Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Who cares?

Remember the week before? VIX reached 40 and the selling pressure was ferocious. How many remembered the DeMark-Cramer call & acted on Friday, October 30 afternoon?

- “DeMark says there should be just enough time for his indicators to turn positive & identify a bottom right before the election“

Even David Rosenberg “loved” this week’s “who cares?” rally:

- David Rosenberg@EconguyRosie – Nov 5 – You have to love the stock market. The Dow soars nearly 1,000 points on Mon/Tues on hopes of Blue Wave stimulus. Next thing you know, there is no Blue Wave and the Dow soars about 1,000 points on Wed/Thurs on no tax hikes. I am calling it the “Tails I win, Heads I Win” market.

VIX fell by 35% this week & previous week’s ferocious selling pressure was swept away by this week’s frantic buying frenzy, especially in indices. Dow was up over 1800 points or almost 7%. S&P was up 7.3%, NDX was up 9.4% and Russell 2000 was up 7% too. But Brazil was up 14.6% and Hong Kong was up over 8%. Germany was up 9% and even EUFN, the European bank ETF, was up over 9%.

So where are we now?

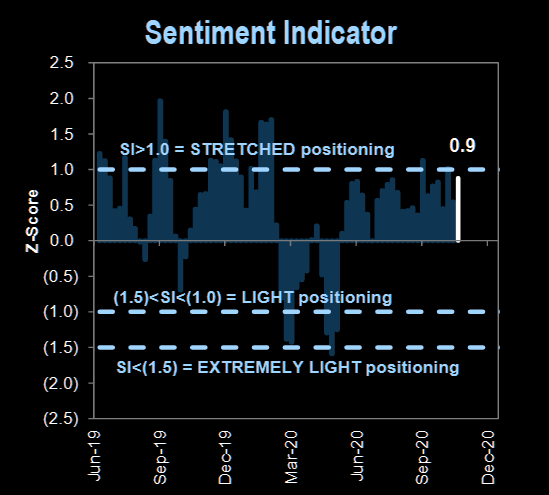

- Market Ear – Sentiment almost back to stretched – The GS Sentiment Indicator measures stock positioning across retail, institutional, and foreign investors versus the past 12 months. Readings below -1.0 or above +1.0 indicate extreme positions that are significant in predicting future return – so we are very close to a sentiment sell signal

But is the above relevant given the “mystery of human psychology”?

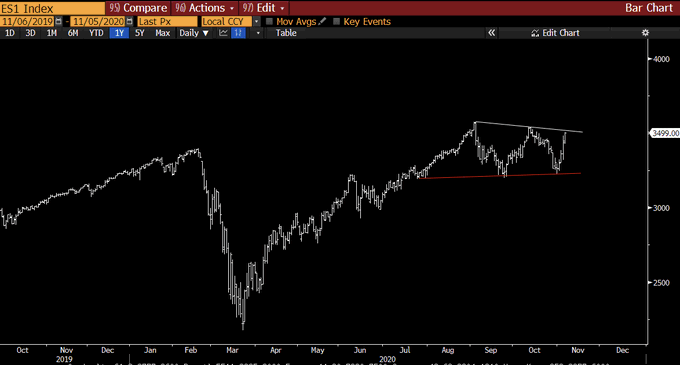

- Raoul Pal@RaoulGMI – Nov 5 – Having rejected the potential breakdown point, the SPX now looks very much like a wedge, ready for another run higher… equity indices are basically a mystery of human psychology..

How about looking back for a glimpse into a possible future?

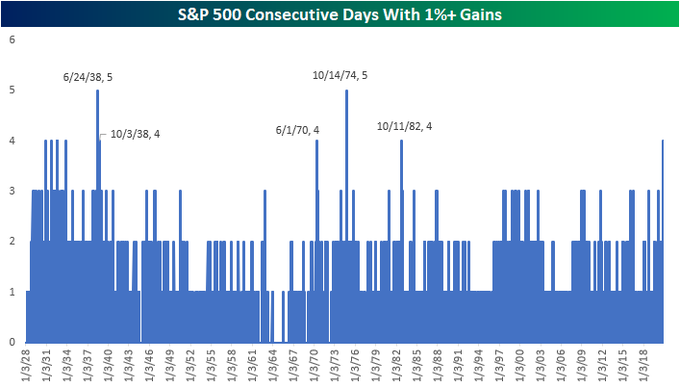

- Bespoke@bespokeinvest – Tracking for 4 days in a row of 1%+ gains for the S&P 500. Last time that happened was October 1982. $SPY

Also from Pictet Asset Management via Market Ear:

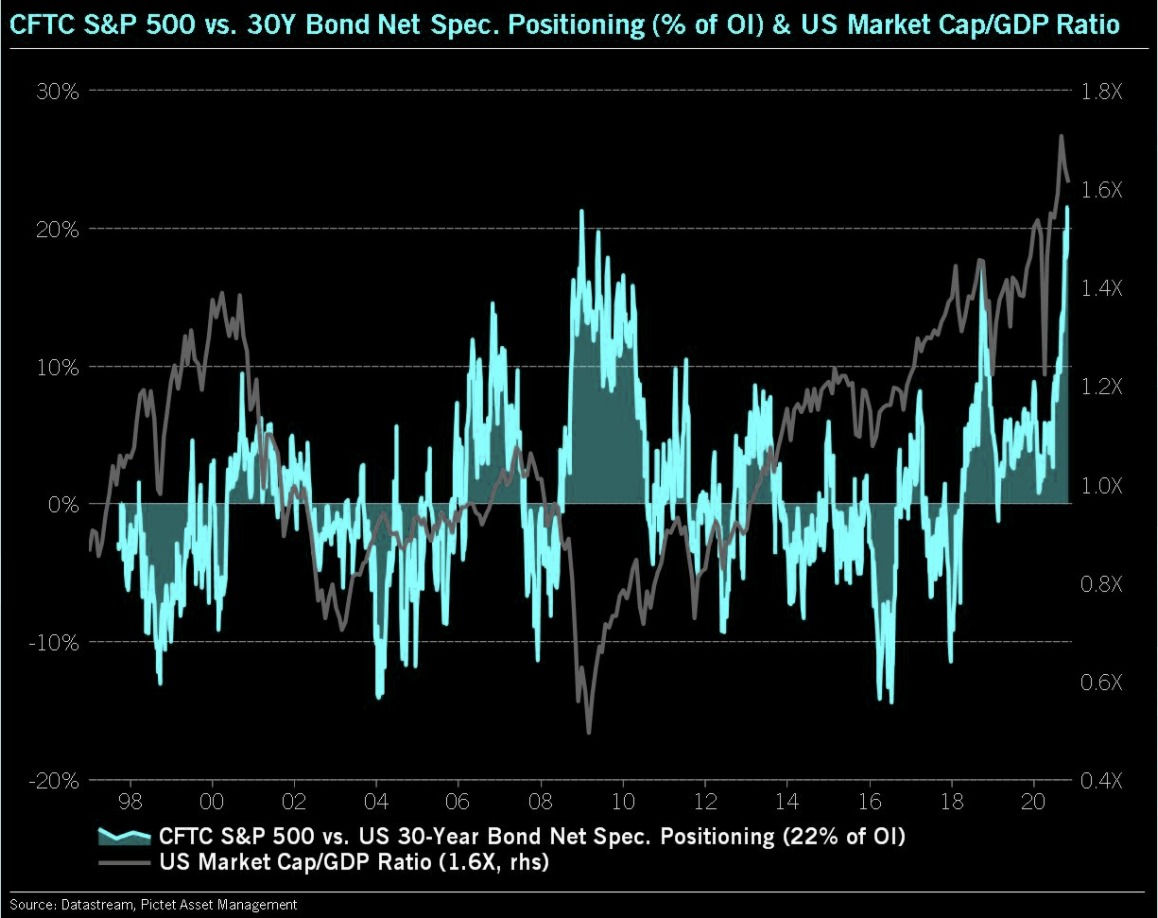

- Last time investors were this long SPX vs 30Y UST was end of 2008; At that time stocks were trading about 70% lower than they are now. With equities (especially tech) at ATH area one can argue about the risk/reward at this time.

What might drive another move higher?

- Jim Bianco@biancoresearch – FOMC statement is out. No change in policy. But they re-wrote major parts of the stmt. See the first three paragraphs. They are (economy) bearish and are ready to “print” at the first hint of trouble, which they seem to expect. Powell in 25 mins

What about the now fabled stimulus? Is there any chance it is even discussed before the election is declared won or lost? And what about after that? Paul Richards of Medley Advisors says we will get a stimulus thanks to a McConnell-Pelosi deal that President Trump will sign. But didn’t Friday’s NFP report take some pressure off of McConnell?

- Bespoke@bespokeinvest – Nov 6 – US Oct Nonfarm Payrolls +638k vs +580k exp/+661k prev U3 UER 6.9% vs 7.6% exp/7.9% prev U6 UER 12.1% vs 12.8% prev LFPR 61.7% vs 61.5% exp/61.4% prev

In the meantime, the Dollar was down nearly 2% on the week and gold was up 4% with Silver up 8.5%. And Bitcoin – fuggedaboutit! Actually don’t:

- Thomas Thornton@TommyThornton – #BTCcould be near a top here. Expect a decent pullback that could be a good buying opportunity

Finally about the election. Two weeks ago, our view was:

- “We do think the momentum is now behind President Trump. But we have no clue if enough time is left for this momentum to convert enough voters. We will see in 10 days or will we?”

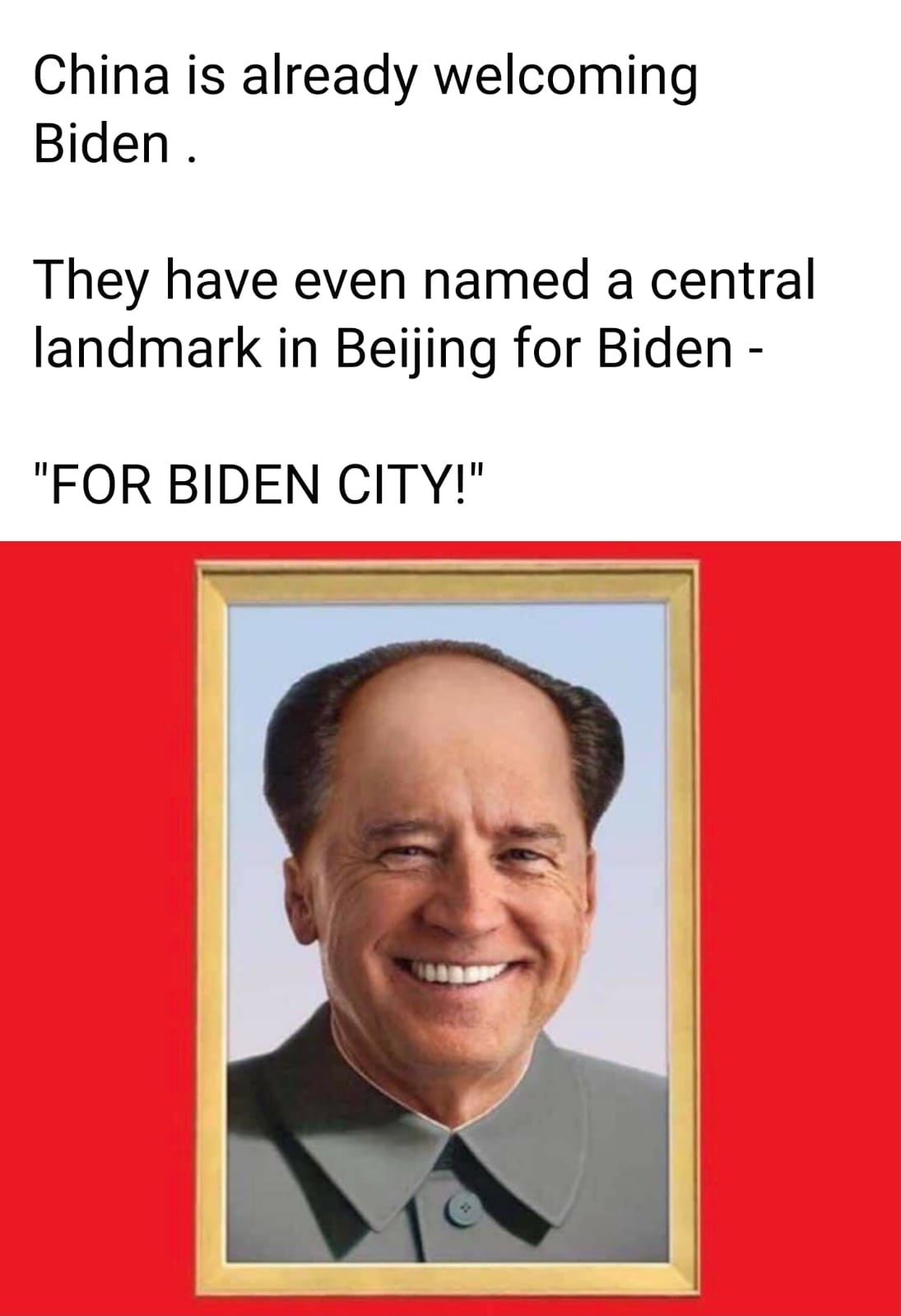

Most agree that President Trump won the battle on election day. But that victory turned out to be smaller than the Biden campaign victory in the mail-in election. But who really won this election? Look at the WhatsApp image we received from India?

Send your feedback to editor@macroviewpoints.com Or @Macroviewpoints on Twitter