Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Cool Tone Jay!

Watch & listen to the 1:47 minutes below:

Do you think Powell is a more of a supply-side productivity bull, as Neal Dutta of RenMac says below?

“I Like Powell More.”– Neil Duttahttps://t.co/UfEQOPQ0Xi pic.twitter.com/LJudqgg3Fs

— RenMac: Renaissance Macro Research (@RenMacLLC) March 29, 2024

So what might Chair Powell deliver in the 2nd half of this year? Continued economic expansion with a slowdown in growth? And what if you combine that with rate cuts by the Fed? Then wouldn’t you say the 2nd half of this year is going to be a particularly strong one? In fact, it isn’t that common to get such a strong environment for risk assets, right? 1991 & 1995 were two such & didn’t Small Caps do great along with Large Caps & fixed income?

We are not smart enough to think like that. The above is the reasoning of Seema Shah of Principal Global. We have heard her before on Bloomberg TV from London. This time, she was on CNBC Closing Bell:

So one way to invest in the 2nd half would be to buy stocks that would benefit from Fed rate cuts, right? But what if the Fed does NOT cut rates in the second half? Then we would get a recession, said Tony Dwyer of Canaccord:

Then there is the view voiced this past week by Carson Block of Muddy Waters, during a discussion with Bloomberg’s Sonali Basak about their short of Blackstone Mortgage Trust:

- “Actually we are more bearish now than we were when we announced the Short in December of last year. Another reason for that is initially we were really only focused on office. But we have come to the view that a lot of multifamily bit of that is in the Blackstone Portfolio but also in Regional Banks. so, yeah, it kind of reminds me of 2007 when there was this zeitgeist for a little while after the Bear Stearns hedge funds failed. There was like I said, OK, there has been deleveraging, everything is OK. And it turned out to be not so. …. I suspect that we are in the early innings of a shakeout in CRE & its not just office but its also multifamily residential.”

If true, then shouldn’t the Fed take the risk of cutting rates sooner?

Regardless of all that, isn’t it time to say Thank You, Jay?

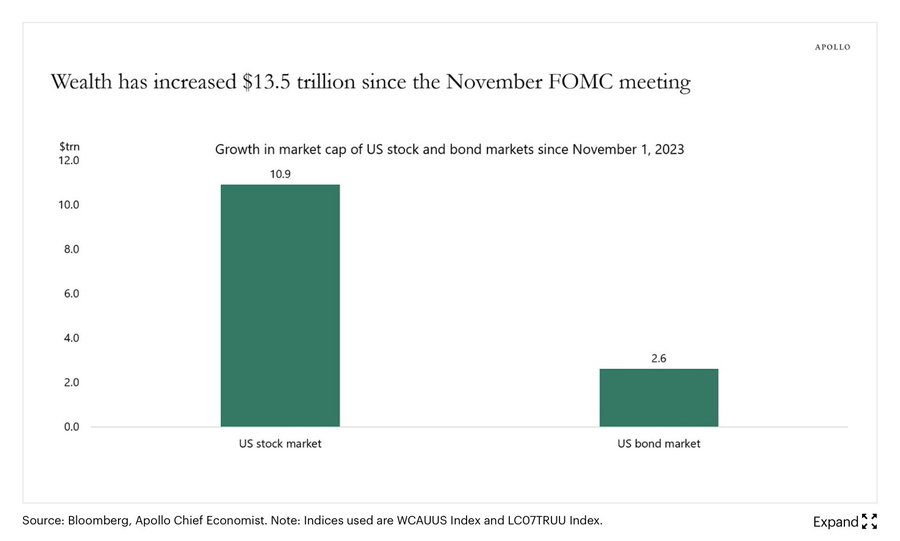

- Liz Ann Sonders@LizAnnSonders – Mar 29 – S&P 500 +25% since November FOMC meeting ($10.9 trillion increase in market cap); similarly, with lower rates/tighter credit spreads, market cap of U.S. bond market up $2.6 trillion … total increase in wealth $13.5 trillion … for comparison, U.S. consumer spending in 2023 was $19 trillion @apolloglobal @Bloomberg

So what does history say about what follows?

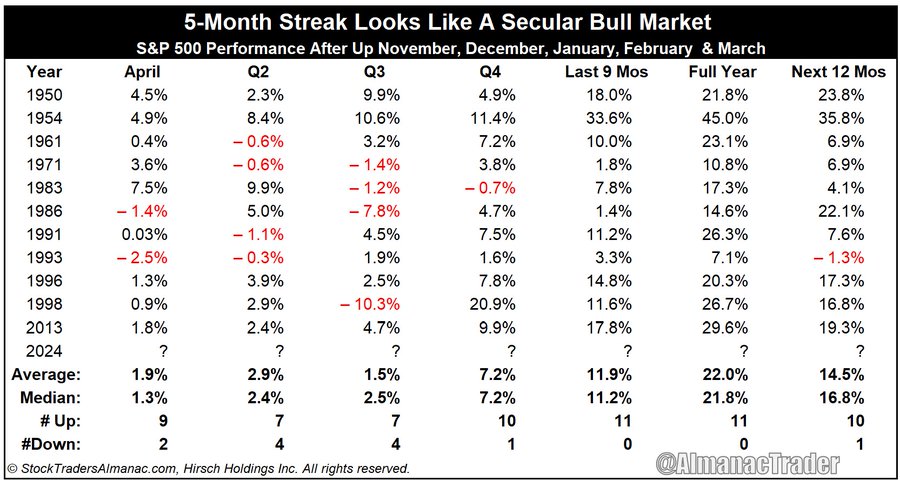

- Jeffrey A. Hirsch@AlmanacTrader – 5-Month Streak Looks Like A Secular Bull Market. Not only is it bullish for April & rest of year. When Nov, Dec, Jan, Feb & March are up stocks have been in a secular bull market that extended to at least the next year. Note a touch of weakness in Q2-Q3 in Worst 6 Months & some huge Q4 rallies. Last 9 months of year up all 11 times, avg gain 11.9%

2. Markets Last Week

Commodities & Commodity Stocks:

- Gold up 3.5%; GDX up 6.8%; NEM up 6.1%; Silver up 64 bps; SLV up 75 bps; Copper up 17 bps; CLF up 6.4%; FCX up 4.2%; MOS up 4.3%; Oil up 2.7%; Brent up 2.3%; Nat Gas up 5.4%; OIH up 1.4%; XLE up 2.2%;

US Stock Indices:

- VIX down 8 bps; Dow up 84 bps; SPX up 38 bps; RSP up 1.7%; NDX down 46 bps; SMH down 1.1%; RUT up 2.6%; IWC up 2.6%; MDY up 2.1%; DJT up 1.3%;

Stock Sectors:

- AAPL down 60 bps; AMZN up 78 bps; GOOGL flattish; META down 4.6%; MSFT down 1.9%; NFLX down 3.2%; NVDA down 3.9%; BAC up 2.3%; C up 3.8%; GS up 2.8%; KRE up 3.4%;

Interest Rates & Bond ETFs:

- 30-yr yield down 3.8 bps; 20-yr down 2 bps; 10-yr down 0.4 bps; 7-yr up 0.4 bps; 5-yr up 2.4 bps; 3-yr up 5.4 bps; 2-yr up 2.8 bps; 1-yr up 5.7 bps;

International ETFs (Dollar up 12 bps):

- ACWX up 45 bps; EEM up 61 bps; FXI up 1.8%; KWEB up 23 bps; EWZ up 61 bps; EWY down 45 bps; EWJ down 64 bps; EWG up 1.5%; INDA up 2.3%; INDY up 1.2%; SMIN up 1.4%;

3. Gold

A good call back in February:

- J.C. Parets@allstarcharts – Mar 29 – A lot of things changed for this market back in February, as we’ve discussed here again and again. But here’s another one that changed that I think few people are talking about

How about Gold on its own?

- Otavio (Tavi) Costa@TaviCosta – Mar 29 – Now it’s official. Gold just had a quarterly close at record levels, likely marking the beginning of a secular bull market. This is indeed one of the most exciting times to be a precious metals and commodity investor that I can recall. Game on.

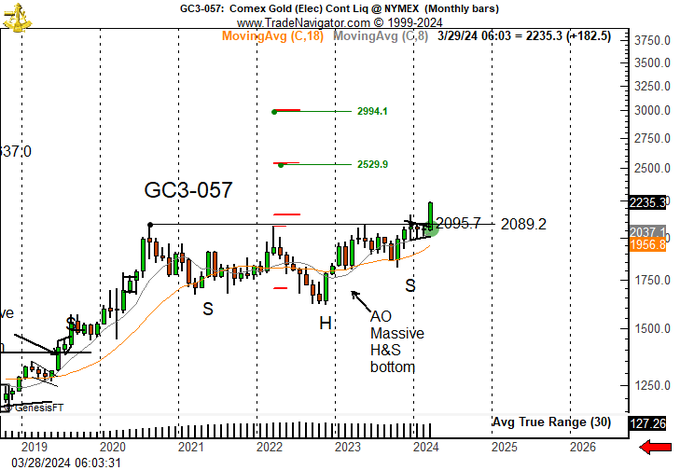

A significant monthly bar?

- Peter Brandt@PeterLBrandt – Mar 28 – With two days left in March, this will likely be one of the most significant monthly bars in the history of the Gold chart. $GC_F $GLD $PHYS

What about Gold miners?

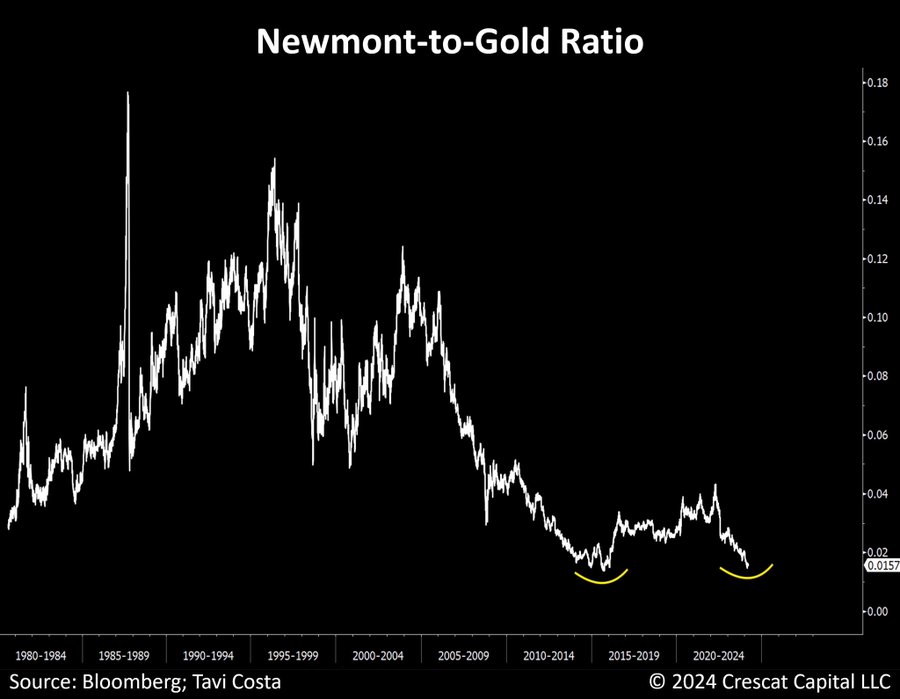

- Otavio (Tavi) Costa@TaviCosta – March 28 – The Newmont-to-gold ratio is currently at its lowest point in 44 years. Today’s levels are likely marking a major double bottom, however, the valuation proposition is what makes this opportunity truly compelling in our view. Gold miners are undoubtedly the most hated industry in the markets today. To reiterate an important concept: Skepticism often morphs into opportunity.

What about the Materials sector?

- Steven Strazza@sstrazza – Mar 28 – Materials just registered their 10th consecutive week of gains, the longest streak on record since the launch of sector SPDR $XLB (Dec 1998)

There is a new big factor this year, as Stefanie Holtz-Jen, APAC CIO for Deutsche Bank said:

- “(minute 3:03) the big factor this year is the Chinese retail investor moving into Gold; … where you have a weakening currency, weak property market … a store of value is not just for the Central Bank but also for the investors“.

4. Rates

For weeks, we have seen the entire Treasury curve rise or fall in rates simultaneously. But this week, Treasury rates rose in the 5-2 yr belly of the curve, remained flat in the 10-yr sector & fell at the 20-30 yr end. We think it is related to the talk about Fed cutting rates.

If the market believes the Fed will cut rates before we see a slowdown, then the rates in belly of the Treasury curve will FALL while the long-duration rates might actually RISE some. Conversely, if the market believes that the Fed will NOT cut rates until they see a slowdown, then rates in the belly of the Treasury curve will RISE while the long-duration rates might actually FALL a bit to adjust for an unnecessary slowdown.

A big factor will be the jobs market.

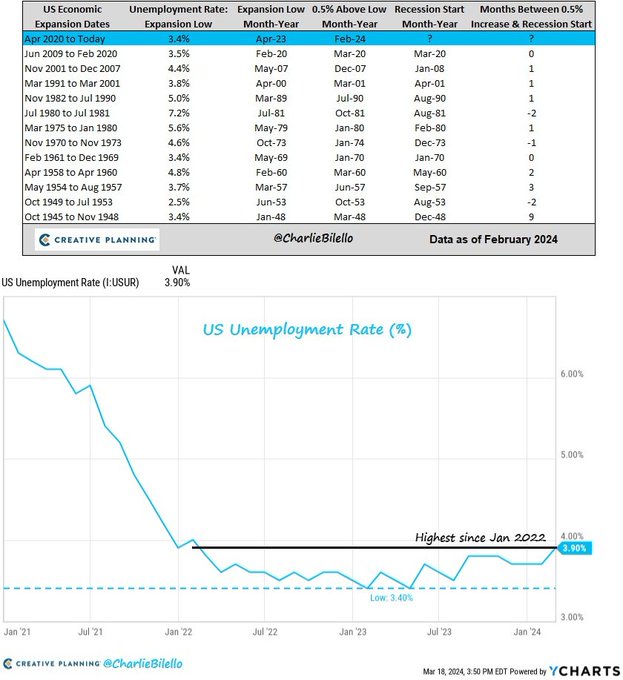

- Charlie Bilello@charliebilello – Mar 27 – The US Unemployment Rate is now 0.5% above the cycle low from last April (3.4%). Historically, that 0.5% move higher has occurred near the start of a recession…

On the other hand, some signals are negative for TLT & long-duration Treasuries.

- Jay Kaeppel@jaykaeppel – Mar 26 – 5-week average of 30-year Treasury Optix crosses above 80% for first time in six months. NOT an “automatic sell signal”, BUT definitely an item for the unfavorable side of the weight of the evidence ledger for bonds. @sentimentrader

All this depends on next week’s employment data.

5. S&P

A couple of opinions below.

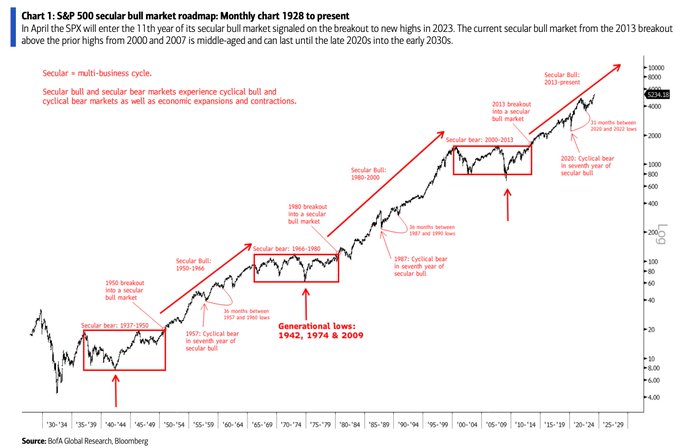

- Holger Zschaepitz@Schuldensuehner – BofA’s Technical Analyst Stephen Suttmeier expects the current bull market to drive the S&P 500 way higher. In April the S&P 500 will enter the 11th year of its secular bull market signaled on the April 2013 breakout above the 2000 and 2007 peaks, Suttmeier says. The secular bull markets from 1950-1966 and 1980-2000 lasted 16 and 20yrs, resp, which means that the current secular bull market is middle-aged and can extend until 2029. In our view, the 2020 dip resembled the dips in 1987 and 1957. If this was “halftime” for the current secular bull market, it does not rule out a 14y secular bull market ending in 2027.

Speaking of a near term peak,

- SentimenTrader@sentimentrader – With a significant number of stocks in economically sensitive sectors like Consumer Discretionary, Financials, and Industrials registering annual highs simultaneously, the uptrend in the world’s most benchmarked index should persist. Indexes rarely peak when participation is broadening, like now.

On the other hand,

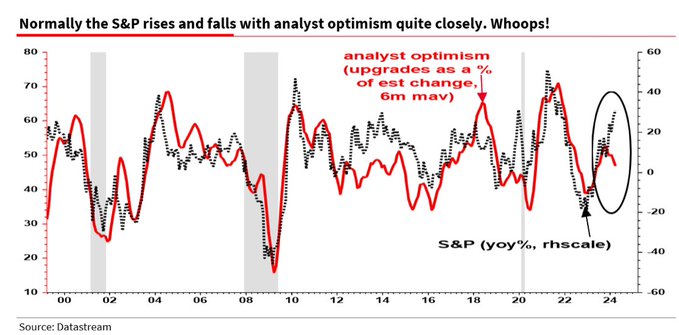

- Albert Edwards@albertedwards99 – Mar 28 – This week i’ve written about how analyst optimism has turned down (defined as % of eps upgrades, 6m mav). What surprised me given all the hype about AI boosting profits is optimism topped out at only 50%. As an ex-girlfriend once said to me, “is that it?”.

6. A parting of ways in Financial Stocks?

On Thursday, we saw Allstate being upgraded to a Buy & Citibank being downgraded to a Hold. We kinda think of both in a similar way – Allstate a decent insurer but no State Farm & Citi a decent bank but no JPMorgan. But both have been great stocks &, despite the Fin TV sponsorship of Citi, Allstate has so far been a better performer.

However, you notice that Citi has made up the earlier underperformance since mid-February. Fortunately for us, both CNBC Half Time & CNBC Fast Money touched on this disparity. Josh Brown of Half Time gave a fundamental positive view of Insurers over Banks and Carter Worth of Fast Money gave a technical view suggesting Banks over Insurance by focusing on the ratio chart of S&P Insurance over KBW Bank index.

Are insurance stocks past their peak?

The Chart Master @CarterBWorth makes the case for reducing insurer exposure in favor of banks. pic.twitter.com/dtben4BEMX

— CNBC's Fast Money (@CNBCFastMoney) March 28, 2024

Going back to Allstate vs. Citi, the positive views seem to be similar – the rate increases pushed thru by Allstate last year will pay off this year AND the change of direction pushed thru at Citi by management will pay off this year.

In a somewhat similar vein well-known oil analyst Paul Sankey said he preferred refiners like Valero, MPC over exploration companies like HAL, SLB etc. The reason being big energy companies are going to be more focused passing benefits of higher oil prices to investors to dividends instead of using higher oil prices on new exploration.

The parting of ways concept might also have a broader application as we discuss below.

7. China vs. India – a parting of ways in EM

We urge all to watch & listen to Carson Block of Muddy Waters Research speak with Bloomberg’s Sonali Basak re China. He has started a New World Order fund, a long-only fund to deal with flows away from China because of the political risk there with emphasis on Vietnam as potentially the most profound beneficiary.

For a succinct view about the relative attractiveness of China & India, watch & listen to the 2;47 minute clip below of Neeraj Seth, BlackRock’s CIO & Head of APAC. He is being questioned by Bloomberg’s Haslinda Amin, whom we respect for the longevity & intensity of her negative views of India. Her negativity is what makes her beneficial to listeners like us.

She opens the clip by saying “does seem like investors still buying the India story, Neeraj“. He responds:

- “I think it is the most transformational story in the World today, by a long margin. … We have seen some pause in the growth story of China. But what’s happening in India is actually remarkable. And it is built on the stability, demographics & infrastructure. And then it is getting the tailwind of geopolitics. It’s transformational. And I do think if you continue to see that political & policy stability, this story has 20 more years at least, if not longer.”

When asked “so what’s the bet in India?“, Neeraj replied

- ” … the key in India is you want to go with the long duration assets for actually riding the macro story. The public markets are straight … so you still have the benefit of compounding of the growth rate of where it is“…”.

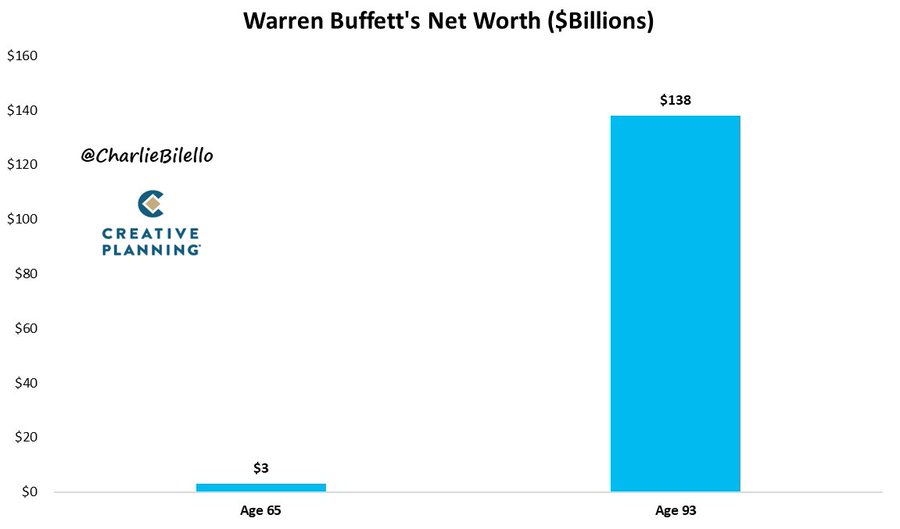

Isn’t that what Jeff Gundlach has been saying for a couple of years now? Look at the chart below to get the benefits of compounding over a long time,

- Charlie Bilello@charliebilello – Amazing stat: 98% of Warren Buffett’s current net worth came after he turned 65. The power of time and uninterrupted compounding. Video: https://youtube.com/watch?v=CWxbU6n3q6Y

But what about China?

- Haslinda – “perhaps it is time to buy China; take money out of India, put it in China because it has been battered; And you know what? we probably have seen the bottom already“

- Neeraj – “that’s an interesting point because that point would have been discussed last year, year before or so. The question is at what point you are going to be right and even a broken clock is right twice a day. … I do think people are underestimating the size or growth of that economy (China) & hence the opportunities that exist in the public markets. So I would tactically be long China here but, as I said, its a little harder to take a much longer term view because of the policy certainty you need“.

We appreciate all the above long-term, the 20-yr compounding stuff, but what about the near term? The nationwide Indian elections begin on April 19. What does history tell us about the post-election period in the Indian market? Watch & listen to Stefanie Holtz-Jen, Deutsche Bank Private Bank APAC CIO below:

- “(minute 1;23) we looked at the last 5 elections & how the market reacted back then; you look at the 6 months after the election, the market on average made 21%; you look at the 6-months before, the market made about 12% on average; and only on election day there were actually 2 occasions where we had a sell-off happening; we made 2% on average; so it looks like a lot gets priced in before; once the uncertainty is out, may be on election day, you get sell the news effect & afterwards we go back to be able to perform; … the outcome we expect is more stability & more of the same policies to benefit India; & I fully believe that you can draw into the future from history“

Getting back to China, Haslinda Amin actually chided Ms. Holtz-Jen on air for going overweight China a month or so ago & now becoming cautious. Ms. Holtz-Jen was politely firm in her response:

- “we can also be technical; … we always looked at China as a second-half opportunity; But I thought about a month ago, that we reached almost an inflection point in terms of negativity & the government was propping up a lot of measures … NOW I’am getting more cautious because of what happened on Friday (22nd). On Friday, we saw the currency allowed to weaken …. but the immediate reaction was for the equity market to sell-off; .. for me it was a sign that sentiment still has not stabilized; … I think that’s it for the signaling“.

8. China vs. India – A parting of the ways in Geopolitics?

8.1 – Xi is no Teddy

Guess Xi has not heard of Theodore (Teddy) Roosevelt who said simply & meaningfully – “Speak softly & carry a big stick“. Sadly all Xi knows is to order like an emperor “tremble & obey“. It did work for a few years. But now it doesn’t. Not even with small Philippines. “Filipinos do not yield” said President Ferdinand Marcos, Jr. to China.

Look what happened 2 days ago on March 29, 2024 – US and Philippines Open New Naval Base in Batanes Island to Bring in US Warship Fleet: Focus the clip below between minute 1:20 to 1:40 to see how critical the location of Batanes Island is to both Taiwan & Philippines – It is located right in the middle of the water that separates Taiwan & Philippines and serves as a critical choke point for naval traffic between the Pacific & South China Sea. Make no mistake. The Batanes base will serve as a trigger wire that, if broken, could lead to military conflict between China & USA.

And Indian External Affairs Minister JaiShankar was also in Manila confirming publicly India’s firm support for Philippines. Recall that India has already sold its BrahMos missiles, fastest supersonic missiles in the world, to Philippines as a defensive measure and there are talks to sell India’s new Tejas fighter aircraft to Philippines as well. Just a couple of years ago, all this might have been difficult to achieve. But President Xi has just about convinced USA, India & most nations in the South Pacific that China has to be reigned in.

Now travel to the other end of Chinese One Belt Road ambitions near the Straits of Hormuz on the Arabian Sea. The CPEC (China Pakistan Economic Corridor) was opened in a blaze of glory & optimism signaling a friendship that was higher than Himaalaya & deeper than the ocean. And now, China has suspended all work on projects in this corridor that runs from borders of Afghanistan to the Gwadar port at the junction of NaPakistani & Iranian coastlines.

Why? Because 5 attacks were launched just in the past 10 days against these projects ranging from dams being built in Khyber-Pakhtunkhawa (across from Afghanistan) to the major Napaki naval base to the seaport at Gwadar that was to be China’s direct access to the Arabian sea. Not only were facilities attacked, but 5 Chinese engineers were killed on the road to the dam. This is despite the dedication of one entire army division by Napaki military to protect Chinese projects.

Moving to a higher level view, President Xi is acting in the same manner with US & European CEOs while he seeks their investment capital. Has no one taught him to be a salesman or even pretend to speak nicely? This is why you see Chinese spokesmen uttering criticisms & threats against their neighbors, either in the South China Sea or in the Indian Subcontinent. Sadly, can anyone even think of one visible positive step taken by China to benefit its global neighbors?

Remember Djibouti, that critical port right at the entrance of the Red Sea where China has a naval base!

That entire naval area from the Red Sea to the Gulf of Aden to East Coast of Somalia into North Arabian Sea is infested with pirates that prey on commercial vessels. Has any of us ever heard of a Chinese Navy ship intercepting these pirate ships or rescuing pirated ships of other small countries? We have not & probably won’t because China just doesn’t get the value of helping/protecting smaller countries.

8.2 Vishva-Mitra or That’s What Friends Are For!

Vishva-Mitra is an ancient Sanskrut adjective & name that literally means friend (Mitra) of the world (Vishva). It is the hallmark and foundation of India’s external affairs under PM Modi. Let us be clear. India has always had soft power of its principles. But it didn’t mean much in the past because India didn’t have or project hard power with it.

Speaking of Djbouti & Somalia above, look what happened about 10 days ago. Indian Navy intercepted a pirated Bulgarian ship MV Ruen as it left Somali Waters. In a 40-hour operation some 2,600 km from the Indian Coast, MARCOS, the marine special forces of the Indian Navy boarded the pirated ship and rescued 17 hostages & captured 35 armed pirates. To quote John Bradford, a US International Affairs fellow,

- “What marks this operation as impressive is how risk was minimized by using a coordinated force that includes the use of a warship, drones, fixed- & Rotary-wing aircraft and marine commandos.”

What followed went viral. How did Minister JaiShankar respond to the thank you tweet below from Bulgarian Deputy PM Gabriel:

- Mariya Gabriel@GabrielMariya – Mar 17 – I express my gratitude to the 🇮🇳 navy for the successful operation to rescue the hijacked vessel Ruen &its crew members, including 7 BG nationals. Thank you for support &great effort. We continue to work together to protect lives of the crew @narendramodi @MEAIndia @DrSJaishankar

- Dr. S. Jaishankar (Modi Ka Parivar)@DrSJaishankar – – That’s what friends are for. @rajnathsingh @indiannavy (highlighting & letter size ours)

He meant every syllable of it & had the grace to show it. Why can’t President Xi or any of his staff manage such simple friendly gestures ? The clip below is more technical in nature & describes US-UK views of the operational capabilities of MARCOS & Indian Navy:

Now look what happened yesterday on March 30, 2024. The Indian Navy intercepted a hijacked Iranian vessel near the Gulf of Aden & rescued 23 Pakistani nationals aboard. As Admiral Ravi Kumar said, India has been deploying continuously 10 naval ships in the area between Red Sea,. Gulf of Aden, North Arabian Sea & the East Coast of Somalia.

We must ask again where is the Chinese Navy that is based at Djibouti at the center of this Naval area? Obviously, we are not the only ones wondering so and that has to affect how countries around the world now view China vs. India.

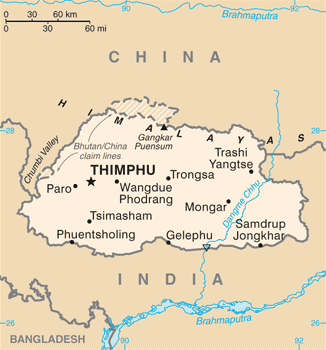

By the way, PM Modi was conferred the Order of the Druk Gyalpo by Bhutan in his state visit a few days ago. This is the first time this highest Bhutanese award has been conferred on a non-Bhutanese. Remember Bhutan is sandwiched between China-occupied Tibet & Indian states of Sikkim & Arunachal Pradesh. And the great Tawang Monastery (a favorite of the Dalai Lama) is adjacent to Bhutan.

Think about this. Tiny Bhutan summoned the courage to give this momentous award to PM Modi within two weeks of PM Modi inaugurating the game-changer all-weather pass to Tawang from Indian military bases in Arunachal Pradesh (which China ludicrously claims as it own). Would Bhutan have had this courage without strong confidence in Indian military power to protect it from China? We don’t think so.

Mark our words. This is the beginning of a Buddhism-oriented drive by India to win over the hearts & minds of Asian countries who worship Buddha. That begins with Bhutan & leads to Tibet, Chinese provinces of Yunnan, Sichuan into Myanmar on the east all the way to Taiwan to the north & west. How can China combat this? Clearly by renouncing the anti-Dharma postulates of Xi’s philosophy & encouraging Buddhism.

Yeah right! If Xi had that level of mental & philosophical dexterity, US & European capital would be flooding into China right now.

If it is Buddhism in the east, it is friendship towards Islam in the west. Look at rescued Pakistani sailors chanting India Zindabad on the Indian Navy ship that rescued them:

Is there any one who doesn’t understand how this travels in & to UAE & Saudi Arabia all the way to Egypt? This Vishva-Mitra principle and the hard power of the Indian Navy is the backbone of the IMEC trade corridor from India to UAE to Saudi Arabia to Jordan to Israel’s Haifa port.

This is also why major multinationals are thinking about making India their base for operations spanning from Middle East to the ASEAN. If you get it, then you will also get why smart investors are looking at a 20-year view of economic growth in & via India.

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on X.