Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Importing still but what?

Remember the dictum that we all got used to? How America has been importing deflation from overseas? And how that was a big headwind preventing interest rates from going higher? Things seem to be changing:

- Richard Bernstein@RBAdvisors – Feb 18 – For the first time in roughly 10 years, the US is now IMPORTING #INFLATION. Core import prices are rising faster than core #CPI by more than 1%.

That is not the only thing breaking out:

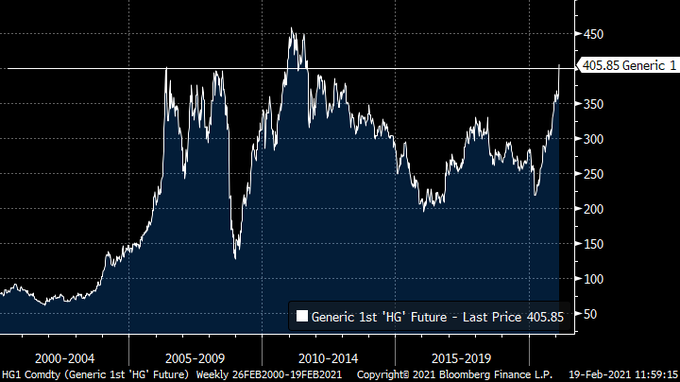

- Richard Bernstein@RBAdvisors – Dr. #Copper breaks $400 for the first time in 10 years! Glass half full.

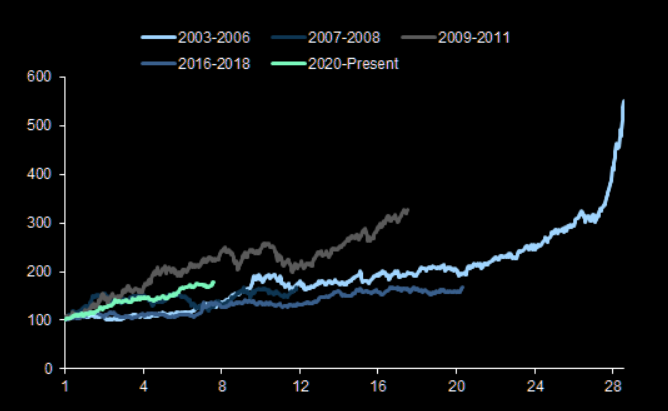

Already copper has had a terrific rally and stocks like Freeport have more than doubled just in a few months. So is this rally a bit too much? No says a Goldman chart per The Market Ear:

- Dr Copper: a multi-year bull regime?No evidence from previous bull markets that copper’s path higher so far in 2021 is nearing maturity

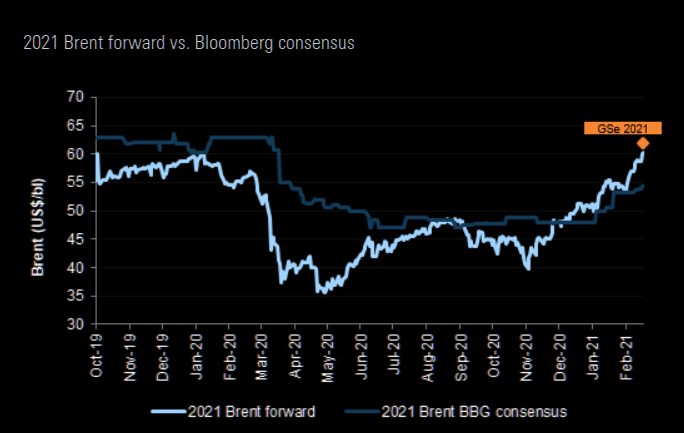

That brings us to another commodity. Funny how things turn out! President Trump was bullish on drilling for oil & making America self-sufficient in energy. So drilling soared and, in part thanks to the Corona Virus, demand slowed & oil prices fell hard & energy stocks were tossed by the way side.

Then comes President Biden and his vow to move away from oil to climate change. He cancels the Keystone pipeline. And oil stocks get going. Then Mother Nature got into the action this week. Lo & behold, Texas, the state richest in fossil energy reserves, suffered a massive blackout. Apparently because the windmills in Texas got shut down as snow covered them.

Now the odds of a large infrastructure program have gone up dramatically. What kind of infrastructure? We don’t know but presumably the kind that prompted Texas to critically depend on Windmills instead of natural gas.

Paradoxically, the one country the Biden team dislikes the most is smiling broadly – Russia & Putin are enjoying the increase monies flowing into their coffers from the exploding oil price. EU not so much. Is that why both Goldman & JP Morgan recommend buying European energy stocks?

- Goldman via Market Ear – …yet the commodity price move higher has not yet translated into meaningful positive earnings revisions which Goldman now anticipates to accelerate in 2021. …with EU Big Oils equities broadly following earnings revisions. Goldman 2021/22 EPS estimates are c.17%/12% above Bloomberg median consensus expectations.

We urge all to read the interview of Larry McDonald (@convertbond) with the themarket.ch. That interview was on 23 November 2020. But it makes for a much better read now. Some excerpts from the interview re energy:

- “We are going to have an energy crisis. With the US energy sector, it’s like turning around an aircraft carrier: If you talk to anybody in the Permian basin, where we have lots of contacts, they’ll tell you that with the amount of supply relative to demand, we are going to be three or four million barrels short a day by the summer.”

- “If you have a snap back in demand, there isn’t enough production out of the US and the rest of the world. That’s why we are going to have a real crisis by probably August next year where the price shoots up to something like $100 per barrel.”

What gave him the signal to buy energy stocks in November 2020?

- “An important leading indicator in this cycle in comparison to the previous ones is that bonds in the energy sector have been dramatically outperforming the equities so far. This is a really big buy signal for energy equities which now are playing catch up. The energy sector went through hell in 2016 with the global slowdown, it went through hell in 2018 with the strong dollar, and it went through hell in 2020 with Covid. Now, what credit metrics in the energy space are telling you is a screaming buy. Many stocks will be up 100% over the next year.”

In that November 2020 interview, Larry McDonald suggested buying XME, the metals ETF. Resident technician at CNBC Options Action, Carter Worth, also said buy XME on Friday:

That brings us to stocks, right?

2. Stocks

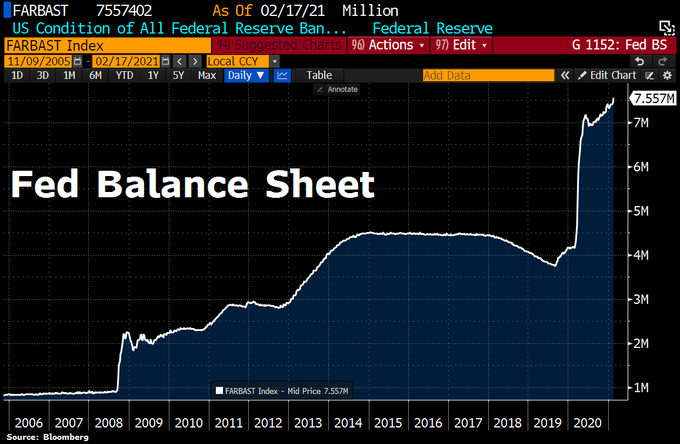

First the engine just keeps on pumping:

- Holger Zschaepitz@Schuldensuehner – #Fed balance sheet rose $115.2bn to fresh ATH of $7.557tn. Once again, increase in assets was almost entirely concentrated in securities holdings. This week MBS were bigger drivers than Treasuries due to lumpy settlement of prev purchases. Balance sheet now equal to 35% of US GDP

We all know about the twin deficits. But there is a 3rd one & that too is at a record:

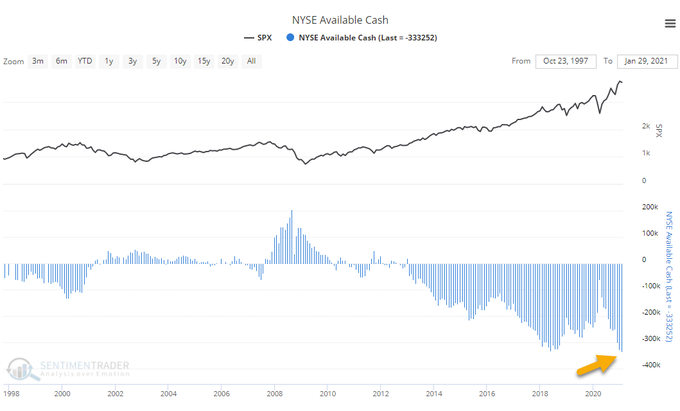

- SentimenTrader@sentimentrader – Investors have $465 billion in credits sitting in cash & margin accounts. They owe $798 billion against the value of their securities. That’s a new record deficit.

Last week we worried about VIX going fast & high. The fast did not happen but the VIX did rally by 10% this week. Bob Lang of Explosive Options warned on Friday – “As we close out February next week, keep your eye on volatility. It’s starting to take hold.”

But Lawrence McMillan of Option Strategist suggested that “the trend of VIX is still down” in his Friday summary:

- “Market breadth has deteriorated rather badly in the last three days. As a result, both breadth oscillators are on sell signals once again.”

- “$VIX remains elevated and its buy signal of January 29th remains in place, and the trend of $VIX is down, in that both $VIX and its 20-day moving average are below the 200-day MA. Those are bullish factors.”

- “In summary, the bullish case is still intact as long as $SPX remains above 3900 — despite some potentially negative indicators. Thus a “core” bullish position should be maintained, but one should roll call strikes up as they become deeply in-the-money and trailing stops should be raised and monitored.”

Perhaps the S&P is in a “good overbought” condition. Look what one guru suggested about the long term on Wednesday:

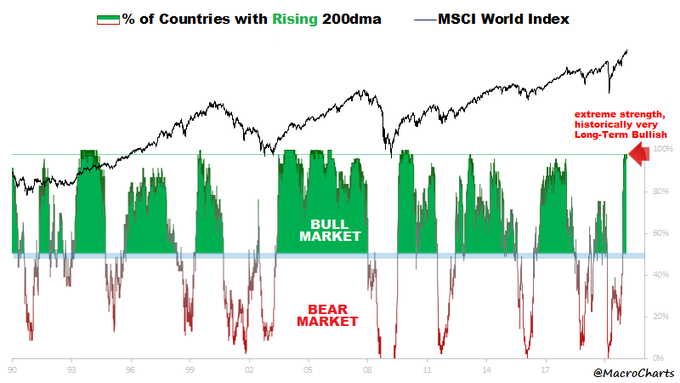

- Macro Charts@MacroCharts – Feb 17 – Why the big picture is critical – especially now: Nearly all global Stock markets are back in uptrends (rising 200dmas). This condition defined all Bull Markets in history. It’s one of the strongest readings ever – usually seen at the start of Major advances. Follow the trend.

What did this guru say on Friday?

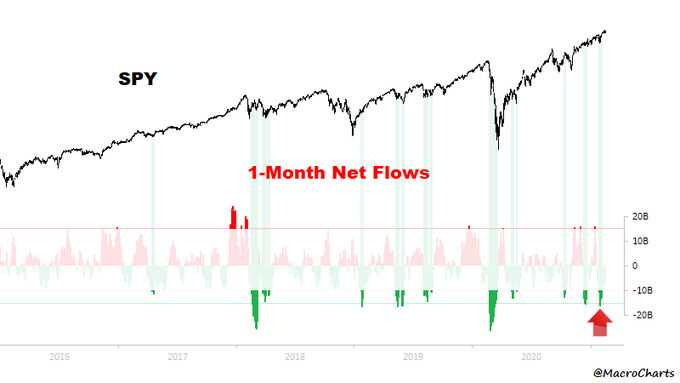

- Macro Charts@MacroCharts – Everyone is NOT long Equities (continued): $SPY had another mini-panic this month. The market dropped a little and traders had one foot out the door. Stocks don’t usually Top like this – Traders are a long way from embracing this rally. Follow the trend.

What about Funds & broader ETFs, you ask?

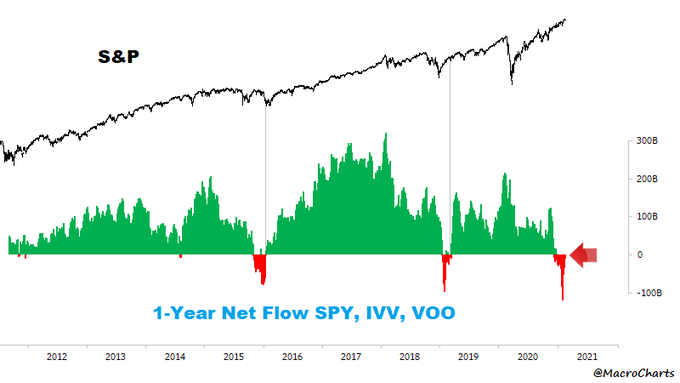

- Macro Charts@MacroCharts – And broad ETFs/Funds look identical: Since mid-Nov, I’ve showed Long-Term Flows were still massively negative. Example: this chart is still <$0 on a 1-YEAR basis. *More* fear than the last 2 recoveries. If history repeats, buyers may just be getting started. Follow the trend.

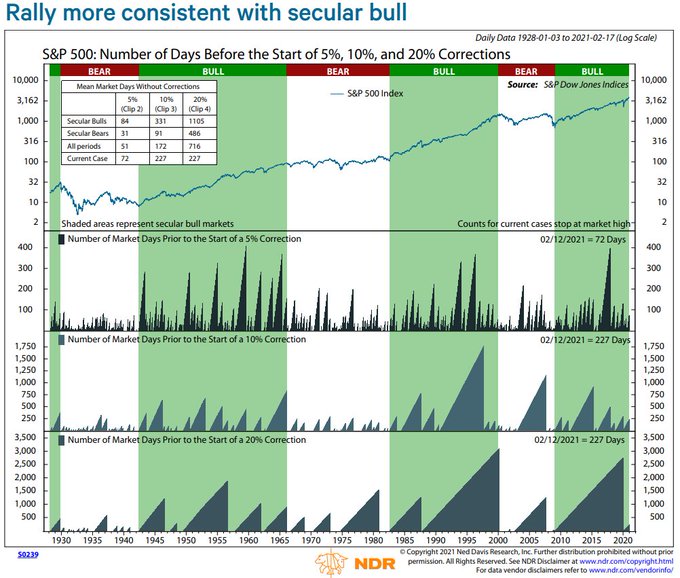

But should we worry we have come so far without a serious correction? How many days could the S&P go without a big correction? Answers to both in the tweet below from the esteemed Ned Davis Research:

- MattCMT@topstockcharts – NDR: With secular bull resuming, the rally in stocks could continue for another 878 days before reaching the mean number of days without a 20% decline in a secular bull.$SPY $SPX

3. Fed Brain Trust on deck

Remember the Gundlach dictum about the Copper/Gold ratio and the direction of long duration Treasury rates. That has been playing to perfection with Copper exploding higher and Treasury rates rising steeply. Once again Treasury rates shot up this week with 30-year up 13 bps to 2.13% and to a positive real yield. The 10-year yield shot up 14 bps to close at 1.34%.

In the face of this we have Fed Chairman Powell, Vice Chairman Clarida and Dr. Lael Brainard speaking next week. Bob Michele of JP Morgan Fixed Income said on Friday’s Bloomberg Real Yield that Powell/Clarida/Brainard will try to stop this rise in long duration Treasury rates. He didn’t say how, though.

What if they do & actually succeed a bit? Yes, some Treasury shorts will cover. But won’t the bigger beneficiaries be the Amazon cohort that has been languishing? Coincidentally Carter Worth of CNBC Options Action actually predicted that this high-PE cohort will catch up. No, we swear he did.

It’s not too late to play catch-up! Exactly a year ago today, the S&P 500 hit its pre-pandemic peak. Today, the benchmark index sits near new all-time highs. @CarterBWorth lays out three ways to get in on the gains. pic.twitter.com/qoRcyXFRp5

— CNBC's Fast Money (@CNBCFastMoney) February 19, 2021

His simple point was that the S&P cannot go up without this group going up, a point made a awhile ago by Marck Kolanovic of JPM, as we recall. What might be a natural corollary? Carter Worth said Long SPY Short IWM.

4. Deeply content

Rarely has something that we didn’t even dare wish come through & how. Tom Brady & his Tampa Bay Bucs swept aside the magician Patrick Mahomes & his almost-guaranteed-to-win Kansas City Chiefs. The utter demolition was something we didn’t even think would happen. It was unbelievable. We have watched the game over 5 times and we get happier every time we watch it.

Nothing against Mahomes. Couple of incompletions were far better than completions of almost all the QBs in the league. His star is undimmed. The demolishing of the vaunted Mahomes offense is entirely the fault of Coach Andy Reed. He had no other plan, no other option devised except letting Mahomes fling the ball.

In fact, Devin White (TB LB) said in an interview that he asked Chiefs running back (another LSU alum) why didn’t they run when Tampa Defense line wasn’t staffed to stop the run. White said the Chiefs were arrogant. He was absolutely right. Reed was so arrogant about his big play offense that he had not even thought of an alternative game plan.

In stark contrast, Tampa Bay had at least a couple of game plans ready. After striking out on the first two drives, they ran Leonard Fournette on three straight downs for a first down. Then came the screen to Brate and the come back pass to AB. After that, the Spagnola blitzes were shelved and it became a vintage Brady game.

This reminds us of a great battle back in 1659 which, actually was a far far greater triumph. That destruction of the greatest general in the Indian Subcontinent & his large army is still lauded as one of the 10 greatest battles in global military history. That victory was so unbelievable that full reports were sent to Lisbon, Paris & London in Europe, to Kabul, Kandahar & Samarkand. It changed the history of India.

Super Bowl 55 was that kind of a victory but on a far smaller scale. It will be analyzed in detail all across the NFL. Even Patrick Mahomes said after the game that he will use the steady, relentless one first down at a time offense instead of focusing only on the big play.

The human stories are just great too, especially Leonard Fournette. Seriously, listen to Jim Nantz go “Fournette”, “Fournette”, “Fournette” in higher & higher emotional pitch (first 9 seconds of the clip) as Fournette ran for his touchdown that essentially put the game away.

After the 28-9 score, Shaq, Suh, JPP went after Mahomes like hungry, snarling wolves going after their prey. Frankly, this was even a better attack than the 85 Bears in that Superbowl. Those Bears were attacking a mediocre QB & a mediocre team. The Tampa Bay defense were demolishing the most successful & most storied offense of this era.

Again, that reminded us of the storied attack of the Maratha Cavalry that no one could withstand, not the Mughals, not the Afghans of Abdali and not the British. It was labeled Janjhavaat or Whirlwind. Like Holkar’s attack at dawn with 50,000 horsemen on a large British army with guns & artillery. It was reported that most of the Brits didn’t even have time to stand; those who did couldn’t get on their horses and those who didn’t couldn’t move their horses.

Mahomes didn’t have it that bad. He actually ran for 490 yards trying to avoid the attacking defense. But he took a lot of punishment, the worst being the one at about 55 seconds in the clip below. The last time we saw something like this was Hampton, McMichael & Dent collapsing on Tony Eason.

Next year should be really interesting. Ideally Tom Brady should win his 8th Super Bowl next year and become the next QB to win back-to-back Super Bowls after a young QB did so in 2003 & 2004. Wait, that QB’s name was also Tom Brady, right?

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter