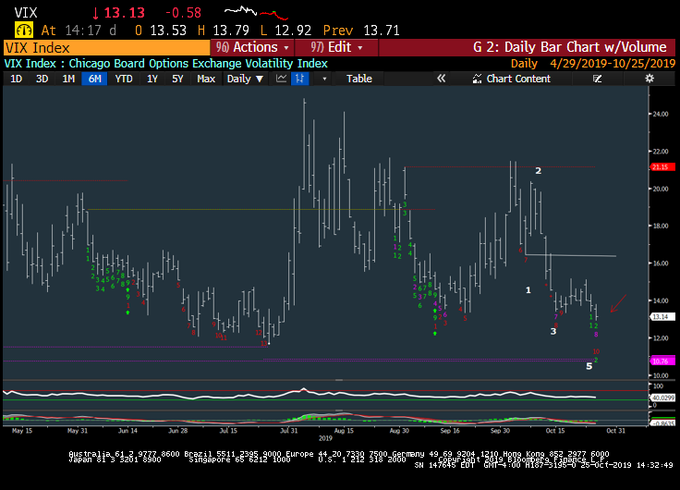

- Thomas Thornton@TommyThornton – 4 important charts that are correlated and suggest a turn is nearing for all of them. $SPY, Nasdaq Composite, $TLT and $VIX

Interesting. Does this suggest the Fed will take their time to either add or announce addition of liquidity? Or will this DeMark stuff lose its potency in the Fed’s liquidity enhancing “Not QE” just as it had proved unreliable during real QE periods under Bernanke & Yellen?

We have been reasonably confident that the S&P will get to new all-time highs this October prior to the FOMC on October 30. But we have also been worried that the FOMC will misread the market’s signals as evidence of economy on the upswing & cause a reversal in risk vs. safe sectors as the FOMC did on October 31, 2007. This week an astute observer/analyst named Jim Bianco expressed similar misgivings in his Swiss interview:

- “I think they are going to cut interest rates for a third time and they will do it like they have done it all throughout this cycle: They will try to make noise that they want to stop cutting rates because they never really wanted to start cutting rates in the first place. … One of the problems the Fed has had is that they can’t really explain why they are cutting rates. The reason they are doing it is that the market is demanding it and they are afraid to fight the market. So if the market wants more rate cuts it will get more rate cuts.”

On October 31 2007, the FOMC felt the markets were fine with what the Fed had done until then. They never understood what the economy was telling them.

We will find out next week whether the 2019 FOMC understands what the economy is saying right now.

2. US Economy

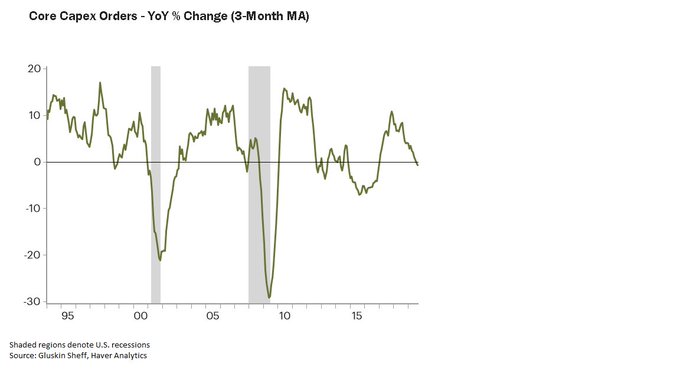

- David Rosenberg@EconguyRosie – – Imagine that the odds of seeing a monthly decline in home sales, housing starts, core capex shipments/orders, production and retail sales in an economic expansion are 1 in 100. Still see no recession??

And he noticed that something had crossed below the zero-line:

- David Rosenberg@EconguyRosie – – The legendary Paul McCulley once told me years ago that his favorite leading macro indicator is the YoY percent change in the 3-mo moving average of core capex orders. It just crossed below the zero-line.

Yeah, yeah! Who cares when the consumer is strong or “fabulous” as a CNBC anchor said recently?

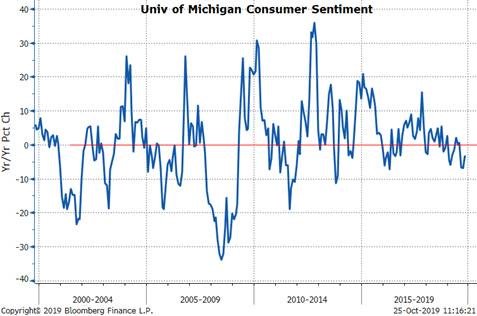

- Richard Bernstein@RBAdvisors – – Consensus is the #US consumer is strong. Then why is #Consumer Confidence losing steam at the fastest pace since 2013?

And you have,

- Richard Bernstein@RBAdvisors – Consensus is the household sector is “strong”, but evidently everyone forgot to actually ask the #household sector whether they felt that way.

As we have said before, when these two ex-colleagues agree, it pays to listen. Their timing may be early as it was in 1999, but they almost always end up proving right together.

What did Jim Bianco say about the economy & bonds in his interview?

- “It looks pretty bad for the globe. Germany might be in recession and Italy already had two quarters with negative GDP growth. The ECB has pushed rates into negative territory and I don’t know what more they can do. Meanwhile, China is at a 28-year low in GDP growth and Japan’s GDP growth is forecasted to be negative in Q4. … I’m bullish on bonds because the global economy is slowing. So, over the next several months, one of the best investments in its history might be sovereign debt.”

3. Stocks

First a summary of the indicators from Lawrence McMillan of Option Strategist:

- “In summary, all of our indicators are bullish, but $SPX has not confirmed with an upside breakout. As a result, we are trading from the long side, but are mindful of the fact that a failure by $SPX to make new all-time highs soon will begin to weigh negatively on the psyche of this market.”

What about $VIX falling to a 12-handle?

- Mark Newton@MarkNewtonCMT – As discussed earlier in the week,, $VIX making what I view to be a final pullback from early Oct in a 5-wave decline which should complete within 3-5 trading days & allow Daily & weekly Counter-trend Demark to line up by FOMC

He also sees a potential rollover in breadth:

- Mark Newton@MarkNewtonCMT – Advance/Decline also looks to be at an area where this should rollover after recently pushing back to new highs- Same signals now as were present in July & early May- So while many discussing how good breadth HAS been.. I see that changing over next 2-3 weeks & turning down

Then you have his virtual sacrilege of doubting the semis:

- Mark Newton@MarkNewtonCMT – Semis- $SMH has reached the upper end of its diagonal triangle- & despite $INTC nice move, I view Semis as high risk here –RSI showing much lower levels than July, while Exhaustion will occur on Daily chart to line up with wkly 9-13-9 next wk

The above are short-term considerations. What about longer term?

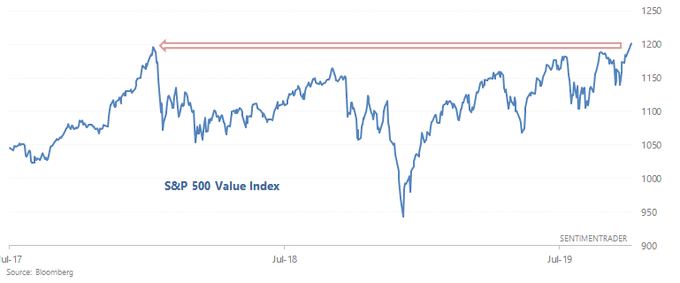

- SentimenTrader@sentimentrader– – S&P 500 Value Index just made a new all-time high. In the past, when it broke out to a new all-time high for the first time in 200+ days, the S&P 500 Value Index always went higher 6 months later

Also true for that ultimate “value” market?

- SentimenTrader@sentimentrader – – The % of $DAX stocks above their 200 dma’s is above 76% for the first time in 2 years. Breadth is improving When the % of stocks above their 200 dma rose above 76% for the first time in 100+ days, $DAX was higher 100% of the time 6-12 months later 2003 2004 2009 2012 2016 now

Can we write about the DAX & not write about EM?

- J.C. Parets@allstarcharts – NEW POST: Playing for a Face Ripper allstarcharts.com/options-face-r feat. @chicagosean #options$EEM $HG_F $JJC

4. Dollar & Gold

Remember what QE did to the U.S. Dollar & Gold? That is not the main reason Jim Bianco is bullish on Gold:

- “You also want to play gold. If you look at a chart of the gold price over the last four years, it’s identical to the amount of negative debt in the world. For 5000 years of human history, the argument against gold was that it had no yield. So why buy it? Well, in 2019 the argument for gold is that it’s the high yielding alternative at zero.”

5. Saint Crispin’s day – “like a Rooster with an itch“

Friday was Saint Crispin’s day. CNBC’s Mike Santoli remembered that & used some of the phrases from the famous St. Crispin’s Day speech (from Shakespeare’s Henry V) in his closing comments to CNBC’s English anchor Wilfred Frost.

That reminded us of our favorite recitation of that famous speech & that too by a proud member of a DD team:

The marvelous Danny Devito plays an instructor at an army base brought in to get a group of DD soldiers into the passing grade at their Drill camp. Everyone at that base had given up on these DD (dumb as dog***) recruits. He uses Shakespeare to motivate & teach these students. The film Renaissance Man is a superb film. Watch the interplay as Devito explains Simile (“like a rooster with an itch“) & Metaphor to the students:

6. Happy Diwali

The 5-day celebration of Diwali began on Friday and the central day is Sunday, October 27. We recall here the ancient Shaanti-Mantra for universal good:

सर्वेऽपि सुखिन: सन्तु; – Let all be happily content

सर्वे सन्तु निरामयाः – Let all be without ill-health

सर्वे भद्राणि पश्यन्तु; – Let all perceive the Noble

मा कश्चित् दुक्खम् आप्नुयात् – Let no one suffer grief

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter