Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Draghi Gone; Long Remain Draghi?

That is essentially what the British Central Bank did on Wednesday, September 28. They reversed their QT to a new & rapid QE by buying British Gilts to stabilize the disaster unfolding at the British Pension system. And it worked better than what Draghi ever delivered in a single day. The yield of the 30-year British Gilt plunged by 106 bps on Wednesday. Has any one ever seen anything remotely approaching this?

The 106 bps fall in yield raised the price of British Gilts substantially &, at least for this week, stemmed the margin crisis in the British Pension system. The British pound paid for it but Liz Truss, the British PM, remained unfazed and reiterated her determination to cut taxes on Friday morning.

So have the margin calls been met & is the problem behind them?

While Mr. McDonald did not use scary words, Mr. Robin Brooks of IIF did:

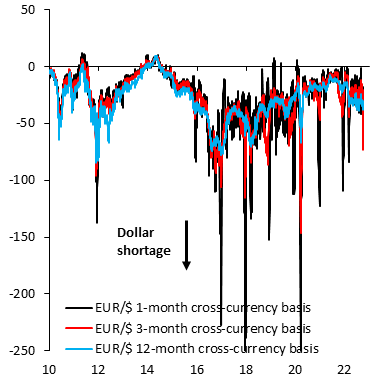

- Robin Brooks@RobinBrooksIIF – Oct 2- Something ominous is building in global funding markets. Euro cross currency basis is starting to point to funding pressures at end-2022. Predictably, those year-end funding pressures don’t show yet in 1-month basis (black), but they’re showing in 3-month (red) and 1-year (blue).

Can the Euro see funding pressures without affecting the global financial system?

- Lawrence McDonald@Convertbond – – Central Banking in 2022 – Fighting inflation while blowing up the financial system. Close to $80T of new debt on earth since the last hiking cycle Bonds sold to investors with very low coupons have plunged 30-60 points. A risk management nightmare for “high quality assets.”

Just look what an arrogantly hawkish Powell has done to U.S. markets – SPY down 8%; QQQ down 8.9% & TLT down 5.6% since his presser on September 21.

We guess Liz Truss & her team have never heard of John Madden, but we hope Jay Powell & his band might be aware of who Madden was. If they are, then they should re-learn his “speed kills” dictum. Markets move with far greater speed than policy impact. And this speed leads to reduction or disappearance of liquidity leading to worse disaster just as the “shouting fire in a crowded theater” phrase warns.

- Lawrence McDonald@Convertbond – – How about another 75 bps – Johnny come lately – Fed chair turned into inflation fighting tough guy. They have no clue as to what they have just done. Looking at 325bps of hikes in six months onto a planet with $50T more, additional leverage since 2018. Delusional academics.

But Powell is not an academic. That shows how so-called independent outsiders get eventually sucked in by the huge bureaucracy filled with several hundred Ph.D.s. What an atrociously dangerous move to inject $95 billion per month of QT into this rocket-like spike in interest rates? Impact of rate hikes takes time to be felt, as smart guys tell us. But QT is a direct artillery hit on asset prices. And doing that in this size & speed creates a UK like accident.

On the other hand has the UK near miss created at least some fear into the know-it-all Fed brain trust?

- Charles Gasparino@CGasparino – SCOOP (1/2): @federalreserve officials getting increasingly worried about “financial stability” as opposed to inflation as higher rates begin to crush bonds, several big investors tell me. Fed growing worried about possible “Lehman Moment” w a 4% FF rate as Bonds and derivatives

-

Charles Gasparino@CGasparino – – Replying to @CGasparino (2/2) tied to them crash, given the enormous debt issued in just the past 3 years at super low rates. A Fed watcher told me the UK intervention was not “a one off” and the same systemic risk could happen here, which might cause the Fed to pause. More later on @FoxBusiness

But isn’t institutional “credibility” of paramount importance to every institution, especially to the Federal Reserve? Wouldn’t they need an “accident” or a “near accident” of such scale that all Americans get zapped with fear? Then the Fed can run to the rescue of America as Bernanke did in 2008-2009!

Remember David Rosenberg’s tweet of September 24 saying “We could be building towards an Oct/87 crash, led by an aggressive Fed & surging bond yields“! How many remember how badly the stock market closed on Friday October 16, 1987? Sort of like the close this Friday, September 30:

Did Friday’s close remind a smart manager to hark back to October 87?

- Otavio (Tavi) Costa@TaviCosta – – I’m starting to think that the next leg down in stocks could look like the 1987 crash. Liquidity is drying up, Nasdaq is about to break support, the Fed is not stepping in (for now)… A big gap down could be ahead of us.

Of course, the Fed & all powers that are have to be watching this ready to step in to avoid the deluge. This might be why we might see this disastrous broth remain percolating for awhile without coming to a fast boil.

2. Yields Peaking?

Stock market crashes are scary & cause serious damage. But they are not as systemic as crashes in credit or bonds-currencies. Those who are fearful of Treasury yields shooting up from here might take some comfort from what Komal Sri Kumar said to CNBC’s Joe Kernen on Wednesday. He had predicted on January 5, 2021 after the Georgia Senate Race that Treasury yields will go up. This past Wednesday, he changed his opinion. Watch-listen to his reasoning:

- “On Jan 5th, after the Georgia Senate elections, I said bond yields are headed higher; since then bond yields have quadrupled in terms of the 10-yr yield; I am going to say for the first time on your program that we have just about topped out; 4% little bit more, little bit less ; this is where we are going to be ; so there is little reason for the Federal Reserve to blink; .. but what I am watching is what is happening with the Dollar, pound sterling story is quantitative easing .. but the pound sterling weakened; in other words bond prices & currency moved in opposite directions; That is a warning signal; I believe the currency market & if there is going to be further trouble in the UK market ; its going to be good for the 10-yr yield which is going to come down further ; so that’s why I am saying we have just about topped out now; its a big change in my expectation; now if they double down & they have more tax cuts; if there is more bad policy emanating out of London, the 10-yr yield in the US is going to go down further; so we are intimately linked at the hip with developments elsewhere in Europe.. … ;

Too many people on TV argue that US markets are independent of what happens in Europe. Mr. Sri Kumar disagrees & our experience suggests he is right. We have also noticed that the open in NY markets is influenced much more by how European markets are behaving rather than the previous close in New York. Perhaps one reason is below:

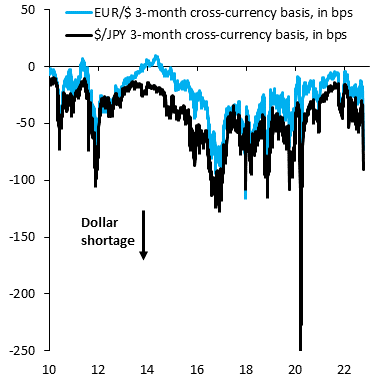

- Robin Brooks@RobinBrooksIIF – – The UK bond market blow-up has sparked genuine stress in global currency markets. 3-month cross currency basis in the Yen (black) and Euro (blue) widened out sharply. That’s a sign people are scrambling for Dollars in the spot market & hedging their exposure in forward markets…

Europe remains a huge economic region & its impact on American economy & U.S. companies is sizable. What about the 3rd largest economic region in the world? Is that in any position to help the U.S. economy? Watch-listen to what Jim Chanos said at CNBC’s Delivering Alpha:

- “I have long said that Chinese apartment prices are, after Treasury bonds, the most important asset class in the world; & they are declining ; we are seeing a real real estate problem in China over the past 18 months, that the government does not seem to have a handle on ; and the reason that is important is that investment is still 50% of the Chinese economy & that residential real estate is almost half of that; so residential real estate is 20-25% of the Chinese economy which is a stunningly large number; the fact that there is a major meltdown occurring among the developers both public & private over there is a major story that is on the back pages of our financial press; … every large Chinese company has a real estate development arm; its not just the developers ; this is endemic to the whole economy … & I think that we ignore it to our own peril … but realize how much of Asia is tied into China; its a big story. …”

Finally, a look into 2023 from the viewpoint of someone who has been extraordinarily successful for decades – Stanley Druckenmiller with CNBC’s Joe Kernen:

- “I would be stunned if we don’t have a recession in 2023; I don’t know the timing but certainly by the end of 2023 ; I will not be surprised if it is not larger than the so-called garden variety ; and I don’t rule out, not my forecast, something really bad … why? because if you look at the liquidity situation that has driven this we are going to go from all this QE to QT ; we are following an asset bubble; we have been doing all this running down the SPR ; it is now below 84 levels; even though oil consumption is much higher .. we have had a bunch of myopic policies that have actually delayed the liquidity shrinkage … QT has been entirely offset by Janet Yellen running down the Treasury savings account; by the way pretty amazing policy ; she could have sold 10-yrs for under 1% during this time ; instead she runs down the Treasury savings account; so all that has masked liquidity shrinkage but it really comes into full gear & she can continue this for awhile ; we can do the SPR for awhile … but by the first quarter of 23 it kinda goes the other way so our central case is a hard landing by the end of 23; … that’s our forecast … recession in 23; …”

4. Putin, Ukraine et al …

Following Mark Fisher on CNBC Half Time, we wondered last week about the possibility of a Russia-Ukraine-EU ceasefire blessed silently by America. Two things now suggest it is not even worth the speculation. First is the attack on NordStream pipelines in the Baltic Sea. Second is an analysis of further mobilization of troops by Russia & Ukraine in this week’s article by Geopolitical Futures titled Russia’s Mobilization May Be a Game-Changer. Key excerpts are below:

- Officially, it decided on a partial mobilization, though every piece of evidence says the mobilization is overwhelming and widespread. It looks like Moscow is preparing a considerable force to enable it to fully dominate the war’s front line.

- … in general Russia is mobilizing against the West. Officially, it sees the war in Ukraine as against the “entire military machine” of NATO.

- … Moscow is trying to meticulously organize the process and avoid economic and political repercussions for the Russian state.

- … the decision called for the immediate mobilization of 300,000 troops, but there are no indications that this will be the limit. Russia is capable of mobilizing several million soldiers, according to Shoigu

- According to Russian estimates, a total of 500,000 to 600,000 troops should be added to the Russian army as a result of mobilization. This would triple the Russian force already in Ukraine and extend Russia’s numerical advantage.

- Historically, when Russia mobilizes, it has had enormous implications for Europe and Russia. Today, a Russian mobilization once again threatens European peace.

Does this support Druckenmiller’s forecast of a hard landing by the end of 2023? It certainly does not negate it!

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on Twitter