Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Mike Wilson’s Dream Scenario

It is almost as if Morgan Stanley’s Mike Wilson has become a kinda Saint Peter, who if our memory serves us, controlled admission to Heaven. Such an admission into heaven was dependent, if we recollect correctly, on the deeds & perhaps even the thoughts of the applicants.

How is that different from what we saw this week? To go into investment heaven, your positioning had to have embraced reflationary love, the Mike Wilson mantra. Dow was up 1%; S&P up 1.7%; NDX up 2.2%; RUT up 2%; all terrific but put to shame by Brazil up 6.3% & Korea up 7.7%. All this with TLT down 2.9% & Silver up 7.3%. And the signature stock, CLF, up 10.5%. What does CLF do, you ask? It does Iron Ore – the Amrut (or Ambrosia as Greeks translated it), the nectar that sent you to heaven. And Iron Ore is indeed today’s ticket to investment heaven, followed by copper.

But what is the vehicle that gets you to this desired destination? A falling Dollar, of course. And that old greenback didn’t disappoint. Both UUP & DXY fell 1% this past week. Go to Bloomberg.com and watch the sheer joy on Mike Wilson’s face as he said:

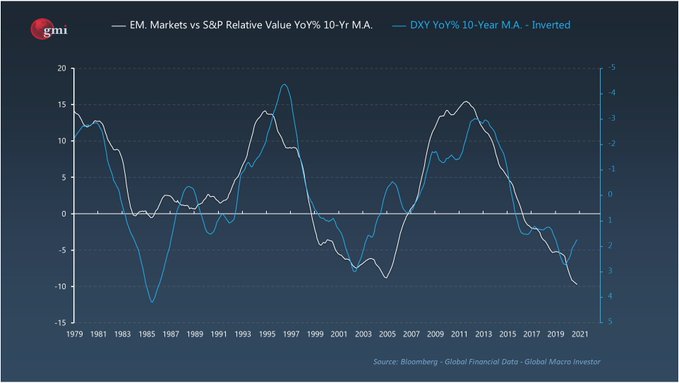

- “… $ weakness is a big part of our reflation story; it is already happening … frankly weaker $ is helpful for the world; we think $ can weaken another 10% over the next 12 months or so; … the direction is down; we think it has entered a structural secular bear market a year or two ago; … the pandemic accelerated that .. ultimately it is a positive story for the reflation idea ; global nominal GDP will benefit; inflation will return which is what is needed for managing the extraordinary debt we have accumulated over the past 10-20 years …”

So what benefits from a Dollar fall?

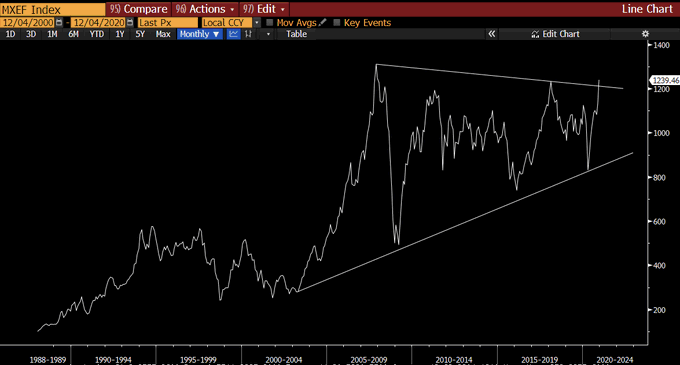

- Raoul Pal@RaoulGMI – MSCI Emerging Markets is the best looking chart in the world right now, outside of bitcoin. If this break is confirmed, then we can expect a decade or more of strong EM performance.

And, a la Mike Wilson,

- Raoul Pal@RaoulGMI – And if the dollar has turned lower, then the trend of EM outperformance will be set.

That brings up the basic question – for whom does the “G” toll? The “G”, of course, means the “Great” in MAGA. Does the “G” apply to the Hedge-Funds, BLK-type firms, Big US corporations who will expand overseas at the cost of US workers? Or does the “G” apply to the middle income working class that needs more foreign investment in America from foreign corporations coming here lured by the weak $?

2. “Trump-er” than Trump – II

Last week, we began our article with the first of our “Trump-er than Trump” thoughts. In this second segment, allow us to remind you of Trump’s most cherished goal – a down Dollar. Isn’t it ironic that his ultra-Trump wish might be realized by the anti-Trump crowd? Frankly, Yellen-Bernanke & presumably Brainard are now more fervent about taking the Dollar down than even Trump was. Wasn’t that why Bernanke launched QE in the first place?

Imagine what 2018 might have been, had Powell not raised rates in 2018 at all? The yield curve would have steepened, the Dollar would have fallen & the S&P would have gone to higher heights. Instead, Powell raised rates & killed the stock market. Coincidentally or otherwise, Democrats took the house in November 2018.

Continuing with our proviso that the Biden team is smart & extremely committed, do you think they don’t remember the November 2018 election? Do you think they would leave any stone unturned to ensure their team wins that election? That means the S&P at a much higher level to show they are better at managing the economy than Trump was; that means letting inflationary pressures rise & keeping Fed policies highly accommodative despite a potentially 5% GDP growth in 2021.

Remember how Chairman Powell became a media hero when he said publicly that he would not resign if President Trump asked him to. Would he publicly refuse to resign if President Biden asks him to? We doubt it. And what if Chairman Powell refuses publicly to resign even if so asked by a President Biden? What would the media & the House do to him in that scenario?

But the Biden team is too smart to make President Biden publicly ask Chairman Powell to resign his Chair. If they want him to leave, they can lean on him through the joint Brainard-Yellen-Bernanke team they have assembled, a team that might have lot more support & clout within the Fed than even Chairman Powell does. We feel Bernanke is still regarded as an intellectual semi-Giant by & within the Fed staff. So the Fed staff & bureaucracy will not be as firmly in the Powell camp as they were against Trump.

So with Yellen-Bernanke from the outside & Brainard et al from the inside, the pressure against Powell might just get too much for him. And if all this pressure doesn’t work, then the House can stigmatize him with the “racist” label for increasing the income inequality during his tenure as Chair.

Remember his four-year term as Chair ends in February 2022. So he becomes a lame duck probably by Q3 or even by late Q2 2021. So what is the probability that Chairman Powell resigns by Q3 2021? Not insignificant, to our thinking. And if he does, what is the probability that a Brainard-Yellen-Bernanke team goes “all Bruce Arians” for long stimulus throws by Q3 2021? Higher than now perceived, we think.

But 2021, whether Q2 or Q3, begins with Q1. And you already have smart people telling institutional clients to chant the reflationary growth mantra, as JPM’s Kolanovic did this week, per Market Ear:

- equities will rally short-term, S&P500 will hit 4,000 in Q1 and 2021 will continue to be strong

- vaccines “cure” COVID – there is no more sell-off potential in equities based on 2nd wave or other COVID related things

- CBs rule the world and the direction for equities is up; partly from the actual bid and partly from driving up multiples

- positioning when looked at over the longer horizon is still below average. More room for re-leveraging from the systematic and hedge fund community in 2021

- value and cyclicals have further to go

- inflation expectations will move higher

- USD is in a bear market and will trade lower

- all “known known” risks are manageable

Releveraging & Reflation – If that isn’t Trump-er than Trump, then we don’t know what is.

And, in case you haven’t noticed, Biden’s foreign relations posture is also turning in a Trumpian direction. China remains ultra-belligerent & even a bit contemptuous of Biden, perhaps a holdover from the old Obama-Biden days. Iran is acting even more stupidly than before, refusing to even consider re-negotiating the old Obama-Biden-Iran deal. Does this force the Biden team to at least publicly reassert support for the Israel-UAE-Saudi peace deal? Would it mean supporting the F-35 sale to UAE? If so, would that actually lift the moribund LMT?

3. Economy & da Fed

First things First. And that means getting the stimulus agreed to & passed. And no one can out-chutzpah Pelosi. She turned this week and embraced what she had vehemently rejected saying simply, she changed because of the new President. And, on the other side, Romney is reviving the small anti-Trump contingent in the Senate GOP to put pressure on McConnell.

So the markets “rightly” believe we will see a stimulus agreement, perhaps “as early as next couple of days“. No wonder the market rallied so hard despite the soft NFP report.

Which smart guru used the adjective “rightly“, you ask? It was BlackRock’s Rick Rieder, of course. First he said “don’t read too much into” the weakness in jobs adding “these jobs will come back“. He also pointed out on BTV that “average work week keeps expanding” and “job openings are at a high“.

Now the Powell Fed will be on deck on December 16. Assuming the stimulus is a done deal by then, can Chairman Powell remain passive & refuse to extend maturity of their Treasury purchases? Can Chairman Powell re-enact the ultra-grinchy Powell of December 2018 and cause a sharp sell-off in both stocks & Treasuries? Remember that is the one risk Mike Wilson highlights in his “frothy” stock market comments.

Actually, the Treasury market might be at greater risk if the Powell Fed does not extend maturities of his Treasury purchases. How much risk? Look what Priya Misra of TD Securities said on Friday on BTV?

- “If that [Fed] meeting happens with nothing, I think we are breaking through the 1.20%, 1.25% [in the 10-year yield]; …. we are at the brink of a taper tantrum …. the Fed knows that which is why we expect them to come in … ”

Why such fear? Priya Misra explained:

- “I am going to say the Fed is the only marginal buyer of Treasuries right now, particularly at the long end …. meanwhile the US Treasury is issuing a lot more of long dated paper …. “

4. Growth Stocks vs. Euphoria

What if the Powell Fed does launch their own “Twist” operation to buy long-maturity Treasuries? Who might the bigger beneficiaries of stable long-duration rates? And what has been relatively moribund in this euphoric stock market?

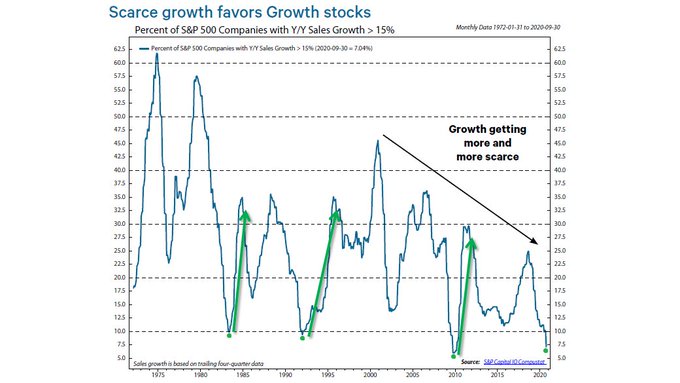

Do you even remember the FAANG acronym? Or even what used to be called Growth Stocks? Who wants them when Banks are going to the moon & CLF/FCX to Mars? Especially when growth has been in short supply as it is now? Why should you even care about Sales Growth? Below might suggest one reason:

- Macro Charts@MacroCharts – Closing the week with this amazing long-term chart on Growth Investing: $SPX Sales Growth has been in structural decline for half a century (source NDR) – driving a premium for Growth Stocks. Impressively, when Growth got this low it led to huge cyclical upturns. (2021?) HAGW!

How about applying this to the moribund FAANG stocks? Remember our old MC/FB measure for Amazon, Microsoft & FAANG in general? It is MarketCap/Fed Balance sheet ratio. Now if the Fed starts buying more long-duration assets & even perhaps increasing the BS size, would FAANG revive in time for a Santa rally?

Yes, with or without the Fed BS, says one Hemachandra-Fibonacci adherent? See Jim Cramer explain why Hemachandra-series suggests a big up move in FAANG, per the work of his colleague Carolyn Boroden:

According to Boroden, the recent low of $112.59 in Apple was a major pivotal low, a major turning point. If it holds, the Hemachandra-series suggests a series of up price targets – $127-130 first, then 136 & “if all goes well” 147. Similar lows & upside targets for other FAANGs:

- Amazon – low of 2950; if that low holds, then upside to 3461, then 3581 to 3544 & finally to 3737.

- Facebook – low of 264; if low holds, then upside to 306 minimum, then to 318 & finally to 342

- Netflix – low of 463 on Nov 10; if held long term upside to 603;

Watch Cramer end the above clip with his exhortation – “get in these stocks, people“!

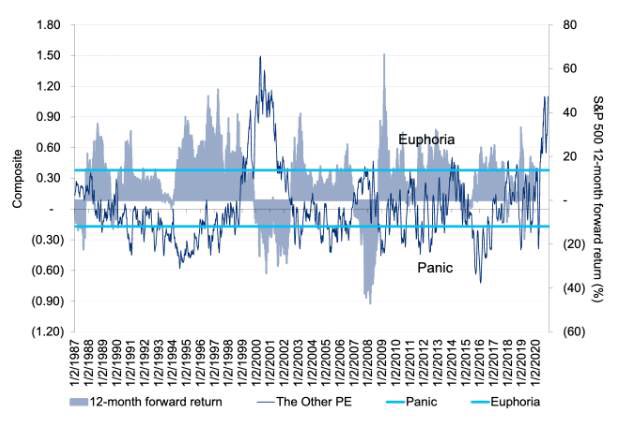

Then you have the other side, the side that screams caution, especially when McConnell-Pelosi and/or Powell could conceivably disappoint:

- Liz Ann Sonders@LizAnnSonders – Dec 2 – Euphoria flashing in @Citi Panic/Euphoria model (rose from 0.87 to 1.1 recently); level last reached in August before stocks’ -9.4% slump

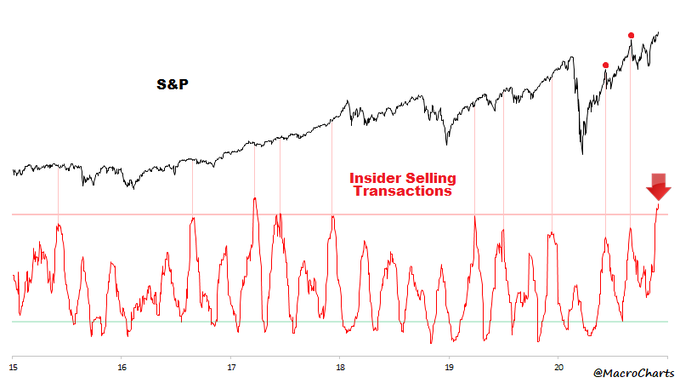

And what are the most knowledgeable people doing, the people who may know the most about their companies?

- Macro Charts@MacroCharts – Updated look at my favorite “Smart Money” indicator: Corporate Insiders are cashing out of Stocks at the fastest pace in nearly 4 years. Doesn’t mean Stocks will collapse – as Insiders *tend* to be early sellers. But they did sell both Short-Term tops quite well this year.

Now back to the greeks!

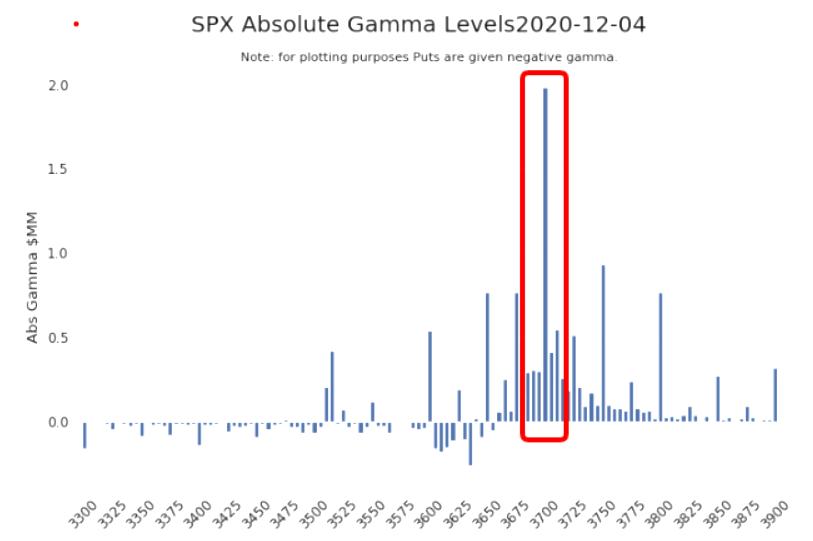

- Market Ear – 3700 is the big long gamma level. As we have written over past sessions, sticky long gamma and very small realized volatility is creating a frustration among dealers experiencing the theta bleed. Vols are down, but realized vols are down even more. … Sudden moves like the late session Pfizer move yesterday was met with buying as long gamma must be hedged. Same works should we spike higher, especially into the 3700 area, long gamma dealers need to sell deltas. … With few strong narratives and sticky gamma, theta frustration continues for longer…

5. Must Watch TV – BrIndian vs. Heartland

First & foremost, the utterly stupid & zero-backbone comment of the viral clip below came from Melissa Lee of CNBC. It is a comment that frankly should get her replaced as an anchor at CNBC. Watch the last 2 minutes of the clip below (from minute 1:29) and be aghast at Melissa’s last line “let’s move on from here“.

“What an idiot?” was our reaction. She forced the end of a discussion that went viral both for the content & for its emotional sincerity on both sides. It was a perfect embodiment of the civil war that is raging in American Society. And she forced an early end to this discussion!!! Professional Malpractice of the nth-degree, we say.

But what did we expect? First, Ms. Lee anchors a pretentious 5 pm show that “purportedly” offers fast money trades from people who don’t even trade for a living. And, even more importantly, Ms. Lee supinely keeps getting publicity largesse from Harvard while Harvard keep blatantly discriminating against students of her own Asian lineage. Contrast that to Laura Ingraham of Fox who has publicized & defended rights of Asian-lineage students at Harvard without having even an iota of Asian lineage. How does Melissa Lee even live with herself, we sometimes wonder?

What was Rick Santelli’s closing point?

- “… the way we are dealing with it isn’t necessarily optimal … “

As a personal admission, when we go out, we wear surgical gloves, a N-95 mask and a face shield that covers our entire face. So the droplets that reportedly cause an infection have to go under our face-shield, then up & inside our mask to get into our breathing mechanism. But even that doesn’t make us feel safe. So we maintain a 6 feet+ distance from everybody & refuse to take an elevator with anyone else in it. And we only wear all-weather sneakers when going outside; remove the shoes before re-entering our residence & immediately wash the soles of the shoes after spraying with Clorox. Some family members think of all this as “nutty”, but that’s OK. We believe in the ancient dictum that even Gold only protects those who help themselves.

Now to the other side; the side of entities that tell us to behave in one way & who themselves behave in the opposite. A few days ago, we walked into our neighborhood Walgreens to get a flu shot. The floor was full of 6ft social distance warnings & spots where we are supposed to stand. We stood 6 ft way from the counter only to have the young lady at the counter tell us to come closer to her desk so that we could hear her. We refused & pointed out to the signs. We also told her that we could hear her fine. Her supervisor was watching & listening but did nothing.

Then we pointed out to her that the container that supposedly dispensed the free wipes was empty. So she got a box &, to our consternation, came within 2 feet of us with a new box. Appalled, we asked her to step back & put the wipes in the container behind her.

The lesson is that entities like Walgreens that have the expertise, that choose to instruct us on how to avoid getting infected DO NOT Practice themselves what they preach. They allow their own employees to flout the restrictions they impose on their customers. That is merely a microcosm of what our elected officials are doing in New York, California & other places.

We don’t know if statistics is deemed as “science” by CNBC’s Andrew Ross Sorkin or if he knows that statistical analysis is used as a cover for all the protective steps enforced by governments across America. Regardless of that, look at what one smart guy brought to our collective attention:

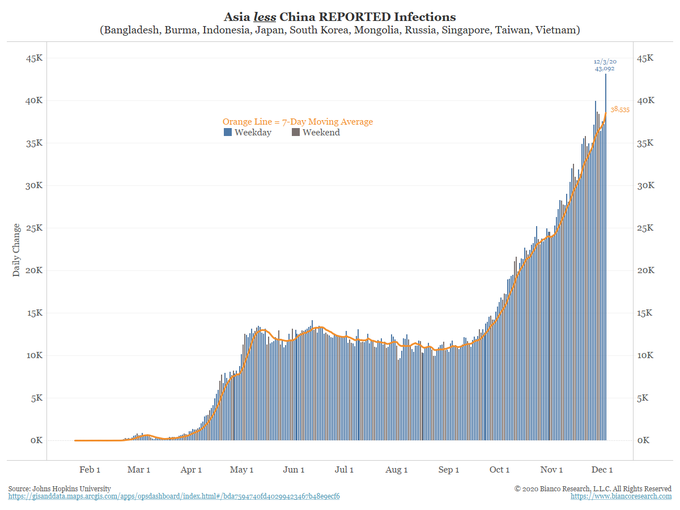

- Jim Bianco@biancoresearch – The media is making a big deal of Biden calling for 100 days of masking on Jan 20. I agree masks help. But they are being wildly oversold as a magic shield that will end the pandemic. Asian countries have about 100% mask usage and have for decades. see the chart, not helping!

Now watch the final two minutes of the clip that went viral on Friday:

We confess we kinda like Mr. Sorkin. He is what we have encountered all our life both in India and now in New York – product of an elite-type upbringing & education; smarts to wear the opinions of the Maha-Jan (muckety-mucks); ability to express opinions with a flair; development of an elite above-others conviction & use of that to propagate elite views to ostensibly improve the lives of the unfortunate.

In other words, Mr. Sorkin is among the best of BrIndians, as we have written before. He is the perfect prototype of the Anglicized Indian Brahmins who ride in intellectual supremacy over the working people in Indian Society. Look at Mr. Sorkin in the above clip, hear him speak, hear his frustration & anger at Santelli’s refusal to accept what Sorkin was preaching as undisputable fact. Those who know today’s Anglicized Indian Brahmins would immediately recognize the stereotype. Frankly, Andrew Ross Sorkin lends credence to the anthropological view (from NYU among others) that Jews were originally Indian Brahmins who moved to Israel from Sapta-Sindhu, the original land of seven rivers at the base of Himalayan range in the north-west.

So we like Andrew Ross Sorkin & we are not afraid to admit that. And we also point out that he is vastly more likable & perhaps smarter than his mentor, the insufferable Tom Friedman of the New York Times. Also Andrew Ross Sorkin is even more BrIndian than another media luminary who was actually born in Mumbai, India. That truly & rigorously BrIndian guy is Fareed Zakaria who was educated in Mumbai’s highly elite & highly expensive Christian schools like Cathedral & John Connon before going to Yale & Harvard. A compare & contrast discussion about Sorkin & Zakaria would be way too long for this article. So suffice it to say that Mr. Sorkin is much more of a BrIndian Brahmin than even Mr. Zakaria.

What can we say about Rick Santelli? The “Sant” in his name means Saint. His activism, based on facts & a heartland ideology, endears him to us. This Sorkin-Santelli discussion reminds us of the literally 800-year old tradition of heated debates between Activist Saints who cared about uplifting the disadvantaged and the elite highly-placed Brahmins who sought to impose social governance on the common people.

Has anyone forgotten the original Santelli rant from February 2009?

That rant was the start of the Tea Party, some say. We wonder whether this Friday’s Santelli rant might lead to another political movement.

Now look at the difference between Becky Quick, anchor of that CNBC episode and Melissa Lee, anchor of this Friday’s CNBC episode. Becky Quick was smart enough to understand what great TV was being created on her show & did not try to shut Rick down. In contrast, Melissa Lee forcefully shut down Rick Santelli without even pausing to understand that, regardless of what she believed, the Santelli outburst was great TV.

Not trying to pick on Ms. Lee but her discomfort over a genuine, heartfelt & emotionally stirring outburst shows us why Asian-Americans are so powerless in America, why they take discrimination against them lying down instead of standing up & speaking.

Ms. Lee should remember how a smart CNBC anchor handled a sudden & far more emotionally strident rant on her show! She should look at & learn from this original “they know nothing” clip from August 2007. Erin Burnett did not attend Harvard as Melissa Lee did. But she showed lot more emotional intelligence in handling the Cramer outburst than Ms. Lee did handling the Santelli outburst.

We literally just thought of an idea for CNBC President Mark Hoffman – Get a live TV debate between Dr. Fauci & Signor Santelli. It will be the biggest TV event CNBC has ever done. Failing that, let Rick Santelli do a town hall anchored by Becky Quick on how local governments are forcing restrictions on people that Governors, Mayors & others flout publicly. This is the BIGGEST issue in America today. And CNBC has the BIGGEST Star to do it.

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter