Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we clude important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.What’s going on?

The entire outperformance of April over March came from the last two days. That is true even of the biggest outperformer in April. Last month the VIX was down 15.6% from 18.70 to 15.78. This huge drop took place during the last two days because on April 26 the VIX closed at 18.80.

To quickly summarize:

- Dow was 2.5% in April, S&P up 1.5%. NDX up 49 bps, RUT down 1.2%; DJT down 2.9%; with UUP down 57 bps & DXY down 92 bps.

- 30-yr up 2 bps; 20-yr down 0.5 bps; 10-yr down 4.2 bps; 7-yr down 6.6 bps; 5-yr down 8 bps; 3-yr down 6 bps;2-yr down 0.3 bps; 1-yr up 0.2 bps;

So what made the last two days the last two days?

- Ryan Detrick, CMT@RyanDetrick – 80% of companies are beating earnings estimates. Q1 real GDP excluding inventories was 3.4%, lead by a super impressive 3.7% increase in real consumption spending. S&P 500 best weekly close since August. Yet, all we seem to hear about are all the negatives.

Wasn’t the big bear case about an earnings recession, a steep fall in earnings that would make the S&P so expensive that it had to fall?

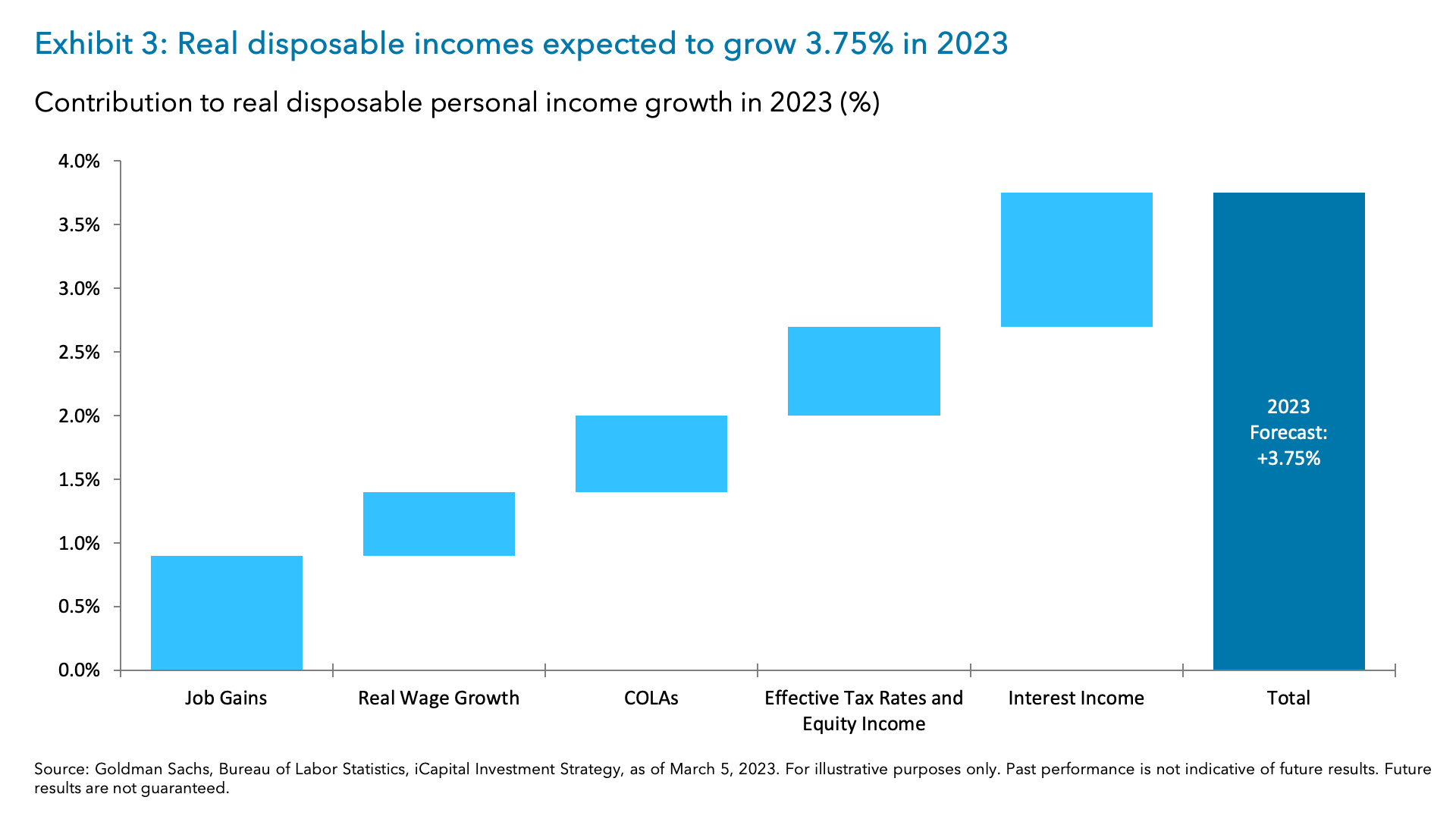

We all know that employment has been firm so far. But what about incomes? Look what Anastasia Amoroso of iCapital showed in her article on April 27:

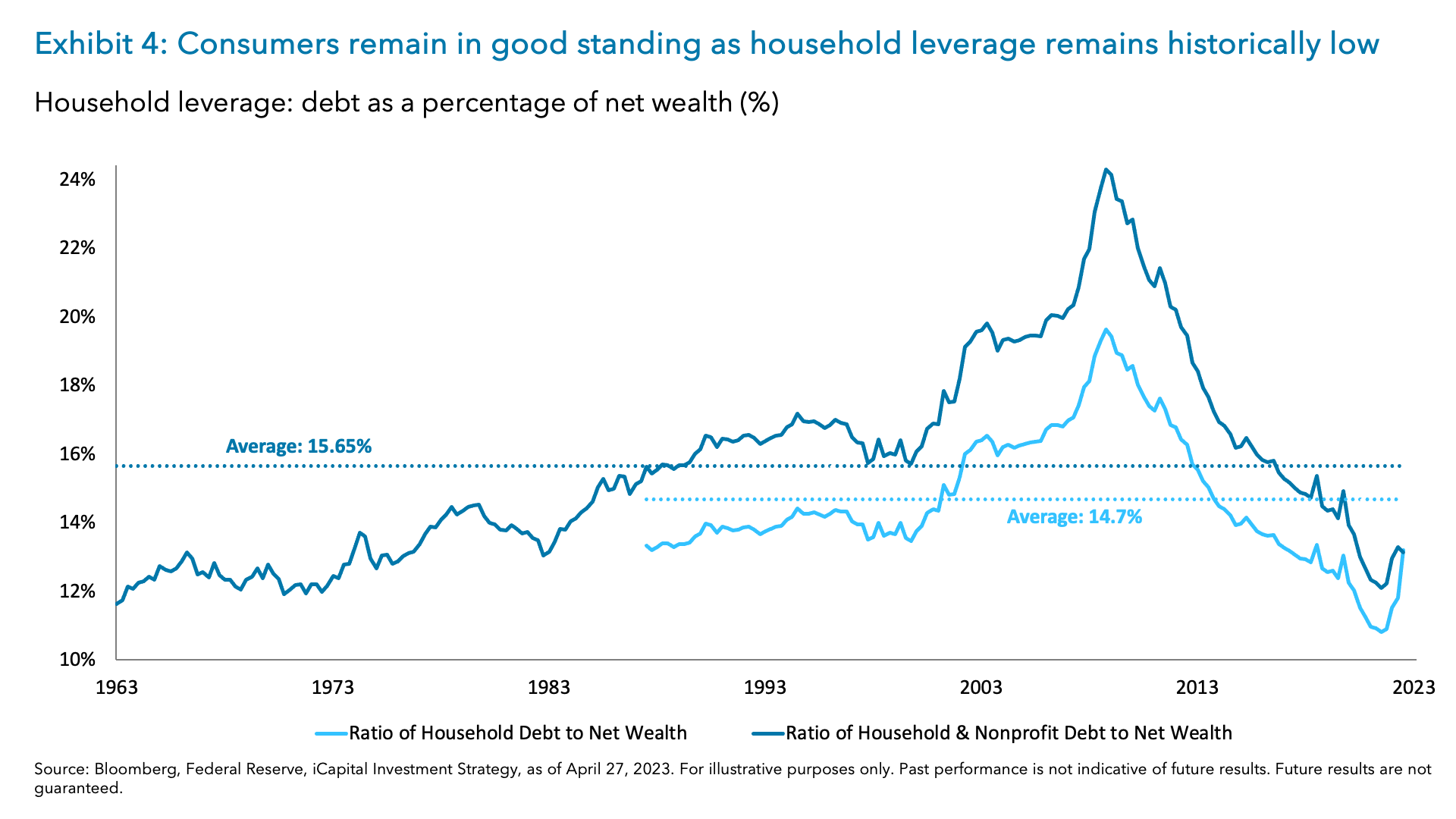

She added that “Consumer balance sheets remain in healthy condition despite a drawdown in excess savings“.

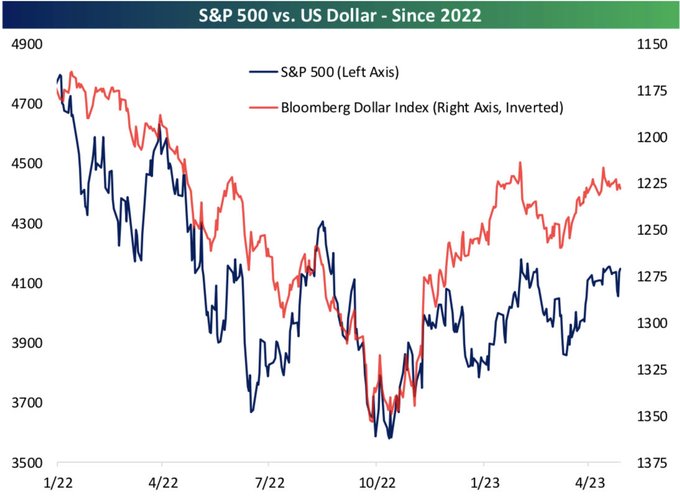

What is a big factor in reported earnings of the biggest weightings in S&P 500? Look it turned decisively in October 22:

- Bespoke@bespokeinvest – Apr 29 – The rally off the lows for US large caps coincides nearly perfectly with the peak and subsequent pullback for the US dollar.

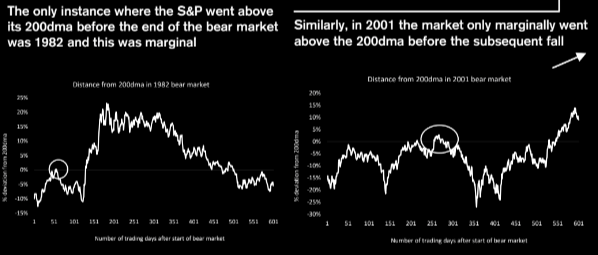

Market Gurus still pronounce this as a bear market, one that will gore us with its savagery. On the other hand,

- Via The Market Ear – Bears do not normally behave like this – “Bear market rallies in general do not go more than 3% above their 200dma (c4083 on the S&P 500) for more than 3 weeks. We are 4.4% above the 200dma and have been above for 26 trading days.” Source Credit Suisse

On Friday, we heard Ed Clissold of Ned Davis Research say “we are mostly likely in a bull market“. He added that “it is not uncommon in years 2 & 3 of recovery to have fears about a double dip … ” Hear him explain this in the clip below.

But what about breadth, meaning RUT down hard vs. S&P up? Jeff DeGraff explained in the same clip:

- “breadth is being overplayed; that can catch up very quickly; …. much of the weakness in small caps comes from a sector differential (small caps far more banks than SPY) …. Keep in mind how much better global indices look than the US indices … the breadth we are seeing globally is more important about the economic outlook, about the health of the market … “

DeGraff made an interesting point about how a (presumably mild) recession might end up bullish for the stock market:

- ” … one of the things that is keeping a lid … on the S&P is the relative attractiveness you are seeing in the bond market; so a recession could actually end up pushing yields downwards & therefore actually give a bid to equities as the yield differential starts to make equities more attractive ”

Jeff DeGraff also cited Semiconductors as an example of where “… we are seeing corrections in what are still very good uptrends… “. That brings us to:

2. Semiconductors

We must first give Kudos to Dan Niles for being publicly open in his reversal on a stock. On April 24, he tweeted:

- Dan Niles@DanielTNiles – Apr 24 – Recap: Sold $NVDA $INTC on weak IT spending concerns. Plan is to be not involved/short into earnings this week on concerns over online ad spend- $GOOGL $META, weak PC demand recovery- $MSFT, cloud spend- $AMZN $MSFT $GOOGL. $TSLA $T $NFLX earnings reactions are warnings.

He reversed himself on April 28:

- Dan Niles@DanielTNiles – Apr 28 – Adding $INTC to our Top 5 Picks for 2023 replacing $MUFG which we removed earlier. Microprocessors are an underappreciated enabler of AI. $INTC valuation along w/ rev growth & margins should expand. Their commitment to EUV 2 yrs ago is yielding better technology & share trends.

Kudos Mr. Niles. Wish every guest on Fin TV would follow your example.

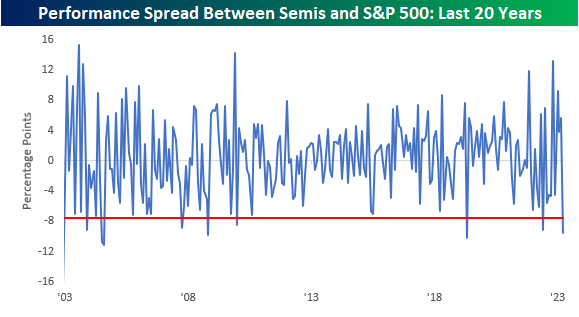

- Bespoke@bespokeinvest – Apr 28 – Semis (SOX) are underperforming the S&P 500 by 9.7 percentage points this month. The only month in the last ten year that the group underperformed by a wider margin was in May 2019.

- Bespoke@bespokeinvest – There’s only been eight other months in the last 20 years that semis have underperformed the S&P 500 by more than 7.5 percentage points in a month. #Semis

And you have:

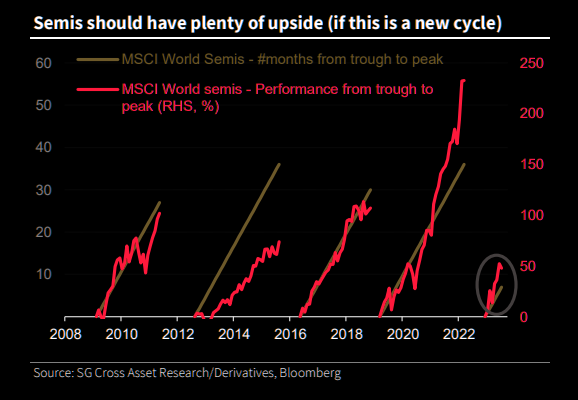

- Via The Market Ear – Time for semis (again)? – The SMH is down top the trend line that has been in place since October lows. Note the ETF is putting in a hammer candle at big support levels. That is the short term view. What about the longer term picture? Soc Gen has long semis as one of their core ideas. They turned bullish in November, and see much more upside: “With the current cycle only seven months long, there should be plenty of upside left. Considering the liquidity and inexpensiveness of options, we prefer the KOSPI 200 index to position for upside on this theme.” See chart 2 for more details.

What if the Semis start running again? Will that support the claim made below?

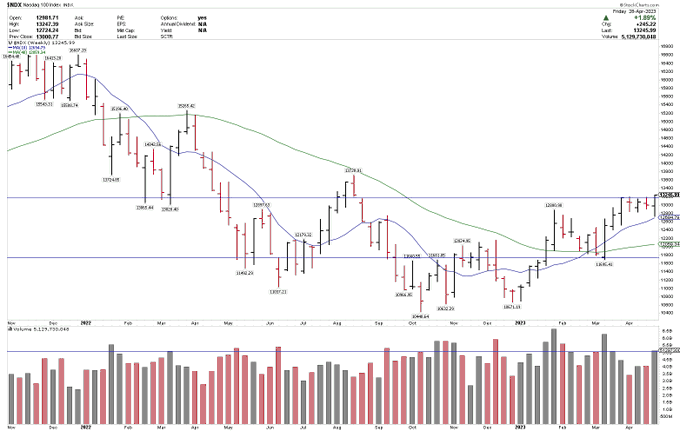

- Larry Tentarelli, Blue Chip Daily@LMT978 – Apr 29 – $NDX starting to break out of the 11600-13200 range. – Rising 10-week MA hold – 5th highest volume week of 2023 – 5 of the 6 highest volume weeks YTD are upside weeks.

How do you distinguish between the next 6 months or so about the growth in Cloud & over the next 3-5 years? Listen to Anurag Rana, (Anuraag for more phonetically accurate spelling) Senior Technology Analyst at Bloomberg Intelligence from 1:29:00 to 1:36:25 of the clip below:

He says “things could get very tough in the next 6 months or so because companies are not spending enough on Cloud”, but listen him out. A few excerpts are below:

- “… Its the next wave of however you are going to build applications; … I have very good clarity for the next 5 years … this business over next 5-6 years will be double from where it is. … majority of tech spending, over 2 trillion dollars, still resides in … the internal data centers; .. that’s where the big movement is … you can’t run generative AI on older infrastructure … ”

Regarding difference between Amazon & Microsoft:

- “Amazon has over 40% market share in cloud infrastructure; nobody comes close to it; even Microsoft & Google are far behind; … Microsoft has been closing the gap from their legacy businesses that have been around awhile;… they are moving their own workloads to the cloud ; that’s driving their business; … “

What about the secular tailwinds? Is that over? In response to this question, Rana said:

- “not even close to it; we just saw the biggest next driver in technology, AI-enabled applications; they run at speeds you can’t even think of; you need the processing power of the cloud to run that; the current footprint, in my view, is less than 20-25% has penetrated in the cloud; we have a long way to go;“

Now read again the Bespoke tweet about May 19 and look at how the SOX performed from May 19 to now:

Note that beta of SMH is 25% higher than the beta of QQQ. Is that why SMH has fallen behind QQQ?

3. Fuel

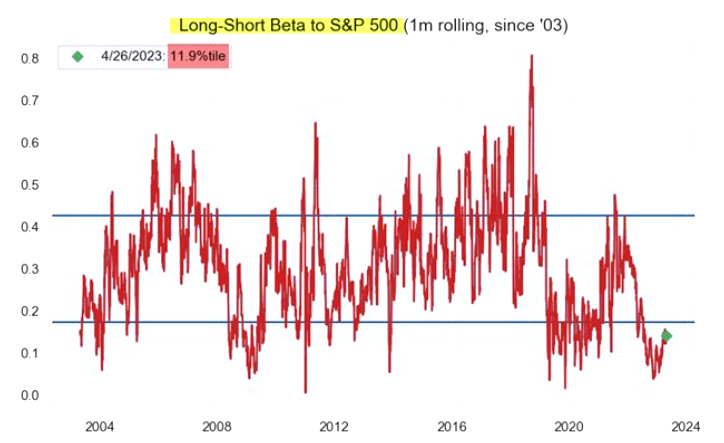

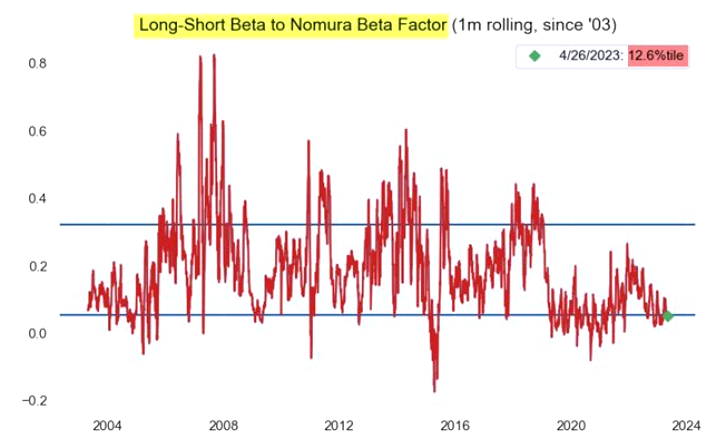

- Via the Market Ear – Apr 29 – Falling behind – Long short hedge fund beta still at longer term depressed levels…and the beta to beta (chart 2) also at very depressed levels. Source Nomura

A broader picture might be:

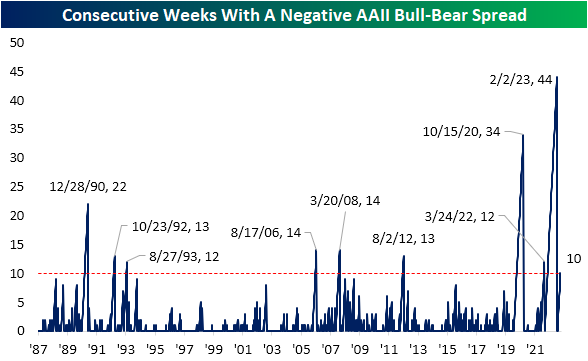

- Bespoke@bespokeinvest – Apr 27 –

The bearish party doesn’t stop. @AAIISentiment

‘s bull/bear spread has now been negative for 10 consecutive weeks after a 44-week streak ended the week of 2/2.

The bearishness is not restricted to stocks:

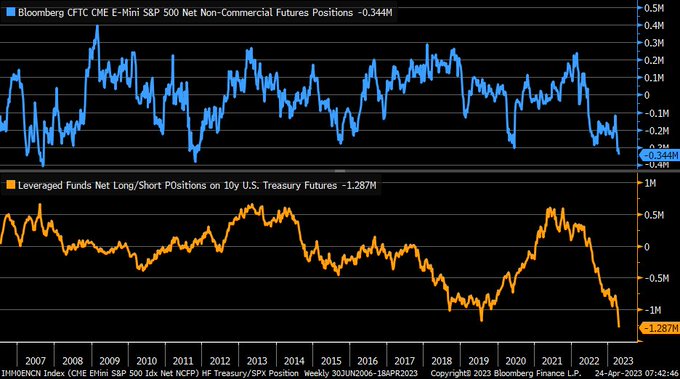

- Liz Ann Sonders@LizAnnSonders – Apr 25 – Just as large speculators/hedge funds have built largest net short position for S&P 500 futures since 2011 (blue), leveraged investors have also boosted net short positions on 10y U.S. Treasury futures (orange) to record

These leveraged investors are supposed to be the smart of the smarts. Surely they know something, like what Fed Chair Powell is likely to say after hiking Fed Funds rate again next week and/or they have a read into the Jobs numbers coming next week.

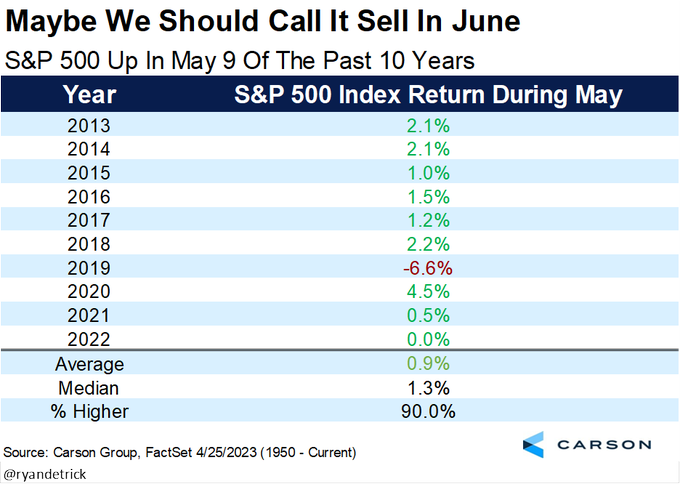

Are they positioned for the “Sell in Money” dictum? They could easily prove right but the near term record suggests otherwise:

- Ryan Detrick, CMT@RyanDetrick – Apr 25 – The sell in May period is right around the corner. Did you know that stocks have gained in May nine of the past 10 years? Sell in June?

Finally Mark Newton pointed out this week that the “market is up last 4-5 weeks but it doesn’t feel like it sentiment has become defensive“; he says the S&P has to fall below 3940 for a big concern.

4. “most aggressive & pernicious” to “fairly moderate”

This section deals with much of what has been discussed bullishly above & it comes mainly from what Bob Michele, Global CIO of Fixed Income at JPMorgan Asset Management told Jonathan Ferro on Bloomberg Open on April 26. This conversation took place in 3 different portions a) from 11:59 to 15:21 minutes b) from 18:27 to 21:42 minutes & c) from 28:55 to 35:40 minutes. This is to help readers to navigate the 47 minute clip below:

First about the terrific earnings reported this past week:

- “.. if you go back to 80s & 90s, one of the first things to be cut down in a slowdown was your tech budget; we have all learnt since then that actually tech is the holy grail of efficiency; that should be one of the last things you cut; we have just run thru this week where the past things businesses & households want to cut are reporting; lets see what happens after that ” …

Our own view is that the bottom quintile of earners in America have the least power, either political or societal. That is why the Fed hardly ever responds to what they might be experiencing. Bob Michele put it differently in his a) segment:

- ” … Bottom quintile of earners have been most punished by the high price of everything; .. so the excess savings they accumulated due to the CARES Act; they have blown right thru it; their deposit balances are lower than what they went into COVID; they are not frittering it away; they are spending it to live off of; we are looking at revolving credit now at the highest rate of usage in a long time; … when we talk to businesses, they are feeling the presure about the new cash burn, the new rate of flowing rate debt … “

What will the Fed do this week?

- “The Fed is not done; the Fed looks at coincident & lagging indicators; .. I think they will do one more; I think it is entirely unnecessary; I think the last hike was entirely unnecessary; I think the cumulative & lagged effect of monetary tightening are here; everything we look at that is a leading indicator has rolled over in a massive way; inflation is rolling over in a massive way; we think by the time they cut rates, it will be below 3% both on the 3-month & 6-month annualized run rate; on core CPI ex-shelter, the trailing 6-month annualized is 1.8%; that’s down from a peak of 7.6%;

The rate hike campaign so far:

- “we are not appreciating what we are seeing is the most aggressive & pernicious pace of tightening by Central Banks, I think, in history; so if you look at the pace of rate hikes, you have to go back in US & globally to 1980 to have seen anything like this; so a rate shock is being delivered to the system in a big big big way; ….. the second thing nobody is talking about is quantitative tightening; … that’s sucking the liquidity out of the system; it is draining reserves; … it is in effect a money-multiplier in reverse; credit conditions are tightening at an alarming rate; “

So?

- “the Fed will ultimately see this; they ultimately will have to cut rates … recession is materializing on the horizon; halfway there, they have always cut rates; .. the market is going to be ball-parking this; they will probably have to take away roughly 1/2 the rate hikes; the Treasury curve will flatten around something like 2.5%; for that the opening gambit will be 3%;”

What is the timing for this?

- “I think it is going to be a fairly moderate recession; historically from the last Fed rate hike to recession, it has averaged 13 months; we are saying the last rate hike will be in May and by Nov-Dec you will be in recession; so we have compressed that because of quantitative tightening; we have also said that mid-way to recession, the Fed starts cutting rates; that’s how we get to something like September … “

Mr. Michele is not just a researcher & opinionator. He is the CIO of JP Morgan Asset Management, meaning he manages client monies. So what is he hearing from clients?

- “we (clients) are under-allocated to Fixed Income; Boy, we wish we bought in the 4h quarter; we are going to wait for a backup & then come into the market“

That’s one of the things that will start driving rates lower, Michele said.

The conversation with Bob Michele in the clip below is followed by a conversation with Rick Rieder of BlackRock, another giant investor. This was a fast action-oriented chat:

- “cash has come down a lot because we are putting so much in these front-end yields (like commercial paper at 6%); when rates are higher, you have to buy but I don’t think you have to chase them when rates move down …. we are pretty neutral on equities; technicals are good but price too high; we have been buying defensive equities like defense, healthcare, parts of tech, staples … “

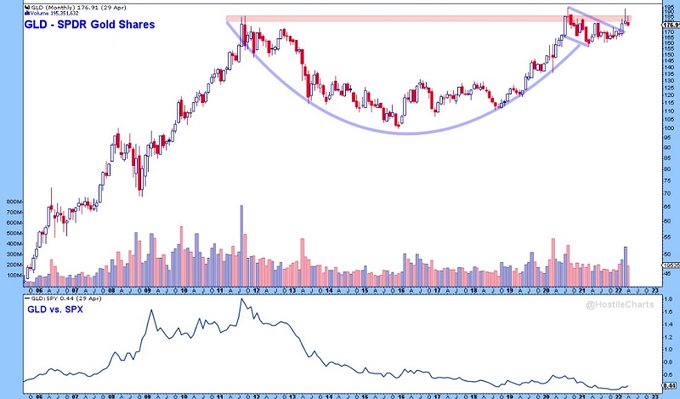

5. Gold

According to J.C. Parets, we just saw the highest monthly close for Gold ever in history. What now?

- Jay Kaeppel@jaykaeppel – Apr 29 – If you’re not paying attention to gold right here, you’re not paying attention. One way or the other, the potential for something BIG is, well, big.

h/t: Larry Thompson @HostileCharts

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on Twitter