Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.A Great 4th

Trust all had a Great 4th. Thanks to American liquidity, American markets certainly celebrated this 4th even without the Fed’s generosity.

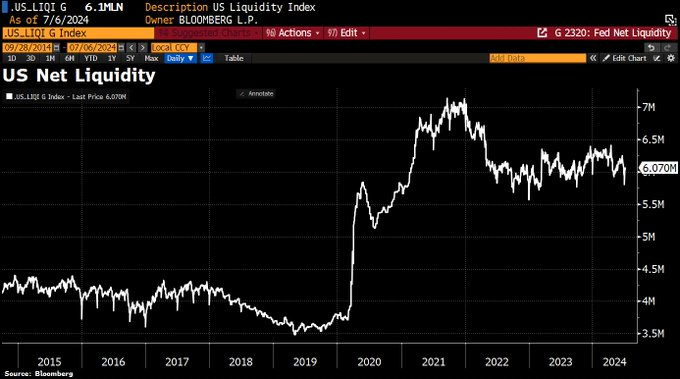

- Holger Zschaepitz@Schuldensuehner – Jul 5 – If you want to know why the markets have risen so sharply this week, you can also find an explanation in this chart: US Net Liquidity has risen significantly this week by $270bn back >$6tn, although the Fed’s balance sheet has continued to shrink slightly.

The Non-Farm Payrolls report was non-recessionary and soft enough to let Treasury yields fall on the week:

- 30-year Treasury yield down 8 bps on the week; 20-yr yield down 7.3 bps; 10-yr down 10.7 bps; 7-yr down 13 bps; 5-yr down 14 bps; 3-yr down 15 bps; 2-yr down 14 bps; 1-yr down 11 bps;

- TLT up 1% ; EDV up 14 bps; ZROZ up 43 bps; HYG up 31 bps; JNK up 24 bps; EMB up 1.1%;

Add quite a bit weaker Dollar that was down 86 bps on UUP & down 95 bps on DXY and what do you naturally get?

- Gold up 2.7%; GDX up 6.9%; Silver up 7.3%; SLV up 7.1%; Copper up 6.8%; CLF up 1.8%; FCX up 5.3%; Oil up 2.1%; Brent up 31 bps; Nat Gas down 10.6%;

- ACWX up 2.2%; EEM up 2.4%; FXI up 1.5%; KWEB up 1.8%; EWZ up 3.8%; EWY up 4.3%; EWG up 2.3%; INDA up 1.5%; INDY up 4.8%; EPI up 2%; SMIN up 3.2%;

What should work best in with slower but non-recessionary growth & lower interest rates with higher market liquidity?

- AAPL up 7.3%; AMZN up 3.5%; GOOGL up 4.4%; META up 6.9%; MSFT up 4.3%; NFLX up 2.2%; NVDA up 1.8%; NDX up 3.6%; SMH up 3.6%; BAC up 1.6%; C up 1.1%; GS up 2.7%; JPM up 71 bps; EUFN up 1.1%;

A chartist & technical view of the above:

- Larry Tentarelli, Blue Chip Daily@bluechipdaily – Sun – $META joins $AAPL $AMZN $GOOGL $MSFT $NVDA and $QQQ on the new all-time highs list. As noted last month, these multi-month range breakouts are most indicative of a bigger trend move to follow – which we are seeing here.

But not all is kosher with US indices, especially the ones that should benefit from lower rates:

- Larry Tentarelli, Blue Chip Daily@bluechipdaily – $QQQ has widened the lead to 2108 bps > $IWM YTD. Leaders still leading, laggards still lagging. $IWM needs a rate cut and soft landing. No interest in the chart until > 215.

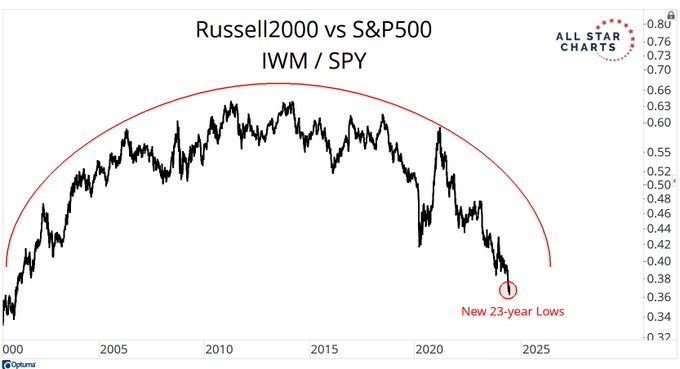

That fits in with the action in regional banks as well with KRE down 2.3% this week. Seriously how extreme is the under-performance in financials-heavy IWM?

- J.C. Parets@allstarcharts – Jul 6 – Here is the small-cap Russell2000 hitting new 23-year lows vs the S&P500 this week $IWM $SPY

Will the cooling economy force the Fed’s mind?

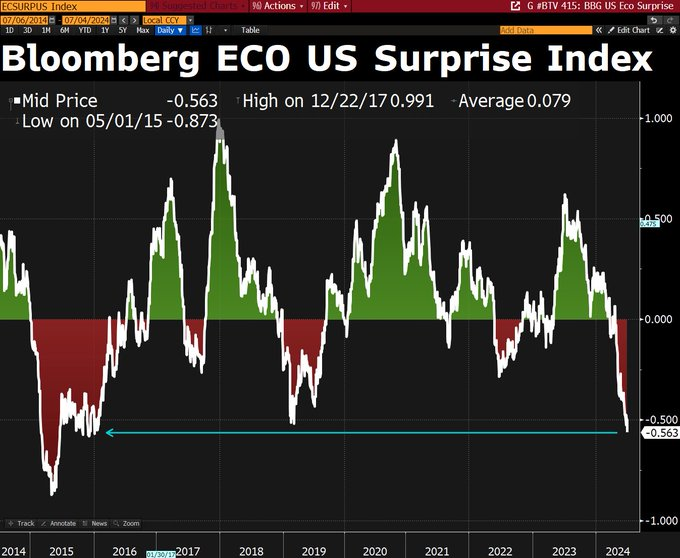

- David Ingles@DavidInglesTV – Jul 4 – Alas, looks like the US economy is cooling quicker than most analysts think. The Bloomberg US Economic Surprise Index has dropped to a 9-year low.

The huge question is whether this slowdown has seeped even a little bit into the earnings of Mag 7. We will know by the end of July. Isn’t that after the seasonally strong period in stocks is past?

2. The 2 sides

First about next week:

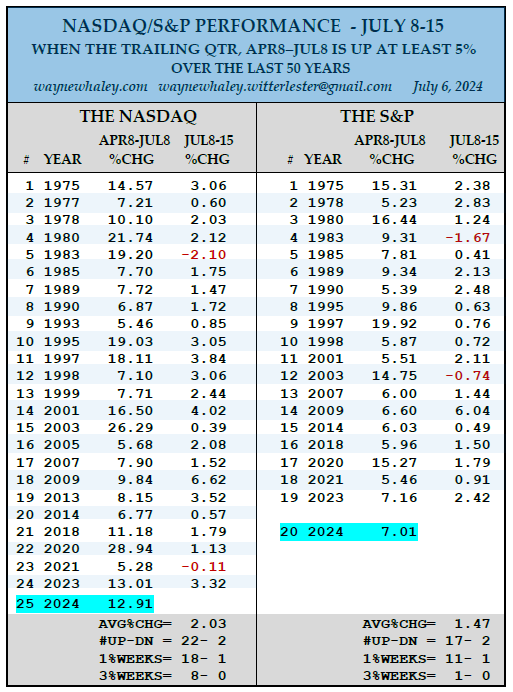

- Wayne Whaley@WayneWhaley1136 – THE S&P/NASDAQ IN THE WEEK OF JULY8-15 WITH TAILWINDS – One of 27 studies on 14 markets shared with commentary subscribers this morning. I save the Picasso’s for Patreons but designated this one as the weekly giveaway selection. Over the last 50 years, the Nasdaq is 37-13 during the week of July8-15 for an avg weekly gain of 1.13%. Similarly, the S&P is 38-12 during that same July8-15 week for an avg gain of 0.68%. Additionally, both markets have historically benefited during that week from a strong tailwind the likes of which experienced in 2024. With one trading day remaining in the April8-July8 setup Quarter, the Nasdaq is up 12.9% in that trailing Qtr while the S&P is up 7.0%. In those 22 years of the last 50 in which July 8 was preceded by a +5% Qtr, the Nasdaq was 22-2 during the July 8-15 reaction week for an avg gain of 2.03% and the S&P was 17-2 for a 1.47% gain. One of the two Nasdaq losers was of the unchanged variety.

About the longer term:

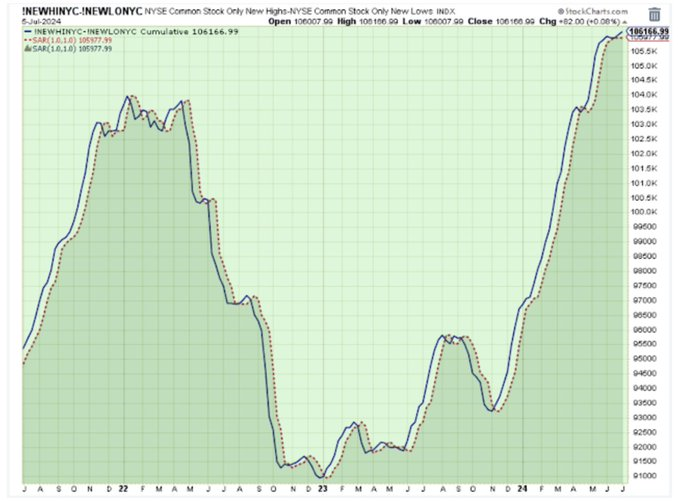

- Seth Golden@SethCL – Sun – My favored longer-term indicator: Cumulative Net New Highs briefly looked like it wanted to turn lower, but then broke higher. For now, this still informs the long-term trend remains bullish, and resistant to bearish notions and/or nonsense. $SPX $SPY $QQQ $NYA $DIA $IWM

On the other side,

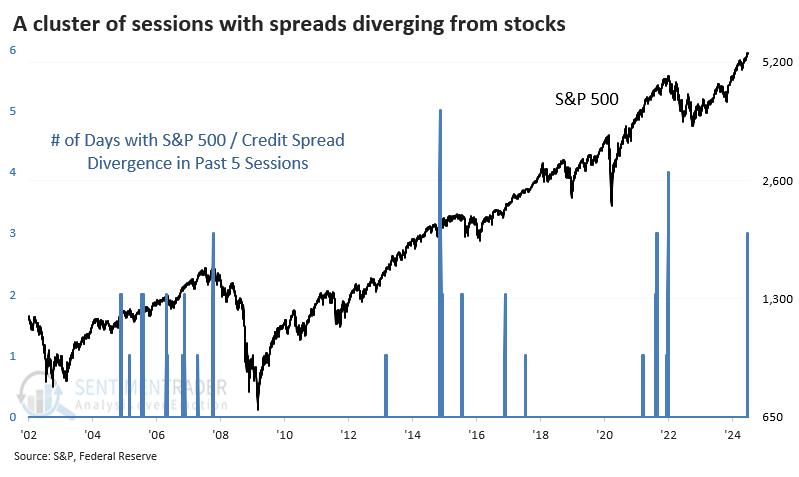

- SentimenTrader@sentimentrader – Wed – In a stark change from the past couple of years, the spread between the riskiest and safest investment-grade credits bottomed about two months ago and is nearing a two-month high, even as stocks rally. After similar divergences, the S&P 500’s returns going forward were poor across most time frames. A bigger problem is that we’re seeing a cluster of readings, not just a one-off. The divergence has been evident for three of the past five sessions, rivaling the largest clusters in 22 years.

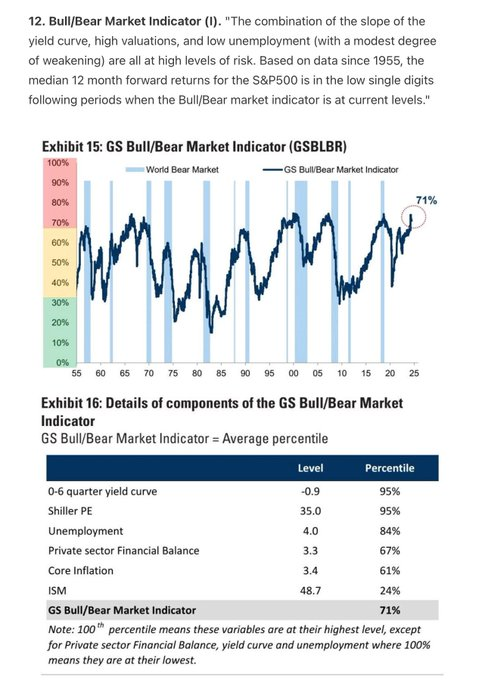

And the bear word!

- Albert Edwards@albertedwards99 – Hang onto your hats! The Goldman Sachs point out equities usually enter a bear market when their Bull/Bear Market Indicator is this elevated. But maybe this time is different! H/T @dailychartbook

3. Europe

Europe is certainly going thru political convulsions. What happens to the French economy if the right takes over in France? How will the UK respond to the most decisive election in a long time? From what we see, there is a definite migration out of UK of the wealthy. We hear of the youngish professionals migrating to Dubai for jobs and we hear of the older wealthy moving to places like Switzerland. The stock markets don’t tell us a lot because the stocks represent global companies instead of UK-focused companies.

How does the EU handle the radical changes in their important member countries? Can the EU function effectively with the right in Italy opposing the right in France in many ways?

So let us migrate from what we don’t understand well to what we understand better.

4. India-Related

This 4th was also a 1-month anniversary of the Indian election. Recall that the Indian markets exploded up on Monday June 3 on the strength of exit polls that proved to be wrong. Perhaps as a result, when the real results came in, the rocket move up was reversed & much more on June 4.

The down move was so fast & steep that the pretend-analysts & hate-spreaders otherwise known as opinion-distributors went into a big defeat for Modi mode. None of them, not even Fin TV hosts who are supposed to look at markets, stood up & said Buy’Em!

What a horrendous disservice to viewers of Fin TV. Look what a terrific buying opportunity June 4 was for people interested in buying or holding India shares:

The above 10% up move in the large cap $INDA has been put to shame by the 20% up move in $SMIN, the small cap BlackRock India ETF:

Defense stocks in India are probably the pure play on Modi remaining a driving force in Indian politics. That’s why Hindustan Aeronautics (HAL) fell over 20% on June 4. Now look at it, not just standalone but in comp with NVDA.

Why do HAL of Indian Defense & NVDA of US Semis march in step? Perhaps because Defense stocks in India have the similar fundamentals to Semiconductor stocks in America?

Another sector is beginning to move again. Tim Seymour, EM guru at CNBC Fast Money, said on June 4 that ICICI Bank ($IBN) is a core position in his portfolio ( Stephanie Link of CNBC Half Time has owned IBN in the past as we recall). We like $IBN at as much as Mr. Seymour. To us, it is a near-Buffet stock given the long & steady growth of Bank revenues in India. Look at the jump in trajectory of $IBN after June 4 & after a key announcement by India’s Reserve Bank ( that too in comparison with our biggest & best bank):

The above is why people should figure out that a fall in Indian stock market is almost always a Buy, partly because Indian markets are difficult to buy as they keep moving higher. This is why luminaries like Jeff Gundlach say buy Indian stocks (via $INDA, he said) & don’t look at your positions for a long time (20 yrs or so ).

Yes indeed and especially so for the next 5 years. Most don’t understand the speed & size of changes taking place in India after the June 4 results. Those who understand Hindi should watch You Tube India clips in Hindi. All BJP-RSS hands have united & Chief Minister Yogi is now the driver of progress in UP, India’s largest & most important state. Those who can’t read the signs should consult some skilled Indian trackers.

Something amazing happened last week, something that has not usually been associated with the Indian temperament. In one of the best cricket matches we have seen, the T20 World Cup final (played in Barbados) between unbeaten India & unbeaten South Africa went down to the last ball. When the last 20% of the game began, South Africa looked all set to win needing only 30 runs needed with 30 balls left to be pitched. So easy since Klassen of South Africa had just scored 24 runs in 6 balls & the pair of Klassen & Miller were in full hitting form.

Then things changed. The Indian captain made a change in the bowling (pitching) and Klassen got out. That slowed down the pace of runs with only 14 runs scored in the next 24 balls. Then the final bowler came on & hard hitting Miller of SA faced him needing 16 runs in 6 balls.

And history was made in the first ball with, as the commentators said, “potentially one of the greatest catches in cricket history“. Any one who watches Football knows that it is not enough to catch the pass but that the process of the catch has to be completed by the receiver. Watch the first 1;40 minutes of the clip below to see a superlative example of the process of a cricket catch being completed in a hitherto unseen manner:

Listen to the Ian , the play-by-play guy, say “what a catch! Unbelievable; very very best; you won’t believe what you have seen … it is potentially one of the greatest catches in cricket history, when you look at the occasion & the presense of mind to keep the emotion in check“

Now Miller, the last star batter of SA was gone. And they needed 16 runs in 5 balls. They only managed 7 runs. And India became World Champion, the first team in history to win the World Cup without losing a single game.

This Indian team showed a very different character than the Indian cricket teams in the past, even near past. We feature this because this new tough & tenacious confident India is being seen in every aspect of India. And this style is a perfect fit for PM Modi. Watch the 2-minute clip below of the amazing celebration in Mumbai. It was NOT a celebration of merely the cricket team & its win – it was a huge celebration of Mother India as the songs said:

This Mother India theme is resonating in virtually everything. Witness the rejection this week by India of China’s request to allow renewal of passenger flights between China & India. The Indian side was very very clear. Resolve the border issue; remove Chinese occupying forces to their previous line of control and then & only then will India begin trade-economy talks.

Also something weird happened during this World Cup & especially as India won. The Taliban-run Afghanistan exploded in happiness with India’s win. Who would have thought that Taliban-run Afghanistan & the Afghani people would become intense fans & friends of India after US left Afghanistan? And this post-US Afghanistan despises NaPakistan & the Napaki regime. Makes you wonder why USA gave so many billions to Napakis to help them fight Afghanis when perhaps it was Napak that was the enemy from the beginning.

Bottom line – listen to Signor Gundlach & don’t SELL your Indian stock positions, especially in panic. If you do, it might be quite difficult to get back in.

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on X