Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Stocks

Jim Bianco reminded us all in the Doubleline Roundtable clip that “the Fed has defined the economy as asset wealth & defended the success of their program by getting the asset markets to go back up“.

Who are we to argue with the astute Mr. Bianco? So we will begin this article by looking at opinions about the S&P and leave other macro issues to later sections. Color us a bit confused. On Wednesday, we saw a sell signal from one of our favorite gurus:

- Lawrence G. McMillan@optstrategist – Jan 12 – An $SPX MVB Sell Signal has been registered today. Learn more about this @tradingview indicator at optionstrategist.com/products/mcmil #OptionsTrading #StockMarket #StockMarketNews $SPY

But on Friday we saw the following summary from him:

- Implied volatility remains elevated, with $VIX hovering in the low 20’s, and that shows some worry among traders about what might happen in the next couple of months. However, the $VIX “spike peak” buy signal remains in effect, and $VIX continues to trade below its now-declining 200-day moving average (which has fallen below 29).

- In summary, we continue to maintain long positions in line with the major trend of the stock market (positive $SPX chart), but sell signals are not that far away. If $SPX breaks down, then we would add to those bearish positions. For now, though, remain long and roll up where appropriate and tighten trailing stops.

The old calendar dictum in support of the remain long thesis:

- Ryan Detrick, CMT@RyanDetrick – Jan 12 – A good start to the year can be a sign of better times ahead. The first 5 days of 2021 saw the S&P 500 up a very impressive 1.8% YTD. Historically, when the first 5 days are up >1.5% the full year has been up 15.6% on average and higher more than 90% of the time.

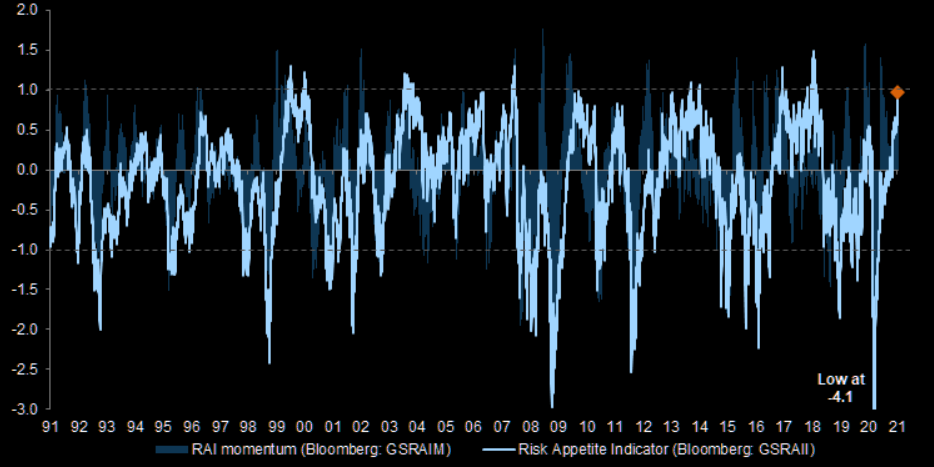

Now two points that suggest turbulence in the near term. First sentiment via The Market Ear:

- GS “Risk Appetite Indicator” (RAI) reached 1 this week after a large increase in risk appetite since Q4 last year. We have seen a similar bullish shift in other sentiment and positioning indicators. Sentiment and positioning alone are seldom a catalyst for a reversal, but at extremes they increase that risk in the event of shocks. From RAI levels close to 1 the asymmetry to add risk is worse: subsequent equity returns, especially in the near term, tend to be more negatively skewed and there is increased risk of drawdowns.

Secondly, positioning:

- Jesse Felder@jessefelder – Jan 14 – ‘Bets against the world’s largest exchange-traded fund have plunged back to pre-pandemic levels seen about a year ago, before the onset of the fastest stock bear market in history.’ bloomberg.com/news/articles/

Large cap stock indices were down this week with Dow down 1%, S&P down 1.5% and NDX down 2.3%. In contrast, Russell 2000 was up 2.3% on the week. And Emerging Markets were down hard with Brazil down 2.1% & the hot South Korea down 4.3%. Gold Miners were down very hard with GDX down 5.4% & GDXJ down 7.6%.

- Macro Charts@MacroCharts – Jan 15 – $EEM traders are piling into Calls aggressively – the 2nd biggest spike in history. Similar speculative euphoria has led to some major losses for EM investors. Critically, in all but one case the Dollar rallied *significantly* the next several months – time to watch it closely.

The U.S. Dollar was indeed up 80 bps on the week.

- Julien Bittel, CFA@BittelJulien – Jan 12 – The dollar is looking very oversold. I still think a stronger dollar will be a key theme to watch out for in 2021.

What else was up? Treasury Bonds. TLT, the 20-year+ Treasury ETF, was up 77 bps on the week & rates along the entire curve fell slightly. You could call that surprising given the large stimulus plan announced by President Elect Biden. Clearly the economy needs another stimulus even after passing a $900 billion stimulus in the last 30 days. But shouldn’t rates have gone up on this news?

2.”it just evaporated ..”

He was too disturbed to even say “pooh” to what evaporated. The “he” is BTV’s Tom Keene and he said immediately after the claims number on Thursday at 8:30 am – “it evaporated at 8:30 am this morning; the idea that Fed can be proactive is over“.

- Bespoke@bespokeinvest – Jan 14 – Non-seasonally adjusted initial jobless claims came in at 1.151 million this week, the highest reading and first time above 1 million since July 30th: bespokepremium.com/interactive/po

Then Fed Chairman Powell himself put the kabash on the foolish notion about tapering or slowing down Fed’s sugar injections this year.

Despite that, Treasury yields rose sharply on Thursday with the 30-year yield up 5.5 bps, 20-year yield up 5.3 bps & the 10-year yield up 3.9 bps on the day. What gives you ask? The expectations of a real stimulus plan from President Elect Biden on Thursday evening.

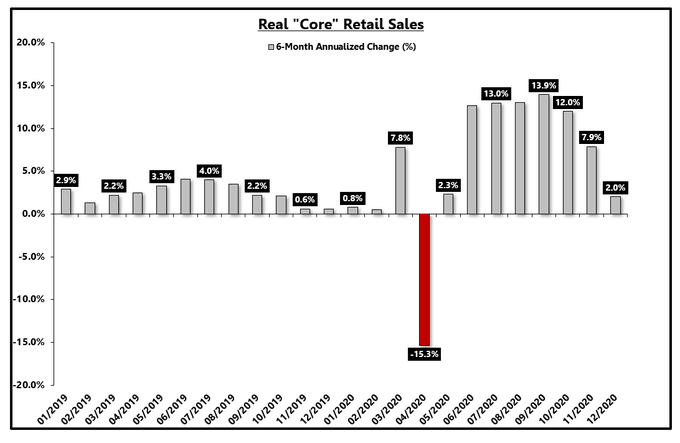

Not only was that a semi-bust but it was followed by an awful retail sales number on Friday morning:

- Larry Adam@LarryAdamRJ – Retail Sales Disappoint. Increased COVID-related social distancing measures weighed on #consumer spending in December, as theretail sales control group (a direct input into GDP) declined for the third consecutive month and posted the third worst decline over the last 20 years.

How can that be with all the stimulus payments? Probably because of the nature of the stimulus payments argued some:

- Eric Basmajian@EPBResearch – Core Retail Sales, adjusted for inflation, declined sharply on a 6-month annualized growth rate basis. This is the problem with funding consumption with transfer payments. The payments need to continue and get larger (income growth).

3. FDR vs. Biden

Since January 2016, our expectation has been that President Trump would act like FDR with an infrastructure program in his second term. After the November 2020 election, our hope was that President elect Biden would take the counsel of Democrats like Sherrod Brown to launch an infrastructure stimulus to generate jobs.

As David Rosenberg had put it a few days before in the Doubleline roundtable,

- “I wouldn’t call it a fiscal stimulus; it is basically an income transfer ; … it is not going to the unemployed; it is not targeted …. nothing in the fiscal side to get a productivity payback,… FDR realized that the best way to keep people engaged was to actually give them a job, any job; … we need to avoid a permanent impairment of the job market … we continue to pay people to NOT work…“

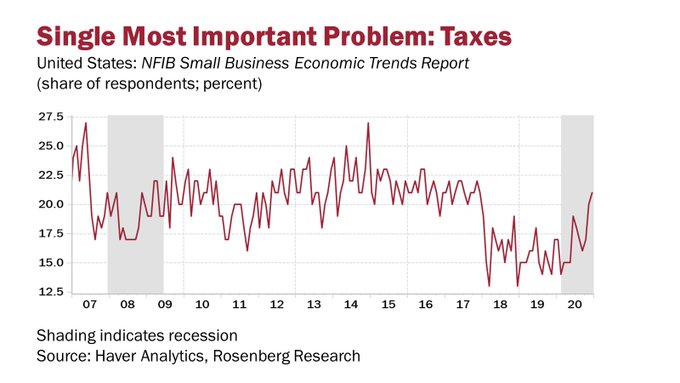

The small business sector drives job growth in America and how are they doing? Gundlach pointed out that “29% of small businesses that were open on year-end 2019 are shut down“.

And what is their biggest concern?

- David Rosenberg@EconguyRosie – Jan 12 – NFIB index shows future tax hikes as #1 concern for 21% of small biz owners. All myopic Mr. Market sees is massive gov’t spending – a near-record low 2% cite inflation as the top worry – yet, the Treasury mkt has been scared off by this phantom (not the first time; not the last).

How do they feel now after Mr. Biden said “everybody has to pay their fair share“, the code-words for higher taxes?

What choice does the Biden team have except, as Jim Bianco said in the Roundtable, “.. keep it up until we have an adverse reaction. I think that is inflation“.

The other way to look at it is what Robert Tipp of PGIM said on Friday to Tom Keene of BTV:

- “… that reflation trade has kinda moved to an extreme; we were at 50 bps breakeven; now we are at 2%; that kind of swing in breakevens happens infrequently; … the bond market has priced in an optimistic future that is unlikely to happen ; what they are missing is a secular tide that is continuously moving in one direction – that is towards shrinking workforces … the demographics are now worse and they are accelerating …. you are into that demographic headwind; you are going into a world that is more damp … it is a deflationary not inflationary backdrop … “

Now focus on the $15 average wage the Biden plan demands and ask yourselves what does that do to jobs in the sector that needs jobs the most – blue collar jobs. Don’t Amazon, McDonalds et al accelerate the replacement of human workers with robotic workers? Isn’t this the opposite extreme of the ancient Henry Ford dictum of viewing the employee as a customer?

Why didn’t the Biden team propose a plan to pay at least part of salaries of workers in blue collar jobs to encourage companies to hire more workers? Why didn’t the Biden team propose a real infrastructure plan to repair bridges, airports and other 4-th world infrastructure in America? Heck, even the bullish Ed Hyman said in the Doubleline Roundtable that we “need wages to pick up for inflation to pick up“.

Frankly, we suspect that the Biden team is beginning to panic at what they might be facing with the economy and discontent. That may be why they didn’t take the time to come with a sensible plan that would help create/save jobs & provide income to people who need it. They look & sound as if they are panicked at the prospect of American people expressing buyer’s remorse. That may be why, all of a sudden, Democrats, including Cuomo, are asking aloud whether lockdowns are actually hurting the economy rather than preventing spread of CoronaVirus.

4. Here as a result of There? Plus the worst kind of trouble?

David Rosenberg made an interesting claim in the Doubleline Roundtable. He postulated that “home country inflation is increasingly dependent on global inflation“.

That’s good, right? Every FinTV anchor is praising the growth in China. Even bullish Ed Hyman of ISI said China’s growth is going to be 8%. Unfortunately he added ” but their inflation is going to be zero“. David Rosenberg warned that “China is about to deflate and it is the hottest economy in the world“. And the Bear Traps Report says “China’s credit growth is slowing …. implying a credit down-cycle in the coming months“. What does that do to goods inflation in America?

But the above is only half of the bad story. Bear Traps Report states,

- “China raises its 2020/21 import forecast for corn to 10 mmt and soybeans to 98.1 mmt. That is an increase of 3 mmt for each. China is recognizing that they will import more corn/soy than they previously stated. Doesn’t necessarily mean demand has increased from previous market expectations, because most people are using higher numbers anyway.”

And Reuters reports that

- “In December, the world’s biggest rice importer China started buying Indian rice for the first time in at least three decades due to tightening supplies from Thailand, Myanmar and Vietnam and an offer of sharply discounted prices.”

And, in a strange & scary twist, the main theme of the Reuters article is that

- “Vietnam, the world’s third biggest exporter of rice, has started buying the grain from rival India for the first time in decades after local prices jumped to their highest in nine years amid limited domestic supplies, four industry officials told Reuters.”

This is not merely an Asian story as Reuters adds,

- “The shrinking supplies will heighten concerns about food insecurity with sub-Saharan Africa among the areas where import demand has been increasing due partly to population growth. … Chronic and acute hunger is on the rise, impacting vulnerable households in almost every country, with the COVID-19 pandemic reducing incomes and disrupting supply chains, according to the World Bank.”

What about America & the money payments based stimulus? Gundlach said in the Doubleline Roundtable:

- “inflation in food could be pretty serious; we have already seen some pretty serious bottoming in parts of the commodities market …. looks like a convincing reversal; when food prices begin to go up, that becomes a direct problem with the happiness of people who are getting government payments; … you almost have to keep upping the ante & it is not a solution; its not an end game …. when food inflation picks up …. homeless encampments in Southern California have exploded …. “

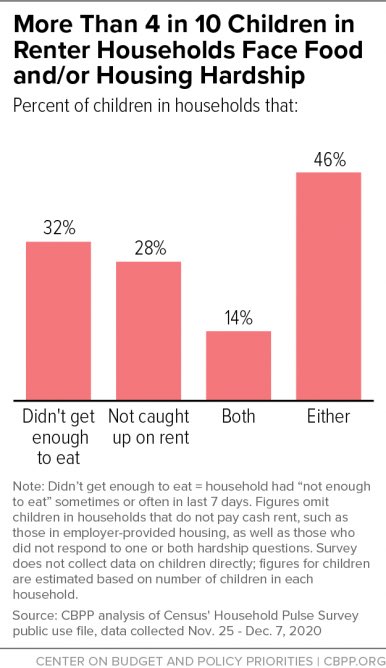

The saddest aspect is the impact on children:

- Danielle DiMartino Booth@DiMartinoBooth – Poverty in America. Shame on Nation Nearly 1 in 3 children living in rentals didn’t have enough to eat via @uscensusbureau between November 25–December 7. More than 4 in 10 children in rentals don’t get enough to eat or not caught up on rent https://cbpp.org/research/

poverty-and-inequality/ tracking-the-covid-19- recessions-effects-on-food- housing-and… @SoberLook

Moving to Latin America, Bear Traps Report informs that Brazil food prices are soaring:

- Food prices soar and Brazil grapples with highest inflation since 2016 – Brazil’s benchmark inflation index rose by 4.52 percent last year, the highest level since 2016. Brazil Selic pressures.

- Brazil: Food prices +14%, highest since 2002 and accounting for more than half of overall rise. Monthly inflation rate in December 1.35%, highest since 2003.

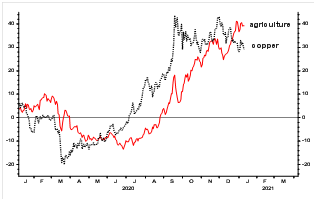

We all know about what copper has been doing. What about Ag prices, you ask?

- Albert Edwards@albertedwards99 – Jan 11 – Hungry people make for angry people: Most attention about rapidly rising commodity prices is focused on copper’s surge. Yet the 6m rise in agric prices are now outstripping copper – agric prices (Blommberg/DJ-UBS) are up 40% higher v LME copper at 30%.

What did Mr. Edwards notice the next day?

- Albert Edwards@albertedwards99 – Jan 12 – Are food prices the new crypto? While many risk assets are ‘correcting’ from Bitcoin to copper, Agric commodities are surging higher today. Unless my screen is wrong, both Wheat and Corn is up 5% today! And Soybeans up a more moderate 4%, are continuing their vertical ascent!

Now what do you need to make this commodities picture more complete? How about a shooting incident in the Persian Gulf, perhaps between Iran & Israel, as a welcome gift for President Biden? That should send oil into a higher trajectory, right? And that might help Tom Lee’s prediction that Energy assets would perform in 2021 as Tesla performed in 2020. In case you think we are now just making stuff up, read the stories about how this week the Israeli air force bombed areas of Damascus, Syria as well as the Syria-Iraq border.

5. GDP & Amazon

But not to worry. The stimulus payments will drive disposable income and GDP higher. That can’t be bad for the stock market, right? And where might you look for an attractive opportunity? Amazon, according to the legendary Larry Williams as communicated by Jim Cramer this week:

- E-mini S&P futures have finished first half of the year higher 88% of the time (vs. 70% of the time) when January has begun this way, says Larry Williams per Cramer. Williams also highlighted AMZN because of its bullish seasonal pattern from January to July. Williams also said funds have been accumulating Amazon and it is time to buy AMZN. Cramer also showed a daily chart & a weekly chart to highlight the bullish patterns.

Try as hard as we did, we could not find this clip of Cramer highlighting Williams case for AMZN on CNBC.com. Perhaps they will add it after AMZN rallies, if it does.

By the way, Bezos is an incredibly smart man and understands how to capture large & incredibly valuable segments. He launched Amazon Academy in India on Friday, January 16 that is designed to help Indian students get into prestigious engineering colleges. Anybody who knows India knows that getting into one of these colleges is the biggest dream of Indian students & of their parents. Tutors charge high high fees to help students and students travel to specific schools set up to train students to succeed in the entrance exams. Now Amazon enters this space & for free at least for the first few months.

If the Amazon Academy succeeds & if the Amazon App becomes a must have product, then Amazon could get a running start in the biggest middle class space in India. Kudos to Bezos.

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter.