Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Defcon One … it’s real!

It has begun. A friend described the below as “lethal”.

This clip shows the theme of the attack we will see over the next 6 months. Smart because Gallup shows 67% unfavorable rating for China among Americans. But such an attack would not have much impact on China without real actions, right? And we saw the first one today. Hear the explanation by T.J.Rodgers, founder of Cypress Semiconductor:

According to Mr. Rodgers, the USA has issued an edict:

- “If you make chips anywhere in the world using American equipment which everybody does or if you use American software on your chips or if you design the chips with American software, all of which are the only way to do it because that in effect is the infrastructure of semiconductors, then you can’t ship to Huawei & we will make your life miserable if you try. It’s Defcon 5. It’s Real“

What could be just as bad? A shortage of Dollars.

- Lawrence McDonald@Convertbond – – Bloomberg Barclays Credit Index + MSCI = nearly $1.6T of future (next 4 years) buying power. China is deeply troubled without US buyers of its stocks and bonds. #leverage

Forget the future. The present looks gloomy enough.

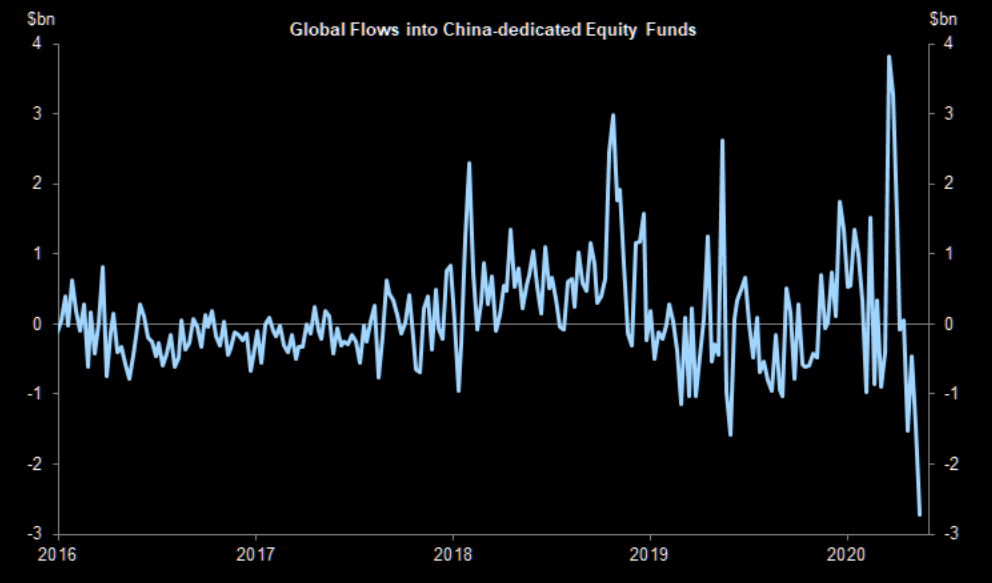

- Market Ear – Fund investors puking China risk. The positive trend from the start of the year in terms of inflows is obliterated. Another small piece in the China/US tension puzzle

We recognize that this China-Huawei stuff is not positive for semiconductors as those stocks demonstrated on Friday. But the anti-China rhetoric may actually end up being a positive for the broader indices. We think the market’s rally does assume President Trump will be reelected. And a successful anti-China message could increase his reelection chances & thus be bullish.This may a dumb overreach but, as we know, the entire rally could be a bigger overreach.

Also look what the famously smart investor, Nelson Peltz, said this week on CNBC:

- “His policies, to me, are the right policies for America, … These are the right policies — these policies should have been put in place ages ago. … We have exported tens of millions of jobs — of manufacturing jobs over the last 40, 50 years, pick whatever time frame you want. We exported them generously: We gave them to Europe, we gave them to Asia. Now it’s time to bring those jobs back.”

When asked whether he would vote for President Trump, Mr. Peltz said “right now for sure I am“.

That is fine but you know what could be an even more powerful bullish signal? Capitulation of Trump bears. And wasn’t Signor Yglesias was a determined bear on Trump?

- Matthew Yglesias@mattyglesias – A genuinely unpopular opinion of mine: Donald Trump is a lot smarter than most of the people working in politics and media.

2. Bull vs. Bear market; Consumer vs. Capex

Right now even babies in their mothers’ wombs know that sentiment towards tech stocks is el nutso. So the air on FinTV is thick with predictions of carnage if not outright doom. But no one asked the BIG question – is this a bull market or a bear market? What difference would that make, you ask?

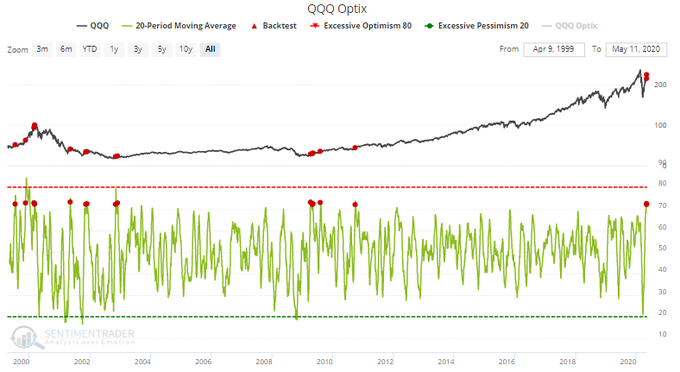

- SentimenTrader@sentimentrader – Sentiment towards tech stocks is at once-in-a-decade levels: In bear markets, this was a disastrous sign for equities In bull markets, it either led to consolidations or pullbacks

So belief is the paramount variable it seems, even more so than in religion.

We don’t know whether this turns out to be a bull or a bear. But no one can deny that we have seen three 2-3 day consolidations during the last four weeks. Does that imply that this is a bull market? Not only does Mike Wilson of Morgan Stanley thinks so, but he said on BTV that we have “at least 12-18 months of runway before we worry about that relapse“. He added that “we can get recovery in US back to where we were by Q4 2021“.

If you think that is nuts, you would term what he added as blasphemy. In a week full of legends describing this market as way overvalued, Mr. Wilson said “… I could argue that the market is cheaper today than it was in December & January .. “.

Warum? He explained:

- ” … we are obviously in a recession now; back in December & January we were not; but we also have $4 trillion of fiscal stimulus staring at us … we have more growth impetus ahead of us for 12-18 months because of this stimulus … rates are lower, stimulus is enormous & the equity risk premium you are getting paid is higher than it was at time.. So I could argue that the market is cheaper today than it was in December & January … “

Who is perhaps as optimistic as Mr. Wilson?

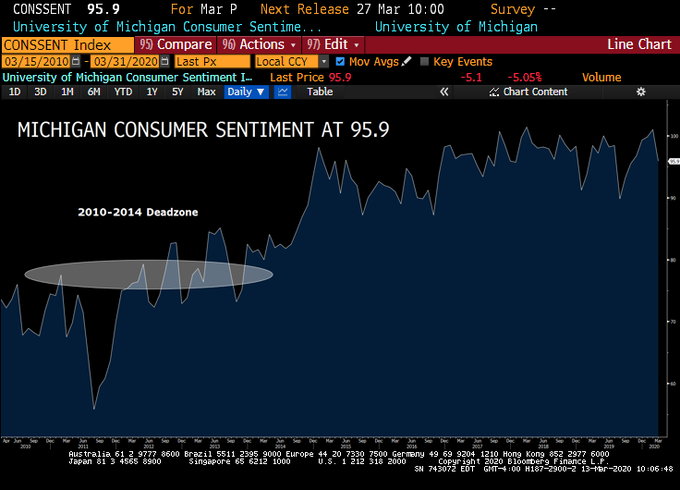

- Lawrence McDonald@Convertbond – – *MICHIGAN PRELIM. CONSUMER SENTIMENT AT 95.9; EST. 95 Amazing, still HIGHER than any reading from 2010-2014, that period averages 75.2. Point being, the consumer was STRONG going into the crisis, should help to weather the storm.

Think of how 2001 would have closed but for 9/11. The decline that began in October 2000 had run its course & perhaps so had the economic slowdown. It was the huge shock of 9/11 that led to the bear market of 2002. Remember that was a corporate recession; the consumer was OK & unleveraged at that time.

That is the case now, said Mike Wilson this week:

- “… consumer sector remains underleveraged …. so we think the rebound will be more centered on the consumer rather than on cap-ex beneficiaries. “

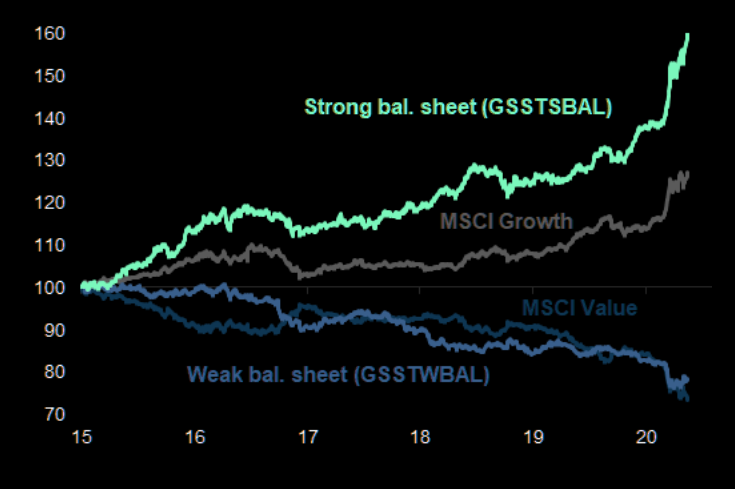

Mr. Wilson also said focus on quality. What is another term for quality?

- Market Ear – Best offense is a strong balance sheet… Companies with strong balance sheets have consistently outperformed

3. Fed & Rates

We had described the May 2 – May 8 week as “perfect”. This past week was not merely imperfect but actually anti-perfect. It was very similar to the week that ended on May 1, especially the last two days & two hours of that week. Remember what happened then?

- VIX up 18%; Dow down 3.8%; SPX down 3.8% (both vs. down 21 bps for entire week); Russell 2000 down 7.7% (vs. up 2.2% for week); EEM down 5.7% (vs. minus 1% for week); Citibank down 9.5% (vs. up 5.9% for week); HYG down 1.5% (vs. up 35 bps for week); JNK down 1.4% (vs. up 34 bps for week); OIH, the Oil Services ETF, down 7.6% (vs. up 16% on the week).

What happened this past week?

- VIX up 14%; Dow down 2.7%; SPX down 2.3% ; Russell 2000 down 5.5%; EEM down 2.5%; Citibank down 9.7%; HYG down 1.3%; JNK down 1.3% ; OIH down 8.5%.

Why the eerie similarity? What was common to both these weeks 4/25-5/1 and 5/9-5/15? Fed Chairman Powell spoke during both these weeks. He put the kabash on stocks & risk markets. Why?

Our guess is that he is still worried about the U.S. Economy but he is really upset about the huge stock rally. He would love a 10% correction in stocks so that he can add more liquidity without fear of being accused of creating another bubble.

One difference between the two Powell weeks? This week Treasury yields fell hard wiping out last week’s rise in rates. And the yield curve flattened:

- 30-yr yld down 6.2 bps; 10-yr yld down 3.5 bps; 7-yr down 3.5 bps; 5-yr down 1.6 bps; 3-yr down 1.3 bps & 2-yr yld down 0.2 bps;

And TLT rallied up 1.5% while HYG & JNK fell 1.3% . Is that a sign of deflationary pressures or is it just?

- Macro Charts – Bond Speculators have piled into the largest SHORT position in history. Similar extreme positioning led to some of the biggest Bond rallies of all time. With so much riding on recovery/reflation – if markets go back to risk-off/deflation, it could trigger a very painful unwind.

Where would yields go if we get another “one of the biggest rallied of all time“? Could the 30-year yield fall below 1% from its 1.32% close? Could the 10-year yield fall from 64 bps to 30 bps or below?

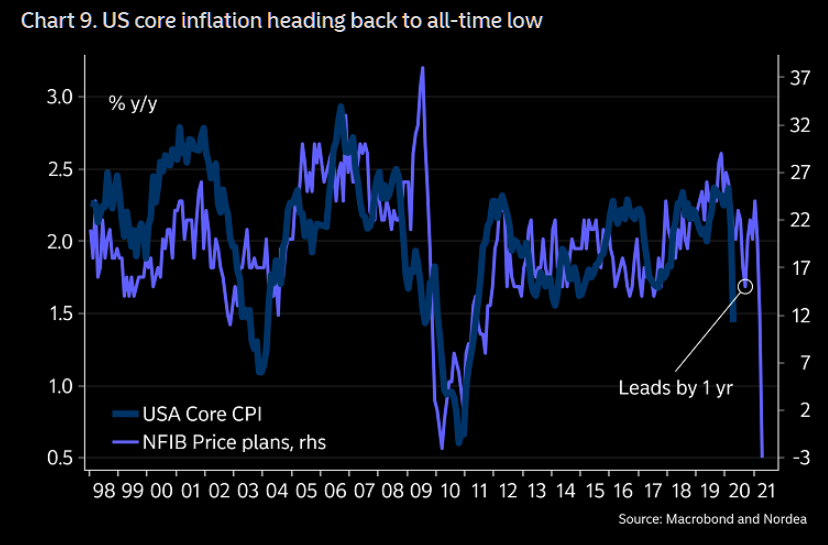

Wait. What about all those who say inflation is nigh? Per Market Ear,

4. Gold

Who likes choppiness? It just builds frustration, right? But Tom McClellan sees a message in high choppiness:

- “A very high Choppiness Index means that prices have not really been going anywhere, just chopping sideways, and thus that a trending move is likely to commence. “

So?

- “Gold’s 14-day Choppiness Index has been at a high level for several days, and now finally appears to be mattering. Gold futures prices jumped 24 points on May 14, 2020, apparently signaling the start of the called-for trending move, in this case higher.”

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter