Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Markets Last Week

US Indices:

- VIX up 4.3%; Dow up 1.5%; SPX up 61 bps; RSP up 1.2%; NDX up 20 bps; SMH down 1%; RUT up 80 bps; IWC down 68 bps; MDY up 97 bps; XLU down 87 bps;

Key Stocks & Sectors:

- AAPL down 2.2%; AMZN up 2.8%; GOOGL up 1.6%; META down 1.8%; MSFT up 1.7%; NFLX up 2.6%; NVDA down 4%; MU down 1%; BAC up 66 bps; C up 1.2%; GS up 93 bps; JPM up 1.4%; KRE up 2.1%; EUFN up 1.6%;

Dollar was up 34 bps on UUP & up 28 bps on DXY:

- Gold down 55 bps; GDX up 1.7%; Silver up 9.6%; Copper down 1.4%; CLF minus 80 bps; FCX up 3%; MOS up 2.6%; Oil up 2.6%; Brent up 3%; Nat Gas down 6.3%; OIH up 3.6%; XLE up 2.1%;

International Stocks:

- ACWX up 30 bps; EEM up 1.1%; FXI up 1.2%; KWEB down 1.6%; EWZ up 88 bps; EWY up 93 bps; EWG up 57 bps; INDA down 94 bps; INDY down 36 bps; EPI down 1%; SMIN up 34 bps;

And interest rates moved up for the week because, perhaps, European Bank stocks recovered?

- 30-year Treasury yield up 5 bps on the week; 20-yr yield up 3.6 bps; 10-yr up 4.4 bps; 7-yr up 4.6 bps; 5-yr up 3.8 bps; 3-yr up 2.9 bps; 2-yr up 3.2 bps; 1-yr up 4.3 bps;

- TLT down 80 bps; EDV down 1.3%; ZROZ down 1.7%; HYG up 38 bps; JNK up 45 bps; EMB up 11 bps;

Last week we highlighted the movements in TLT as “chartable”. This week showed that what seems chartable might not in reality prove profitable, at least in the short term. On the other hand, something notable happened this week – a die-hard anti-Bond trader stopped being so and said on Bloomberg Surveillance:

- “to me, it looks a lot like an inflection point & a pivot where we might be looking at some sort of sea-change for markets that we had not seen before”

Strong words from someone who is trained to not even acknowledge sunrise until her signals tell her the sun is rising. That someone is Katy Kaminsky of Alpha Simplex who has saved us all year from getting anything more than tactically short term bullish on bonds. So we might mock her discipline gently but that’s mostly out of respect & a bit out of jealousy from our ignorance of her models.

No! She hasn’t pivoted herself into a bullish bonds position, but she is seeing something different this month and she elaborated:

- “what we have seen is … weaker economic data; secondly we are starting to hear some murmurs of demand destruction; what does it mean from a technical perspective? it means we have seen synchronous selloffs in cross assets space – agricultural, metals & particularly rallying in bonds – a really big adjustment in the yield space; we have seen risk-off behavior which we have not seen most of this year; … it really feels like other asset classes are telling us something about the economic picture that we are still not seeing in equity markets …. I think the big challenge is seeing risk off type behavior in the markets as an indication that for the first time this year, market is starting to get nervous about the potential or higher probability of some sort of harder landing & that wasn’t in the data before … “

When asked about her conviction, Ms. Kaminsky replied:

- ” … in the near term, it is definitely mixed, but you have definitely seen a pivot; … I think the US curve, especially with the cautious Fed, still remains as short view in the short term, but if we continue to see evidence of risk-off behavior, you are going to see that pivot as well. ... “

Watch her discussion in the clip below from minute 54;23 to 1:03:00.

Interestingly, we heard the same kind of pivot from a bullish equity investor who owns all of the Mag 7 stocks. Ankur Crawford of Alger said on CNBC Closing Bell on Thursday:

- “I do think there are starting to see cracks in the economy; consumer isn’t great; transports are weak; …. all is not good;”

Without waiting to be asked about the impact of the above on her stocks, she said:

- “I think you are going to get consolidation into Mag 7 (or Mag 5) stocks as they put up the numbers… earnings season will be pretty good [for Mags] … I don’t think that will be the case for everything in the market“

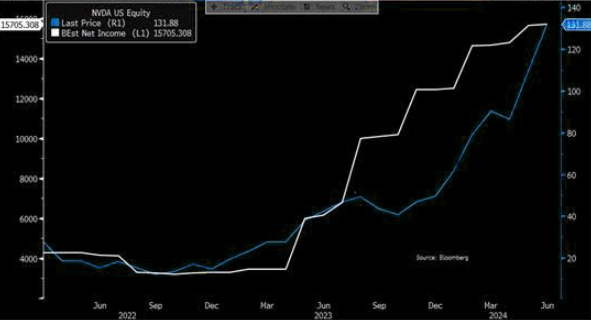

The simplest fundamental view of NVDIA came from JPMorgan via The Market Ear:

- NVDA – cheaper and cheaper – JPM market intelligence: “For those not involved in NVDA, the stock continues to cheapen on a P/E, e.g., last fiscal year the stock was +200% and earnings were +581% (Jan 29, 2023 – Jan 28, 2024).”

And finally the most interesting fundamental view of NVDIA came from Ed Yardeni:

- “.. Back in 1999, it was seller-financing;… this time NVDIA is getting purchases from very rich technology companies that can certainly afford to buy chips … Look the GPU chip is basically a fast computer – its big data on speed & steroids – the whole idea is that we are going to be moving into quantum computers; GPUs are kind of quantum computers; … Dell is going to be providing AI-related technology to Elon Musk who is going to put a lot of these technologies together to build a super-computer; he has more often than not delivered on what he says he is going to do; he basically views GPUs as super-conductors when they are really put together & I agree with him“

2. S&P 500

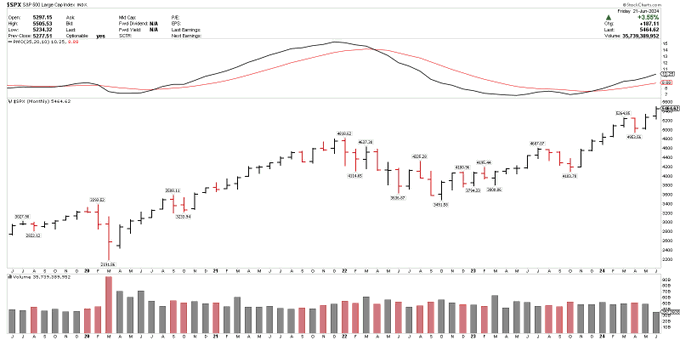

- Larry Tentarelli, Blue Chip Daily@bluechipdaily – $SPX +12.9% since clearing the January 2022 high and the bullish monthly PMO cross. Bullish PMO signal intact.

And on earnings basis:

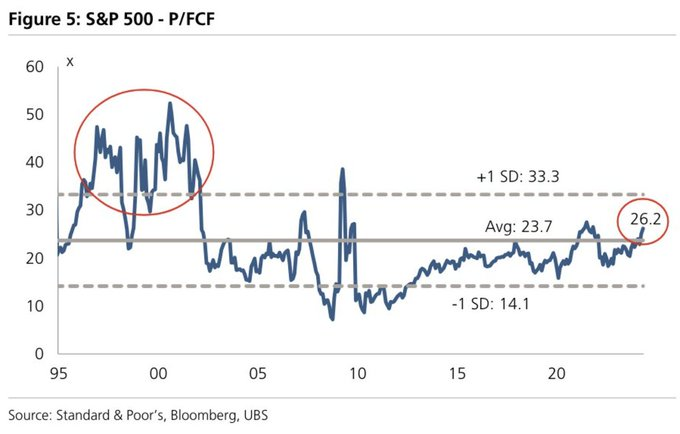

- Seth Golden@SethCL – HOLY BEJEBUS‼️ 🤯 – The rally may go a lot further than the P/E punditry is willing to consider. “P/Es today are a full standard deviation LOWER than in the late 90s. On a Free Cash Flow basis (FCF), $SPX is 2 standard deviations CHEAPER” – UBS $SPY $QQQ $DIA H/T @SamRo

On the other hand,

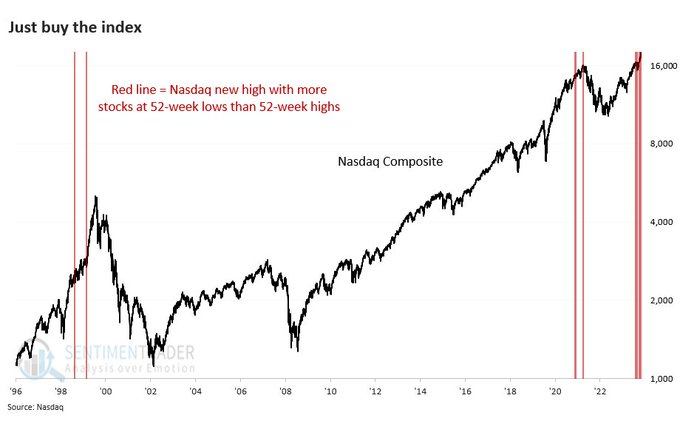

- Jason Goepfert@jasongoepfert – Jun 18 – We’ve never seen anything like this before. Once again, a new high in the Nasdaq. Once again, more stocks falling to 52-week lows than rising to 52-week highs on that exchange. That’s 9 days out of the past 20. It blows away any other time period.

What about the Summer rally?

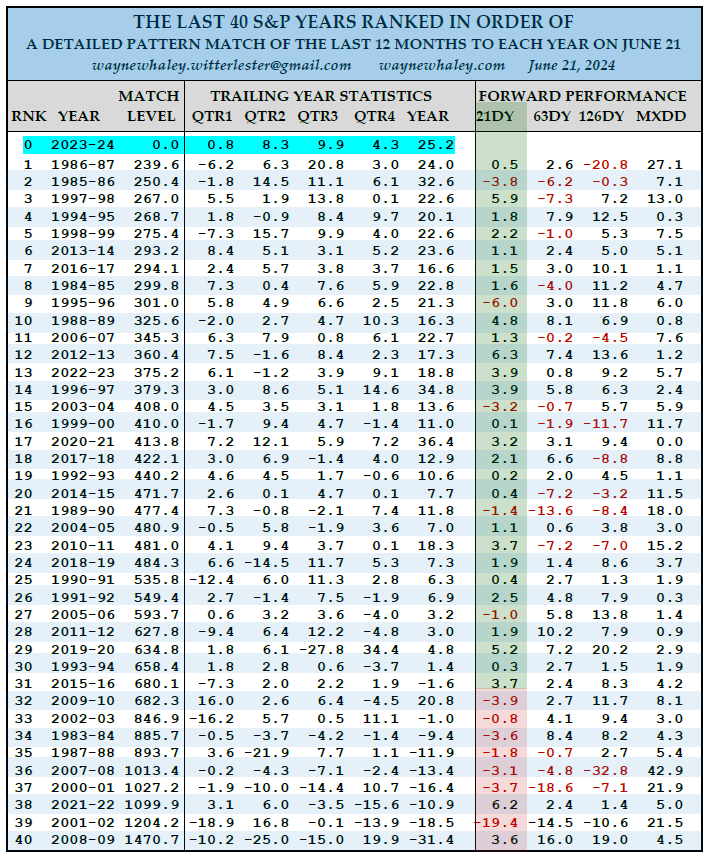

- Wayne Whaley@WayneWhaley1136 – THE LAST 40 YEARS PATTERN MATCHED TO THE CURRENT LAST 12 MONTHS – This is one of 26 studies shared with commentary subscribers this week as we do each week….When writing price pattern matching models, one can seek to match trailing Years, Qtrs, Mts, Wks, Days, Hours, Minutes or per trade. I once had the idea to write a pattern match routine that didn’t play favorites and would do pattern matching evaluation taking into consideration every price move in the last 40 yrs from one day to 12 Mts in comparing past patterns to today on this Date each year. Below is the product of that scan ran on Jun 21 for the S&P. 19860621-19870621 was deemed the best match. 2008-09, the worst. The match level reflects how closely each past yr matches the current yr. A zero is a perfect match. In the ‘Trailing Yr Stats’ column, I can’t display all time periods studied and choose to display five periods which reflect the nature of the year. Forward performance is evaluated at 21, 63 and 126 trading days as proxies for Month, Qtr and Six Months. In reviewing the forward performance, what caught my eye was that 25 out of the top 30 matches saw positive performance in the following month (21 trading days). Conversely, seven of the 12 forward losing Months on this Date over the last 40 years occurred after the worst nine matches. An encouraging study for the Summer Bulls.

3. The NVDIA Turbulence

The most interesting & timely input was delivered by Igor Dusaniwsky, MD Predictive Analysis at S3 Partners via Kelly Evans of CNBC.

Mr. Dusaniwsky was simple & clear-stated as you would expect a Predictive analysis professional to be. He said that in analyzing short interest, he “likes to see Dollars at Risk” and added “.. so I am looking at $39,413,644,788, bigger than the 1.3 billion number of shares” and said “this is a wildly shorted stock across all the trading platforms …. I look at the squeez-ability of the stock” .

Speaking of the S&P 500, he said: “ we have got 1.2T of short interest which is a record high; shorts are going up but they are just not going up as fast as the long side; … I don’t see there is a huge amount of shorts coming into the market; they are not putting money where their mouths are; not quite the resolve on the short side that we are seeing on the long side”

Kelly Evans quickly got the point and said “in other words, you think the risks are that we get a breakout to the upside in NVDA or the whole market at this point even though we feel that’s exactly we have experienced“.

Wowzer, we said to ourselves – this was totally against the psychology that was gripping NVDA & the S&P early afternoon on Thursday. But the numbers shared by Mr. Dusaniwsky make sense and there is a reason why Arithmetic is called the queen of all sciences.

Later we saw the below courtesy of JPM via The Market Ear:

-

The Market Ear@themarketear – Already? People seem to be buying the NVDA dip. The stock is putting in some sort of a hammer like candle in the lower part of the “imperfect” trend channel. Note the 21 day is down around 120.

On the other hand,

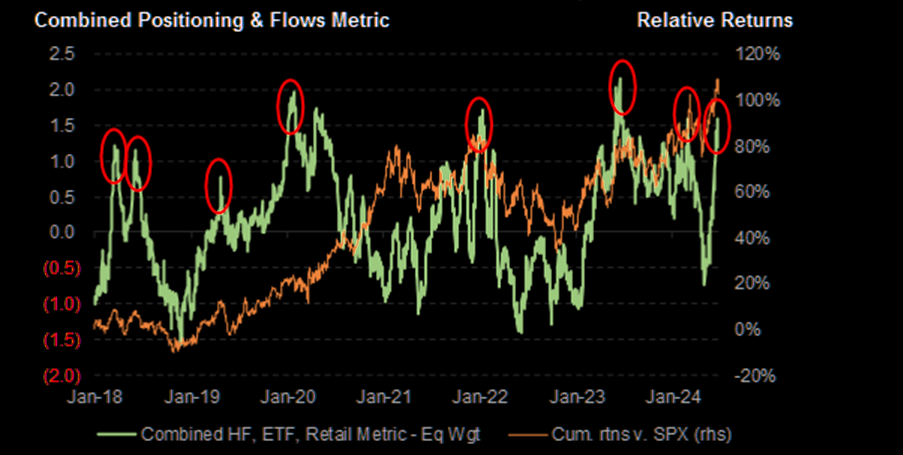

- The Market Ear@themarketear – JPM PI – Semis could be flat / weaker from here. “…our combined metric (hfs, etfs, retail) of flows & positioning in us semis has jumped back to peaks from which semis have often been flat / weaker

Doubly on the other hand,

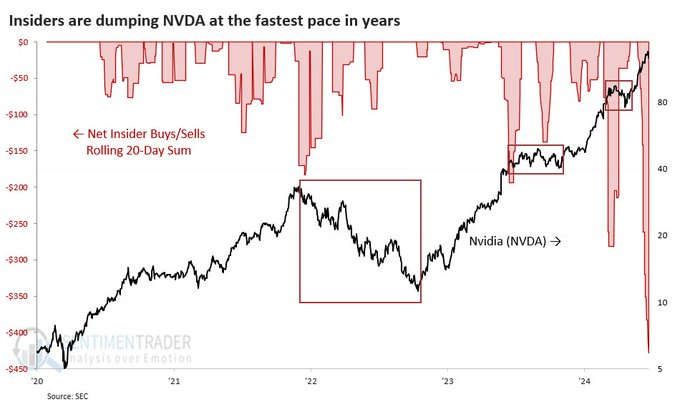

- Jason Goepfert@jasongoepfert – Jun 22 – I mean, it’s probably something. $NVDA insiders are dumping at the fastest pace in years. The other times it exceeded $150 million during a month, the stock got put in the penalty box.

Some may remember our chart comparing Hindustan Aeronautics (HAL) with NVDA. Look at this week’s chart of this pair:

HAL got a huge order for its new Light Combat Helicopter on Tuesday. The stock opened big on Wednesday morning in Mumbai and quickly sold off on overbought conditions & great-news-is-now-behind the stock sentiment. A day later, NVDA sold off just as intensely on overbought-overdone sentiment. The stocks are in different industries, trade in different markets. Both have moved consistently & strongly up as a pair. And now, both sold off in 24 hours on similar concerns. Weird?

That brings us to the Indian market & all the geopolitical activity.

I1. Indian Stock Market

Last week we quoted Ridham Desai from Morgan Stanley India saying:

- “.. I expect a deluge of primary deals in the next several months and that will allow foreign investors to start buying. If I may make a prediction here, foreign institutional investors will start buying India in the second half of the year largely because primary issuance will go up & that will create the space for them to buy .. “.

This week news broke about plans by Hyundai India to go public in India with India’s biggest IPO.

We have liked India’s Defense sector since the launch of ChandraYaan in October 2023. Stocks like Hindustan Aeronautics (HAL ) & Bhaarat Electronics (BEL) have been our favorites. Apparently others have noticed defense stocks too, even though our (presumably) Indian-origin named friend from India, Bob Pisani, has not or at least he has not tried to get his ETF buddies to launch a India Defense ETF in USA.

Instead we saw the launch of India’s First Ever Defense Index Fund by Motilal Oswal, an Indian financial firm.

And we saw a clip confirming our conviction that the Defense sector is a priority for Modi 3.0. The clip is a good primer about how Indian Defense firms are seeing annual 20%-25% growth in orders over the next 5-10 years.

Finally Hindustan Aeronautics received the order for 196 Prachand Helicopters, the new Light Combat Helicopter launched by HAL that made the stock jump 7-8% on Wednesday morning.

I4. Foreign Policy in fast gear – US-China-India

Only a couple of weeks have elapsed since Modi was sworn in as the Prime of Minister of India. Despite all the comments about a “weakened Modi”, “moral defeat of Modi” from a certain section of US media, the global status & foreign policy moves of PM Modi & India have accelerated.

PM Modi was invited to attend the G7 in Italy as the honored guest of Italian PM Meloni & was given the center position in the group photo. The Pope & he exchanged a warm hug as he did with French President Macron & other G7 leaders. China couldn’t let that pass without negative comments.

On the other hand, Ian Bremmer, a long term critic of Modi’s India, turned over a new leaf & hailed Modi as a leader “with one of the world’s most successful foreign policies“. This momentum continued this week with a High Level Bipartisan Congressional Delegation visiting the Dalai Lama in his abode in India. The trip & the topic was tailor-made for Nancy Pelosi, the former Speaker. Listen to her deliver her message in one minute with clarity that others can’t match in multiple minutes:

This is far more than a PR issue. President Biden has a major decision to make about signing the Tibet Bill. For those not aware, below is a simple description of the US Bill & China’s opposition to it.

The above was Tibet & the below is Taiwan. PM Modi responded warmly to the congratulatory message on X from Taiwanese President Lai Ching-Te & China responded.

I5. Bolly-Holly Films

Back in 2008, this Blog’s first article was about what we called Bolly-Holly films – Bollywood Interpretations of Hollywood Originals. Usually both versions are true hits in their own milieu. Today it is not a pair but a threesome – a Hollywood breakout film of 1944 that was followed 35 years later by another Hollywood breakout film in 1981 which was then followed 20+ years later by a Bollywood breakout film.

The story essentially is the same – a wealthy man’s youngish wife makes love to a younger man & tempts him to murder her rich husband so that they can live forever on their love & the husband’s money. The sub-concept is of the sexual predatorial power (term used by Kathleen Turner) of some women to trap younger (& less affluent) men to do what they would normally not do.

Per Wikipedia, the 1944 film Double Indemnity was nominated for seven Academy Awards. Widely regarded as a classic, it is often cited as having set the standard for film noir and as one of the greatest films of all time.

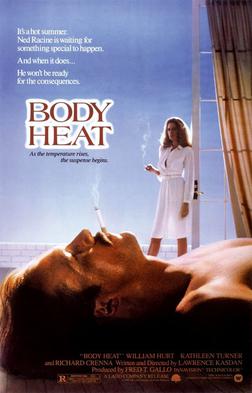

Per Wikipedia, the above film inspired the classic 1981 film Body Heat, a neo-noir[1][2] erotic thriller film written and directed by Lawrence Kasdan in his directorial debut. It stars William Hurt and Kathleen Turner, featuring Richard Crenna, Ted Danson, J. A. Preston and Mickey Rourke. The film launched Turner’s career—Empire magazine cited the film in 1995 when it named her one of the “100 Sexiest Stars in Film History“.[3] The New York Times wrote in 2005 that, propelled by her “jaw-dropping movie debut [in] Body Heat … she built a career on adventurousness and frank sexuality born of robust physicality“.[4]

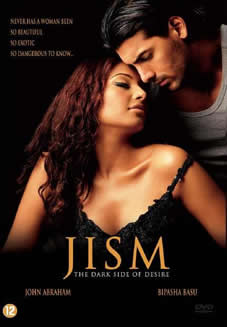

The film ends with Richard Crenna’s character going to jail for the murder while Kathleen Turner’s character getting the husband’s money. That brings us to the 2003 Bollywood Interpretation of Body Heat – Jism (Body) – the dark side of desire.

This film essentially launched the career of Bipasha Basu while John Abraham excels as usual. One difference between Jism & Body Heat is the elongated seduction of Abraham by Bipasha Basu pictured in two superb clips . The really big difference is the final scene in which Kabir (Abraham) recognizes he has been played. He asks Bipasha if she ever loved him in their relationship. Her answer became a cult line:

- “yeh jism pyaar karana nahi jaanta Kabir ; yeh janata hai sirh bhukh, jism ki bhukh “

- “this body doesn’t understand love, Kabir; it only understands hunger, the Body’s hunger“

She adds she has never loved anybody; that she has only loved herself. Then she shoots him. But as he falls, he wrests the revolver from her & shoots her. This difference between Body Heat & Jism was necessary, meaning had Bipasha lived to enjoy her wealth (as Kathleen Turner’s character did) , Indian audience would have rejected the movie.

Watch Jism on YouTube or at least go thru it & watch the seduction clips (first at 12:44, 2nd at 48:00). The film is a visual delight & set in beautiful Puducherry on the Indian Ocean. We just got see that sunrise on the bridge in Puducherry. Some Day!

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on X.