Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Big News or Big Event in 3 weeks?

No. We don’t mean the “substantive” first phase announced by President Trump & Vice Premier Liu He on Friday. That actually took the Dow down 200 points in the last 30 minutes or less on Friday.

No. We mean the “deal” between PM Boris Johnson of England & PM Leo Varadkar of Ireland. And that deal has the potential of achieving a non-hard Brexit on October 31. Wasn’t that why Barclays was up 8%, Deutsche Bank was 5% & EUFN, the Euro bank ETF, was up 4% on Friday. No wonder US banks also rallied hard on Friday.

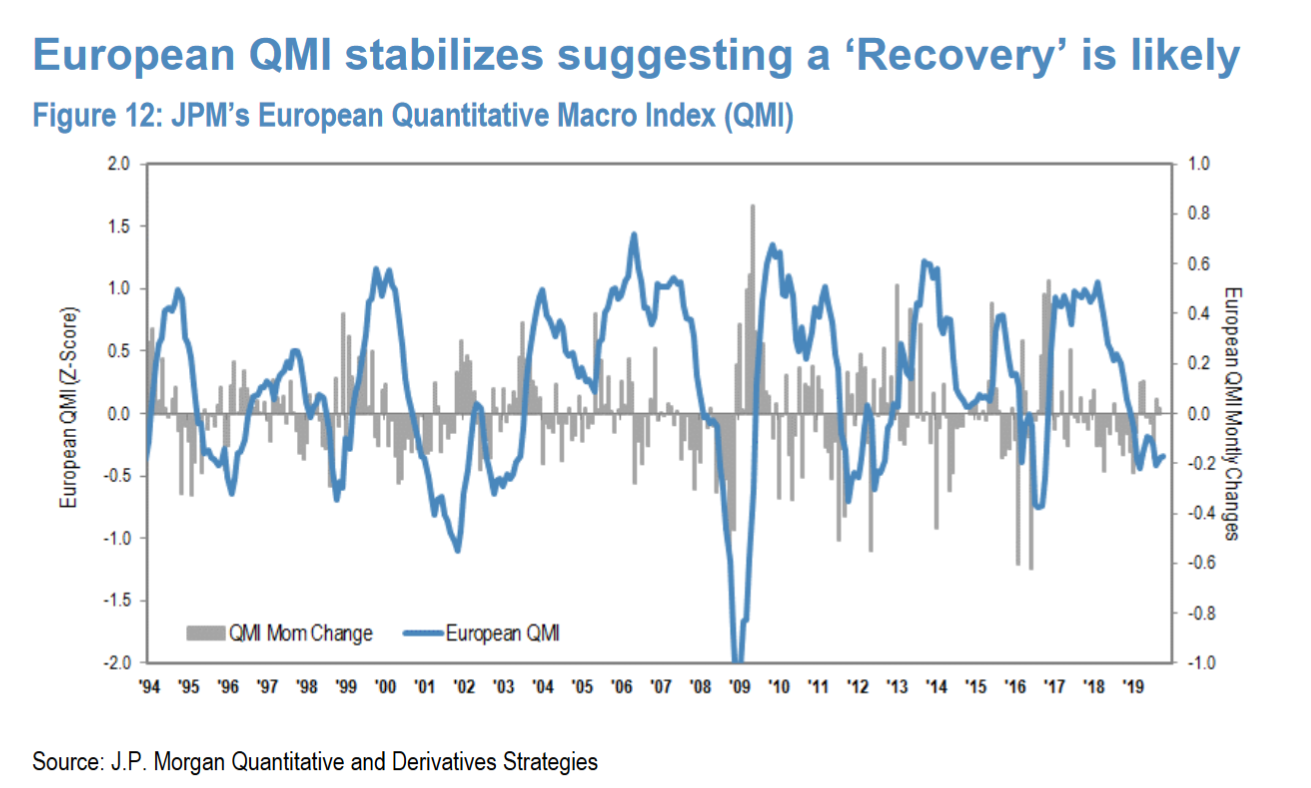

Remember ECRI’s Lakshman Achuthan has been pointing out for about 2-3 weeks that the Eurozone is looking better. You also have the below from a Quant model from JP Morgan via The Market Ear:

- Quant model makes major shift from Contraction to Recovery – The JPM QMI has improved for two consecutive months shifting their recommendation from Contraction to Recovery.

- JPM: “We appreciate that many of our clients fear a pending ‘recession’ but the QMI is now at levels that are historically associated with mean reversion to the upside rather than a time to double downside”

No wonder German 10-year yield has bounced from minus 75 bps to minus 44 bps, above the “big” level of minus 45 bps.

Our view that the US Treasury yields have been impacted more by European yields than US economic numbers was validated this week by this week’s 20-22 bps rally in US Treasury yields that matched the 21 bps rise in the German 10-year Bund yield.

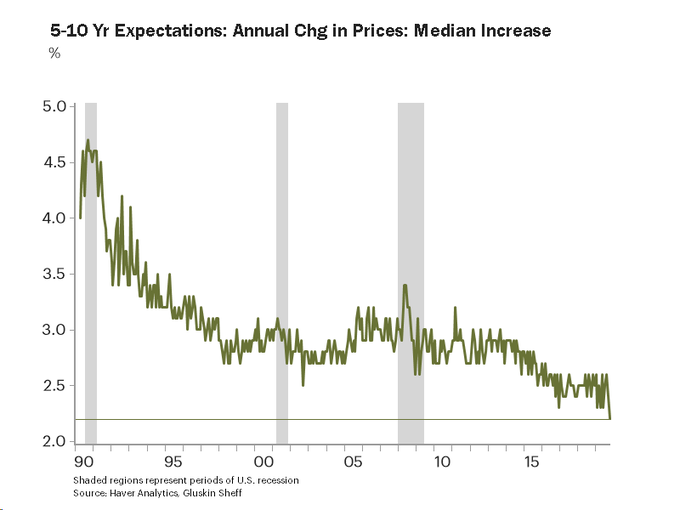

The US 10-year yield which almost touched 1.50% last Friday closed this week at almost 1.75%. And this is despite US PPI & CPI coming in either below or at expectations this week. Not just actual numbers but expectations too!

In commenting on his chart above, David Rosenberg wondered about bond markets being fixated on politics. But we wonder whether the bond markets were fixated on a possible confidence-generating resolution to Brexit by October 31. We are not saying that the ills of British-Irish-European economies will be fixed soon. But it is possible that Christine Lagarde at ECB plus a realization that Negative Rates are not an answer & a non-disastrous Brexit might boost confidence in European bond & stock markets. And that may remove a big risk from the US banking sector & reduce the downward pressure on US rates.

And Chairman Powell signaled his own “Not QE” labeled QE of $60 billion per month. Remember how Bernanke’s QE ended up raising long duration yields!

We do not mean to pooh-pooh the US-China phase I accord announced on Friday. That does reduce a big uncertainty in the stock market. At least it might have bought us 4-5 weeks of relative certainty as the two sides put that deal to paper. We think both Presidents Trump & Xi have agreed to adhere to the Phase I deal at this time just as President Xi & Prime Minister Modi have seemingly agreed to maintain their own status quo in their Friday summit. All these leaders would rather focus inwards at the situations in their countries at least for the next few months.

Will such a relative quiet help consumer confidence? And, as Pimco told us, the biggest variable in the US might be consumer confidence:

- Lisa Abramowicz@lisaabramowicz1 – “The first half of 2020 will be slow in the U.S. If the rhetoric on the trade war gets worse, you may be in recession simply because the consumer loses faith:” Pimco CEO Manny Roman

2. On the Other Hand,

- Lakshman Achuthan@businesscycle – Downturn in consumer spending growth fits with jobs growth slowing.

.

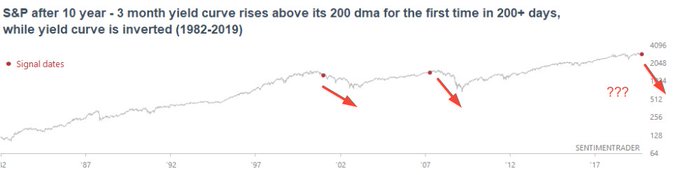

Remember the inverted 3-month – 10-year yield curve? It un-inverted on Friday. Good or bad?

- SentimenTrader@sentimentrader – The yield curve flattened nonstop over the past year and inverted. Now it’s steepening Yield curves steepen in recessions when the Fed cuts rates. There are only 3 periods in which the yield curve flattened for a long time, inverted, then steepened: January 2001 April 2007 Now

This puts the ball squarely & almost entirely in the Fed’s court.

3. US Stocks

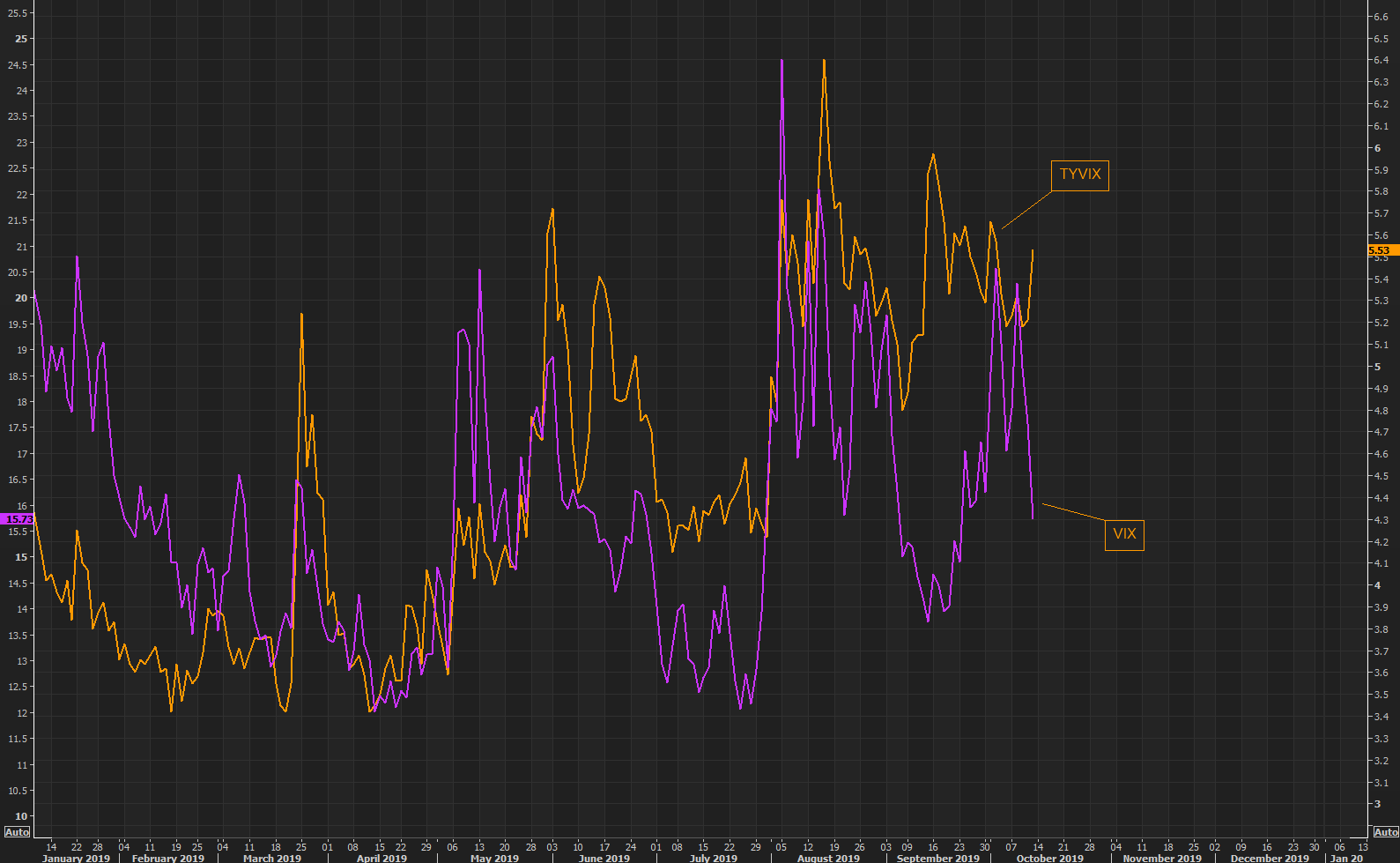

The volatility in the bond market may pose a challenge to stocks.

- The Market Ear – Treasury volatility, TYVIX, versus VIX getting wider again

And, like two weeks ago, you have the trend line above:

- The Market Ear – Spuz back to the trend line...

A DeMarkian also sees am exhaustion signal ahead:

But what may cause a cautious guru to turn positive?

- Lawrence McMillan of Option Strategist – In summary, we have been maintaining a “core” bearish position since $SPX broke down below support at the beginning of October. A close above 2990 would change that. Meanwhile, we are also trading the oversold short-term buy signals that have arisen.

But another well-known guru is already positive:

Tom McClellan wrote this week in his article Seasonal Inflection Point Has Moved Earlier:

- “… it is a pretty compelling chart at the top of this article, showing how the dance steps of the DJIA in 2019 have been pretty closely approximating what the Annual Seasonal Pattern has been saying should happen. The bulls just need it to keep on working now, as we head into the period of favorable seasonality”

And then you have the 3333 target for the S&P from Michael Hartnett of BAML via The Market Ear:

- Hartnett: “irrationally bullish” – we are “irrationally bullish” driven by bearish positioning, desperate liquidity easing, and “irrational contagion” from bond bubble to equities; Greece auctioned negatively yielding T-bills, US auctioned record low-yielding (2.17%) 30-year government bonds this week…bond bubble delays global recession and encourages irrational contagion to stocks; in our view there’s no reason SPX can’t overshoot to 3333 next year (perhaps peaking around “Super Tuesday” on March 3 ) completing its extraordinary 11-year bull market from the 666 lows.

If you think 3333 is nuts, look at the “perfect trend channel” below from The Market Ear:

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter