Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.A Perfect Week?

What would a perfect week for markets would look like at this stage? Big indices Dow & SPX go up; Nasdaq keeps its torrid outperformance; Laggard sectors like small caps & financials outperform strongly; energy stocks & oil keep flying; copper & iron ore rally; miners rally hard; emerging markets also outperform; High yield rallies while Treasuries fall; Treasury yield curve steepens. Wouldn’t that be a perfect week not just for investors but even for the Fed? It would be a sign that everything is working according to the plan.

Guess what? The above wish list came true this week:

- Dow was up 2.5%. The S&P was up 3.5% and closed above 2,900. Nasdaq & NDX rallied by almost 6%. And Russell 2000 rallied by 5.6%. EEM was up 4.7% & Goldman was up 4.7%. Copper was up 4.5% & iron ore leader CLF was up 16%. Copper & gold miner FCX was up 9% while Newmont was up 6.5%. Both Oil Services & Integrated Oils rallied 9%. High yield ETFs, HYG, JNK, rallied by 1% while leveraged credit funds rallied by 3%. And the Treasury yield curve steepened with long treasury yields up 5-6 bps & TLT down 1.2%. To cap it all, VIX fell off the cliff by 25% on the week.

The Fed announced its intentions to buy high yield debt once some structures got into place, probably goaded by the Gundlach tweet of the Friday before.

Yes, but did this week exhaust all the ammunition? Not really when you start enumerating.

- Michael Hartnett of BAML via Market Ear on Friday – ”9/10 say bear market rally, 8/10 say “U” or “W” recovery, 7/10 say only buy what the Fed buys, 6/10 expect retest of lows…just 2/10 say GT10 yield >1%, and <1/10 say stocks in bull market; consensus remains bearish.”

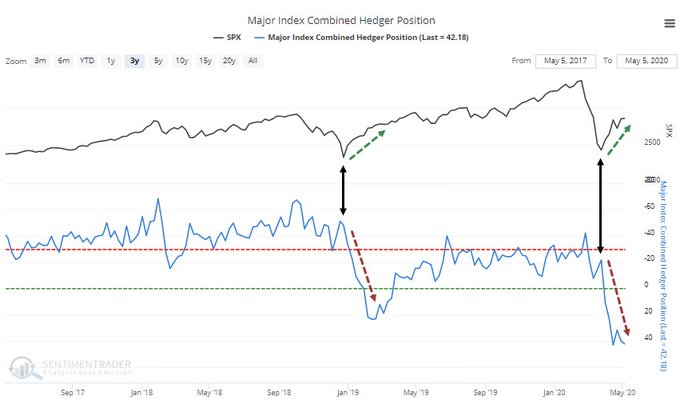

For those who like pictures & dream of a bonfire of the shorts,

- SentimenTrader@sentimentrader – Speculators are *still* betting against this rally. They’re again holding more than $40 billion of equity index futures net short. They tried this in early 2019, too.

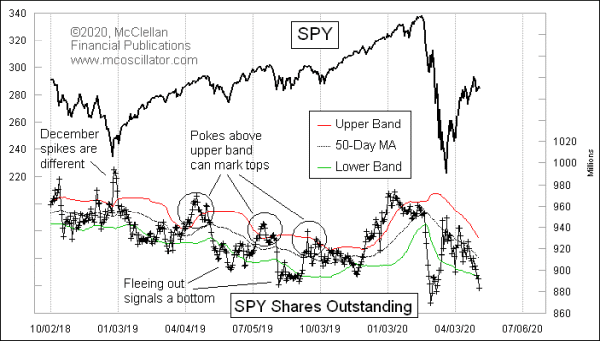

Not only are speculators short futures, but Tom McClellan saw “Investors Fleeing Out of SPY“.

Isn’t that a bad thing? Not so, explains Mr. McClellan:

- “Stock prices have risen energetically off of the March 23 price low. At first there was a big surge of money pouring into SPY, the largest of the SP500 ETFs, and that lifted its number of shares outstanding. But as the rally has proceeded further, investors have started getting shy and pulling out of SPY, taking the number of shares outstanding to one of the lowest readings of the past few years.”

- “Right now, we are seeing a peculiar circumstance where prices are rising, but the number of shares outstanding has fallen rapidly, dropping below the lower band. This conveys the message that investors are not believing in the uptrend, which of course is a sign familiar to every contrarian, that the uptrend should continue.”

OK, but what is the VIX saying? Kill Vol, apparently! (with apologies to Quentin Tarantino & Uma* Thurman of Kill Bill).

- Market Ear – VIX 2/8 months futures spread is taking a new “aggressive” move lower today after holding same levels for 2 weeks. Not overly surprising as demand for short term protection fades and we are not realising much volatility recently. … The spread is still “elevated” from a historical point of view, but note we are taking new post Corona crisis lows.

The above is a kind of artificial or technical ammunition. What about real cash that could come in? BAML points out that cash in money market funds is now at $4.8 trillion. And fund managers are petrified of negative rates in the Treasury markets & the impact on their funds & fees. Further, as BAML points out, courtesy of Market Ear, that

- “$53.5bn into cash, $11.3bn into bonds, $2.3n into gold, $16.2bn out of equities (largest equity redemption since March crash).” – BofAQuestion remains will MMF join the FOMO eventually?

But is this money really likely to move? That brings us to the mainstay of the US economy.

*Uma is a juxtaposition of U (you) & No (Ma). Goddess Paarvati was extremely naughty as a child & her mother used to keep saying U Ma meaning don’t do that. Eventually U Ma became Paarvati’s nickname & now Uma is one of the most popular names for women in India. And Uma/Paarvati in her Durga role is a violent destroyer of evil, much more violent than portrayed by Uma Thurman.

2. US Consumer

We all know what Rick Rieder of BlackRock & other Mahaa-Jan like him are saying:

- Rick Rieder@RickRieder – Finally, on the other side of the equation, the #fiscal and #monetary policy response to the #labor market crisis has been nothing short of monumental, and it should go some distance toward supporting job markets as the #economy slowly reopens.

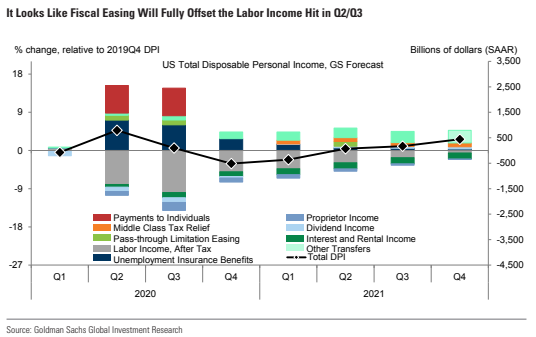

But what about disposable income of consumers? That picture can’t be good, right?

- Cullen Roche@cullenroche – – Truly amazing statistic here. How big is the stimulus for individuals? Goldman says disposable income in Q2 & Q3 will be slightly POSITIVE.

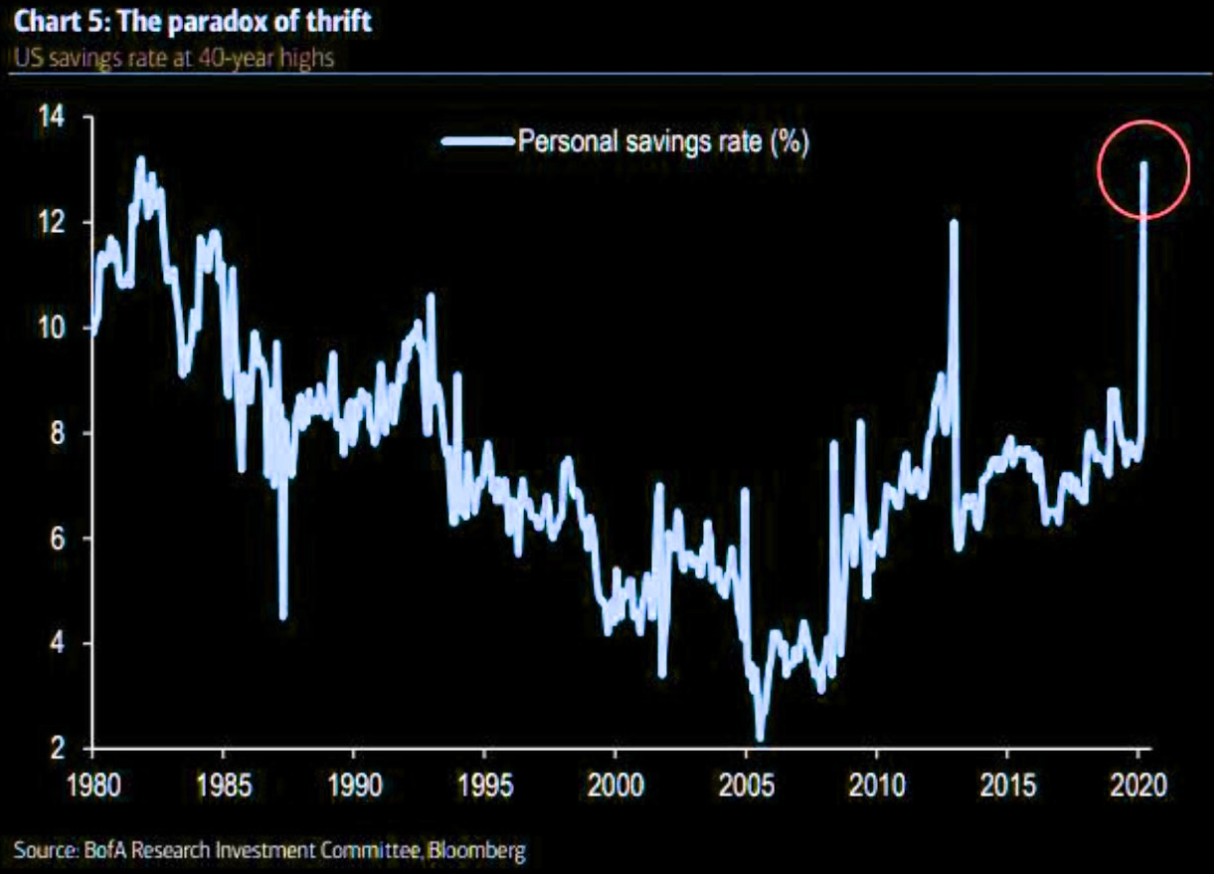

Holy Whatchamacallit! But wouldn’t this increased disposable income go towards building personal savings given the ravages of CoronaVirus? Look at the picture below from BAML, courtesy of Market Ear:

And this is real money, folks. Not some artificial construct like CTAs sitting flat. On the other hand, cash doesn’t have to flow into stocks. Isn’t demand for income more secular when interest rates are virtually near zero, especially the 5.49% income kind ?

3. Credit & Rates

- Lisa Abramowicz@lisaabramowicz1 – – The biggest US high-yield bond ETF has increased its assets by 60% in less than 2 months thanks to the Fed’s plan to buy junk-rated debt. Another $1.4 billion flowed into $HYG over the past week, bringing its assets to $20.7 billion from a recent low of $13 billion on March 23.

How critical is the Fed put behind corporate credit?

- Jenna & John@StrategicBond – – Boeing’s $25 billion deal takes it from 82nd in the investment grade index with $19 billion, to 17th, with $44 billion. It also pushes the total IG issuance of April at $297bn past March’s, to take over as the largest month of issuance ever. March had $261 billion.

We can’t say for sure but we feel this $25 billion deal could not have been done without the Fed put. Companies like Boeing that are critical to the manufacturing sector are precisely the ones that the Fed will not go down. Actually candidates for the Fed ” guarantee” don’t even have to be as critical as Boeing. They simply need to be large cap, it seems.

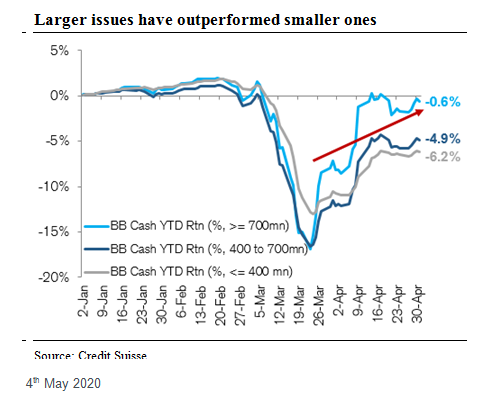

- Jenna & John@StrategicBond – Great chart from CS demonstrating the significant outperformance of US large cap BB credit, compared to smaller cap BB credit; we always favour large cap, non cyclical bonds in all rating categories!

Is this outperformance of large cap credit over small cap credit another reason for the outperformance of SPY or small caps?

Then you have another supporting condition for risk markets:

- Richard Bernstein@RBAdvisors – Glass half full: #YieldCurvebreaks out steeper. Continued steepening would likely be a good sign for nominal growth.

If that is not enough, note how the 30-10 year yield spread (NOB) has steepened as Rick Santelli pointed out on Friday. That should help in reducing the fear of deflation that lies under the worries.

Given all of the above, wasn’t last week an almost perfect week for risk markets?

4. Commodities

But why stop there? After all, the star of the week was Oil including energy stocks. The rally in energy stocks has been absolutely stupendous since they were virtually dumped by all. The energy sector is up 7 weeks in a row. Is it time for a reversal? No, said Carter Worth, resident technician at CNBC Options Action on Friday:

Virtually every commodity sector rallied this week. Gold miners continued their torrid run with GDX & GDXJ up 4%+ on the week. CLF, the iron ore stock, FCX, the copper stocks & X, the best known steel stock rallied 16%, 9% and 13% resp. Even MOS from the Ag sector rallied 6.7% on the week.

The only fly in the ointment, perhaps, was the rally in the Dollar.

5. German Court vs. EU Court & BundesBank vs. ECB

The pain in Italy is so clear, so vivid that even Ursula von der Leyen (European Commission head) apologized in late April for not acting sooner. And Brussels suspended budget deficit limits & eased rules governing state aid. So far so good.

Then the European Central Bank (ECB) launched its 750-billion euro Pandemic Emergency Purchase Program &, we believe, suspended its own rules to enable it to prioritize buying Italian government bonds. As Bear Traps reports, “3 year Italy has compressed nearly 80 bp’s vs 3 year Germany …”.

This week the other shoe fell. The German Constitutional Court issued a firing on Fort Sumter type landmark ruling. As Bear Traps reports,

- The ECB has a way out but it is a tight path and not clear to us what ECB can do to fit the requirement and still buy. PEPP (pandemic emergency purchase program) is ok for now but will be at risk in short order. The PEPP did not exist when the case was filed – but most arguments will apply to it and to a greater extent. Markets are seeing ways they can continue to muddle through for now… BUT this is a real problem.

The German Court has no jurisdiction over the ECB but they do, at least in their own eyes, have complete jurisdiction over the German Bundesbank. So the German Court has issued instructions to the Bundesbank to not participate in certain operations until the ECB meets the requirements laid down by the German Court.

In response , the European Court of Justice, EU’s top court, said in a rare statement that

- “In order to ensure that EU law is applied uniformly, the Court of Justice alone — which was created for that purpose by the member states — has jurisdiction to rule that an act of an EU institution is contrary to EU law,”

Meaning only the EU court determines what is legal & the German Bundesbank is obligated to go by what the EU court says.

So why are the European bond markets & the Euro still sanguine? As the FT reports,

- “The ruling was discussed at a teleconference meeting of eurozone finance ministers on Thursday, where German minister Olaf Scholz insisted that a solution would be found to keep the Bundesbank involved in ECB bond-buying, diplomats told the Financial Times. Mr Scholz said he was confident the ruling would not affect Germany’s participation in the scheme after the three-month deadline imposed by Karlsruhe and said it was a matter to be dealt with in Germany rather than by the ECB, said people familiar with the discussion. “He was very reassuring,” said a eurozone diplomat.”

The real fight underneath does have Fort Sumter like emotions. What Italians think EU should do for Italy & Southern Europe with German money is totally contrary to what Germans think Germany & Northern Europe should do for Italy with German money. Underlying this is the real question whether Germany is a nation or just one member of EU? Merkel has tried her best to reduce, if not eradicate, the “national” ethos of Germany. Will it survive her?

In the meantime, watch Italy CDS spreads. At least that is what the Bear Traps Chart suggests:

6. Women’s Empowerment

This term & its stated goal has been bandied by many & for long. The reality is women are very rarely given the chance to command & run mission critical functions especially under extreme conditions. This week, we came across an exception that stunned us.

Think back to February 27, 2019 when air forces of two nuclear-armed neighbors got into a large dogfight, one of the largest such battles in recent years. That day 27 Napak fighter jets, including 10 US-made F16 Falcons, flew towards India. In response, the Indian Air Force (IAF) scrambled its fighters, MIG-21s, SU-30s & Mirage 2000, to intercept & engage. In that 16 minute dogfight, an Indian MIG-21 shot down a Napak F-16 & was subsequently shot down itself. The Indian pilot, Wing Commander Abhinandan, landed in Napak territory & was taken into custody. He was then released to India after intense pressure.

To our amazement, we discovered this week that the Indian Air Force controller of this dogfight, the fighter controller who talks & instructs the fighter pilots as they engage enemy aircraft in a live battle, was a woman. This woman, who had dreamed of joining the Indian Air Force as a child, actually ended up running the biggest air dogfight of recent years in the world. In her 24 minute TV interview (in English), this woman from a small town in India simply said (min 22:35-22:45)

- “… success is irrespective of gender, irrespective of the place you belong to”

Listen to this not because you care about the dogfight or geopolitics but because it is rare to find a woman who has been given such an incredible responsibility & one who manages it with confident humility.

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter